Digitizing the Future with Software & Cloud Computing

Weekly updates on the innovation economy.

Introduction

At Drawing Capital, we are of the view that disruptive and transformative innovation fuels future growth. Several software companies are increasing societal efficiency, integrating technology in our everyday lives, and digitizing both the tech industry and traditionally non-digital industries. At Drawing Capital, we share the opinion of being incredibly optimistic about the future of software and its applications for consumers and companies.

In this newsletter, we enable you to learn more about the following 4 key topics:

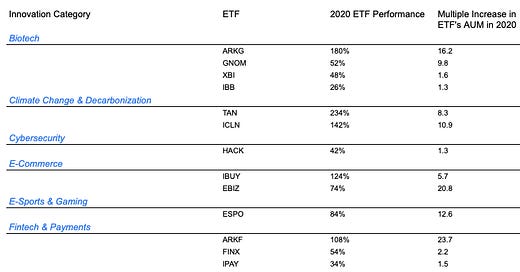

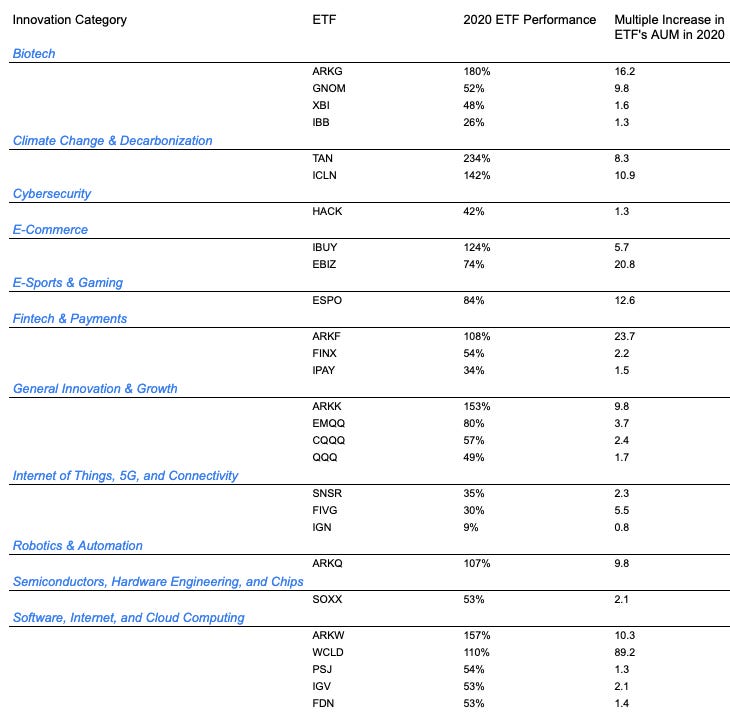

Historical returns from investing in the innovation economy

Sample ETFs to track specific innovation themes

What is SaaS?

Benefits and distribution approaches for SaaS companies

Earlier this month, Drawing Capital partnered with Interactive Brokers to co-host a webinar about software companies. You can find a recording of this free webinar and the presentation deck at this link: https://ibkrwebinars.com/webinars/valuing-saas-companies/

Historical Returns

Two of the most powerful phrases that describe the past 10 years in the investing landscape are Stanley Druckenmiller’s “long the disruptors and short the disrupted” and Marc Andreessen’s “software is eating the world” (1,2). Numerically, we see these phrases play out in prime time, as seen by the following three illustrations:

Data Source: Chart by Drawing Capital and Data from Koyfin

The following chart below highlights the “long the disruptors and short the disrupted” trend:

What can we learn from the above chart from Koyfin?

“XOP” is an index ETF that tracks American oil producers and fracking companies.

“IGV” is an index ETF that tracks American software companies.

Over the past decade, being invested in the XOP ETF indirectly supported environmentally-destructive behavior (via carbon emissions) and also was a money-losing bet compared to betting on the surging historical rise of a software index fund such as the IGV ETF.

What is Software as a Service (SaaS)?

The SaaS Equation

The SaaS Equation: Software Over the Internet + Subscription Model or Consumption Model = Software as a Service

Software Over the Internet:

Software in the cloud streams data to users.

Subscription Model:

Customers pay a flat monthly or annual fee, regardless of usage.

At the consumer level, Netflix and Spotify are examples of subscription models; you can watch or listen to as many movies and songs as you want for the same price.

