Introduction

“Idea frameworks” and “mental models” can be helpful in providing a guiding roadmap, applying existing knowledge to another field, or quickly analyzing & adapting to new information.

Today’s blog post describes 15 traits that are related to establishing an investment framework for value investing.

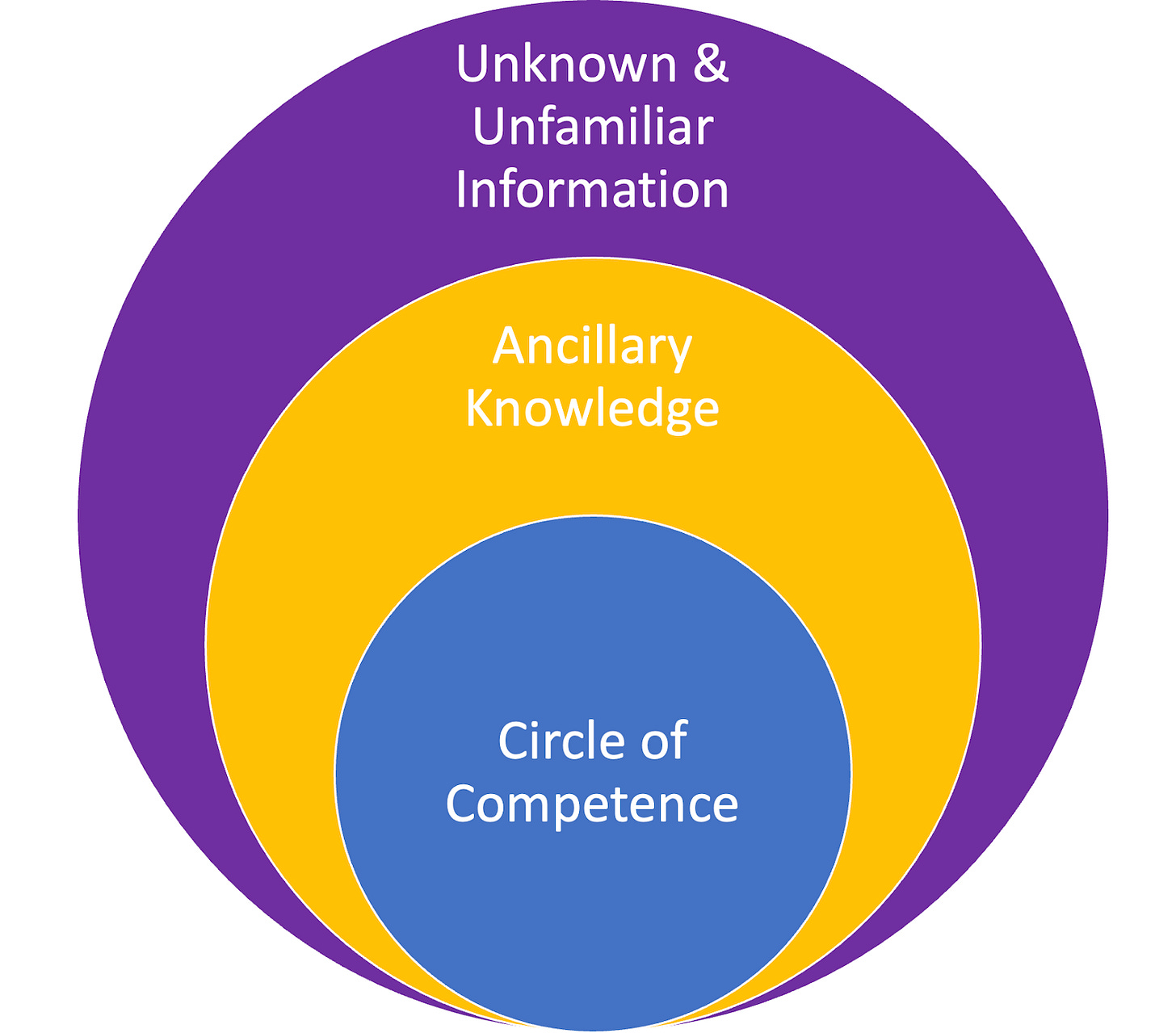

1. Circle of Competence:

Only investing in companies where the investor has a solid understanding of the business and its industry keeps the investment aperture within one’s “circle of competence”, reduces the propensity of missing obvious information, and both maintains and accumulates domain expertise over time.

