While we enjoy exploring both the technical and scientific aspects of innovative technologies, focusing on sustainable businesses is also paramount to the success and adoption of their products. After all, if you build it, they may not come.

Every groundbreaking technology needs both capital, distribution, and sound economics (among other things) to survive and prosper. In this week’s post, we’ll be diving deeper into five of the key metrics that help technology sector analysts decide whether or not a company is a sound business or just another pretty face.

Conveniently, you can also explore these metrics and more on our new analytics page (note: although you can view from a small screen, due to the volume of data, the Analytics page is best viewed from a laptop or desktop):

Why This Is Important

Today, we’re experiencing very successful public offerings of new technology companies. On the first day of trading, companies such as Snowflake, AirBnB, and C3.ai all appreciated more than 100%, as seen in the table below.

Amidst all of the public market optimism, it is important to remain methodical and rational. While it’s easy to get excited by the upside enthusiasm we’re experiencing, having context to operate in will provide clarity and help you to remain focused on important decision-making factors.

1-day Price Appreciation of Select Group of Recent IPOs

Additionally, many technology companies are not profitable (measured over the preceding 12 months) at the time of their IPO.

% of Tech Companies with Positive LTM Earnings at IPO:

Five Key Metrics

The metrics that we’ll be discussing today are meant to provide a “finger on the pulse” as you’re reviewing companies of interest. They’re not intended to be exhaustive, but rather, should be seen as the initial filter or “test” that should be passed before qualifying for deeper analysis.

It is often helpful to apply the measurements below to peer groups as well as industry leaders. The five key metrics are:

EV/ Revenue

Revenue Growth

Magic Number

Gross Margin

FCF (Free Cash Flow)

EV/ Revenue

Enterprise Value (EV)-to-Revenue is a fundamental financial metric used to determine whether a stock is priced fairly.

Compared to market capitalization, or “market cap,” which is simply the value of total outstanding shares multiplied by current stock price, EV takes into account the use of debt and cash on the balance sheet and is a more accurate measure of a company’s size.

As a ratio, dividing the company’s enterprise value by its revenue (typically the next twelve month’s [NTM] revenue) provides an indication of whether the stock is undervalued, fairly valued, or overvalued. Typically, the lower the EV/ Revenue ratio, the better the opportunity is considered to be by those focused on buying stocks at a bargain.

Based on our Analytics page, the following companies are currently trading at the highest EV-to-revenue multiples. Coincidentally, nearly all ten companies are software companies.

Of the almost 430 companies listed, the average EV/ Revenue is 28x. As such, you will notice the current “premium” that many industry leaders are trading at. Although many of them are well in excess of the average, that does not mean that they will contract in the near future, if the investors that make up the marketplace determine that such valuations are warranted.

Revenue Growth

This metric is certainly self-explanatory, yet essential. Simply put, is the company in question growing, and at what rate? This growth rate can be observed quarter-over-quarter, year-over-year, or over the course of a series of years.

While it is important to dig deeper into why revenue growth is (or isn’t) occurring, this can be a good metric to filter on when running a quick scan across a sector or industry. Shareholders are the owners of a company, and business owners generally want to invest in growing businesses. After all, if we don’t anticipate any growth, why would we consider this company a viable candidate for our hard-earned capital?

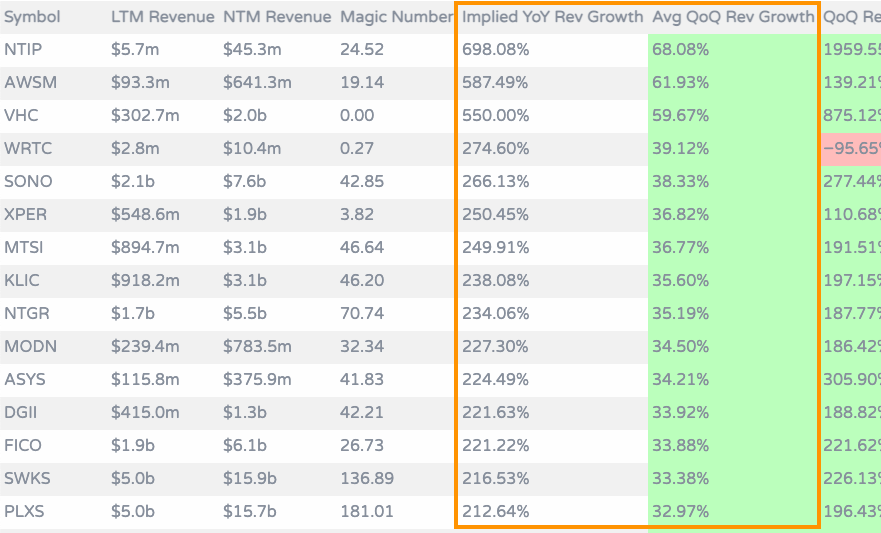

In our sample of 426 companies in the technology industry, the top 10 revenue growers are:

