Drawing Capital Newsletter

November 25, 2020

Introduction

Happy Thanksgiving to you, your family, and friends!

Recently, an avid reader of Drawing Capital’s weekly newsletter proposed the following topic:

“What have the underlying assets of large company breakups done post-breakup, i.e. Standard Oil, Bell. I read somewhere that after assets were broken up, the individual pieces were able to grow even larger as they weren't constrained by being a part of such large companies. This could relate to what may come for certain tech companies.”

As a result, in this week’s newsletter, we will discuss these topics in concert with corporate antitrust, spin-offs, conglomerate holding companies, and more.

Historical Context

Breakup of Standard Oil

(1)

The breakup of Standard Oil led to a multitude of different energy companies, with some of them eventually recombining into one entity.

Breakup of AT&T

(2)

The breakup of AT&T created a complex web of companies that subsequently engaged in mergers and acquisitions (M&A).

The Number of Investigations from US Treasury’s CFIUS Have Increased Over the Past Decade

(3)

Performance of Spinoffs

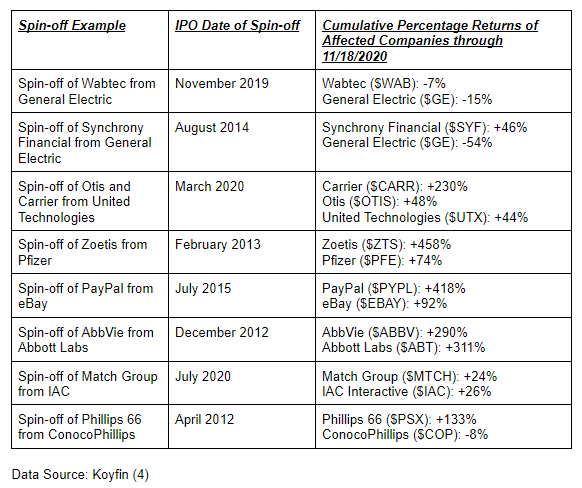

Since the inception of the S&P Invesco Spin-Off ETF (ticker symbol: CSD) in December 2006, CSD has underperformed the S&P 500 Index and Russell 2000 Index. Historically, the CSD ETF has outperformed the Emerging Markets Index and the MSCI International Developed Markets Index since CSD’s inception.

Data Source: Koyfin (4)

While the CSD ETF has historically underperformed the S&P 500 Index since CSD’s inception, a number of spin-off companies have outperformed their respective parent companies. Possible reasons for the performance alpha of some spin-off companies relative to their former respective parent companies include:

There is often less initial coverage and hype by the investment community and retail investors on smaller spin-off companies, which can lead to lower initial stock prices for spin-off companies, which provides more attractive entry buying prices for prospective investors.

Increased focus and clarity regarding specific business segments reduces corporate distractions.

The ability to unlock value by raising awareness for a lower-priority yet high-performing business segment or subsidiary inside a large parent company.

The ability to recruit, retain, and motivate talented employees by providing more autonomy and meaningful impact to employees inside a smaller and more nimble spin-off company.

Historical Context and the Rise of Large Technology Companies

From a historical perspective, there is a big shift in the dominant companies over time.

In 1980, the biggest companies were the “Sister 7” oil companies, auto companies, AT&T, GE, and IBM.

