Introduction

Over the past 20 years, content consumption has been transformed from an a-la-carte consumption model to a content consumption model that is monetized by advertising, monthly subscription revenue, licensing partnerships, and sponsorships. This transformation is predicated on consumers increasingly desiring three traits:

Greater content breadth & depth

Greater curation of content

Greater convenience in accessing content

An example of an a-la-carte consumption model is buying or renting individual movies in physical stores like Blockbuster and Redbox or digital stores like Apple iTunes. The video content business model is increasingly monetized either via recurring subscription revenue (such as Netflix and Disney+), advertising (such as YouTube), or a combination of both (such as Peacock).

A Changing Media Landscape

There are 5 traits in media content that matter more than ever before:

Scale

Distribution

Quality Content

Content Aggregation

Delivery of great consumer experiences with well-made digital apps

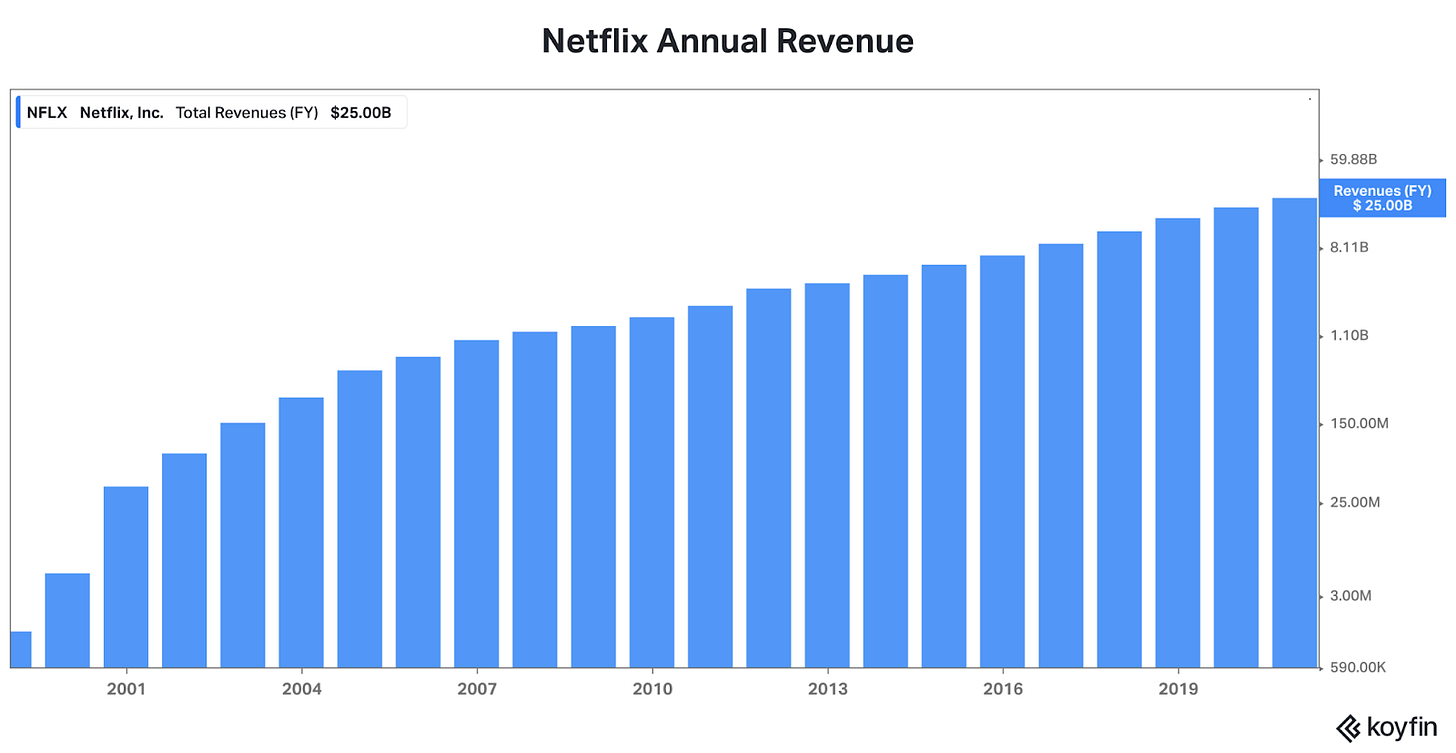

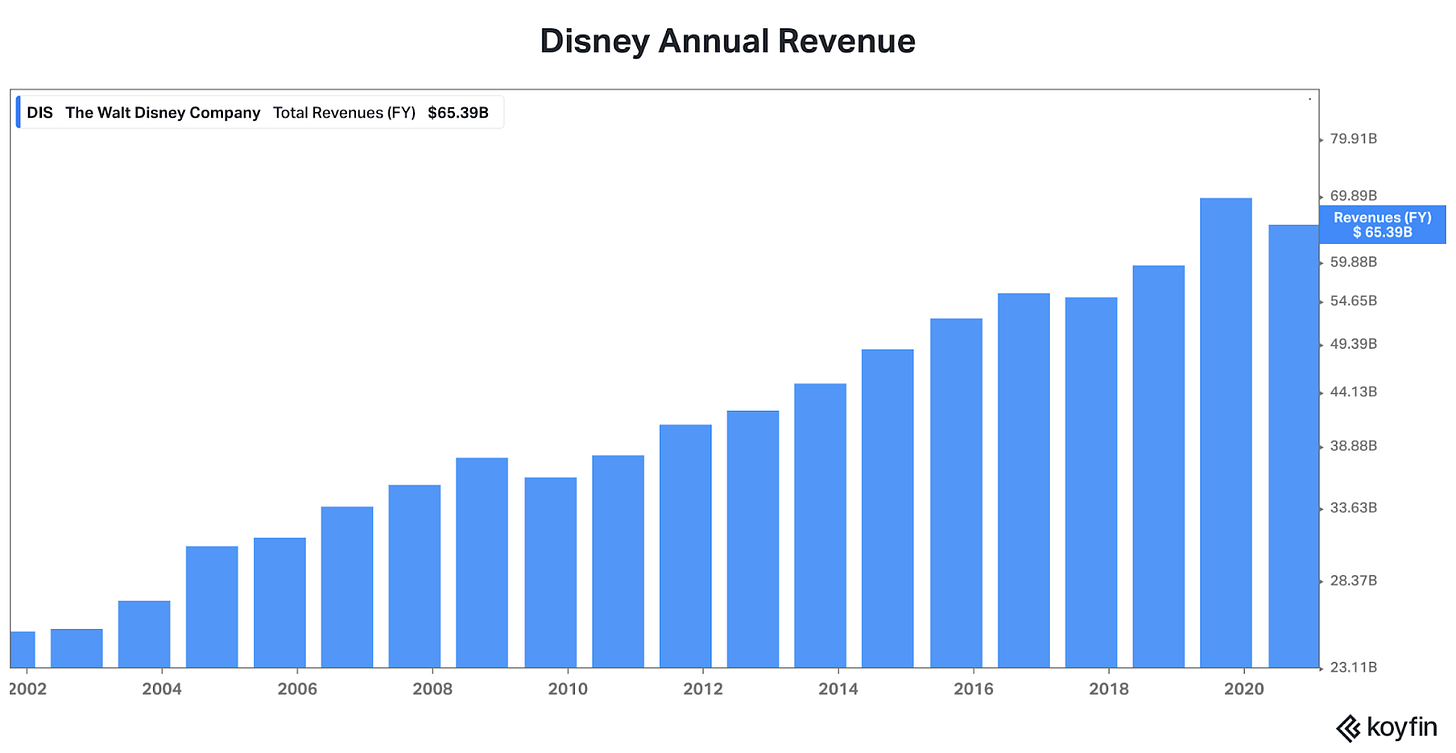

As we can see from the following two charts for Netflix and Disney, revenue growth can be extraordinary when a media company achieves the 5 traits mentioned above:

Over the past 20 years and regardless of the economic environment, Netflix has consistently grown its revenue every year. From 2010 to 2020, Netflix grew its revenue by ~11.57x.

