2 Styles in Investing: Batting Average vs Slugging Percentage

Weekly updates on the innovation economy.

Introduction

There are 2 popular styles of investing: investing for growth and investing for recurring return. Each investor has their own personal investing style, preference, goals, time horizon, and risk profile. At Drawing Capital, we are growth investors and have an investment approach that focuses on high-growth technology-enabled companies in the “innovation economy”.

Notably, the investor mindset for achieving both types of return is often different, and it’s helpful for many to reference the mental model from baseball of “batting average versus slugging percentage”.

Good investors understand their maximum loss, likelihood of loss (risk), and multiple scenarios for upside potential.

Batting average is calculated by dividing a player's hits by his total at-bats.

Slugging percentage measures the total number of bases a player records per at-bat.

A Batting Average Mindset

A “batting average” mindset is useful for investing for the purposes of generating a recurring return. When returns are in a bounded range, an investor should desire to increase their probability of winning (“maximizing number of hits when at-bat”). In fact, Oaktree Capital Management has a good quote about this exact concept: “If we take care of the losers, the winners will take care of themselves”.

Let’s use the following example to better understand a batting average mindset.

Example: Suppose that the max gain on all 10 equally-weighted investments in a portfolio is 30% each, and your max loss on each investment is 100%. Now, let’s look at a sample outcome from this investing scenario:

2 investment returns 30%

5 investments return 15%

2 investments return 0%

1 investment loses 50% in value.

From the above table and the sample scenario above, $1 was each invested into 10 investments to invest a total of $10. The outcome of the sample scenario yielded an ending portfolio value of $11.10 ($2.60+$6+$2+$0.5 = $11.10), which equates to a 11% cumulative gain in the portfolio. Notably, the majority of investments in this example needed to generate positive returns in order to achieve a positive cumulative return.

A Slugging Percentage Mindset

A “slugging percentage” mindset is useful for investing for the purposes of generating high potential returns on invested capital. Some investors also reference a “power law distribution effect” in growth investing. When potential upside return is massive, the magnitude of the victory is more important than the winning percentage of investments. Of course, while the ideal scenario is generating high returns from all investments, the reality is that investors will often have some losing positions in a high-growth, high-volatility portfolio.