Usually, unless the individual is a polymath, one can assume that most companies are outside of one’s “circle of competence”.

Remaining within one’s circle of competence maintains investment discipline, reduces the likelihood of “tourist behavior” that chases hot trends and market bubbles, and reduces the likelihood of making silly mistakes (such as missing obvious industry dynamics or trends).

According to Warren Buffett in the 1996 Berkshire Hathaway Annual Letter, “Obviously many companies in high-tech businesses or embryonic industries will grow much faster in percentage terms than will The Inevitables. But I would rather be certain of a good result than hopeful of a great one. Of course, Charlie [Munger] and I can identify only a few Inevitables, even after a lifetime of looking for them.”

According to Warren Buffett in the 1996 Berkshire Hathaway Annual Chairman’s Letter, “Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

2. JOMO, not FOMO

The FOMO acronym stands for “fear of missing out”. In contrast, JOMO stands for “joy of missing out”.

Focus Increases the Probability of Excellence: Distraction can dilute, while focus can increase the level of excellence. FOMO may catalyze the chase of trendy narratives, while JOMO can offer prudent, disciplined investment processes that ignores the "trendy topic" & focuses on long-term compounding of returns.

The attraction for short-term greed versus desire for long-term value creation is an important distinction that also distinguishes price-flippers from investors.

Delayed Gratification & Compounding of Returns: Delayed gratification is related to time. The value of time and its positive relationship with the compounding of positive returns are important concepts in wealth accumulation. For example, a 12% compounded annual growth rate, or CAGR, over 1 year is just a 12% increase, while a 12% CAGR over 10 years triples the initial investment.

3. Value Investing vs. Price Forecasting

Differences in Focus: Value investing focuses on the cash flows from the asset or investment (which is largely dependent on the quality of the underlying business), while price forecasting focuses on future prices of the asset (which may or may not be correlated with the quality of the underlying business in the short-term).

Differences in Accessing Liquidity: Investors look for liquidity from the underlying asset. In contrast, price forecasters look for liquidity via selling to other investors.

4. Finding Value

Notable Traits Commonly Associated with Value Investments:

Profitable business models

Stable & rising margins & market share

Endurance of business moats, competitive advantages, and future profits

Excellent capital allocation programs

Great management teams

The intrinsic value of the stock is far greater than the current stock price.

Low likelihood of new startups and competitors entering the industry to disrupt the industry’s dynamics and market share.

Future cash flows have perceived predictability within a range with low volatility and with high confidence, which enables a more confident estimation of a stock’s intrinsic value.

Companies that create their own liquidity via positive operating cash flows and companies that provide liquidity to investors via dividends or share buybacks are more likely to survive in the long-term.

Value Creation: Often, long-term value creation in markets is predicated on strong business performance, financial fundamentals, lowering of discount rates, and rising free cash flow per share.

Business Fundamentals vs. Changes in Sentiment: Long term value investing often focuses on the company delivering returns to shareholders as opposed to deriving returns solely based on changing perceptions of other shareholders. “Changing perceptions of other shareholders” can be quantified via price multiple expansion, price multiple reduction, or capital flows into or out of an industry or asset class.

Profits: Positive investment performance is about generating investment profits, which implies selling at higher prices than the price paid.

There is Value in Growth: Good business models with secular growth engines, high returns on invested capital, and great management teams are valuable; as long as there isn’t significant equity dilution and as long as the investor doesn’t pay exceedingly excessive prices, the investor is likely to have positive returns in the long term. In contrast, buying a cheap yet no-growth company has limited upside, which is likely the difference between the purchase price and the intrinsic value.

5. Variant Viewpoints

There is a difference between “variant viewpoints” versus “conformity with consensus”.

Often, successful value investing requires having a variant viewpoint or having a different position size on a popularly-held viewpoint.

Value investing often requires a variant viewpoint because it identifies a mispricing (price divergence between personal belief and the consensus belief by Mr. Market).

Index fund investing represents conformity with consensus and is a popular method of investing in the stock market. Benchmark-sensitive investors are implicitly against holding varying viewpoints and strongly support conformity with the consensus. In contrast, value investing often requires variant viewpoints and contrarian perspectives; whether these variant viewpoints turn out to be correct is measured by the investment results related to value investing.

6. Concerns with Value Investing

Identification of Value: Value investing requires that other investors see value in that stock in the future. If investors don’t see the value, then the stock price doesn’t materially increase via price multiple expansion.

