Bessemer’s Cloud Index and Categorizing Software Companies

Weekly updates on the innovation economy.

Introduction

At Drawing Capital, we are of the view that disruptive and transformative innovation fuels future growth. Several software companies are increasing societal efficiency, integrating technology in our everyday lives, and digitizing both the tech industry and traditionally non-digital industries. We share the opinion of being incredibly optimistic about the future of software and its applications for consumers and companies.

In this newsletter, we enable you to learn more about the following 3 key topics:

Historical returns from investing in software and technology

Categorizing company leaders in various subset industries within software

Bessemer’s BVP Nasdaq Emerging Cloud Index and related insights

Historical Returns

Clearly, software and technology index funds have delivered significantly higher historical performance compared to the Dow Jones over the past 10 years.

Categorization of Software Companies

Bessemer’s Cloud Index: Measuring Public Software & Cloud Companies

In August 2013, a partnership between Bessemer Venture Partners and Nasdaq launched the “BVP Nasdaq Emerging Cloud Index” under index ticker $EMCLOUD. As we can see from the chart below (as of June 30, 2021), publicly-traded cloud-based software companies in aggregate performed tremendously well and delivered significant outperformance compared to the 3 popular US stock market indices (Dow Jones, S&P 500, and NASDAQ 100).

Notably, this historical surging performance of the BVP Nasdaq Emerging Cloud Index is not just an incremental performance boost; the cumulative return of the BVP Nasdaq Emerging Cloud Index since August 2013 is about 7 times higher than the cumulative return of the S&P 500 index. Of course, while past performance returns may not be replicated or indicative of future performance, highlighting this historical performance helps to understand the possibilities associated with correctly investing in high-growth themes without taking significant risks associated with concentrated investing in individual companies.

From an investor perspective, WisdomTree’s Cloud Computing ETF under ticker symbol $WCLD seeks to track the BVP Nasdaq Emerging Cloud Index. Since the inception date of the $WCLD ETF in September 2019, the $WCLD ETF has significantly outperformed both the Dow Jones and a general tech index fund ($VGT).

This chart from Bessemer Venture Partners highlights that despite some deceleration in revenue growth rates for cloud and software companies, the median revenue growth rate of a company in the BVP Nasdaq Emerging Cloud Index is greater than 30%. On the other hand, there are only 19 companies in the S&P 500 Index that have compounded annual revenue growth rates of 25% or more over the past 5 years. Therefore, many cloud and software companies have revenue growth rates that far exceed the current median revenue growth rates of S&P 500 index companies.

