A Superpower Metric: The Importance of Contribution Margin

Weekly updates on the innovation economy.

Introduction

At Drawing Capital, we are of the view that disruptive and transformative innovation fuels future growth opportunities. In a digital world that strives for a “winner take most” environment, massive scale, and global distribution, one of the best economic metrics to understand scalable growth is contribution margin.

In this newsletter, you will learn or reinforce your knowledge of the following 4 topics:

What is the definition of contribution margin?

How does contribution margin differ from gross margin and other financial margin metrics?

How is contribution margin connected to scalable growth and operating leverage?

In an environment where numerous publicly traded companies report negative net income, how does data about contribution margin help to better understand a company’s business model?

Definition of Contribution Margin

“Contribution Margin” is a metric that helps to answer the following business question, “How much does the company keep after paying the variable expenses associated with making the product and selling the product?”

Contribution Margin = (Revenue - Variable Costs) / Revenue

Contribution Margin in Dollars = Revenue - Variable Costs

Typically, “cost of goods sold” on the income statement displays the costs associated with making a product. The costs associated with selling the product include sales & marketing expenses, customer acquisition costs, and additional variable costs associated with product distribution.

A company with negative contribution margin without corrective action is a money-losing enterprise with poor unit economics. Good investors often target companies with good unit economics.

In several instances, contribution margin is a better indicator than gross margin for future corporate earnings power when revenue increases.

Low variable costs in producing revenue is a competitive business advantage and leads to a higher contribution margin, which creates higher operating leverage, which leads to higher percentage increases in operating income from smaller percentage increases in revenue, which allows companies to expand and scale worldwide.

Contribution Margin & Growth Investing

While the P/E ratio can be a useful price-multiple financial metric to view the implied earnings yield of a stable, low-revenue-growth company, the P/E ratio is functionally useless when evaluating high-growth companies that currently have negative earnings per share.

Notably, there is a difference between earnings and cash flows. Net income (earnings) is an accounting measure that includes non-cash expenses, such as depreciation, amortization, stock-based compensation, and net changes in unrealized gains & losses of equity investments on the balance sheet. On the other hand, cash flows measures the actual cash that is entering and leaving the door of a business, as measured by cash inflows and cash outflows.

Fundamental long-term investors can value a stock as a present value of discounted cash flows. As future cash flows per share increase and as discount rates decrease, the present value (ie. the implied fundamental value per share) increases, which is obviously favorable to existing investors.

The higher the contribution margin, the higher the operating leverage, which translates to a greater potential efficiency in translating revenue into operating cash flows in the future with increased scale or volume. Typically, companies with low customer acquisition costs have high sales efficiency, which translates into higher contribution margins. On the other hand, companies with low contribution margins may perhaps have a challenged environment in generating substantial long-term profits unless the business model has achieved significant scale, gross margins are expanded, and/or sales & marketing expenses as a percentage of revenue can be reduced.

High operating leverage implies that only a small increase in revenue is needed to have a significant positive percentage increase in operating profits. A common observed characteristic is that as companies become larger, their revenue growth rates stagnate or decelerate, so having high operating leverage allows a company to translate revenue into greater operating profits and free cash flow.

As a contrast to many “physical businesses”, “digital businesses” (ie. software and cloud computing companies) often have significantly higher contribution margins. Two examples help to illustrate this point:

If Chevron wanted to expand the number of gas stations to sell more gasoline to consumers, then it would need to build or buy the necessary equipment and infrastructure for a gas station, obtain regulatory approvals & permits, hire employees or contractors to staff gas stations and the logistics that connects the refined oil from a refinery to a gas station, and survey additional costs.