Mispricings: Many companies have mispriced stock prices relative to estimated intrinsic values, but if nobody is there to notice or create a catalyst so that the stock price converges with intrinsic value, then mispricings can continue to perpetually exist.

Impact of Indexing on Value Investing: The resulting consequence of the rise of indexing and having high market beta exposures in portfolios is that more money gets invested into index funds and momentum-based investment strategies, with far less money (or perhaps net withdrawals) occurring in value investing strategies.

Value vs. Growth: “Value investing” may underperform “growth investing”, particularly in euphoric bull markets with expansionary monetary policy and expanding economies. Additionally, “value investing” may underperform “growth investing” because “growth investing” can experience positive serendipity (high upside via prevalence of innovations, extreme right tail events, and upside optionality), while value investing is often focused on the knowable information with estimated extrapolations about the future based on prior historical business performance and financial fundamentals.

7. Liquidation Value vs. Intrinsic Value

Several years ago, it was common to find investment opportunities in which the stock price was trading below the book value of the company, and as a result, liquidating the entire company hypothetically would generate a positive return on investment. Today, many of these opportunities no longer exist, which is why discounted cash flow calculations are important to estimate intrinsic value, not just rely on liquidation value.

Because it’s important to find value from growth in “growth investing”, there is value from the importance of determining intrinsic value of the company.

Intrinsic value of a stock or of a company is determined by calculating the asset’s discounted future cash flows, which implies correctly estimating 3 traits:

1. The amount of future cash flows.

2. The timing, distribution, or uniformity of these future cash flows.

3. The discount rate applied to these cash flows.

8. Cash Creation and Discounted Cash Flow Calculation

Among the primary reasons to invest in a company is for the belief that the company will produce more cash than the cash it absorbs. Said differently, companies are cash machines or cash furnaces; poor business models produce variable and negative cash flow, while great companies are great cash machines that produce lots of cash with repeatability, consistency, and durability, and then the cash flow as retained earnings can be redistributed (re-allocated) via capital allocation strategies, such as dividends, share buybacks, M&A, organic growth expansion projects, capex spending, etc.

An asset’s intrinsic value (present value) is the asset’s discounted future cash flows.

Businesses that produce positive and growing cash flows with high predictability (high confidence) have intrinsic value.

If an asset produces zero future cash flows, then an investor in such an asset is entirely relying on price appreciation, which is the hope of selling the asset to someone else at a higher price.

A bond is a certificate with attached and scheduled coupon payments. In contrast, a stock is also a certificate of ownership but has variable unknown coupons in the future, so it is the role of the investor to estimate the future cash flows of the company and its stock.

Given a choice between consistent cash flows over time and variable cash flows of the same amount over time that both produce the same intrinsic value (present value calculations), many investors would prefer the smooth (consistent) cash flows. However, given a choice between consistent cash flows with a lower present value vs. variable cash flows with a higher present value, some investors would choose the investment with a higher present value. Because many companies and investors place a significant premium (affinity) for consistently smooth cash flows (even if the net present value of these cash flows is low), investors that are willing to earn large yet fluctuating cash flows potentially may earn a premium by buying companies with variable cash flows with higher present values.

9. Opportunity Cost

Opportunity cost of capital helps to explain why managing concentrated portfolios (not diversified portfolios) perhaps is a better approach for highly knowledgeable and capable investors. This opinion might be counterintuitive or contrarian, especially considering the vast academic and practical literature regarding the benefits and importance of diversification.

Higher opportunity cost of capital (aka, higher discount rate) is a forcing function for a more concentrated investment portfolio.

For example, if the target investment return is 2%, then many investments can be included in the portfolio because many investments have a likelihood of delivering 2%+ annualized returns. In contrast, if the target annual investment return is 20%, only a few investments can be included in the portfolio because only a few investments have a likelihood of delivering 20%+ annualized returns in the long term.

The concept of “opportunity cost” also applies to ideas and decisions. Capable people with a better set of opportunities may make better investments and better decisions because there is a minimum quality barrier to overcome. In contrast, when there is zero opportunity cost, then any positive decision seems reasonable, which then leads to inputting in the least amount of effort, time, or resources in hopes of efficiently achieving a positive return, even if the positive return is low.

Often, truly disciplined investing requires the investor to maintain a high discount rate (modeling investments with a high potential return) regardless of the current trend or market environment; there is always a bull market somewhere, and only investing at high discount rates implies that there is a high quality barrier and money is only invested when high potential opportunities exist (not just when any opportunities exist). Of course, modeling a scenario with a high potential return does not guarantee a high actual return on investment, future performance can deviate from past returns, and investing involves risk, including the risk of losing the initial investment or principal value.

