Today, we’re exploring Berkshire Grey under the ticker symbol $BGRY. Berkshire Grey is attempting to disrupt a $280B+ total addressable market (TAM), which is calculated as a combination of $230B of warehouse labor expenses plus $56B in automated equipment handling market (that continues to grow).

Mission

“Improve Efficiency, Raise Quality, Lower Prices, and Get Goods to New Places More Rapidly by Supporting People With Intelligent Automation”

Key Stats

CEO: Tom Wagner, PhD

Year Founded: 2013

Market Cap: ~$750M USD

As of Fiscal Quarter Q3 2021:

LTM Revenue: ~$31M USD

YoY Revenue Growth: 750.4%

Gross Margins: -14.6%

Operating Margins: -249.8%

Net Income Margins: -215.5%

Free Cash Flow Margins: -142.5%

Tom Wagner, PhD and Leadership Background

Tom Wagner was previously the CTO of the robotic automation company iRobot ($IRBT) which produces the popular Roomba vacuum cleaner. He also held leadership positions at DARPA and Honeywell. Lastly, he was a professor at the University of Maine after pursuing his PhD in artificial intelligence and computer science.

You can read more about Berkshire Grey’s senior management at https://www.berkshiregrey.com/about-us/senior-management/ which includes Matt Mason, PhD, the former director of the Robotics Institute as Carnegie Mellon.

Some notable individuals on the Board of Directors include Sven Strohband, PhD (Partner at Khosla Ventures) and Nadia Shouraboura, PhD (Former VP of Global Supply Chain and Fulfillment at Amazon).

Overview

Berkshire Grey focuses on transformative, AI-enabled robotic solutions to automate online order fulfillment and store replenishment operations for leading retail, third-party logistics, grocery, and eCommerce companies. Some examples of what they do are shown below (taken directly from their Fact Sheet).

Here's a picture of their Mobile Robotic Fulfillment technology which combines mobility and robotic picking:

These robots move boxes around the factory using a tiled railway system as seen by the squares on the ground.

And here's what their Robotic Product Sortation looks like. It’s essentially a vacuum pump attached to a robotic arm, and while it’s great for larger objects like books and meats, it may not work for small items like LEGO (the toy bricks) or candies.

Strengths

Berkshire Grey has over 300 patent filings and 71 patents issued around robotic picking, robotic movement and mobility, and system orchestration (enabling various intelligent subsystems to work together). They claim to have asset-light operations by using third-party manufacturers which they believe will enable them to scale production rapidly.

They have no plans to build their own factories as they strive to focus more on designing solutions rather than manufacturing them. BGRY also has two pricing options, subscription (RaaS) or upfront payment, which allows for clients to opt into what suits them best. Their vision consists of their 400 employees (75% of which have technical degrees) designing the brains behind automation while third parties compete to build their vision.

Weaknesses

$BGRY has never been profitable. They’ve lost money every single year since inception, and expenses will continue to rise as they try to scale their product offerings and hire a larger team. Additionally, most of their revenue comes from just 4 companies (explained later). Lastly, they rely heavily on third party manufacturers whose own success is not under Berkshire Grey’s control. If these manufacturers were to financially collapse, Berkshire Grey would hopefully find another manufacturing solution with equal cost.

Catalysts

So what are the catalysts for Berkshire Grey to succeed? Well, simply looking at Amazon being the retail leader today pushing for automation, their competitors must transition to automation to stay competitive.

There are 4 companies that are supporting $BGRY's revenues at the moment: Walmart ($WMT), Target ($TGT), FedEx ($FDX), and TJX ($TJX). See below for just how big these customers really are, and how much they could use automation.

One thing that all these companies have in common is that they all compete with Amazon, whether it's in retail, e-commerce, grocery delivery, or parcel delivery. Amazon also has an advantage by having innovation in their blood, whereas their incumbents will need the help of companies like Berkshire Grey. Amazon has been working on warehouse automation as early as 2012 with their acquisition of Kiva Systems (now Amazon Robotics). It wasn't until Covid-19 that labor scarcity and therefore costs have risen dramatically such that automation is now heavily desired to fill in the missing labor. The problem is, Amazon had an 8 year head start in 2020, so how much time do competitors have to stay competitive? That's why companies like Berkshire Grey are so necessary.

Here’s a chart from Statista depicting the growth of industrial robot installations globally since 2004. The trend has generally been positive with a 295% cumulative growth over 16 years from 2004 to 2020 (which is about a 9% CAGR).

On a related note, we can see the growth of the operational stock of multipurpose industrial robots globally. From 2010 to 2020, we saw 184% cumulative growth (or about a 11% CAGR) in operational stock.

