Drawing Capital Newsletter

December 11, 2020

This week, we explain why Bitcoin and other crypto currencies are the next logical step in the evolution of finance.

What is money?

Money can be considered a store of value, a medium of exchange, a unit of transfer, or even a guarantee of debt repayment. It was first used ~8,000 years ago, but its form has changed over time to continuously solve the problems around seamlessly storing and moving value between entities.

How money evolved

Below is a high-level depiction of our financial system’s evolution over the last several millennia.

In the days of bartering, business was relatively hard because not everyone wanted what you owned. That made it difficult for you to trade for other items. People could either loan items to you (recorded on paper), or they could skip the headache and take something from you that could be sold later (which was risky). If only there was something that everyone found valuable… then it wouldn’t be so hard to move goods and services around the economy.

At some point, people naturally converged toward a general currency that served this exact purpose. Whether it was metals, cocoa, or rocks, as long as everyone agreed that these items were worth something, then everyone could track value. In 550 B.C, Gold became the standard currency for ages, but it had some drawbacks.

Gold is heavy in weight

Gold can be arduous to securely store and transport

There is difficulty in divisibility of gold

Incorrect scale measurements might cause you to underpay or overpay

In 1690, paper currency and metal coins were introduced as a certificate of an IOU. However, there are still some issues that we see today with these forms of currency:

Inflation caused pennies to be worth less than the copper they’re made of

Paper monies are counterfeited

You can still under or overpay by 1 cent when buying groceries weighed by the pound

The cost of transportation, especially overseas, is high

People still had to carry pockets and purses of change around

Cashiers took a long time to count dollars and coins

Eventually, credit cards were introduced in 1950 which expedited transaction times, reduced the burden of carrying a lot of physical monies, and introduced more transparency and history of personal finances. The problem with credit cards are:

They can be easily stolen or hacked

People now carry multiple cards, often too many, which can become a nuisance

Debts are more easily piled up for people with poor spending habits

They still rely on US dollars where the smallest fraction of currency is 1 cent

In 2007, mobile banking was introduced though not widely used until years later. People could store various credit cards, gift cards, and coupons on their phones which reduced transaction times via tap & pay systems, reduced clutter of cards in their wallet, and improved security of their finances. Alas, there are still problems with the financial system, such as:

Almost every major country has their own currency which creates fragmentation

Banks are closed on weekends

ACH and wire transfers can take days to complete and usually come at an additional cost

Fiat currencies are pegged to the outcome of regional governments, which carries substantial political and inflationary risk (e.g. Venezuela and Zimbabwe)

Banks charge high costs (both as direct fees and as indirect costs) for storing and moving money which is virtually free

The US Dollar still suffers from a lack of decimalization smaller than 2 decimal places

More than 1 billion people worldwide are unbanked and have little to no access to modern banking.

Security risks remain for transferring money internationally.

Many forms of financial services disproportionately benefit wealthy people and introduce additional complexity for the working class.

These issues with our financial system have led to the invention of Bitcoin and other crypto currencies across the world.

What is Bitcoin?

Bitcoins are decentralized stores of value that can be divided into units as small as 0.00000001 units. Bitcoin only exists in the digital world and is not backed by any physical assets. No banks are needed to validate transactions because Bitcoin carries its own ledger digitally. The ledger is verified by computer hardware that solves difficult cryptographic math problems such that no one can tamper with the history of transactions unless they control > 50% of the bitcoin mining power in the world. The process of verifying Bitcoin transactions is called “mining” which costs electricity and heat and is rewarded with additional Bitcoins.

Unlike fiat currencies which are prone to infinite inflation and monetary debasement, Bitcoin has a limited supply of 21M coins; no one can create or print more. This means that Bitcoin will be valued solely by its users and the supply-demand curve. On the other hand, M2 money supply in America increased from $15.4 trillion in January 2020 to more than $19 trillion in December 2020. Said differently, money creation in America in the past year alone accounts for about 20% of the sum total of money created in the history of America. From an economics perspective, this level of monetary debasement will eventually lead to either consumer price inflation, producer price inflation, financial asset inflation, or all of the above.