A high discount rate provides some relief when a plan does not have perfect implementation. In contrast, a low discount rate implies a low time value for money and implicitly implies that many things need to go right when paying high prices for investments. Said differently, a high discount rate can help to account for risk factors, provide some margin for change, and plan for speed bumps along the investment journey.

10. Liquidity-Driven Auction Markets

As per Corporate Finance Institute, an auction market is defined as “a market where the price is determined by the highest price the buyer is willing to pay (bids), and the lowest price the seller is willing to take (offers)”. Source: https://corporatefinanceinstitute.com/resources/equities/auction-market/

The stock market is a liquidity-driven auction market. This is important to note and is different than a private business or residential homes (which are not real-time markets), which has some resulting consequences:

Many home prices often oscillate with a range between -10% and +10% in any given year. In contrast, individual stock prices routinely move -30% or +30% in a year. Many stock prices have wider price ranges than home prices.

Looking at the daily price changes in an illiquid or not-for-sale asset is largely meaningless, particularly if the goal is to have ownership for a long time horizon (of course, checking in once in a while is fine).

If the home price goes down, one can’t “buy the dip” for their own house; if the home price goes up, then only paper gains exist but not material wealth that can be spent in the real economy unless the home is sold, there is a cash-out refinance, or a home equity line of credit is used. This situation directly contrasts the stock market, where the investor can easily change the ownership quantity of shares owned, “buy the dip”, or easily sell stocks to get cash back in return.

An auction market assumes reasonably informed and continuously willing buyers and sellers. Willing is a keyword; when a home is not for sale, there is no willing seller, and hence why residential real estate is not a real-time auction-driven market; in contrast, there are almost always willing buyers and sellers for most stocks (depending on the price).

An auction-driven market is driven by liquidity, buyer’s willingness to pay, momentum, and seller’s motivations for selling. This is why stock prices can wildly and widely swing far above or far below their intrinsic price, and mispricings may provide a potential profit opportunity for value investors.

The Market Liquidity Hypothesis

In the short-term, liquidity is an important contributor in influencing stock price movements and stock market price trends.

The economy is not the stock market, and the stock market is not the economy.

Understanding supply-demand dynamics is important because these dynamics and changes in capital flows influence market prices.

Markets absorb and distribute liquidity between companies and investors.

There are 3 types of companies: companies that require liquidity (funding from investors), companies with sufficient liquidity to manage company operations, and companies that actively distribute liquidity to shareholders via dividends and buybacks. Based on this classification system, it should be easy to classify (bucket) companies into one of these 3 categories. Additionally, phase shifts in liquidity (when a company moves between these 3 categories) can be a major stock price inflection point, which is how investors may potentially capture large price movements (and related profits) in a short time interval by investing in inflection points.

Inflection Point Investing is based on the premise that prices don’t move linearly towards the end state; instead, different price changes happen in different time intervals, and this observation helps describe how stock prices can hardly move for several years and then take off for a few years.

Buying stocks drains investor liquidity (cash balance reduces when stocks are purchased), so there needs to be a compelling reason to buy stocks in the form of potential investment profits. In contrast, selling assets creates liquidity (cash) for investors. Liquidity (cash) today is more valuable than the same liquidity (cash), and the implied time value of liquidity is measured via the investor’s discount rate; a rational investor with the desire of earning economic profits (which are profits that exceed the opportunity cost of capital or discount rate) will pursue investments when reducing liquidity today will result in more liquidity in the future.

In the 2010s and 2020-2021, the Federal Reserve created liquidity for financial markets directly and indirectly: directly via buying bonds via the QE program and indirectly via influencing investors to invest more capital into long-duration risk assets due to the TINA Effect, with the resulting consequence being a large tailwind for financial assets and especially long-duration risk assets like cryptocurrencies and software stocks. Now that the Federal Reserve is no longer providing liquidity to financial markets via restrictive monetary policy, the source of liquidity needs to come from somewhere in order to provide buying demand for stocks.

Companies with large balance sheets and positive operating income can create liquidity for their own stock via share buybacks.

Stronger companies with large balance sheets can create liquidity for other stocks by buying minority interests or making acquisitions.

