Building an Investment Framework for Evaluating Companies

Weekly updates on the innovation economy.

Introduction

Data-informed decision-making can lead to better outcomes.

In this newsletter, we would like to discuss the following 3 key topics:

What is the relationship between revenue growth and stock price appreciation?

What are 7 qualitative investing questions that are useful in building an investment framework in evaluating companies?

How can the company and other stakeholders benefit from a rising stock price?

The importance of building a solid investment framework cannot be underestimated. If you have one investment idea, that might be a one-off situation. If you have a solid investment framework, then you have the potential capability to repeatedly make good investment decisions over time.

Positive Relationship between Company Revenue Growth Rate and Company Stock Price

The chart below highlights that on the median over the past 5 years, companies with higher revenue growth rates often experienced higher stock price appreciation.

All else equal, companies with higher revenue growth rates and higher margins should command higher EV/sales price multiples because they have greater ability to generate higher and growing cash flows compared to their peer group.

In the long term, if investors evaluate a business as the present value based on discounted future cash flows, then having a higher revenue growth rate allows the company to increase future cash flows due to more future revenue, and higher margins allow the company to convert more of the revenue into cash flow. Hence, when companies both increase margins and increase revenue (especially when they outperform consensus estimates/expectations), this is a "double win" scenario.

Additionally and as of June 13, 2021, only 19 companies in the S&P 500 Index have experienced 25% or higher compounded annual growth rates in revenue over the past 5 years. This statistic is important because it displays that while there are hundreds of companies in the S&P 500 index, there are only a select group of S&P 500 companies that have high sustained revenue growth rates. The chart below highlights this select group of companies:

The 7 Investing Questions in Building an Investment Framework

The first question goes as follows: Is this business growing? We can view this through a number of ways, such as user growth, customer growth, revenue growth rates, growth rates in operating cash flow and earnings per share, and revenue growth endurance. The last metric called revenue growth endurance can be thought of as the durability of a company’s revenue growth. For example, if a company can consistently grow revenues at 40% per year for years in the public markets, that is excellent revenue growth and excellent revenue growth endurance. However, if a company has spiky revenues with uncertainties about future revenue growth, then such a company would exhibit poor revenue growth endurance due to a lack of consistency in the revenue growth rate.

The 2nd question focuses on a company’s earnings from its capital base. One metric to highlight here is the Rule of 40, which represents the summation of both revenue growth rate and free cash flow margin. The Rule of 40 is helpful in understanding the balance between chasing maximal growth vs. seeking cash-flow profitability. Great companies have a Rule of 40 score that exceeds 40%.

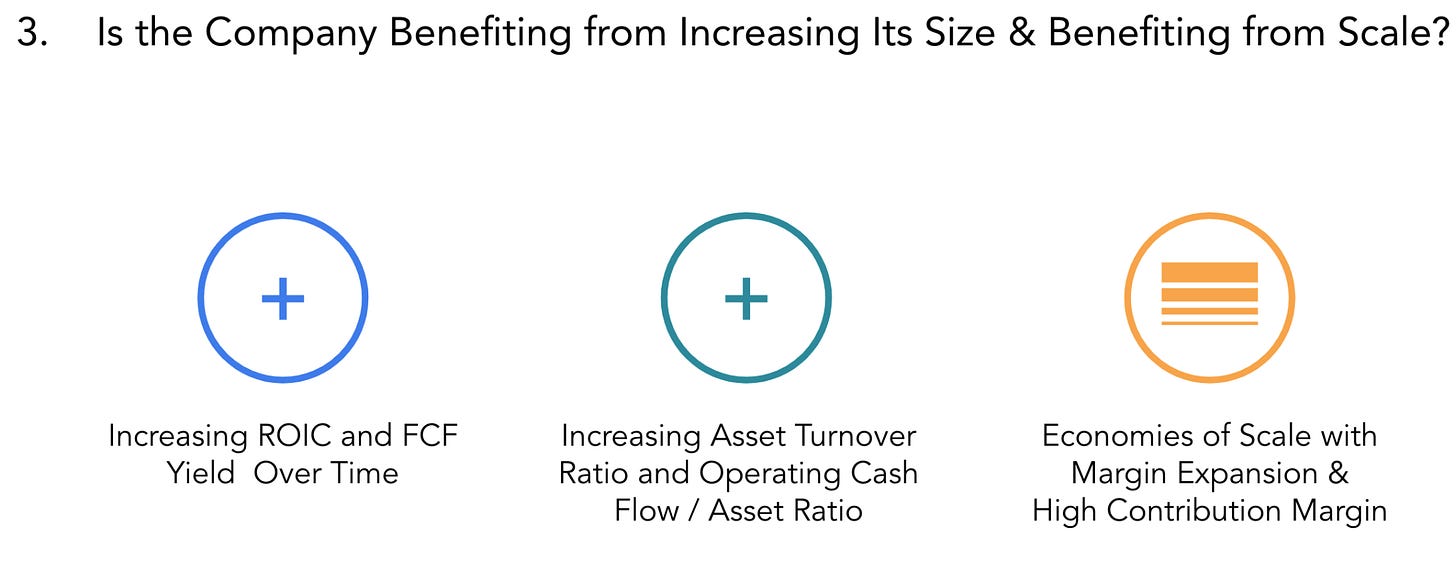

The 3rd investing question focuses on size and scale:

Does the company have increasing returns to scale with unit economics and margins that improve as the quantity of products sold increases?