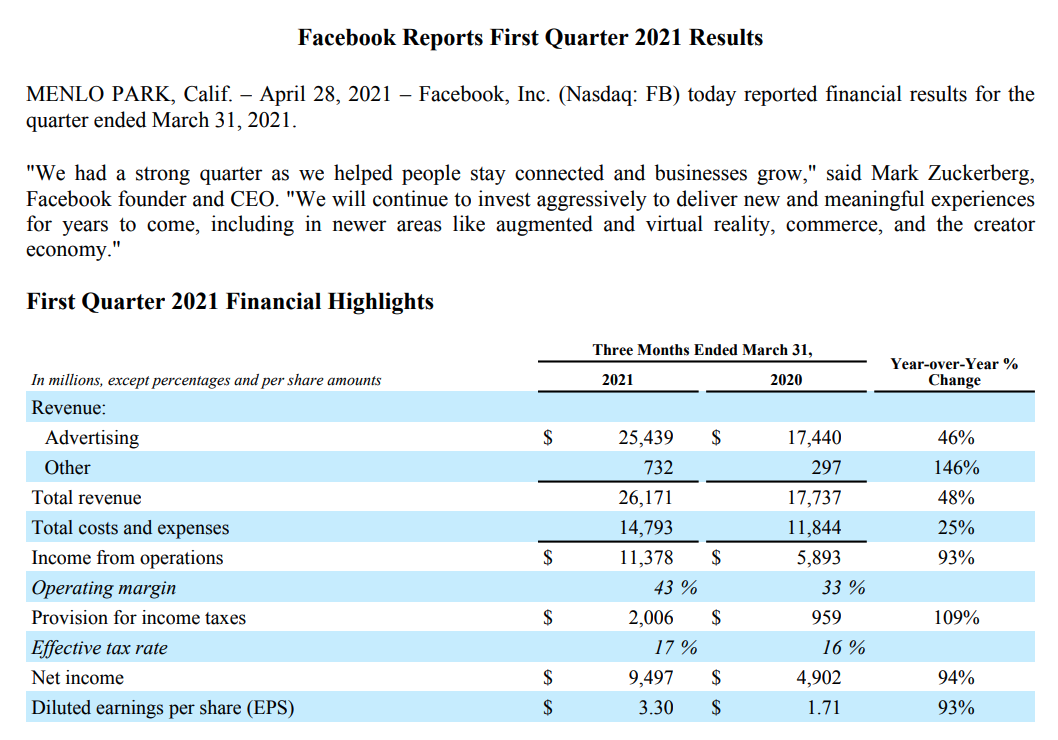

On the other hand, nearly anyone with an internet connection that is not in China can create a Facebook account. Facebook and its acquired digital assets (Instagram, WhatsApp, Oculus) have incredible scale and global distribution, and there are little marginal costs for Facebook to service the next user that joins Facebook. Facebook reported over 2.8 billion monthly active users and over 1.8 billion daily active users on the Facebook platform in the company’s Q1 2021 earnings release (1), implying that over one-fifth of the world’s population uses Facebook or its other digital platforms on a daily basis.

Expanding on the Facebook example even further, let us please look at the following snapshot below from the company’s Q1 2021 earnings release. Specifically, notice how Facebook’s net income grew a whopping 94% from Q1 2020 to Q1 2021 even though total revenue “only” grew 48% from Q1 2020 to Q1 2021. That’s the definition of a business model with a significant degree of operating leverage.

Break Even Analysis and Contribution Margin

Variable Costs + Fixed Costs = Total Direct Costs.

Total direct costs are the expenses reflected on the income statement. One point of nuance is that total direct costs does not include opportunity costs and cost of capital decisions. Variable costs include cost of goods sold, customer acquisition costs, sales & marketing expenses, and other costs that vary with production quantity of a product or service. To contrast variable costs, fixed costs are all non-variable costs in the short term that do not vary with production quantity.

Fixed Cost % + Variable Cost % = 100% of Total Direct Costs

Good business models often have high fixed cost % attribution and low variable cost % attribution. A high fixed cost business has a barrier to entry via cost, and a business with low variable cost has high contribution margin. Companies can increase their contribution margin ratio by decreasing variable costs or increasing prices on inelastic products and services.

Break Even in Revenue Dollars = Fixed Costs in Dollars / Contribution Margin.

Revenue = Price * Quantity Sold

Break even analysis helps to showcase a path towards profitability or positive cash flow.

If you assume the same fixed costs and the same contribution margin ratio (aka hold these 2 variables as constant), then it’s easy to calculate the revenue needed to achieve breakeven profitability. If a company is currently reporting losses, then the company needs to increase revenue, either by increasing prices on inelastic products and/or increase quantity sold (revenue = price * quantity sold). However many years it takes to reach this revenue number essentially becomes the estimated number of years it takes to reach profitability.

3 Examples

For example, let’s suppose 3 company scenarios:

Company A has $30M in fixed costs and variable costs that are 75% of revenue.

Company B has $30M in fixed costs and variable costs that are 50% of revenue.

Company C has $30M in fixed costs and variable costs that are 25% of revenue.

As discussed earlier, lower % variable costs implies a higher contribution margin. In reviewing the 3 examples above, Company A has a 25% contribution margin, Company B has a 50% contribution margin, and Company C has a 75% contribution margin.

This chart illustrates that the orange line (which represents Company C) has a steeper slope due to Company C having a higher contribution margin compared to the contribution margins for Company A and Company B. As a result of higher revenues, Company C achieves higher operating profits compared to the operating profits of Company A and Company B at the same revenue dollar amounts and at the same fixed costs.

Company C also achieves breakeven profitability faster than Company A and Company B in this scenario.

This chart illustrates that despite the same fixed costs across all three companies, Company A has the highest break-even revenue point at $120 million and Company C has the lowest break-even revenue point at $40 million. This is derived as a direct result from Company C having a higher contribution margin than Company A, which therefore allows Company C to achieve break-even profitability in a quicker revenue timeline than Company A.

Overall, a high contribution margin is a competitive advantage. A key benefit of achieving break-even profitability sooner with a high contribution margin and a high revenue growth rate is that positive cash flows either can be be reinvested to pursue new growth opportunities for the company, reduce extra equity dilution, make acquisitions, or be diverted to shareholders via dividends and share buybacks.

Conclusion

Contribution margin helps to define a company's "unit economics". Understanding contribution margin is an investing superpower, and companies with high contribution margins have higher potential of achieving significant and sustained cash flows in the future as long as revenues increase.

Several of the top fundamental investors and venture capitalists in the world use this contribution margin metric, yet this metric often is not a focus of emphasis (compared to net profit margins and earnings per share) in business schools and isn't easily accessible/web-scraped because contribution margin is a non-GAAP accounting metric (on the other hand, gross margin and net income margin are easily available across many data providers).

The combination of revenue growth, contribution margin, and trends in free cash flow per share over time are three valuable metrics (among many) to consider in making investment decisions, particularly for fundamental, long-term, growth investing.

References:

"Facebook Q1 2021 Earnings - FB Investor Relations." https://investor.fb.com/investor-events/event-details/2021/Facebook-Q1-2021-Earnings-/default.aspx. Accessed 2 May. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.