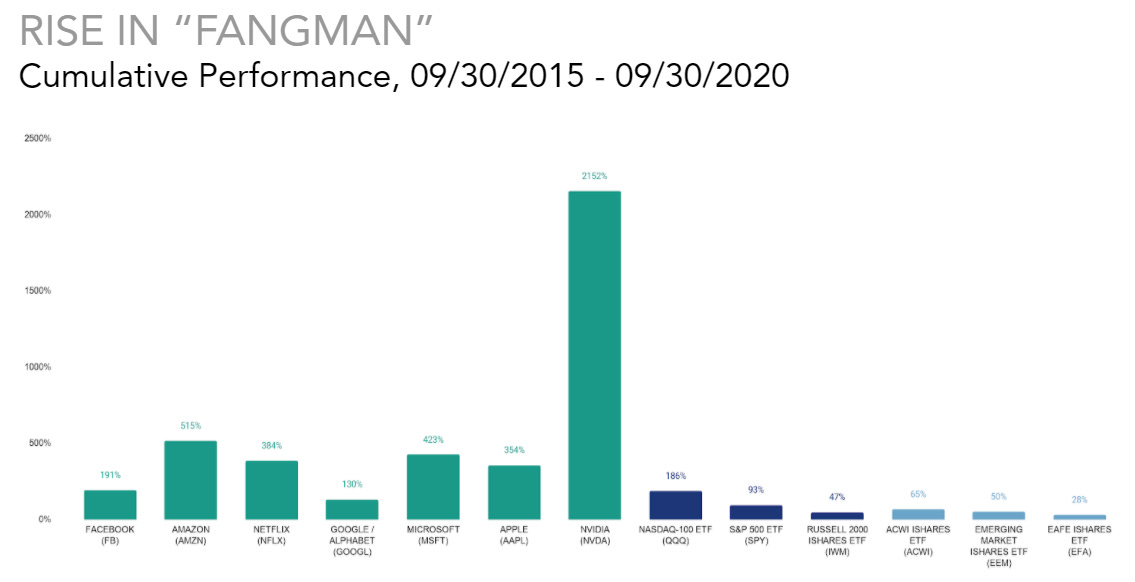

Fast forward 20 years to the year 2000, and “CIMQS” was a common acronym to describe leading companies at the time, such as Cisco, Intel, Microsoft, Qualcomm, and Sun Microsystems.

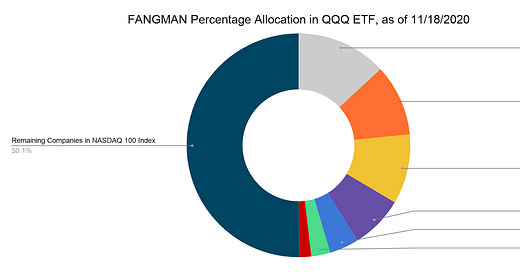

As of November 18, 2020, “FANGMAN” (Facebook, Amazon, Netflix, Google, Microsoft, Apple, and NVIDIA) accounted for about 49.9%, or basically half, of the QQQ ETF, which seeks to track the NASDAQ 100 Index.

Between the “CIMQS” and “FANGMAN” acronyms, Microsoft is the only overlapping company.

Social media companies like Facebook, LinkedIn, and Twitter are more than just social networks. They are broadcast networks and social platforms that are used by hundreds of millions of people on a daily basis.

Data Source: Morningstar (5)

Data Source: Koyfin (4)

As outlined by venture capitalist Tomasz Tunguz at Redpoint Ventures, seed financing for startups in social media, big data & analytics, internet of things, video streaming, travel, e-commerce, and advertising experienced a drop-off from 2014-2018. Coincidentally, Facebook, Google, Apple, Netflix, Amazon, Booking.com/Priceline, and Airbnb all compete in these industries and have notable market shares. (6)

Importantly, a virtuous cycle exists with internet companies and digital businesses, and this cycle is amplified by these three key characteristics:

1. There exists a strong relationship between data quantity and quality of artificial intelligence and machine learning models.

2. Data is a valuable asset. Access to differentiated and high quality datasets generates compounding benefits.

3. The combination of network effects, asymmetric information, increasing returns to scale, and technological advantages have enabled many internet companies and digital businesses to experience a “winner take most” market environment.

Pathway to the Breakup of Big Tech

Key Benefits of Breaking Up Big Tech Companies

Increase in competition - More opportunities for small players with big ideas to enter and succeed, and drive better experience and products for the end-user. Clearly, Zoom does a better job at video calls than many competitors.

Cash Flow - Reduced efficiency is not always bad as it means more cash is being spent. If there’s 10 companies doing similar things, then there’s 10x the cash flow to services like Azure and AWS. Velocity of money and productivity are positively correlated, and there will certainly be a number of benefactors from breaking up larger incumbents.

Possible regulatory efficiency - Similar to Glass-Steagall Act creating the FDIC, a separate body for technology-specific regulation would be beneficial and is absolutely necessary at this point in time. It is clear from past Congressional hearings that there is a steep learning curve to converge the difference in understanding between individuals in Washington DC and engineers in technology hubs like Silicon Valley and Seattle. Often, educated deliberation can raise proper awareness of issues, increase the rational prioritization of goals, can promote American ingenuity and interests on a global scale, and can increase the efficiency of legislation. Technology grows exponentially, and as a result, we cannot take a linear approach to solving these problems.

