Introduction

Today’s newsletter focuses on Affirm (ticker: AFRM), dashboards for summarizing Affirm’s growth statistics, and the buy now, pay later industry.

Buy now, pay later (BNPL) is fundamentally about converting browsers into buyers by providing transparent financing plans to consumers (i.e. converting people that simply browse various shopping websites into actual buyers of products). Financing increases the current buying power of consumers, helps e-commerce stores generate more sales, and promotes transparency to the consumer instead of being saddled with a lengthy credit card contract with high-interest rates and onerous & complex terms. Notably, the size of the prize for BNPL is already large: The cumulative market cap valuations of Affirm, Afterpay, Klarna, and PayPal exceeded $300 billion earlier this month.

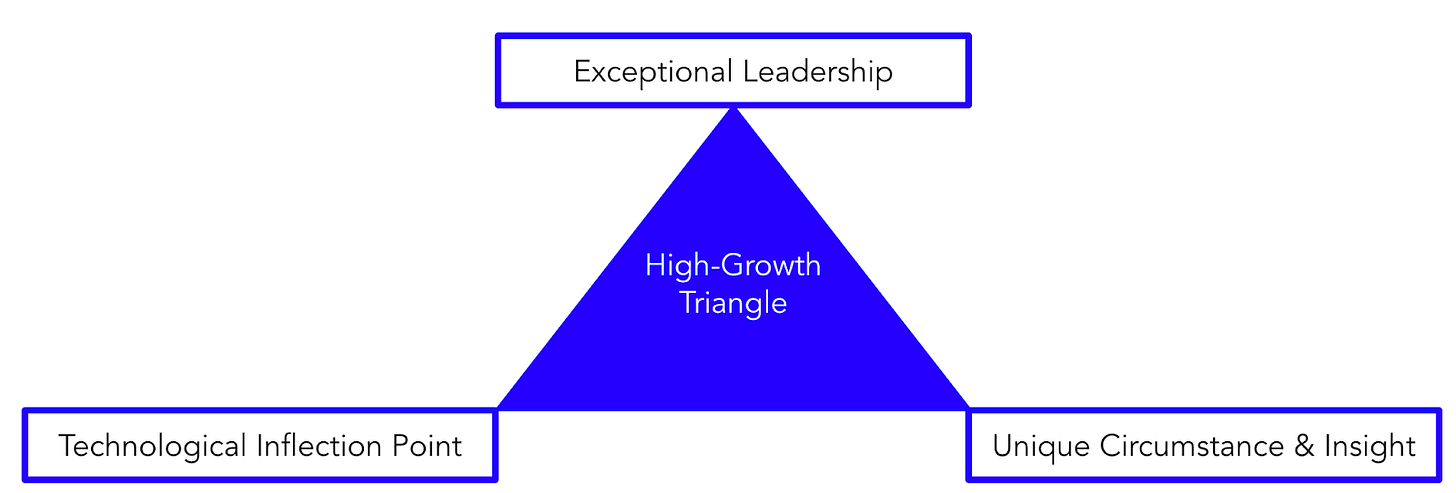

The High Growth Triangle & Identifying Exponential Opportunities

At Drawing Capital, we invest in companies that have the opportunity to experience exponential growth via the intersection of a technological inflection point, exceptional leadership, and unique circumstance.

We are of the opinion that a major inflection point exists in fintech, which is the intersection of financial services and technology. For example, we believe that several fintech companies have the potential to become thriving and enduring enterprises. Applying the “High Growth Triangle” investment framework to fintech:

The technological inflection point is that software-enabled financial services and payments can dramatically improve corporate margins, grow revenues at scale, increase customer satisfaction scores, create aligned win-win situations between shareholders and consumers, and enable a nice user interface for the consumer that’s often supported in the back-end by a partner bank.

Exceptional leadership and talent are present in several fintech companies, and many of the leading fintech companies today have influence from the “PayPal Mafia”, either via co-founding the company or being early venture capital investors in the company. Additionally, fintech companies such as Square, Affirm, and Opendoor have founder-led CEOs, and it helps to have high equity ownership in making bold acquisitions and in making commitments to long-term projects that pursue large growth opportunities.

