Business Strategy for Startup Founders: Circles of Excellence and Expansion

Weekly updates on the innovation economy.

Introduction

When company founders and corporate leadership assess their business landscape, they often see one of 2 approaches, as represented by these two paraphrases:

“It would be great to capture a small percentage of a large but highly competitive total addressable market”. For example, capturing just 1% of a $100B industry would hypothetically create $1 billion in annual revenue for a company.

“We prefer to dominate a growing but niche category to validate the product, pricing, and fit with customers, followed by growing the business”. For example, capturing 60% of a $1B industry that grows 30% annually would theoretically start at $600M in revenue yet exceed $1 billion in corporate revenue by the third year of business operations.

Fundamental Value Creation

Fundamentally, a business creates “V” dollars of total stakeholder value and keeps a percentage, “K”, of that value creation. Therefore, the “VK” acronym represents the dollar value that the company keeps. If a company desires to become a large and thriving enterprise, then it needs to create significant stakeholder value (“high V”) and capture a portion of that value (“K”).

Idea >> Product >> Platform >> Franchise

As seen across many examples, enduring and thriving companies are the ones that can successfully create products from ideas, then create thriving platforms to build & enhance more products, and then create enduring franchises from these platforms.

Business Strategy: Circles with Excellence and Expansion

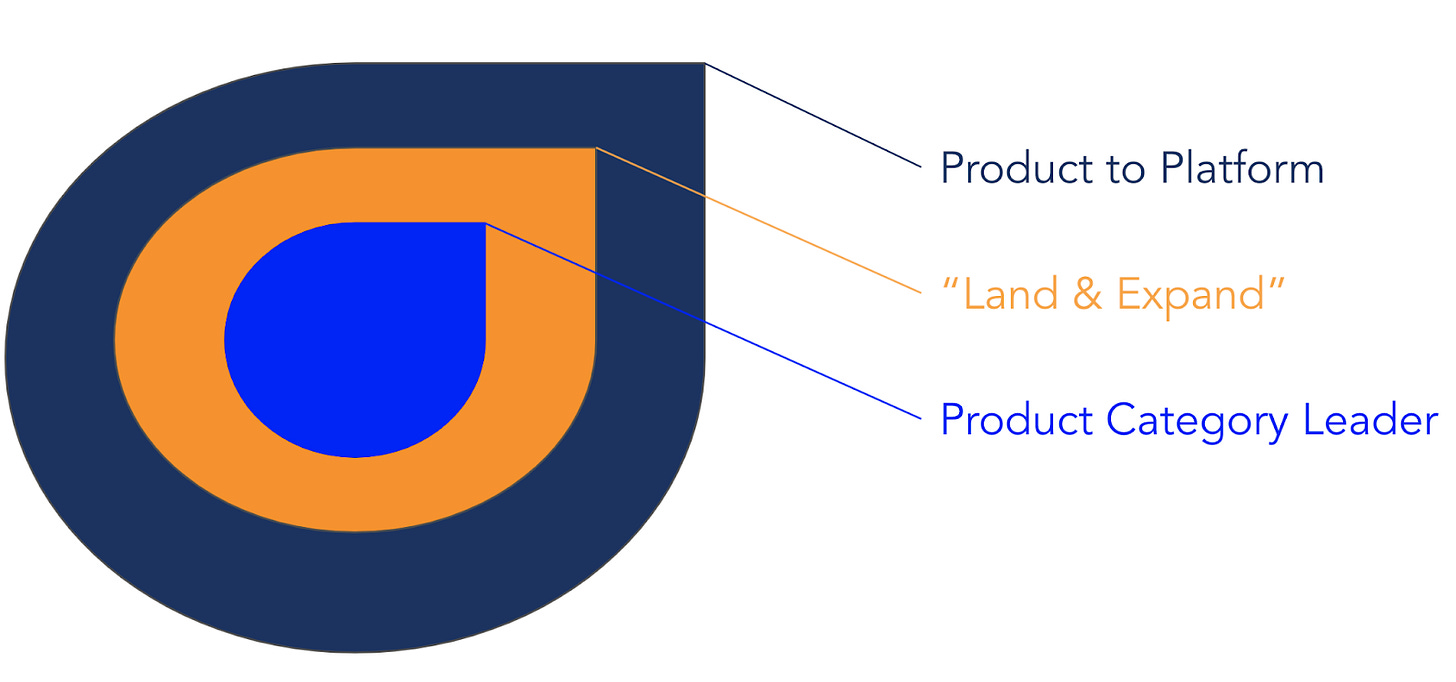

We believe that the business strategy that we have named "circles with excellence and expansion" is a winning approach for several startups and publicly-traded companies that eventually become enduring and thriving enterprises. We can visualize this strategic approach with the following illustration:

The 5 Steps in “Circles with Excellence and Expansion” for Founders and Company Leadership Teams:

Build one product that becomes a category leader with significant market share and high product quality.