Consumption Model:

Customers pay an ongoing subscription cost with variable pricing options. Larger consumption of the software product leads to higher revenue for software companies.

Consumption-based SaaS business models allow the SaaS company to grow their revenues as their customers grow.

At the enterprise level, Twilio and Snowflake are examples of consumption-based software business models.

Software as a Service:

Customers can subscribe to a service relatively quickly and easily.

SaaS products reduce the need for additional hardware and complexity for customers.

Usage of the 3 main cloud service providers (Alphabet’s Google Cloud, Amazon’s Amazon Web Services, and Microsoft’s Azure) helps abstract away the complexity of back-end infrastructure at the enterprise customer level. As opposed to buying and racking servers via on-premise storage, cloud computing typically enables faster scalability and reliability of computing over time.

Typical SaaS Company Benefits

Predictable recurring revenue

High margins

Simplified business pricing

Scalability for future global expansion when there are low variable costs.

High use of stock-based compensation broadens shareholder ownership, conserves corporate cash flow, and allows employees to participate in the potential growth of their employers..

SaaS Sales Approach

Often, enterprise SaaS products are sold either via a top-down or bottom-up approach.

A top-down approach involves pitching and selling to a Chief Technology Officer, VP of Engineering, or other senior individual at the buying company, and then the buying enterprise adopts the software product across several users.

Benefits: The individual making the buying decision is often a known person.

Downside: Top-down software sales approach can be time-consuming, intensive in marketing costs, and subject to bake-offs (competitive bidding and feature-showcasing events against other competitor products).

A bottom-up approach involves allowing the actual end users of products inside the buying enterprise to use and buy software products. After a critical mass of users inside a buying enterprise use the software product, a senior individual such as the Chief Information Officer may acknowledge the viability and benefits of the SaaS product, thereby buying more and possibly negotiating for discounted pricing.

Benefits: The end user’s voice is heard in the procurement process of software products. When a software product is useful, it can be quickly adopted with little marketing expenses due to the network effects.

Hurdle: Product quality matters, and low quality SaaS products are less likely to go viral.

Historical Returns From Investing in Software

Notably, generating a 20% CAGR over 10 years implies that an initial investment would have increased by nearly 6.19x.

Clearly, software and technology index funds have delivered significantly higher historical performance compared to the Dow Jones over the past 10 years.

3 Key Insights

Disruptive and transformative innovations fuel future growth. Given the necessity of digital transformation for companies due to the coronavirus pandemic and the right-sizing of business models to lower costs, grow revenues, and expand margins, software and cloud computing are certainly in vogue.

The benefits of SaaS, such as predictable revenue, high gross margins, and scalable distribution when there are low variable costs, are likely to remain in the future. While past performance returns may not be replicated or indicative of future performance, highlighting this historical performance helps understand the possibilities associated with correctly investing in high-growth themes.

Cloud computing and software companies in aggregate have historically delivered extraordinarily positive returns over time that have also significantly outperformed popular US market indices such as the Dow Jones Industrial Average and the S&P 500. In gaining exposure to software companies, investors can either do the hard work of individually picking and choosing to invest in individual software companies, contact Drawing Capital to learn more about Drawing Capital’s software investing approach, rely on experts, or utilize software and cloud-focused ETFs such $FDN, $IGV, or $WCLD.

Summary

Overall, we are attracted to the creativity of new technologies and remain committed to seeking multi-period opportunities with a tech-focused lens that enables scalable growth. The growth of software and its multi-industry applications have been remarkable, and we expect the digitization of traditionally non-digital industries to continue for the foreseeable future.

References:

"https://www.bloomberg.com/news/videos/2019-12-23/citi-s ...." https://www.bloomberg.com/feeds/markets/sitemap_video_2019_12.xml. Accessed 18 Sept. 2020.

"Why Software Is Eating the World - Andreessen Horowitz." 20 Aug. 2011, https://a16z.com/2011/08/20/why-software-is-eating-the-world/. Accessed 18 Sept. 2020.

"Trailing Returns - XNAS | Morningstar." https://www.morningstar.com/etfs/bats/igv/performance. Accessed 16 June 2021.

"BVP Nasdaq Emerging Cloud Index - Bessemer Venture Partners." https://cloudindex.bvp.com/. Accessed 1 May 2021.

"Koyfin." https://app.koyfin.com/. Accessed 16 June. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.