Are there learnings and network effects from the existing users or customers of a company’s products or services to drive value creation for all new and existing customers?

These sample questions can help highlight a company’s potential scale advantages.

One trait to double click on is the contribution margin on this slide. In growth investing, we have the opinion that contribution margin is one of the most important metrics that also help to define the unit economics of a business. The higher and more positive the contribution margin, the higher the operating leverage, which implies a greater potential efficiency in translating revenue into future profits when there is increased scale or volume for the company.

The 4th investing question focuses on either growing market share or establishing a dominant market share position. Importantly, high market share typically enables pricing power for a company. We have the opinion that there are 2 types of industries: highly competitive industries and industries with a winner-take-most environment. For example, Google’s information search business with digital advertising or NVIDIA’s GPU business would be examples of companies with significant market share.

The 5th investing question focuses on the quality of the company’s products and services. Good products easily sell themselves and therefore often have high sales efficiency ratios because little spending in sales and marketing expenses are typically needed to create an amplified output in revenue. Additionally, having innovative distribution channels, high customer satisfaction, and recurring growth are all nice features of a business with quality products.

The 6th investing question in evaluating companies focuses on the quality of the corporate leadership team. In many instances, the combination of a product-led founder with significant ownership over the company, along with strong capital allocation decisions in recruiting and deploying resources, can lead to significant job creation and significant returns to shareholders.

The 7th investing question that we would like to highlight comes after answering the first 6 questions. Suppose you have researched a company and its industry dynamics and have a favorable viewpoint. Now the question becomes, is there a reasonable entry price that can be achieved? Remember, financial markets are constantly repricing public market securities on a regular basis and do not necessarily care about the cost basis of the individual investor. However, the cost basis of the individual investor is necessary to track the return on investment. Therefore, underwriting investments at attractive rates of return is a standard exercise in financial modeling.

How a Rising Stock Price Benefits Multiple Stakeholders

Ongoing Secondary Share Issuances: Companies can sell more shares in the public stock market in order to fundraise for additional cash on the balance sheet, which can be useful in pursuing acquisitions, paying down corporate debt, growing existing business units, or branching out to launch new business initiatives.

Recruiting and Retaining Talent with Cash Preservation: Companies can incentivize employees with stock-based compensation (such as stock options, RSUs, employee stock purchase programs, and performance-based stock grants) in order to recruit and retain talented employees. Stock-owning employees and stock-owning company alumni can benefit from significant wealth creation when the stock price rises rapidly in value. Since stock-based compensation is a non-cash expense, companies save this cash outflow, which can be redeployed into other business initiatives.

Share-Based Mergers and Acquisitions: Companies can use their stock as currency in making acquisitions. In a stock-based acquisition, the shareholders of the acquired company receive shares of the acquiring company.

Conversion of Convertible Debt: When a company’s stock price rises significantly beyond the conversion price, investors have a greater incentive to convert their convertible debt into equity. When the corporate debt becomes converted into equity, the company no longer has this debt liability on its balance sheet and gains a shareholder, and the shareholder benefits from a rising stock price.

Free Marketing, Branding, and Publicity: Companies often receive increased financial media and press when they have surging stock prices. Companies can enjoy this additional free publicity through a variety of methods. For example, the company can leverage this publicity for marketing their products to help drive more revenues or pursue corporate allocation strategies listed above.

Ancillary Benefits: In addition to the benefits listed above about how multiple stakeholders can benefit from a rising stock price, there are ancillary benefits as well. For example, if a rising stock price allows a company’s market cap to become eligible for index inclusion into a popular stock index (such as the NASDAQ 100, S&P 500, or Dow Jones Industrial Average), then the company’s stock often benefits from index inclusion due to the significant number of index fund investors that create automatic buying demand for the shares. Additionally, when investors recognize realized profits on investments in taxable accounts, then governments benefit via tax revenues that are collected from taxes on capital gains.

Overall, it is clear that multiple stakeholders (such as investors, governments, stock-owning employees, and the actual company) can all benefit from a rising company stock price.

Summary

In this newsletter, we discussed the following 3 key topics:

What is the relationship between revenue growth and stock price appreciation?

What are 7 qualitative investing questions that are useful in building an investment framework in evaluating companies?

How can the company and other stakeholders benefit from a rising stock price?

The importance of building a solid investment framework cannot be underestimated. If you have a solid investment framework, then you have the potential capability to repeatedly make good investment decisions over time.

We hope this newsletter is helpful to you in your investment journey.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.