Companies that provide liquidity to their shareholders via distributing cash through cash dividends and share buyback programs are valuable to investors. In contrast, companies that require liquidity from financial markets (such as unprofitable companies that need external financing from equity investors through equity dilution & fundraising) are draining investor liquidity and therefore is not well appreciated by investors when there is a scarcity of liquidity, thereby contributing to plummeting stock prices for many unprofitable companies when there is restrictive monetary policy, tight credit creation, and when the availability, affordability, and accessibility of capital are low.

Investors in companies that need liquidity often invest in these unprofitable companies when the exit liquidity (future selling price) is very high or when an external source (such as expansionary monetary policy from the Federal Reserve or government grants) are providing the funding source for the added liquidity. When these sources of liquidity largely no longer exist in the 2022 environment, the resulting consequence is falling stock prices, low M&A activity, and low IPO activity.

Rising dividends are valuable to investors because investors receive liquidity (cash) directly from the company, which can then be reinvested back into the company’s stock, reinvested in other assets, spent, or used for other purposes.

If price multiples were always held constant, then changes in financial fundamentals would drive changes in stock price; in reality, this assumption is incorrect because price multiples significantly fluctuate over time.

Company fundamentals matter to the extent that they provide liquidity for the company’s stock (via investor demand that likes the narrative of strong fundamentals) and/or provide liquidity directly to shareholders (via dividends and share buybacks that are financed by operating profits from the company or debt financing). From an equity shareholder perspective, a corporation is a machine that ingests and distributes cash; the value of a company increases when its perceived or actual ability to distribute a high and growing amount of cash exceeds the cash it needs.

Earnings growth does not always have a high correlation with stock price returns in the short term. A 15% growth in EPS in a year does not equate to a 15% stock price return. Therefore, changes in price multiples (not fundamentals) are a key contributor to stock returns in a year, and liquidity (along with liquidity cycle, monetary policy cycle, investor sentiment, capital flows, and more) is a key consideration and contributor to changes in price multiples.

Liquidity and changes in liquidity from the Federal Reserve via the Federal Reserve’s monetary policy directly impacts the prices of tech stocks, currency exchange rates, and other asset classes.

11. Margin of Safety:

There are 3 main methods of establishing a “margin of safety” in investing:

Buy profitable companies that accrue value (via retained earnings on the balance sheet) over time.

Buy stocks of companies where the purchase price is below today’s intrinsic value of the stock.

Underwrite investments with high discount rates so that stock purchases aren’t made on the assumption that everything will go perfectly according to the initial plan. Estimation errors can occur, and accounting for a margin for error is useful for planning purposes.

Note: The term “margin of safety” does not imply safety in investment values, does not imply assurances of positive returns, and is a term coined by Benjamin Graham and David Dodd in their “Security Analysis” book and in “The Intelligent Investor” book. Future performance can deviate from past returns, and investing involves risk, including the risk of losing the initial investment or principal value.

12. Businesses, Not Digital Ticker Symbols:

Business, not Digital Tokens on a Screen: Stocks are not simply “constantly fluctuating digital symbols with flashing red and green colors on screens”; instead, a stock represents ownership in a company.

Ownership in a Business: A stock represents ownership in a business. If an investor wouldn’t want to own the entire company, then why would an investor want to own part of the company?

Business Owner Perspective: From a business owner perspective, if one owns an entire company, the business creates value when it pleases customers and produces more cash flow than it absorbs.

Focus on Creating Value, not Monitoring Hourly Price Changes: Many businesspeople, corporate management teams, and employees don’t look at stock prices every hour because they are busy actually running business operations and trying to improve the business; similarly, an investor that looks at stock prices every minute when there’s a 5+ year holding period is exemplifying silly behavior that is an ineffective use of time.

Buying Cash Flow: If a goal of buying a business or a rental property is to produce cash flow, then a similar sentiment can be held by value investors in buying future cash flows when buying partial ownerships in public companies.

Stock Price is Noisy While Market Cap is Signal: Knowing the market cap of a company is more valuable than just knowing the stock price. Market cap is related to the company, company’s business performance, financial fundamentals, and investor perception.

13. Valuation Matters

Valuation matters, and a lower stock price for the same free cash flow per share provides a higher yield.

If a stock falls 50%, it’s not necessarily a discount if the previous high price was mis-priced by Mr. Market to begin with. A discount implies that the asset’s value can be correctly priced AND that the current price is below the intrinsic value of the asset.