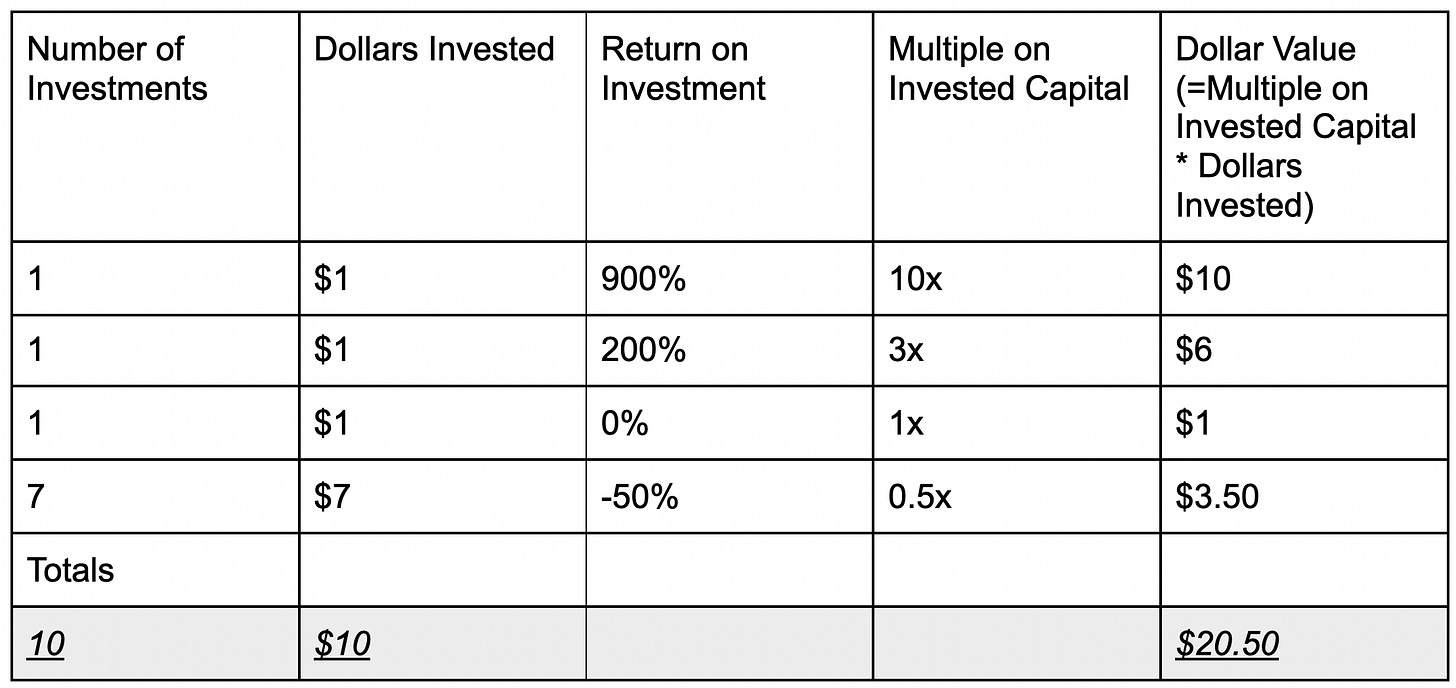

Let’s use the following example to better understand a slugging percentage mindset.

Example: From a basket of 10 equally-weighted investments in a portfolio, let’s look at a sample outcome from a growth investing scenario:

1 investment returns 900%

1 investment returns 200%

1 investments returns 0%

7 investments lose 50% in value.

Notably, and from the above table and scenario above, there are 3 key insights:

$1 was each invested into 10 investments to invest a total of $10. The outcome of the sample scenario yielded an ending portfolio value of $20.50 ($10+$6+$1+$3.5 = $20.50), which equates to a 105% cumulative gain in the portfolio.

Despite 70% of the investments losing value, this portfolio more than doubled its value by investing in these 10 hypothetical investments.

The investment that generated a 10x return was a “Fund Maker”, because the dollar value from this singular investment paid for the portfolio’s cost basis and represents almost half of the portfolio’s ending value.

Applying Batting Average vs. Slugging Percentage Mindset to Investing

Example 1: If one invests $100 into a stock with the expectation that it will go to $150, then the max loss is $100 and the max gain is $50. This is a downwardly asymmetric bet. When investing in securities with a downwardly asymmetric bets, the winning percentage (“batting average”) matters. Investment grade bond investing and financially-oriented relative value investing in equity markets are often examples of securities with downward asymmetry.

Example 2: If one invests $100 into a stock with the expectation that it will go to $350, then the max loss is $100 and the max gain is $250. This is an upwardly asymmetric bet in which the max potential upside is significantly higher than the maximum potential loss. When investing in securities through upwardly asymmetric bets, the weighted average (“slugging percentage”) matters. Venture capital and growth investing are examples of upwardly asymmetric investments.

2 Common Costs in Investing:

Direct Investing Costs

There are direct costs in investing, such as brokerage fees and commissions, data licensing fees, research subscriptions, and the costs to file tax forms that are related to investing.

Opportunity Costs

Opportunity cost is the potential value given up by choosing another alternative. While accounting costs focus on direct expenses, economic costs include both direct expenses and implicit opportunity costs. Opportunity cost can be thought of as a “cost of capital” investing approach. As the opportunity cost decreases, the aperture and willingness for making more investments should increase.

For example, when a Treasury bill or CD pays less than 1%, then the opportunity cost of forgoing this little yield is low, which incentivizes more investors to pursue other investing opportunities. On the other hand, if an investor has access to an investment fund that consistently generates 25% in annualized IRR, then an investor rationally would have a preference of investing in this investment fund unless the investor can find an even better investment opportunity that can generate more than 25% in annualized IRR.

3 Notes on Portfolio Risk Management

The purpose of diversification is to reduce the risk of exaggerated drawdowns while maintaining favorable and positive returns. At the same time, the purpose of investing is not to overly diversify your portfolio by buying tens of thousands of securities of poor-performing investments. Bridging the gap between these two sentences, an investor can maintain a portfolio of high-return-potential assets in a portfolio and is considered diversified if the individual holdings in the portfolio have a low or inverse correlation to one another.

By definition, risk is the probability of loss. Hazards increase risk, and a peril causes a risk to occur. Importantly, risk is not the loss itself. The magnitude of the loss measures how large a loss has become, either in dollar terms or percentage terms.

Investors can help companies reduce or eliminate risks with talent, time, and money. Good investors are in the “risk reduction” business. Exceptional investors are in the “risk elimination” business, whereby the probability of permanent capital impairment is small.

Summary

Understanding the differences between investing for growth versus investing for recurring returns is helpful in developing a better investment framework when managing a portfolio. By understanding both the distribution of outcomes and opportunity costs of investing as opposed to simply looking at a binary outcome of “will this investment go up or down in value”, an investor has an improved sophistication and knowledge, which thereby is helpful in potentially generating higher returns, managing downside risks, and improving financial outcomes.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.