Introduction: The FANGMAN and MT SAAS Companies

The “FANGMAN” acronym stands for 7 companies:

Facebook ($FB)

Amazon ($AMZN)

Netflix ($NFLX)

Google / Alphabet ($GOOG and $GOOGL)

Microsoft ($MSFT)

Apple ($AAPL)

NVIDIA ($NVDA)

Recently, the cumulative market valuations of these 7 companies exceeded the $10 trillion milestone in July 2021. The size, scale, and scope of FANGMAN companies are enormous and continue to grow. Importantly, all 7 of these companies share the following trait of being platform technology companies.

You can view our previous post on FANGMAN companies here:

FANGMAN’s Younger Sibling, MT SAAS

Aside from the “FANGMAN” acronym and as the total addressable market for cloud computing continues to grow, Bessemer Venture Partners recently coined a new acronym titled “MT SAAS” to describe a specific set of premier high-growth cloud software companies. “MT SAAS” stands for the following companies:

Microsoft ($MSFT)

Twilio ($TWLO)

Salesforce ($CRM)

Amazon ($AMZN)

Adobe ($ADBE)

Shopify ($SHOP)

While both FANGMAN and MT SAAS companies have demonstrated significant benefits to users, customers, shareholders, and other stakeholders, it’s possible that over the next several years, an equal-weighted portfolio of MT SAAS companies may actually outperform an equal-weighted portfolio of FANGMAN companies in terms of percentage returns to shareholders.

Inception to IPO and Beyond for MT SAAS Companies

Internet-Scale Businesses

Notably, total addressable markets ("TAM") for several industries and sectors have been expanded by global internet distribution. If you operate a gas station, your addressable market is restricted to travelers, car renters, and car owners in your locality. If you operate a social network or online store, your theoretical addressable market is anyone that has access to the internet.

With massive distribution at scale with reasonably low variable costs, internet-scale businesses benefit from significant secular tailwinds with a growing total addressable market that is currently worth tens of trillions of dollars.

For many traditional physical businesses and industrial companies, the combination of diminishing marginal benefits of scale after a certain size and increased organizational complexity place an artificial ceiling on the growth prospects of these types of businesses. On the other hand, this artificially-defined growth ceiling vanishes for internet-scale businesses that operate as technology platforms with low marginal costs, high degree of network effects in concert with exponential technologies, high product market fit with customers, and strong distribution channels. By definition, positive network effects imply that as a company gains more customers, all of the previous customers also benefit via a better product or service, which creates an accumulating competitive advantage with increasing marginal utility with greater size, scope, and scale. As a result and with the benefits of software, internet-scale businesses can continue to grow at scale and command significant company valuations. As “software continues to eat the world”, more and more software companies will become several of the largest companies in the world.

The Size, Scale, and Scope of Tech Companies

The size of the prize for tech companies is significant, as seen by the fact that the cumulative market valuations of FANGMAN companies and MT SAAS companies.

From 2013-2020, the cumulative market valuations of FANGMAN companies grew by more than 7x, which represents a nearly 28% compound annual growth rate (CAGR).

From 8/31/2016-8/31/2021, the cumulative market valuations of MT SAAS companies grew by more than 5x in 5 years, which represents a nearly 39% compound annual growth rate (CAGR). The cumulative market caps of MT SAAS companies was above $4.85 trillion as of August 31, 2021.

Both FANGMAN companies and MT SAAS companies have vertically and horizontally grown several business units, either via organic in-house development and via acquisitions. In many instances, these companies used the strategy of “concentric circles with excellence and expansion”: hyper-focus on 1 product category, become the category leader, and then earn the right to build more products or create new concentric circles via additional business segments in order to grow revenues and expand total addressable markets. For example, Amazon first started selling books online, then expanded its e-commerce retail platforms, then launched Amazon Web Services (AWS), and now is rapidly expanding into other industries after achieving significant market share in e-commerce and cloud computing infrastructure.

Historical Stock Price Performance of MT SAAS Companies

MT SAAS companies have delivered significant returns to shareholders and stock-owning employees:

Translating the numeric historical returns into meaningful dollars, higher annualized returns lead to higher investment multiples and demonstrate the beauty of compounding returns. For example:

A 25% annualized return in 5 years creates a ~3x return (i.e. tripling an initial investment).

A 40% annualized return in 5 years creates an over 5x return.

In the extreme above example with Shopify, a ~106% annualized return in 5 years creates a nearly 37x return on initial investment in 5 years. That’s incredible.

Over the past 5 years, Shopify’s stock ($SHOP) has been the best performing stock among the MT SAAS companies. Notably, all 6 of the MT SAAS companies historically have generated significantly positive returns that have also outperformed the return of the S&P 500 Index over the past 5 years.

Business Moat with a Strong Competitive Edge

There are 3 steps to understand if a business has a moat with a competitive edge:

High competitive win rate and high customer retention: Advantaged business models allow a select group of companies to win a lot more than they lose on a persistent and recurring frequency over time.

High returns on equity (ROE) and incremental invested capital (ROIIC) are financial performance measures. Great companies have solid returns on equity and understand how to reinvest cash flows back into existing and new business units to pursue future growth opportunities, which enables positive compounding at scale over time. Companies that generate high and compounding returns at scale over time are lucrative for shareholders and stock-owning employees.