Talent - One of the major complaints from startups in the ecosystem is that many technology companies with large balance sheets or large venture capital financing can afford to pay extraordinarily high annual compensation, plus RSUs, in order to attract talent. In some cases, this overbidding for talent seems peculiar in that it can block other companies from hiring said talent, and occasionally, some really talented engineers work on small incremental projects inside large companies with little impact and little development in skills. In breaking up some companies, one can free up some of that talent to work on things that would be more beneficial to a broader population.

Key Drawbacks of Breaking Up Big Tech Companies

Competition: Too much competition wastes resources and introduces fragmented markets which only reduces productivity. Especially after the initial break up, this would very likely be the case. Imagine if 10 different competitors to Microsoft Word all needed to support each other’s formatting; that’s 10x10 relationships leading to 100 possible options. Said differently from a consumer perspective, an individual trying to select a car ride from 40 different ride-sharing apps would have a worse user experience compared to selecting from a couple of well-functioning ride-sharing apps. The marginal benefit of additional competitors falls quickly with software, which often follows a “winner takes most” phenomenon - ultimately, we may end up back at square one again.

Cost: As packaged services are eliminated, end users will need to manage across new and separated platforms, leading to higher costs. Operations may be less streamlined without integration and data being carried between applications and platforms.

Unit Economics: Depending on how companies are broken up, you could see a dramatic impact to certain arms of their businesses. The ability to shift revenue to fund other businesses may be impacted, and that can create a detrimental scenario. If Amazon is running “project A” - something that would greatly benefit customers in the long-term, but its current unit economics aren’t great and therefore is being subsidized by the revenue from AWS, you may unintentionally de-fund something great if Amazon is forced to separate that service from AWS.

Efficiency: Large tech companies have infrastructure already in place which is why it is easier for them to build new applications with a fraction of the engineers required for a new startup. Additionally and across several tech platforms, the code has been written, engineered, and interwoven in such a way that it would be extremely difficult to separate. Impacts of separating that at this point could lead to inefficiency.

Additional Thoughts on M&A Strategy and Spinoffs:

Is there a conglomerate tax (holding company detracts value from subsidiaries) or conglomerate efficiency (holding company adds value to subsidiaries)? When there is a conglomerate tax, conglomerates should pursue corporate carve-outs, spinoffs, or asset sales to streamline efficiencies and focus on their core businesses in order to unlock shareholder value. Examples of conglomerates and holding companies include Interactive Corp, Proctor and Gamble, Constellation Software, Danaher, Social Capital, Berkshire Hathaway, and Alphabet.

Interestingly, several successful conglomerates have centralized decision-making for capital allocation and decentralized decision-making for business operations. Decentralized decision making for business operations provides higher autonomy to decision makers, empowers more employees in an organization, and drives efficiency through a reduction in corporate friction. Said more succinctly, this strategy involves centralized strategy and decentralized tactics.

According to John Malone (Chairman of Liberty Media and ex-CEO of Telecommunications, Inc.), horizontal mergers are typically more successful than vertical mergers since the merged companies are in similar businesses. Vertical mergers are more complex because the acquiring company may have little familiarity with managing another type of business segment outside its core competency. In addition, when understanding synergies in a merger or acquisition, financial synergies, revenue synergies, synergies from horizontal mergers, and tax-driven synergies are often easier to define metrics to realize the possible planned synergies. On the other hand, intangible synergies are often harder to define and realize with metrics. Also, recognition of operational synergies often requires the management team of the acquiring company to review line items on operating expenses to understand where, when, and how excess expenses can be eliminated. (23)

Simply acquiring more companies for the rationale of growing a company's size in hopes for future efficiencies from a business combination can be foolish. There needs to be a plan of recognizing proposed synergies with accountability. Culture, intangible assets, and other qualitative factors also matter in successful M&A transactions. Similar to when an organ transplant doesn't fit the body, an acquired company may not necessarily fit well into the parent company, and in some cases, be detrimental to the parent company after acquisition. Examples of poor acquisitions: AT&T & TCI, AOL & Time Warner, New York Central & Pennsylvania Railroad, Yahoo & Tumblr, Quaker Oats & Snapple, and Sprint & Nextel. Examples of excellent M&A deals by the parent company: Google's acquisition of Android, YouTube, and DoubleClick; Facebook’s acquisition of Instagram; eBay’s acquisition and subsequent spinoff of PayPal; Disney's acquisitions of Pixar and Marvel, Berkshire Hathaway’s acquisition of Geico, and Priceline’s acquisition of Booking.com. (24)