Why is scale important?

Netflix, Disney, Amazon, Discovery, and others have global distribution and enormous scale in media content. Of course, the main social media platforms such as Tik Tok, Facebook, Instagram, Twitter, Snapchat, Pinterest, LinkedIn, and others enjoy these benefits as well. Scale compounds because the fixed costs get spread over a larger user base, thereby making average fixed costs low compared to competitors with a small user base. Also, Disney & Amazon have other businesses that help finance hockey-stick growth in their media businesses, while Netflix uses a combination of revenue growth, debt financing, and equity-based compensation as a financing method to finance the significant cash outlays for original content.

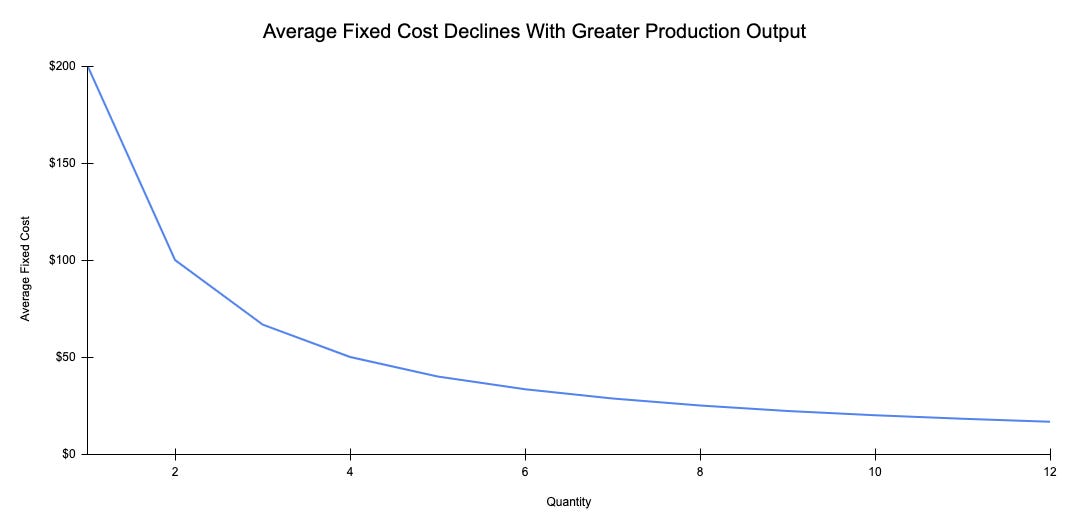

The following chart below illustrates the importance of scale from an economic perspective:

The creation and development of media content have high fixed costs. For example, Amazon spent $11 billion on video and music content in 2020, and Netflix intends on spending more than $17 billion on content in 2021 (2-3). When more subscribers use Netflix, Netflix enjoys a declining average fixed cost curve because the fixed costs are spread over more users. A declining average fixed cost curve provides 2 structural advantages: expansion of financial margins and the ability to reinvest excess cash flows into new content, thereby creating a “content moat”.

Netflix is a great example that exemplifies these 2 structural advantages:

As Netflix grows its subscriber base, it faces a declining average fixed cost curve, which allows the company to invest billions of dollars into content creation and content licensing partnerships.

According to Koyfin, Netflix grew its EBITDA margin and net income margin from 2.64% and 0.48% respectively in 2012 to 18.81% and 11.05% respectively in 2020. Clearly, high revenue growth, margin expansion, and creation of a moat around quality content are good advantages to obtain for a content and media company.

M&A in Media

Within media, a strong digital strategy and M&A have changed the media landscape. For example:

Over the past several decades, Barry Diller and John Malone have orchestrated a series of successful partnerships, M&A deals, and corporate spinoffs. Arguably, they are two of the most successful business operators and capital allocators in the media industry.

Under Bob Iger’s leadership, Disney was bold in deal-making, emphasized high-quality content and animation, globally expanded Disney’s physical and digital presence, and embraced technology in the media industry. Bob Iger oversaw Disney’s transformative acquisitions of Pixar, Marvel Entertainment, Lucasfilm, and 21th Century Fox’s entertainment assets.