One unique circumstance is that persistently low interest rates are putting downward pressure on the profits earned from net interest margin for traditional banks. A second unique circumstance is that changing human behavior is leading to consumer trust increasingly being made across digital channels; Millions of Americans believe that they can establish trust digitally with a financial institution without the need to visit a physical banking branch (thereby creating a distinguishing feature of “physical trust” vs “digital trust”), and examples include SoFi, Affirm, Square, and Venmo by PayPal.

What is Buy Now, Pay Later (BNPL)?

BNPL is a fintech innovation in the e-commerce ecosystem, and e-commerce is a long-term, multi-trillion-dollar tailwind. BNPL enables consumers to purchase a product, service, or experience today and pay for it over time.

BNPL is a parallel network outside of the existing credit card industry that has gained interest from both consumers and merchants.

From a retailer’s perspective, BNPL helps convert browsers into buyers and leverages the behavioral changes in consumer buying power for driving higher revenue, gross merchandise volume, and loyalty.

While financing choices for large purchases have existed for a long time (i.e. mortgages for houses, auto loans for vehicles, etc.), BNPL enables financing for both large and small product purchases. BNPL is an alternative financing mechanism that emphasizes transparency, convenience, flexibility, and lower entry prices.

Major BNPL providers include Klarna, Afterpay, Affirm, Zip (formerly Quadpay), Zezzle, Splitit, ChargeAfter, Paidy, and LimePay. Additionally, large integrated fintech companies with BNPL products include Visa, Mastercard, and PayPal.

Nine Notable Numbers: Supporting Industry Research on BNPL

$7.3 Trillion: Grand View Research estimates that global e-commerce spending may rise from $4.6 trillion in 2020 to more than $7.3 trillion by 2024.

$20 Billion: Grand View Research estimates the global revenue forecast for BNPL to exceed $20 billion in 2028.

$1.6 Billion: According to an Accenture study, American consumers enjoyed $1.6 billion in consumer surplus value via BNPL in 2021.

$590 Million: Afterpay created $590 million in merchant cost savings in 2021.

$459 Million: Consumers saved $459 million in credit card fees when using Afterpay instead of traditional credit cards.

34%: In a Credit Karma survey, 34% of surveyed consumers that have used BNPL products have fallen behind on one or more payments. This is a risk factor for BNPL.

20%: Grand View Research estimates a greater than 20% compounded annual growth rate for BNPL’s market size in America from 2021-2028. Additionally, McKinsey forecasts a greater than 18% compounded annual growth rate from 2020-2023 for point-of-sale financing.

12%: According to an Accenture study, about 12% of online fashion retail spending was completed in America via BNPL in 2021.

2x: FIS Worldpay estimates that the adoption of BNPL is estimated to double its market share in global e-commerce transactions by 2024.

BNPL helps create inelastic demand on previously-elastic goods, which thereby helps merchants to increase sales and enable consumers to be less price sensitive via financing purchases over time. The key takeaway is that simplified financing often increases current consumer purchasing power, and demand generation often leads to revenue conversion for merchants, thereby creating dual positive benefits for both merchants and consumers via BNPL.

For additional commentary and analysis on the BNPL industry, you can view Drawing Capital’s BNPL webinar that was hosted last week by Interactive Brokers at this link: https://ibkrwebinars.com/webinars/fintech-innovations-buy-now-pay-later/

Affirm & the “Circles of Excellence and Expansion”