If the earnings yield (earnings yield = earnings per share / stock price) is lower than Treasury bond yields, then prospective equity investors are perhaps foregoing the current higher bond yield with the hope of growth in earnings, free cash flow, and possible dividend payments to shareholders. For companies with low or negative earnings yields that do not grow their free cash flow per share in the future, this may explain why many individual stocks fail to outperform Treasury bond returns.

Notably, a normal Treasury bond provides zero growth in coupon payments over time, while corporate earnings fluctuate over time (either increasing or decreasing earnings per share and cash return to shareholders over time).

While revenue growth is often needed and seen in companies with high stock price growth, revenue growth does not guarantee growth in stock price. This is why margins and valuation matters. Investing is about the difference between the exit price and the entry price; investing is not simply an evaluation & assessment of future business growth.

When buying the stocks of companies with high projected growth in future earnings, the investor may face a competing battle between reductions in the P/E ratio versus the EPS growth rate.

For example, if earnings per share (EPS) doubles yet the P/E ratio collapses by 50%, the investor likely hardly made any money on the stock, even though the underlying company performed well to double earnings per share.

Valuation matters. The investor can seek to both identify a quality company and then pay a reasonable price for that company. The key word in this sentence is “both”.

Even if a public company is a quality business, paying a 200x EV/S (enterprise value / sales ratio) is unlikely to provide an exciting future return, especially if the future revenue growth rate is expected to decline in the future.

Simply buying stock with low P/E ratios is not a guarantee of future returns. If earnings per share falls and/or if the future durability of a company’s earnings are questionable, then the stock may become a “value trap”, in which cheap stocks maintain cheap prices.

Simply buying a quality company at any price is not a guarantee of high future returns. Even if earnings per share (EPS) increases by 5x in 5 years, if the P/E ratio falls from 80x to 16x in this hypothetical 5-year time period, then the stock remains mostly flat in price.

14. Accelerating EPS Growth with Share Buybacks

When a company has growing margins and earnings, then the company can accelerate the growth rate in earnings per share (EPS) via share buybacks. Apple is a great example of this situation; from fiscal year 2020 to fiscal year 2022:

Apple’s gross margin increased from 38.2% to 43.3%.

Apple’s revenue increased by about 44%.

Apple’s operating income increased by about 80%.

Apple’s earnings per share increased by about 86%.

Share count reduced by about 7%, enabling rising corporate earnings to accrue to less shares, thereby accelerating the growth in earnings per share. Apple spent about $89 billion in share repurchases in fiscal year 2022.

Data Sources: Apple’s Fiscal Year 2022 10K Filing, https://investor.apple.com/investor-relations/default.aspx and https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf

15. There’s Always a Bull Market Somewhere

In every market environment, there’s always a bull market somewhere.

There are opportunities in investing across market cycles. Good investors can identify, access, and establish position sizes in winning investments irrespective of market conditions.

Often, it is easier to find winning investments in expansionary economic conditions with bull markets, particularly when large tailwinds contribute to broad-based rising of asset prices across a variety of industries, sectors, and asset classes. In contrast, it is often more difficult to find winning investments in economic recessions and market turmoil, although opportunities still exist.

Due to the stock market being a liquidity-driven, real-time auction market, it realistically cannot be possible that every single stock in the stock market is perfectly priced to its estimated intrinsic value, and different investors can underwrite investments at different discount rates. Said differently, there’s always an opportunity somewhere.

Summary

In this blog post, we identified 15 traits of value investing:

Circle of Competence

JOMO vs. FOMO

Value Investing vs. Price Forecasting

Finding Value

Variant Viewpoints

Concerns with Value Investing

Liquidation Value vs. Intrinsic Value

Cash Creation and Discounted Cash Flow Calculations

Opportunity Cost

Liquidity-Driven Auction Markets

Margin of Safety

Businesses, Not Digital Ticker Symbols

Valuation Matters

Accelerating EPS Growth with Share Buybacks

There’s Always a Bull Market Somewhere

We hope these traits of value investing are helpful in your investment journey.

References:

“1996 Annual Chairman’s Letter” by Warren Buffett, Berkshire Hathaway Inc., Dated 2/28/1997, https://www.berkshirehathaway.com/letters/1996.html

“Auction Market”, Corporate Finance Institute (CFI), https://corporatefinanceinstitute.com/resources/equities/auction-market/

Apple’s Fiscal Year 2022 10-K Financial Filing, Announced on 10/27/2022, https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf

Apple Investor Relations, https://investor.apple.com/investor-relations/default.aspx

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.