Improve the product quality over time to improve sales, create better customer experiences, and reply to customer feedback. If the product has not achieved strong product market fit, then either improve it or pivot to another approach until strong product market fit is achieved.

Based on positive customer feedback and customer demand, earn the right to expand the product offering and/or form new concentric circles (aka new business units to tackle more problems and expand the company's total addressable market). Importantly, step 3 typically should not occur until steps 1 and 2 are accomplished. Said differently, if one hasn’t achieved success in one area, then pre-mature expansion can lead to diverted attention, reduced focus, and an overall reduced level of excellence.

Transform ideas into products and a suite of products into a platform. With the benefits of network effects & low variable costs & a virtuous data cycle, platform companies benefit from accumulating business advantages, lower sales & marketing costs as a percentage of revenue, high operating leverage via high contribution margin, and more proprietary data to better train AI/ML/data science models.

"Hyperscale the business": Pursue high & durable growth. Continue to develop and improve product quality, business sales cycles, talent acquisition & retention, and corporate capital allocation decisions. Make thoughtful decisions about building products in-house vs. buying other companies.

Company Examples

Alphabet/Google, Amazon, Qualtrics, and Meta/Facebook all successfully utilized a business strategy that we title as, “circles with excellence and expansion”.

Alphabet

Google started with machine-based programmatic responses to search queries, then leveled up its information search infrastructure, then monetized information search via digital advertising and auction-based pricing models and gained significant market share, and then rapidly expanded across the “digital economy” and other categories under the Google’s (and later Alphabet’s) corporate umbrella, such as:

Productivity apps (ex. Gmail for email and Google Meet for video conferencing)

Cloud infrastructure (ex. Google Cloud Platform)

Video content (ex. YouTube)

Mobile operating system (ex. Android)

Web browser (ex. Chrome)

Mapping technology (ex. Google Maps, Waze)

Self-driving car initiatives (ex. Waymo)

Venture capital and growth-stage investments (ex. GV, Gradient Ventures, CapitalG)

Artificial intelligence and machine learning (ex. DeepMind, Google Brain, Google AI)

Life sciences, healthcare, and anti-aging research (ex. Verily, Calico)

Innovative technologies, pioneering ideas, and reimagining industries with digitally-enabled technology solutions (ex. Google X, Moonshot projects, Other Bets)

Amazon

Amazon first started selling books online. Then, Amazon expanded its e-commerce retail platforms to sell a large diversity of products, then launched Amazon Web Services (AWS), and now is rapidly expanding into other industries such as Alexa devices, podcasting, Amazon Video, advertising, and more after achieving significant market share in e-commerce and cloud infrastructure.

Qualtrics

In the beginning years of Qualtrics, the company only entered markets where they believed that they could be the number one category leader, and the founders stressed the importance of winning in their existing vertical before expanding elsewhere. In the case of Qualtrics, the company focused on the education sector by signing up 200+ universities as customers before fundraising from venture capitalists or creating an enterprise product for companies. After achieving success in the education sector, the company expanded its horizons across other sectors, up-leveled its infrastructure and software-enabled capabilities, and provided significant value to customers. In the corporate sector, Qualtrics identified the “massive experience gap”, which is the difference between what management thinks they are doing versus what the customer is actually receiving. In several instances, Qualtrics identified that 80% of CEOs believe they are delivering great experiences to customers, but only 8% of customers believe they are receiving great experiences. Over time, Qualtrics expanded its category-leading experience management platform across universities and companies to help them manage customer experiences, employee experiences, branding & marketing, surveys, product quality experiences, and more. Today, Qualtrics continues to grow revenues at scale, improve its product and service offerings to customers, demonstrate high gross margins, and had a ~$25 billion public company valuation in late October 2021 after previously being acquired by SAP for ~$8 billion.

Facebook

After “The Facebook” launched at Harvard University, the social network went from 0% to 60% market share in about 10 days (according to Facebook’s first outside angel investor), which clearly demonstrates both the product hook and differentiated distribution channel, as seen by the significant market share growth in a short amount of time. Then, Facebook enabled usage for college students at elite universities, then expanded across American consumers, and then rapidly expanded (both organically and through acquisitions) around the world via network effects to eventually build a platform of billions of users across Facebook, WhatsApp, Instagram, Oculus, and more, all while simultaneously building a digital advertising juggernaut. Network effects can be difficult to start, but once activated, they can create accumulating and enduring business advantages at scale. As of Facebook’s Q3 2021 earnings announcement, Facebook reported 2.91 billion monthly active users and generated ~$29 billion in quarterly revenue. Additionally in October 2021, Facebook rebranded its corporate name to “Meta” to highlight the company’s growing initiatives in the metaverse.

Concluding Thought

Generalizing a key takeaway from the above company examples, one perhaps can conclude an emphasis on the following business strategy: hyper-focus on one product category, then become the category leader, then earn the right to “land and expand” by gaining more customers or building more products, and then create a platform for creating new concentric circles via additional business segments in order to grow revenues, expand total addressable markets, have attractive brand recognition, and maintain durable growth rates with attractive margins.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.