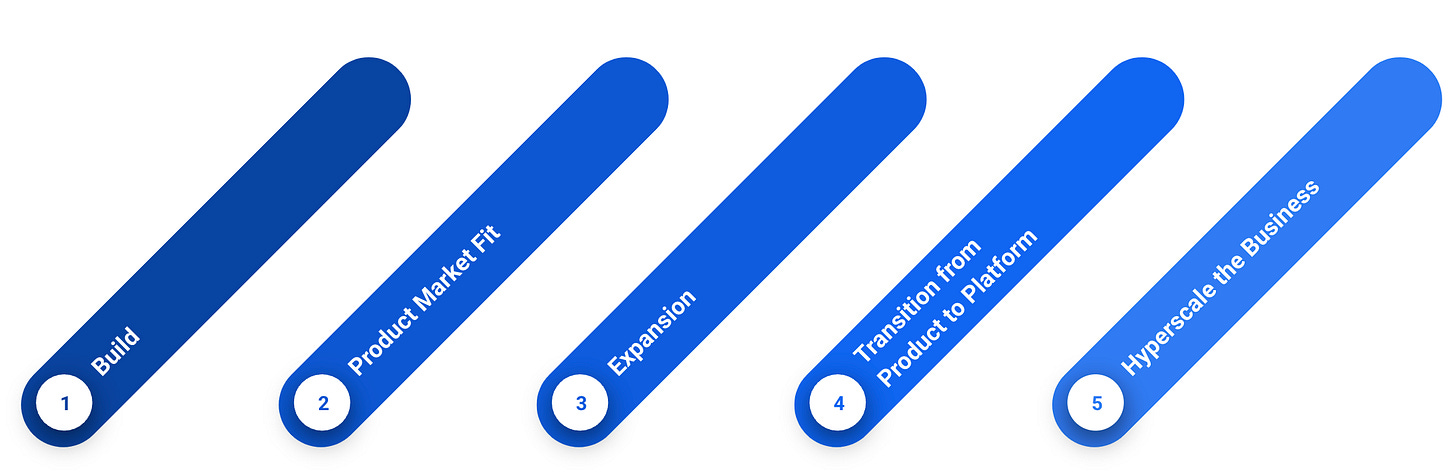

At Drawing Capital, we believe there are 5 steps in implementing the “Circles of Excellence and Expansion”:

Build 1 product that becomes a category leader.

Improve the product offering over time to improve sales, create better customer experiences, and reply to customer feedback. Pivot or improve the product approach until strong product market fit is achieved.

Based on positive customer feedback and customer demand, earn the right to expand the product offering and/or form new concentric circles for excellence and expansion.

Transform ideas into products and then transform a suite of products into a platform. Platforms with positive network effects and a virtuous data cycle can benefit from accumulating business advantages at scale.

Hyperscale the Business: Pursue growth opportunities. Continue to develop and improve product quality, business sales cycles, talent acquisition & retention, and corporate capital allocation decisions. Make thoughtful decisions about building products in-house vs. acquiring other companies.

We can apply these 5 steps to Affirm:

Step 1 (Build): Affirm started with a BNPL product and the mission of “building honest financial products that improve lives”. Notably, Affirm’s founder and CEO was previously the co-founder and CTO of PayPal and is a member of the famous “PayPal Mafia”. Returning back to BNPL, the initial product attraction was 2-fold: convince merchants that BNPL can increase their revenues and provide consumers with simpler financing choices as an alternative to the side effects experienced by consumers from traditional credit cards, such as late fees, deferred interest, complex terms & conditions.

Step 2 (Product Market Fit): As the BNPL product improves over time and gains both consumer & merchant adoption, more value can be provided to consumers and merchants, and lending risk models should hopefully improve over time. Affirm’s 78 NPS score highlights the level of satisfaction among consumers and merchants and can be a measure of product market fit. Additionally, Affirm has partnered with large retailers and merchants, such as Walmart, Amazon, Shopify, Peloton, Target, Neiman Marcus, Lowes, and more. Within BNPL, Affirm has a significant market share and has created a business moat via a network of merchants and consumers.

Step 3 (Expansion): Affirm expands in 2 methods: first, with land & expand with consumers & merchants, and second, with product expansion such as debit cards and savings accounts for consumers and Affirm’s Shopping website as a merchant sales funnel.

Step 4 (Transform Into a Platform): Affirm has a risk-lending platform, and Affirm’s CEO has mentioned aspirations of building a platform of trusted consumer financial products.