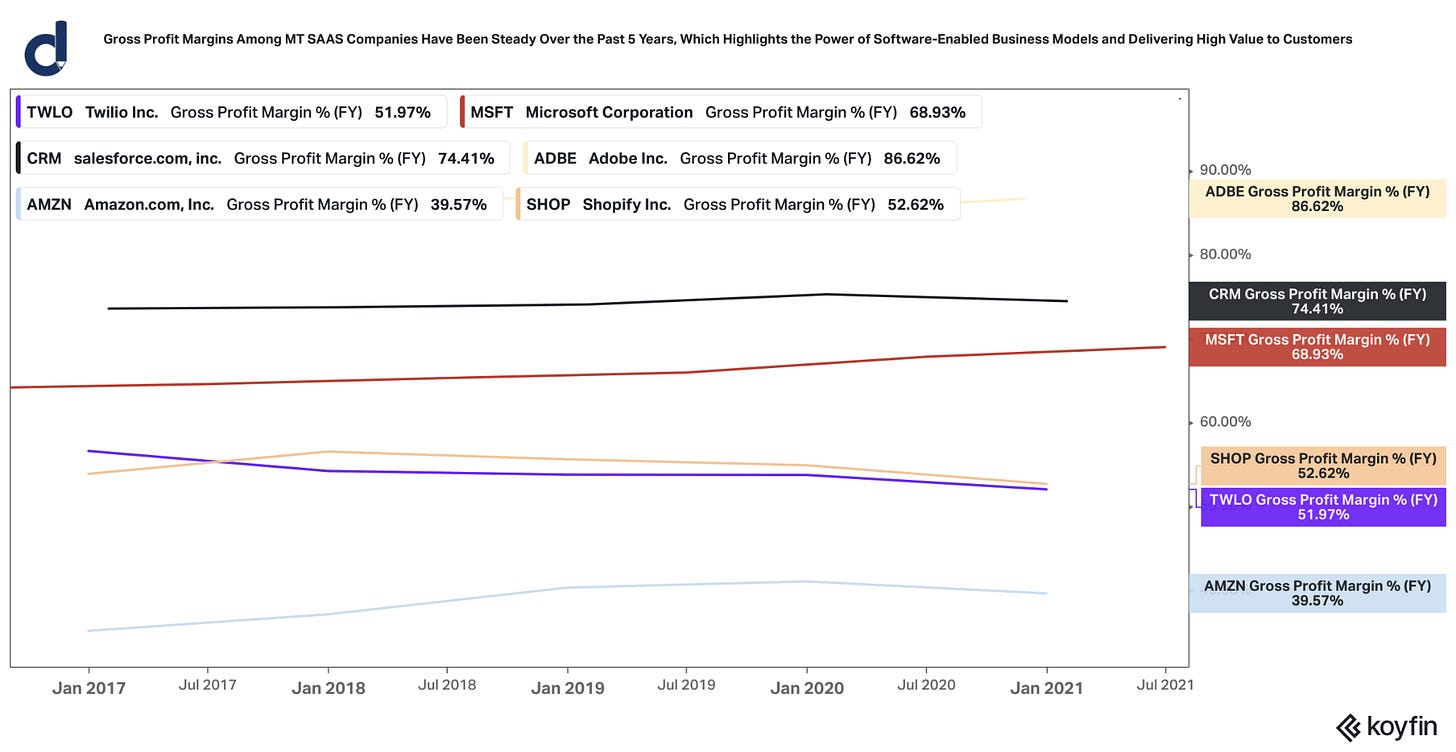

Pricing power translates the concept of “advantaged business model” in step 1 into actual revenue, gross margin dollars, and cash flow. Good businesses have good pricing power. Companies in perfectly competitive industries have no pricing power, while companies that are monopolies or oligopolies have huge pricing power. Gross margins should be steady or ideally increasing over time.

Concluding Thoughts

MT SAAS companies collectively exceeded $4.85 trillion in market cap in August 2021, which demonstrates the size, scale, and scope of these companies. In comparison, FANGMAN companies collectively reached a combined $10 trillion in market cap in July 2021.

It is abundantly clear that software companies benefit from a significant secular tailwind. In aggregate, software companies continue to grow in revenue, business size, and in relative market share within the S&P 500.

We are of the opinion that Big Tech companies continue to be undervalued. While we believe that Big Tech companies will continue to face antitrust scrutiny and be political punching bags, the realities of Big Tech continue to be an enormous net positive for stakeholders by generating a significant surplus to consumers, significant collective wealth for employees, significant corporate revenue growth and cash flows, and significant shareholder value.

Internet-scale businesses have been routinely under-estimated in the size of their total addressable markets (TAMs) by most investors. Internet-scale businesses can expand their TAM across various sub-sectors and industries, continue to find specific niches to add value, and go nationwide and go global in distribution.

The business strategy of “concentric circles with excellence and expansion” presents a compelling and informative method of founding startups and building new business units inside platform technology companies.

References:

"Forget FAANG—it's time to scale MT SAAS · Bessemer Venture ...." 20 Nov. 2020, https://www.bvp.com/atlas/mt-saas. Accessed 2 Aug. 2021.

"Koyfin | Advanced graphing and analytical tools for investors." https://app.koyfin.com/. Accessed 2 Aug. 2021.

"Shopify Inc (SHOP) Trailing Returns - XNAS | Morningstar." https://www.morningstar.com/stocks/xnys/shop/trailing-returns Accessed 5 Sept. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.