Growth

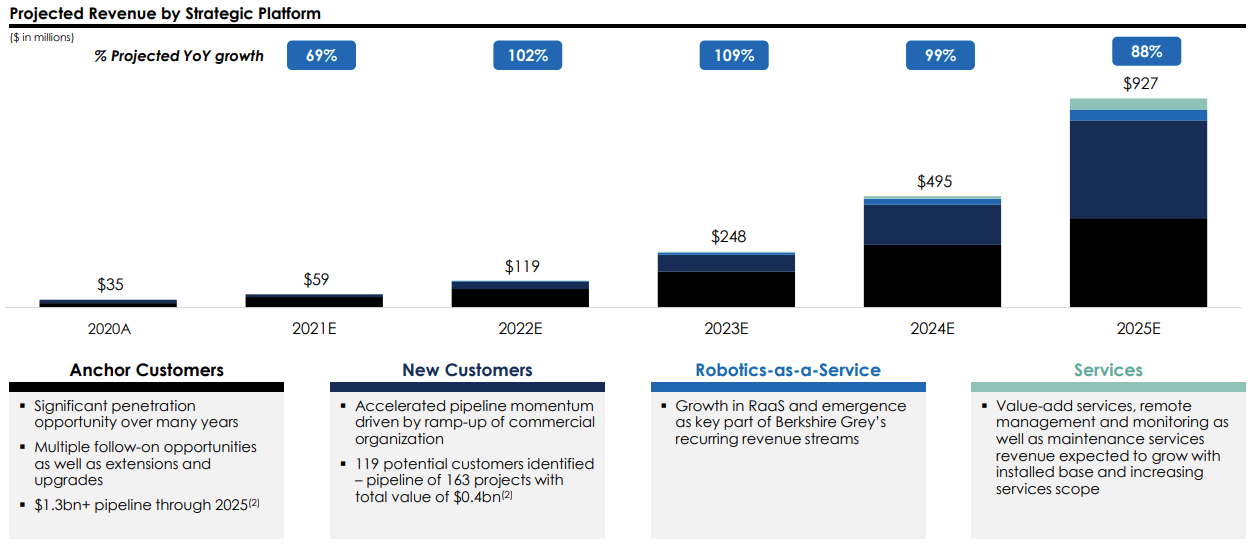

Berkshire Grey's growth based on their own expectations is shown below.

As we can see, most of their revenue will be coming in the near term primarily from anchor customers (recurring clients responsible for a majority of revenues). By 2025, BGRY currently expects new customer revenues to outpace their anchor customers, signaling an inflection in their business. You'll also notice the onset of revenues from RaaS (Robotics as a Service) and Services (remote management, monitoring, and maintenance) is expected to play a larger part in their growth around 2024-2025. Until then, their fate is largely tied to their anchor customers.

Additionally, as of Q4 2020, they had 275 employees. Today, they have about 400 employees, which is a 45% growth in team size over just about 1 year. If the team continues to grow at this rate, we could see them have ~580 employees by Q1 2023.

Future

BGRY has a lot to prove, and we hope to see them meet their expectations of positive margins and consistent 95%+ revenue growth YoY until 2025. The chart below shows their expectations of reaching 48% gross margins and 25% EBITDA margins by 2025. While the axes of their charts are missing (perhaps to hide the low or negative margins today), we believe the subtle gray line symbolizes “breakeven” or 0. This presentation is from July 2021, and so far, the gross margin expectations have not been positive despite the positive expectations shown.

While they say they will continue to rely on third party manufacturers, it's also entirely possible that one day they will automate away their own manufacturing (because they are an automation company after all). The need for robotic automation to fulfill labor scarcity will continue to rise as seen by the data from Statista. We believe that there are millions of jobs that are repetitive and uninteresting for people who seek more creative and fulfilling work, which will also pave the way for further automation.

References

TIKR Terminal, https://app.tikr.com

Berkshire Grey, https://www.berkshiregrey.com/

BerkshireGrey Company Fact Sheet, https://www.berkshiregrey.com/wp-content/uploads/2021/12/BerkshireGrey-Company-Fact-Sheet-P20211112.pdf

“Berkshire Grey Extends its Commercial Momentum with $14 Million in New Orders, Bringing Total Orders to Date to Approximately $200 Million”. Berkshire Grey, Inc., https://ir.berkshiregrey.com/news-events/press-releases/detail/48/berkshire-grey-extends-its-commercial-momentum-with-14

S-1, https://www.sec.gov/Archives/edgar/data/0001824734/000119312521263234/d207499ds1a.htm#rom207499_6

10-Q, https://www.sec.gov/ix?doc=/Archives/edgar/data/1824734/000095017021004278/bgry-20210930.htm

Mission & Values - Berkshire Grey, https://www.berkshiregrey.com/about-us/mission-values/

Berkshire Grey Investor Presentation, https://www.berkshiregrey.com/wp-content/uploads/2021/07/Berkshire-Grey-Investor-Day-Presentation-7-13-21.pdf

Statista - The Statistics Portal for Market Data, Market Research and Market Studies, https://www.statista.com/

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.