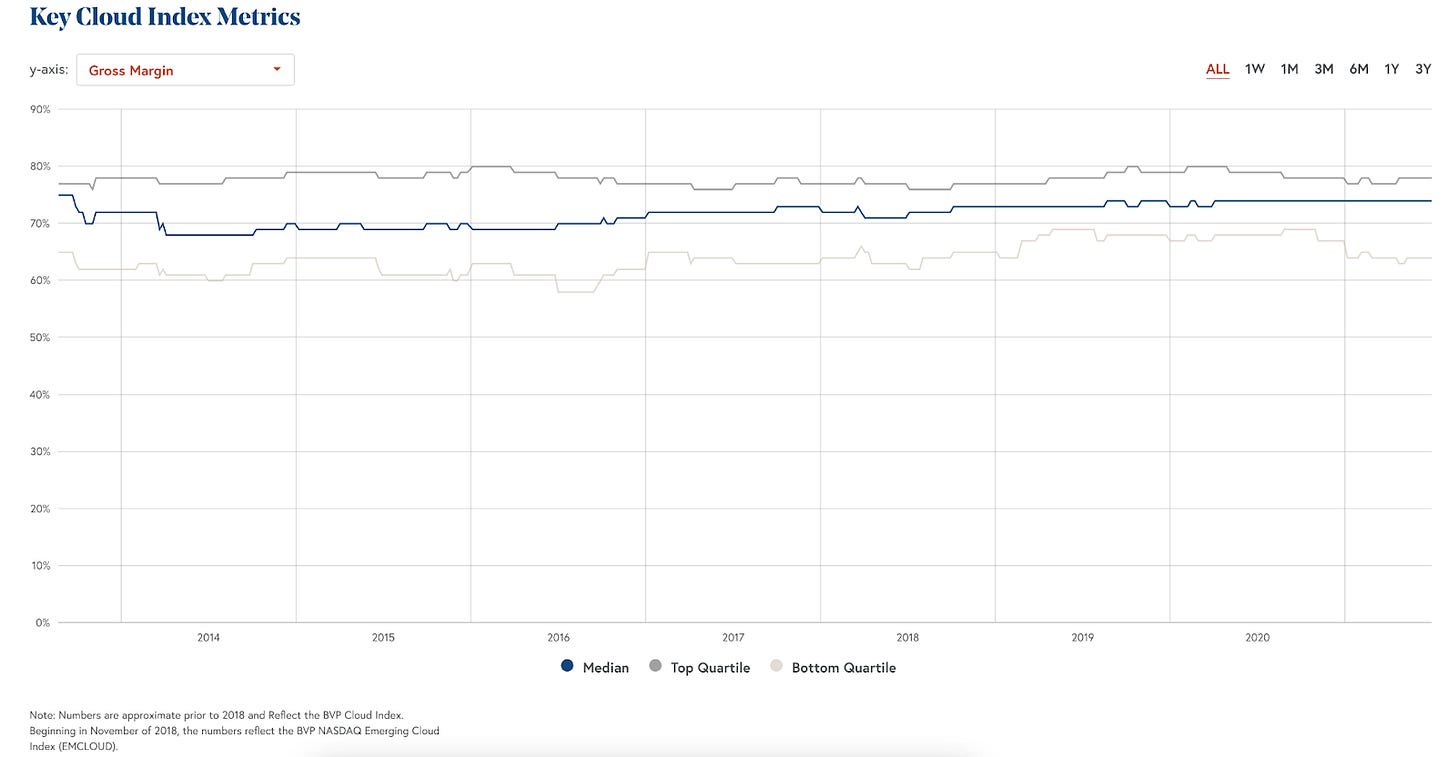

As of July 1, this chart from Bessemer Venture Partners highlights that for both the median and top quartile cloud and software companies in the BVP Nasdaq Emerging Cloud Index, gross margins have historically been relatively stable and high. This statement has importance with 3 major implications:

Despite the presence of rising competition and acquisitions from legacy tech companies, innovative startup companies, and other publicly traded cloud and software companies, many cloud and software companies are able to maintain stable margins. Multiple companies can win in each subset of the broader software industry.

Companies with high gross margins often have a competitive business advantage compared to companies with low gross margins. Gross margin measures the percentage of revenues that a company keeps after paying for the cost of producing the product or service. Gross margin = (Revenue - Cost of Goods Sold) / Revenue. Higher gross margins allow companies to allocate this higher gross profit into business endeavors that build more products (such as through R&D expenses), grow the business (via sales, marketing, and advertising expenses), or engage in cash return programs to shareholders (dividends and share buybacks).

High gross margins allow companies to scale, grow faster, and enable a distribution strategy to reach customers. Low variable costs allow companies to enjoy high operating leverage in their business, especially when the fixed costs are eventually overcome.

5 Key Insights

Understanding important software metrics is useful for both investors and builders of software companies. Both investors and builders of software companies are aligned in that both are seeking high revenue growth that eventually commands dominant market share and significant creation in enterprise value.

Often, revenue is a primary contributor to SaaS valuations: How much is the revenue, how fast is the revenue growing, how predictable is this revenue, and how enduring is the revenue growth rate for the next several years?

Investors can use these software metrics to evaluate and invest in their view of high-quality software companies. Founders and builders of software companies can use these metrics to benchmark their results, understand what’s important for investors (which is useful in increasing shareholder value and fundraising for additional capital), and find areas of improvement.

Disruptive and transformative innovation fuels future growth. Given the necessity of digital transformation for companies due to the coronavirus pandemic and the right-sizing of business models to lower costs, grow revenues, and expand margins, the growth of software and cloud computing is certainly in vogue.

Cloud computing and software companies in aggregate have historically delivered extraordinarily positive returns over time that have also significantly outperformed popular US market indices such as the Dow Jones Industrial Average and the S&P 500. In gaining exposure to software companies, investors can either do the hard work of individually picking and choosing to invest in individual software companies, contact Drawing Capital to learn more about Drawing Capital’s software investing approach, rely on experts, or utilize software and cloud-focused ETFs such $FDN, $IGV, or $WCLD.

Summary

Overall, we are attracted to the creativity of new technologies and remain committed to seeking multi-period growth opportunities with a tech-focused lens that enables scalable growth. The growth of software and its multi-industry applications have been remarkable, and we expect the digitization of traditionally non-digital industries to continue for the foreseeable future.

References:

"Trailing Returns - XNAS | Morningstar." https://www.morningstar.com/etfs/bats/igv/performance. Accessed 1 July 2021.

"BVP Nasdaq Emerging Cloud Index - Bessemer Venture Partners." https://cloudindex.bvp.com/. Accessed 1 July 2021.

"The Cash Conversion Score for cloud companies - Bessemer ...." https://www.bvp.com/assets/media/bessemer-whitepaper-cash-conversion-score.pdf. Accessed 1 July. 2021.

"Koyfin." https://app.koyfin.com/. Accessed 1 July. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.