As a decentralized mechanism for money and value transfer, Bitcoin allows for the separation of traditional government and money. Today, there are ~18.5M Bitcoins in circulation and ~2.5M left to mine. Bitcoin operates on a protocol that changes over time based on user votes. Essentially, the government controlling the mechanics of Bitcoin is run by the people who use it, not a central entity. When citizens place greater faith in the good of the common republic compared to having faith in a centralized governmental authority that may not share the same alignment of interests, an increasing number of people will prefer a decentralized framework instead of heading toward a central authority.

Similar to the internet providing permissionless power to people for information, discovery, content, and many other segments, Bitcoin gives power to people through financial access, distributed financial access, and the ability to own a currency that is not manipulated by a centralized authority, such as a central bank. Eventually, financial assets (including currencies) will be digitized.

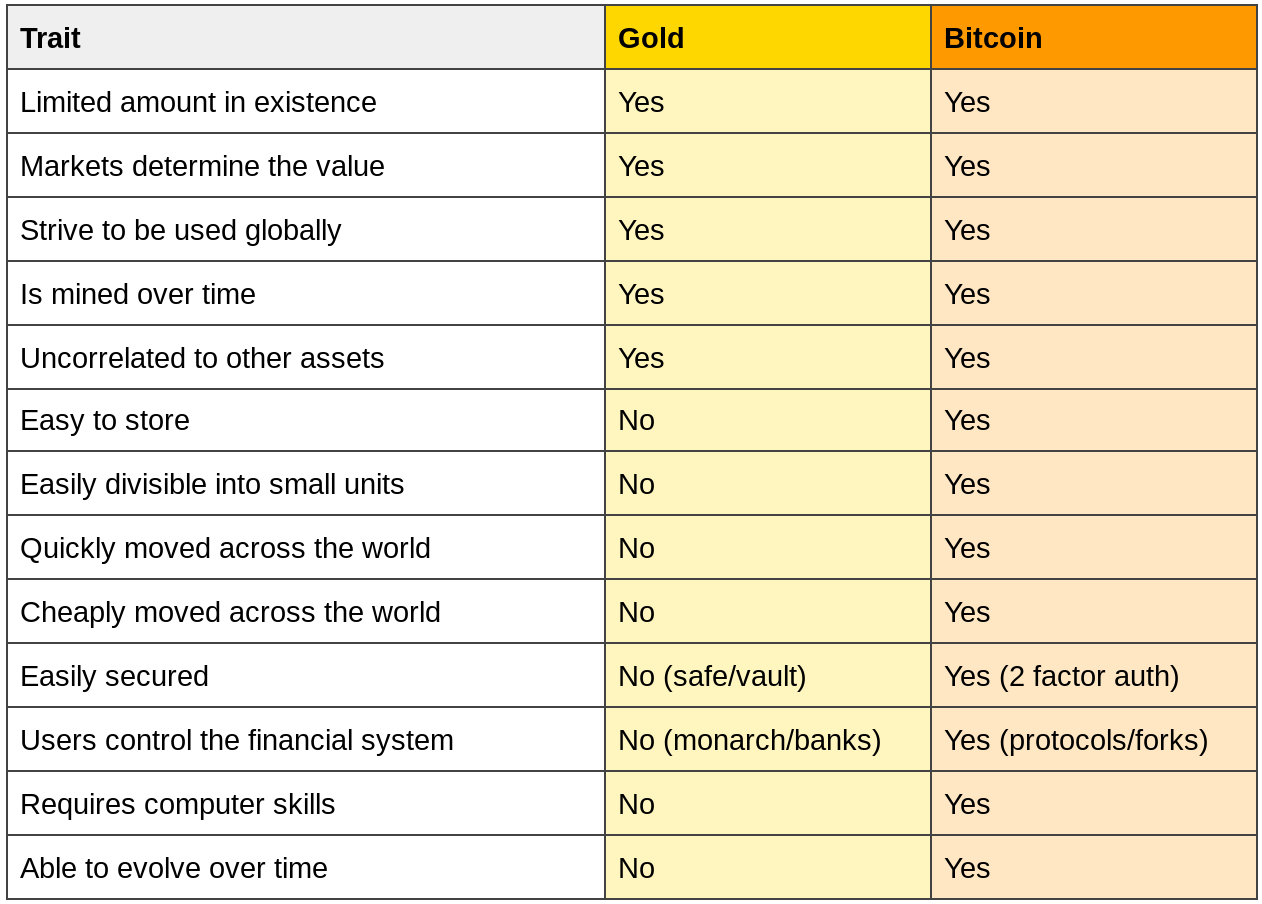

At its core, Bitcoin is similar to Gold except it offers more value. See the chart below.

Who uses Bitcoin?

There are four methods of managing debt: repay the debt, restructure the debt, default on the debt, and devalue the currency to finance the debt. If the first three methods are considered untenable for government debt, then the 4th method of currency devaluation, inflation creation, and monetary debasement is the only remaining method in the traditional financial infrastructure. Countries in deep political unrest with hyper-inflated currencies are finding refuge in Bitcoin. An increasing number of people are flocking towards the US Dollar, Bitcoin, gold, and other safe-haven assets to preserve their wealth and maintain their buying power. Citizens of Venezuela and Zimbabwe seek Bitcoin’s financial stability to buy local goods without worrying about the daily value of their currency, which is more volatile compared to the price of Bitcoin.