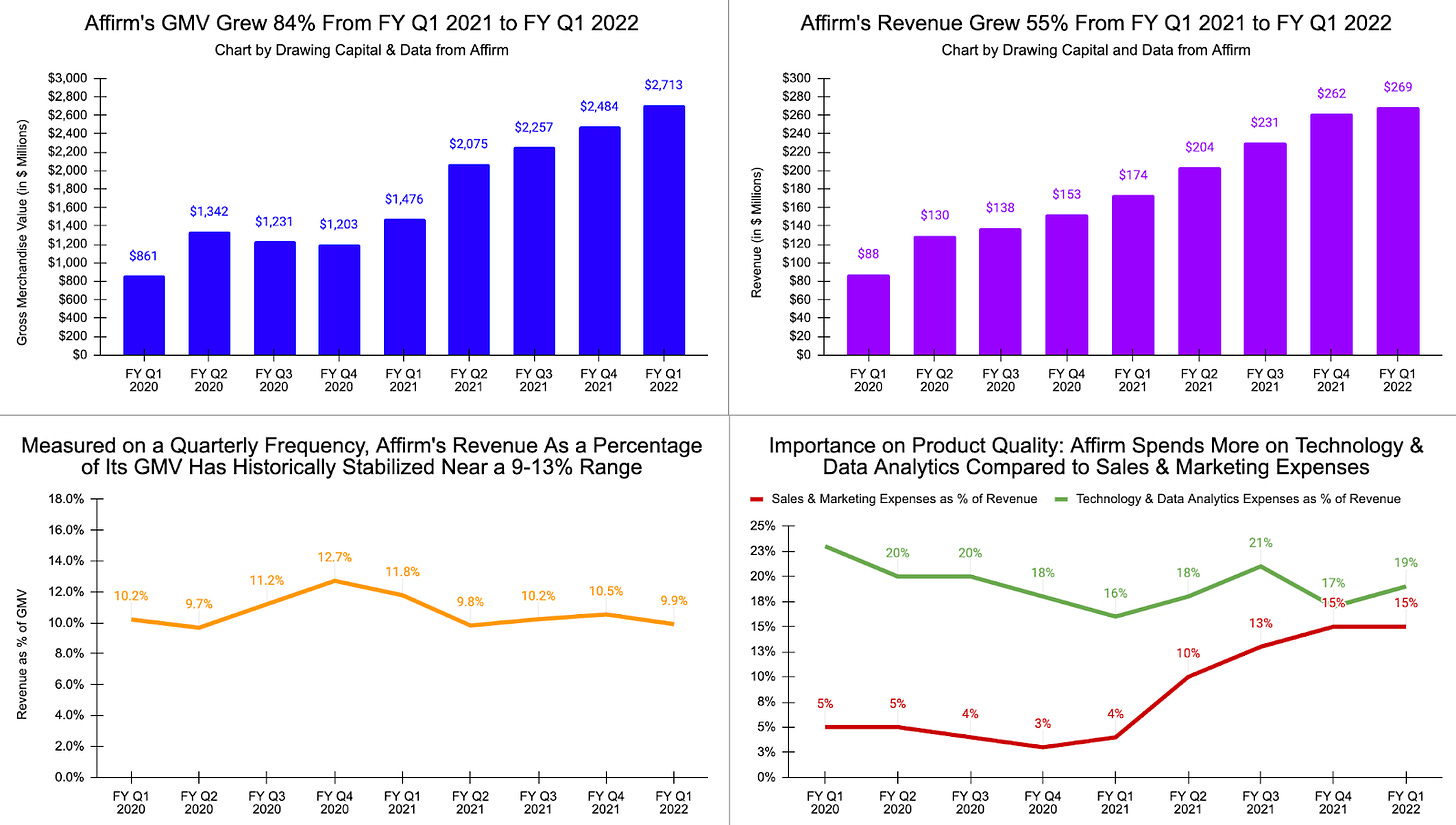

Step 5 (Hyperscale the Business): Step 5 is the hyperscale phase. Affirm is growing quickly, as seen from growth stats on Affirm’s investor relations page. From fiscal quarter Q1 2021 to fiscal quarter Q1 2022: there was 124% growth in active consumers, 84% growth in GMV, and 55% revenue growth. From an acquisitions perspective in 2021, Affirm acquired Returnly (company focused on online return experiences and post-purchase payments) and PayBright (a Canadian BNPL company).