In March 2021, Amazon signed a 10-year agreement with the NFL to exclusively broadcast Thursday Night Football games on Amazon Prime Video. (4)

On May 3, 2021, Verizon announced its intention to sell Yahoo and AOL to Apollo for $5 billion. (5)

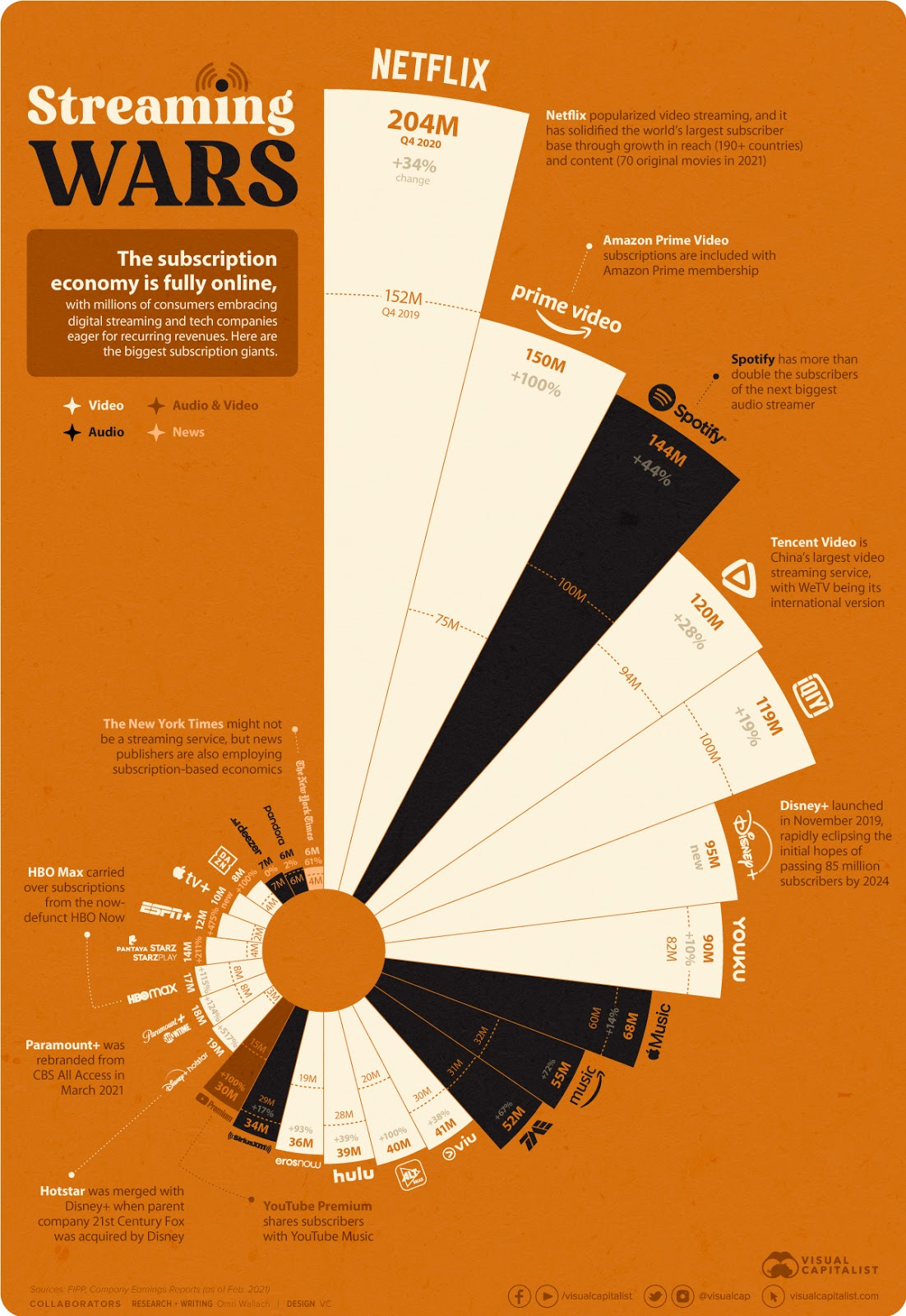

On May 17, 2021, AT&T announced an agreement to spin-off and merge its WarnerMedia group with Discovery as a publicly-traded company. This proposed transaction was structured via a “reverse Morris Trust” for a tax-friendly merger. The CEOs of AT&T and Discovery described that the combination of Discovery and WarnerMedia already spend about $20 billion in content per year and have 100 million total subscribers. In contrast, Netflix intends on spending about $17 billion in content this year and has about 208 million global subscribers. Disney has developed a plan to spend about $15 billion in streaming content by 2024 and has more than 100 million subscribers. (6-7)

With their media sale and spinoff, Verizon and AT&T are exiting their large media business units and re-focusing their efforts in their core telecom & connectivity businesses, especially given the capital-intensive nature of the business and the 5G rollout.

On May 26, 2021, Amazon announced its intention to acquire MGM for $8.45 billion. (8)

Subscription Streaming Services

As seen by the illustration below, a recurring subscription model is increasingly an integral part of how individuals digitally consume and connect with video, audio, music, news, and more.

Notably, a recurring model impacts both the producers and consumers of content. From a consumption perspective, individuals are increasingly accustomed to renting access to media content, news, and other services in their lives for a monthly fee. From a content production perspective, regardless if media content is monetized via advertising or recurring subscription revenues, media production needs to consistently produce high quality content that is engaging for individuals in order to remain relevant and consumer-focused.

Conclusion