While this all sounds great, to be growing at >30% quarter-over-quarter, it is not the only thing that matters. Let us pivot slightly to look at how one might go about measuring efficiency and profitability under the umbrella of rapid growth.

Magic Number

The “Magic Number” was made a popular SaaS metric in the 2000s as a way to measure a company’s sales efficiency. Specifically, the Magic Number adjusts Quarter-over-Quarter revenue for sales and marketing spend. Another way of saying “sales and marketing expenses” is “business development dollars”. The Magic Number answers the following question: how much does it cost your company in business development dollars to achieve the revenue you’re experiencing?

The higher the Magic Number, the more effective the company has been in managing the acquisition of new revenue. Companies that experience “viral” or word-of-mouth type growth with high product quality will commonly have a higher Magic Number.

However, it is important to note that the Magic Number can be skewed in certain circumstances, which can warrant a deeper dive into the causation, such as if a company signs a significant new customer contract that is quickly recognized as revenue on the income statement. You will notice on our Analytics page that you can also experience a significant skew in this Magic Number metric.

Gross Margins

Gross margin is simply revenue minus the cost of goods and services sold, expressed as a percentage of revenue. Several software companies exhibit much higher gross margins than other businesses. This phenomenon is due to the declining cost curves of software, low marginal costs and low variable costs associated with many software platform companies, and the expansion of cloud computing service providers such as Amazon’s AWS, Alphabet’s GCP, and Microsoft’s Azure. To think on a smaller scale, if you’re a capable engineer, you might be able to build a useful piece of software on your own, with little to no overhead, and the greatest cost being your own time. Any sales made thereafter are simply profit, and thus, very high gross margins.

Of our sample size of 426 companies in the technology industry, the average gross margin is 50.45%. Compare this figure now to the S&P 500’s trailing 4-quarter profit margins of 9.0%. On average, the technology sector trades at higher price multiples because several technology companies simply have better and more enduring business models compared to legacy companies that display low margins, low growth, and low degrees of innovation.

In recent years, gross margin has become an increasingly popular metric, as investors have become overwhelmingly focused on high multiples and the sustainability of corresponding growth rates.

Free Cash Flow Margin

Having briefly mentioned that newly publicly traded companies in the technology sector are commonly unprofitable, it is important that we also highlight a profitability metric, such as free cash flow margin.

We could certainly continue to see unprofitable companies appreciate in value, but for those focused on profitability and weathering any looming storms, FCF margin is a fantastic metric.

FCF margin is defined as free cash flow from operating activities divided by net sales, and provides analysts with a clear picture of how well a company is converting sales into cash. Similar to measuring gross margins, the greater the percentage the better.

Relative to the S&P 500, which has an average FCF margin of 10.31%, the technology companies in our Analytics sample have an average FCF margin of 16.19%.

Conclusion

Every firm and investment manager will have a unique process and set of criteria for evaluating companies, and the measurements used should always complement the objective, time horizon, and client-base of the strategy.

For those who manage their investments themselves and are interested in a quick way to gauge whether or not they should investigate a stock position further, the above metrics and our Analytics page are a good place to start.

If there’s anything more you’d like to see on our Analytics page, or if you feel that there are areas for improvement, please let us know. We’d like to make this ongoing project as useful as possible.

References:

“S&P 500 Cash-Flow Margins, Effective Tax Rates Information & Trends.” https://csimarket.com/Industry/industry_Profitability_Ratiosc.php?sp5#:~:text=Free%20Cash%20Flow%20Margin%20Comment,average%20Free%20Cash%20Flow%20Margin. Accessed 13 Jan. 2021.

“S&P 500 Sectors & Industries Profit Margins.” https://www.yardeni.com/pub/sp500margin.pdf. Accessed 13 Jan. 2021.

"Koyfin | Advanced graphing and analytical tools for investors." https://app.koyfin.com/. Accessed 14 Jan. 2021.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.