Affirm’s Growth Dashboard & Key Metrics

The growth numbers are from Affirm’s fiscal quarter Q1 2021 to fiscal quarter Q1 2022. This visualization illustrates these key takeaways:

Both Affirm’s high net promoter score and the company’s selected year-over-year growth numbers for Affirm’s Q1 2022 fiscal quarter are favorably positive.

The number of merchants that are using Affirm surged higher, demonstrating growing adoption in BNPL and/or growing effectiveness in Affirm's sales teams & product quality. Additionally, when Affirm can demonstrate growing revenues to merchants if they adopt Affirm's BNPL product offering, then this is a win-win aligned situation in which Affirm's revenues increase as merchant revenue increases.

The rising number of consumers using Affirm is a positive trend for 2 reasons: More consumers are adopting BNPL (specifically Affirm's BNPL product) as a valid payment alternative, and since many satisfied consumers often have loyalty in their relationships with their trusted financial firms, then having more satisfied consumers is a positive trait for building a suite of financial products that consumers can adopt on Affirm's consumer finance platform. Once Affirm has "landed" a satisfied customer, it's easier to market other financial products that add value to "expand" the customer relationship, thereby enabling a "land and expand" model with customers.

The following set of charts above provide a growth dashboard for visualizing Affirm’s revenue growth, GMV growth, spending allocations, and more:

The top 2 charts in blue and purple highlight the historical double-digit positive growth rates in gross merchandise volume and revenue for Affirm.

The bottom-left chart in orange indicates stabilization in take rate, and having a stabilized percentage is helpful in approximating revenue from GMV or implying the amount of GMV needed to achieve a revenue target.

The chart on the bottom-right indicates Affirm’s commitment and importance given to product quality, data science modeling, and the virtuous data cycle, as seen by Affirm spending more on technology and data analytics compared to sales and marketing expenses. Additionally, when a company can generate significant revenues with little sales and marketing expenses, this is often a hallmark of high sales efficiency in an organization.

Affirm’s Added Value to Merchants Extends Beyond Payment Processing

By providing simplified financing via BNPL, Affirm increases current consumer purchasing power, which enables consumers to buy more products and services and finance these purchases over time. By providing demand generation to merchants, Affirm enables merchants to increase conversion and revenues. The key takeaway is that there are many examples of Affirm’s added value to merchants beyond payment processing. For example:

Based on Affirm’s Q3 investor presentation deck, Affirm helped merchants increase their average order value by 85% compared to other methods.

BNPL firms can gather product-specific SKU-level data and then present analytics and insights to merchants regarding pricing models, product demand for specific items, and trends in consumer spending patterns. The mentioning of stock-keeping units, or SKU-level data, is a data advantage for BNPL compared to some traditional credit card companies that may not actually see SKU-level purchasing data.

Affirm’s Marketplace created personalized data-driven product discovery for consumers on Affirm’s mobile app.

Affirm’s Shop Icon provides a sales funnel, product placement feature, and demand generation for merchants. Additionally, the rising popularity of Affirm leads to free marketing for merchants that use Affirm, as seen by the “featured and trending stores” section on Affirm’s website. This is important because instead of a merchant thinking of Affirm as just a payment processing expense, Affirm is increasingly viewed as a revenue generator for merchants.

Additionally and based on the data presented at Affirm’s Investor Forum presentation in September of last year, Affirm’s Merchant Capital Program facilitated over $50 million in non-dilutive, low-cost cash advances to merchants. The key insight is that merchants are increasingly looking for attractive, transparent, and cost-efficient solutions and capital sources to increase growth, improve cash conversion cycles, and manage cash flows.

Affirm’s Flywheel Effects for Revenue and Value Creation

This visualization illustrates Affirm’s flywheel effects for revenue, value creation, and the virtuous data cycle. Double-clicking on the concept of the virtuous data cycle, more high-quality data positively impacts businesses. First, data is a valuable asset, and access to differentiated and high-quality datasets generates compounding benefits, and these benefits can include better customer experiences, higher corporate revenues, improved client retention rates, and positive network effects by improving the product for all existing and new customers as the company gains more customers and data.