While corporate executives obviously seek successful decision-making in M&A deal-making, not all M&A transactions should be expected to be successful. Many acquired companies at Google and Cisco failed to provide any significant value to the parent company. However, many of the best M&A strategists understand that a successful acquisition strategy displays the importance of asymmetric returns and slugging percentage over batting average. When the size of the price of successful acquisitions is enormous, one or a few winners can pay for all of the losing acquisitions and still generate a positive and competitive rate of return. For example, Instagram, PayPal, and YouTube were all acquired at a price below $2B, and all three companies as stand-alone entities today are estimated to be worth hundreds of billions of dollars. Even if Google or Facebook lose tens of millions of dollars in acquisition failures, their winning acquisitions in YouTube, DoubleClick, Android, Instagram, WhatsApp, and others have been enormously successful. Furthermore, even if Google, Facebook, and other large companies lose millions of dollars in financial write-downs from failed acquisitions, the value associated with acqui-hiring & retaining talented employees, killing competitor products, and learning knowledge from a specific ecosystem or sub-industry can all be valuable to the acquiring company.

Closing Thoughts

Many industries have previously faced antitrust scrutiny and increased regulatory burden from governments. The antitrust scrutiny against Big Tech companies is just another iteration of the antitrust cycle. The outcomes of these antitrust deliberations have had varying results, but many of the subsequent spin-offs have resulted in additional shareholder value.

The CEOs of Big Tech companies today control more economic resources than Presidents and Prime Ministers of several countries.

Governments desire a monopoly of policy-making power and rule of law over their citizens. When companies threaten or disrupt this monopoly, they may be in the crosshairs of antitrust scrutiny or other regulatory scrutiny from governmental regulators.

Corporate M&A strategy fundamentally can change the direction of a company.

When conducted correctly, corporate spin-offs can create value for shareholders and employees. Corporate spin-offs also can refocus a company towards its core business segments and mission statement.

Happy Thanksgiving!

References:

(1) "Chart: The Evolution of Standard Oil - Visual Capitalist." 24 Nov. 2017, https://www.visualcapitalist.com/chart-evolution-standard-oil/. Accessed 10 Nov. 2020.

(2) "Look at this chart - The Verge." 24 Oct. 2016, https://www.theverge.com/2016/10/24/13389592/att-time-warner-merger-breakup-bell-system-chart. Accessed 10 Nov. 2020.

(3) "Annual Report - Treasury." https://home.treasury.gov/system/files/206/CFIUS-Public-Annual-Report-CY-2019.pdf. Accessed 20 Nov. 2020.

(4) "Koyfin." https://www.koyfin.com/. Accessed 20 Nov. 2020.

(5) "Invesco QQQ Trust (QQQ) Portfolio | Morningstar." https://www.morningstar.com/etfs/xnas/qqq/portfolio. Accessed 20 Nov. 2020.

(6) "Which Categories of Seed Startups are Thriving? Which Aren't ...." 8 Aug. 2019, https://tomtunguz.com/which-categories-of-seed-startups-are-thriving-which-aren-t/. Accessed 20 Nov. 2020.

(7) "General Data Protection Regulation (GDPR ...." https://gdpr.eu/. Accessed 20 Nov. 2020.

(8) "California Consumer Privacy Act (CCPA)." https://oag.ca.gov/privacy/ccpa. Accessed 20 Nov. 2020.

(9) "NY State Senate Bill S5575B - The New ...." https://www.nysenate.gov/legislation/bills/2019/s5575. Accessed 20 Nov. 2020.

(10) "The Justice Department Unveils Proposed Section 230 ...." 23 Sep. 2020, https://www.justice.gov/opa/pr/justice-department-unveils-proposed-section-230-legislation. Accessed 20 Nov. 2020.