The customer demand for greater content, curation, and convenience in consuming media has created a transformative shift in the content media landscape. There are 5 traits that matter for media providers more than ever before, and these 5 traits are scale, distribution, quality content, content aggregation, and the delivery of great customer experiences with well-made digital apps. We feel that companies that execute on these five traits have a competitive advantage in delivering significant returns to shareholders and delivering delightful experiences to their viewers.

References:

"Koyfin." https://app.koyfin.com/. Accessed 26 May. 2021.

"Netflix (NFLX) Q1 2021 earnings - CNBC." 20 Apr. 2021, https://www.cnbc.com/2021/04/20/netflix-nflx-q1-2021-earnings.html. Accessed 26 May. 2021.

"Amazon spent $11 billion on video and music content last year CNBC." 15 Apr. 2021, https://www.cnbc.com/2021/04/15/amazon-spent-11-billion-on-video-and-music-content-last-year.html. Accessed 26 May. 2021.

"Verizon Media to be acquired by Apollo Funds | About Verizon." 3 May. 2021, https://www.verizon.com/about/news/verizon-media-be-acquired-apollo-funds. Accessed 26 May. 2021.

"Amazon Prime Video Makes History as the First Streaming Service ...." 18 Mar. 2021, https://press.aboutamazon.com/news-releases/news-release-details/amazon-prime-video-makes-history-first-streaming-service-secure/. Accessed 26 May. 2021.

"AT&T announces $43 billion deal to merge WarnerMedia ... - CNBC." 17 May. 2021, https://www.cnbc.com/2021/05/17/att-to-combine-warnermedia-and-discovery-assets-to-create-a-new-standalone-company.html. Accessed 26 May. 2021.

"Discovery, Inc. - AT&T's WarnerMedia And Discovery, Inc. Creating ...." https://ir.corporate.discovery.com/news-and-events/financial-news/financial-news-details/2021/ATTs-WarnerMedia-And-Discovery-Inc.-Creating-Standalone-Company-By-Combining-Operations-To-Form-New-Global-Leader-In-Entertainment/default.aspx. Accessed 26 May. 2021.

"Amazon and MGM have signed an agreement for Amazon to ...." 26 May. 2021, https://press.aboutamazon.com/news-releases/news-release-details/amazon-and-mgm-have-signed-agreement-amazon-acquire-mgm. Accessed 26 May. 2021.

"Which Streaming Service Has the Most Subscriptions?Visual Capitalist." 3 Mar. 2021, https://www.visualcapitalist.com/which-streaming-service-has-the-most-subscriptions/. Accessed 26 May. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.