Individual and institutional investors are increasingly exploring Bitcoin as a fundamentally uncorrelated asset which can serve as an insurance policy against the traditional legacy financial infrastructure. This form of insurance has an asymmetric risk-reward dynamic.

You may ask, why now for Bitcoin? Part of Bitcoin’s price surge in 2020 can be attributed to increasing anxiety over the trillions in fiscal deficits and the trillions of dollars of money creation worldwide by central banks in an effort to financially combat the devastating economic impacts from the coronavirus crisis. Once thought of as a nascent and speculative asset, Bitcoin is moving along the adoption curve and trending towards an eventual mainstream monetary asset. Notable macro investors and market technicians, such as Stanley Druckenmiller and Paul Tudor Jones, have publicly announced portfolio allocations to bitcoin. Quantitative trading firms like Jump Trading and DRW are increasingly becoming very involved in the cryptocurrency space. Fidelity launched a Bitcoin Fund, and TD Ameritrade launched the ability to trade futures on Bitcoin contracts. In addition, the rise of tradeable fund products (such as GBTC), the rise of brokerage, custody, and trading services for cryptocurrencies (such as Coinbase), and the increased involvement from companies (ex. Square, PayPal, MicroStrategy) allow family offices, retail investors, and companies to participate in the Bitcoin ecosystem.

The number of Bitcoin transactions has grown exponentially over the past decade to ~300k per day while the number of unique addresses (essentially users) has risen to ~600k.

What is Bitcoin worth?

Gold has a $9 Trillion market cap today while Bitcoin is around ~$350B. If you believe that Bitcoin can replace Gold, then Bitcoin should be worth $9T. If you also believe that Bitcoin will provide more value than Gold, then Bitcoin should be worth some multiple of $9T.

Let’s assume the case of Bitcoin reaching $9T in market cap. With 21M coins in circulation, that’s about $428,571.428571 per Bitcoin, or $428,571.43 because we have to round to the nearest penny.

Can Bitcoin’s protocols change over time?