(11) "Silicon Valley giants accused of avoiding $100 billion in taxes." 2 Dec. 2019, https://www.cnbc.com/2019/12/02/silicon-valley-giants-accused-of-avoiding-100-billion-in-taxes.html. Accessed 20 Nov. 2020.

(12) "Digital Services Tax - GOV.UK." 11 Mar. 2020, https://www.gov.uk/government/publications/introduction-of-the-digital-services-tax/digital-services-tax. Accessed 20 Nov. 2020.

(13) "Big Tech needs to pay more tax, EU's Gentiloni says." 5 Sep. 2020, https://www.cnbc.com/2020/09/05/big-tech-needs-to-pay-more-tax-eus-gentiloni-says.html. Accessed 20 Nov. 2020.

(14) "Apple to Pay $38 Billion in Taxes on Cash Overseas, Build ...." 17 Jan. 2018, https://www.wsj.com/articles/apple-to-pay-38-billion-in-repatriation-tax-plans-new-u-s-campus-1516215419. Accessed 20 Nov. 2020.

(15) "Google's $2.1 billion Fitbit acquisition is getting closer scrutiny ...." 3 Jul. 2020, https://www.theverge.com/2020/7/3/21312383/google-fibit-acquisition-antitrust-data-regulatory-eu-scrutiny. Accessed 20 Nov. 2020.

(16) "Nvidia's $40 billion deal to buy Arm is under scrutiny ...." 14 Sep. 2020, https://www.fiercetelecom.com/telecom/nvidia-s-40-billion-deal-to-buy-arm-under-scrutiny. Accessed 20 Nov. 2020.

(17) "Broadcom's Blocked Acquisition of Qualcomm - The Harvard ...." 3 Apr. 2018, https://corpgov.law.harvard.edu/2018/04/03/broadcoms-blocked-acquisition-of-qualcomm/. Accessed 20 Nov. 2020.

(18) "CFIUS Annual Report to Congress - Treasury." https://home.treasury.gov/system/files/206/CFIUS-Public-Annual-Report-CY-2018.pdf. Accessed 20 Nov. 2020.

(19) "U.S. blocks chip equipment maker Xcerra's sale to Chinese ...." 22 Feb. 2018, https://www.reuters.com/article/xcerra-ma-hubeixinyan/u-s-blocks-chip-equipment-maker-xcerras-sale-to-chinese-state-fund-idUSL2N1QD01X. Accessed 20 Nov. 2020.

(20) "Here's how we can break up Big Tech | by Team Warren ...." https://medium.com/@teamwarren/heres-how-we-can-break-up-big-tech-9ad9e0da324c. Accessed 20 Nov. 2020.

(21) "Democrats call for Congress to rein in, break up Big Tech." 6 Oct. 2020, https://apnews.com/article/technology-50e69e921c6699a3edbd730c12292436. Accessed 20 Nov. 2020.

(22) "Former Amazon vice president calls for AWS spinoff." 24 Jul. 2020, https://www.cnbc.com/2020/07/24/former-amazon-senior-engineer-calls-for-aws-spinoff.html. Accessed 20 Nov. 2020.

(23) "Zuckerberg Facebook Testimony Doesn't Diminish Case ...." 30 Jul. 2020, https://www.bloomberg.com/opinion/articles/2020-07-30/zuckerberg-facebook-testimony-doesn-t-diminish-case-instagram-separation. Accessed 20 Nov. 2020.

(24) "Tech competitors are 'blown away' by House antitrust CEO ...." 31 Jul. 2020, https://www.cnbc.com/2020/07/31/big-tech-competitors-were-blown-away-by-house-antitrust-ceo-hearing.html. Accessed 20 Nov. 2020.

(25) "State, federal antitrust lawsuits likely to challenge Facebook." 19 Nov. 2020, https://www.washingtonpost.com/technology/2020/11/19/facebook-antitrust-lawsuit/. Accessed 20 Nov. 2020.

(26) "2012 Mavericks Lecture: John Malone - YouTube." 4 Oct. 2012. www.youtube.com/watch?v=v5QfCLeloEg. Accessed 20 Nov. 2020.

(27) "The Best Acquisitions of All Time - Acquired Podcast." 17 Mar. 2020, https://www.acquired.fm/episodes/acquired-top-ten-the-best-acquisitions-of-all-time. Accessed 20 Nov. 2020.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.