In the flywheel effect illustrated in this visualization, notice how the initial product attraction provides value to both merchants and consumers. As Affirm and other BNPL providers use dual innovative distribution channels, they have the potential opportunity to experience high growth rates, and high effectiveness in distribution leads toward a large ecosystem of merchants and consumers. As more merchants and consumers use BNPL, they become accustomed to BNPL, and for merchants, it becomes an essential part of their daily business operating system in processing e-commerce transactions. From all of this data and from the network of merchants and consumers, Affirm can learn insights from data, hopefully improve its credit risk modeling and underwriting, and both expand & deepen relationships to ultimately provide more benefits to merchants, consumers, and shareholders.

Observation on Affirm’s Revenue Guidance

On this screenshot, we note an observation from reading Affirm’s supplemental earnings commentary and forward guidance. Interestingly, the Amazon-Affirm partnership, Affirm’s Debit+ card, and Affirm’s Australian expansion plans are all currently excluded from the company’s revenue guidance.

Additionally, Affirm’s announced product roadmaps from its Investor Forum Day in September 2021 (such as their Cash Back Rewards initiatives, SuperApp, crypto-related initiatives) are perhaps excluded from revenue guidance.

Key Insight: If one assumes that Affirm will achieve success in either a few or several of these product roadmaps, expansion plans, and partnerships, then there’s a possibility that the revenue guidance is significantly lower than the actual future revenue. This observation, if under-appreciated in markets, may provide a potential investment opportunity after conducting additional research and due diligence.

Summary

E-commerce is a long-term, multi-trillion-dollar tailwind. Over time, payment methods, technologies, and consumer preferences have evolved. BNPL is a fintech innovation in the e-commerce ecosystem.

In summary, there are large potential opportunities for investors, merchants, and consumers in understanding BNPL. This newsletter provides an overview of the buy now, pay later (BNPL) industry and focuses on Affirm as a case study by describing Affirm’s flywheel effects, growth dashboards, revenue forecasts, and more. Clearly, there are multiple methods of creating and adding value by BNPL companies when building a network of merchants and consumers.

References:

“Fintech Innovation: Buy Now, Pay Later” Webinar by Drawing Capital and Interactive Brokers in January 2021, https://ibkrwebinars.com/webinars/fintech-innovations-buy-now-pay-later/

Afterpay-commissioned report titled “The Economic Impact of Buy Now, Pay Later in the US” by Accenture, Published September 2021, https://afterpay-corporate.yourcreative.com.au/wp-content/uploads/2021/10/Economic-Impact-of-BNPL-in-the-US-vF.pdf

FIS Worldpay Report, https://worldpay.globalpaymentsreport.com/ , https://www.businesswire.com/news/home/20210224005222/en/Digital-Wallets-Eclipse-Cash-Globally-at-Point-of-Sale-for-First-Time-During-Pandemic-FIS-Study-Finds

BNPL Research by Grand View Research, https://www.grandviewresearch.com/industry-analysis/buy-now-pay-later-market-report

BNPL Research by McKinsey & Company, https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

Affirm’s Investor Forum Presentation on 9/28/2021, https://investors.affirm.com/static-files/097f3211-8ea5-4a6d-9b86-6dfa969bbe8a

Affirm’s FY Q1 2022 Earnings Supplement (Updated on November 26, 2021), https://investors.affirm.com/static-files/4c9ae5a2-3b35-4aca-a2d1-75017d4a282e

Affirm’s Investor Forum Presentation on 9/28/2021, https://investors.affirm.com/static-files/097f3211-8ea5-4a6d-9b86-6dfa969bbe8a

Affirm’s FY Q3 2021 Investor Presentation (With Statistics on NPS, AOV, and Merchant Dollar Retention), https://investors.affirm.com/static-files/18f24d87-9ccd-4e3d-9253-dff937441677

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.