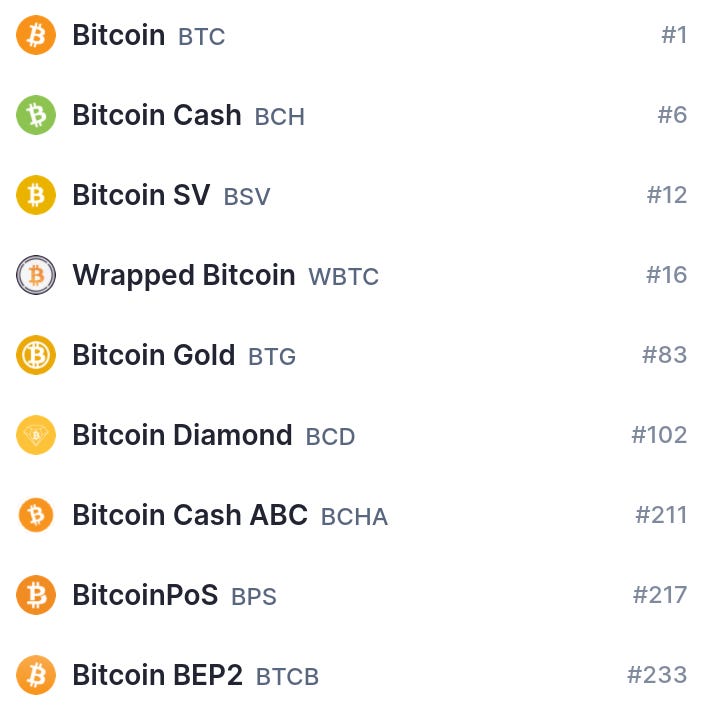

Yes. Bitcoin’s validation protocol can change based on how users vote. If a majority of users propose and vote for a change, then it will pass thus changing the policies and value of the coin over time either for better or worse. For those that strongly disagree with the Bitcoin protocol at any moment in time, these individuals can choose to fork their own version of Bitcoin that preserves their desired protocol. Today, this has already happened numerous times with coins such as Bitcoin Cash, Bitcoin Diamond, and Bitcoin Gold.

What happens when the last Bitcoin is mined?

This question is not as scary as people may think. Gold has the same exact issue, but we never mined the last nugget of Gold so it never became a problem. It’s projected that the last Bitcoin won’t be mined until 2140, in which case, the next evolution will replace it well before then. Just like everything in human civilization, Bitcoin is not a perfect solution, but it has significant advantages over its predecessor. Over the next century, we will discover other limitations of Bitcoin that make it less valuable than its successor, but we have a feeling that will take a long time.

Conclusion

Bitcoin and other crypto currencies offer a way to simplify the complex financial system we have today by acting as the democracy, the bank, and the currency all in one. It truly democratizes the financial system by allowing the users to decide how it operates. However, Bitcoin is not perfect and will need to evolve over time to work for all tiers of society, the rich and the poor.

References:

"Gold Standard - Econlib." https://www.econlib.org/library/Enc/GoldStandard.html. Accessed 6 Dec. 2020.

"The First Printed Currency - 1690 - Coin and Currency ...." https://coins.nd.edu/ColCurrency/CurrencyIntros/IntroEarliest.html. Accessed 6 Dec. 2020.

"Credit card | Britannica." 22 Oct. 2020, https://www.britannica.com/topic/credit-card. Accessed 6 Dec. 2020.

"The evolution of mobile banking: Five quick facts | BBVA." 20 Aug. 2018, https://www.bbva.com/en/evolution-mobile-banking-five-quick-facts/. Accessed 6 Dec. 2020.

"M2 Money Stock (M2) | FRED | St. Louis Fed." https://fred.stlouisfed.org/series/M2. Accessed 8 Dec. 2020.

"Bitcoin Adoption in Venezuela Makes It Unique ... - CoinDesk." 11 Nov. 2020, https://www.coindesk.com/bitcoin-adoption-venezuela-research. Accessed 6 Dec. 2020.

"Transactions Per Day - Blockchain Charts." https://www.blockchain.com/charts/n-transactions. Accessed 6 Dec. 2020.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.