Enthusiasm for Semiconductors and Next-Generation Computing

Weekly updates on the innovation economy.

Drawing Capital Newsletter

January 29, 2021

Technological Advancement & Engineering Laws

Technological deflation involves receiving more for less. Many technologies and products exist today such that delaying purchasing gratification leads to better price-to-quality ratios. For example, for every annual iteration of the iPhone, the previous versions command lower prices.

The following chart from Ray Kurzweil, Steve Jurvetson, and Future Ventures highlight technological progress regarding computational power per constant dollar (1).

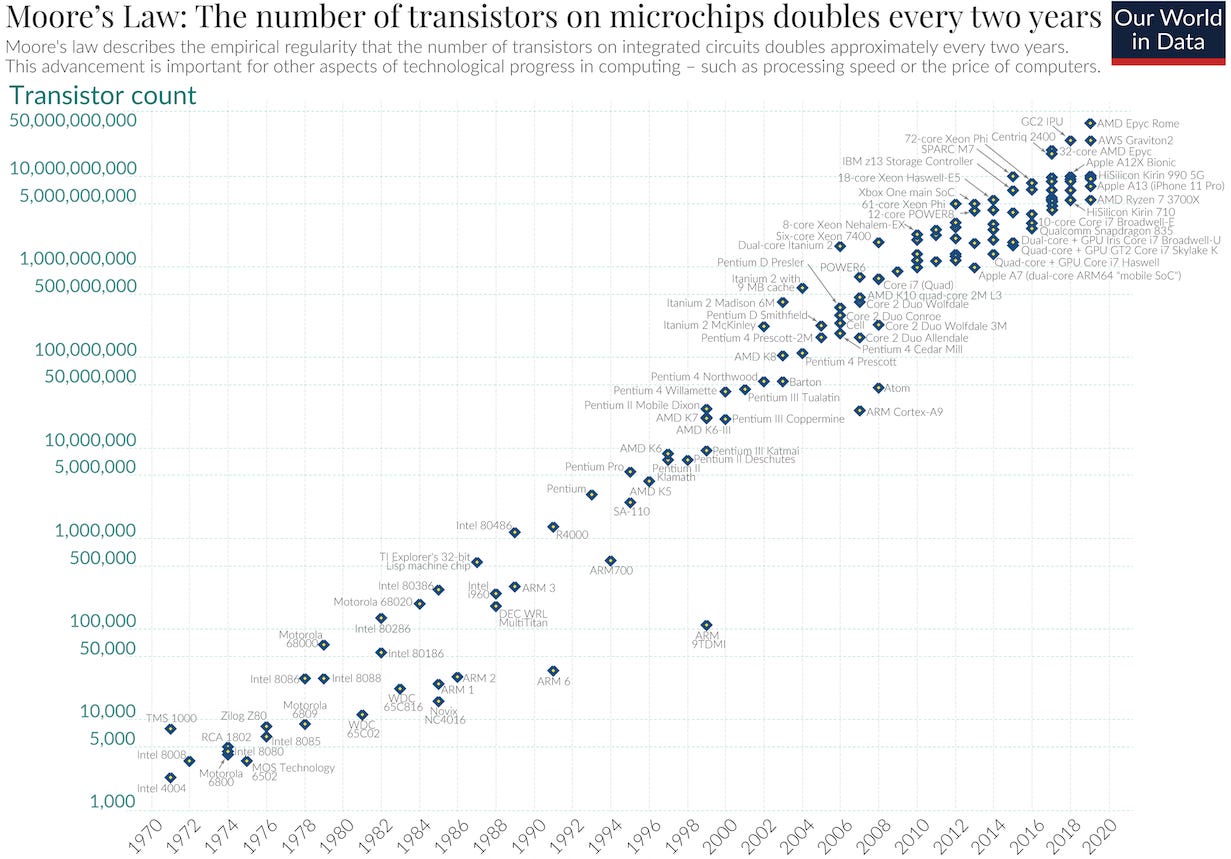

Moore’s Law (named after Gordon Moore) states that for every two years, the number of transistors in a silicon chip approximately doubles. A byproduct of Moore’s Law is that when there are twice as many transistors on a chip, then the cost of the compute is effectively halved.

Interestingly, Moore’s second law (also known as Rock’s Law, which is named after Arthur Rock) suggests that the cost of a semiconductor chip fabrication plant (fab) doubles every 4 years. Importantly, this law demonstrates the degree of high capital intensity of operating fabs.

The following chart from Our World In Data displays the advancement of chips over time (2).

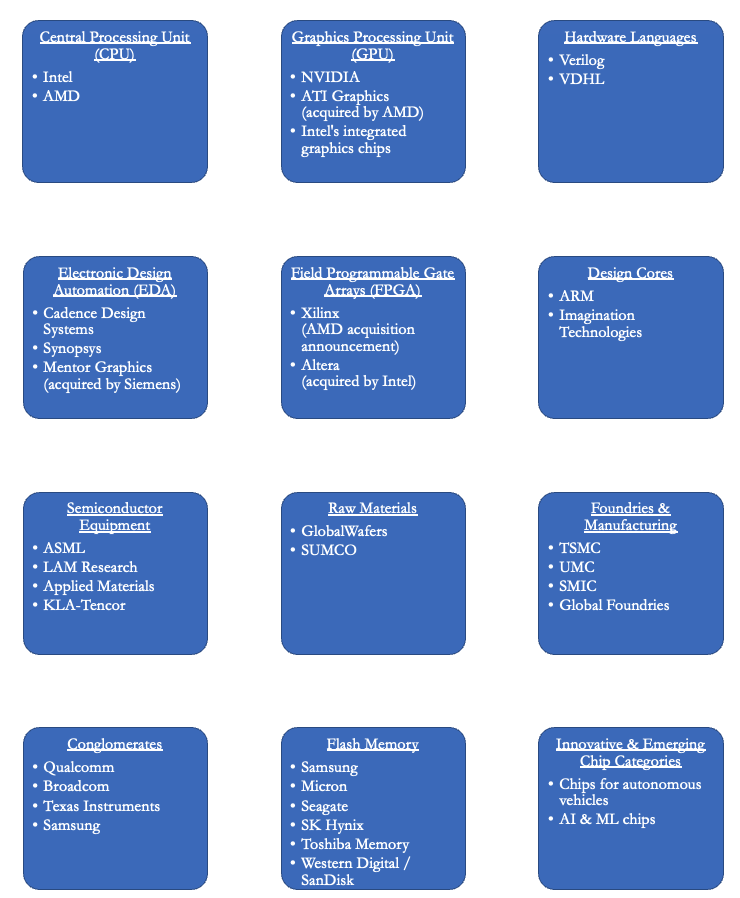

Semiconductor Categories

In many instances, as a hardware company gets closer to the money (aka the end consumer or an enterprise revenue source), the larger the market cap because the hardware company is closer to the end customer relationship and therefore has the ability to capture more profit from the hardware value chain. For example, Apple’s market cap exceeds TSMC’s and Foxconn’s combined market caps. Over time, there has also been a consolidation in the hardware industry, with about 2-3 companies increasingly dominating a specific semiconductor sub-category.

(3)

The iShares PHLX Semiconductor Index ETF (ticker $SOXX) represents a straightforward method of investing in semiconductors through a diversified approach. Interestingly and as seen in the chart from Koyfin above, there is a wide dispersion in the stock price performance of various semiconductor companies, with AMD shares and NVIDIA shares experiencing meteoric rises over the past 5 years. Even if an investor missed the rise in AMD shares and NVIDIA shares, several stocks of semiconductor companies outperformed the S&P 500 Index over the past five years.

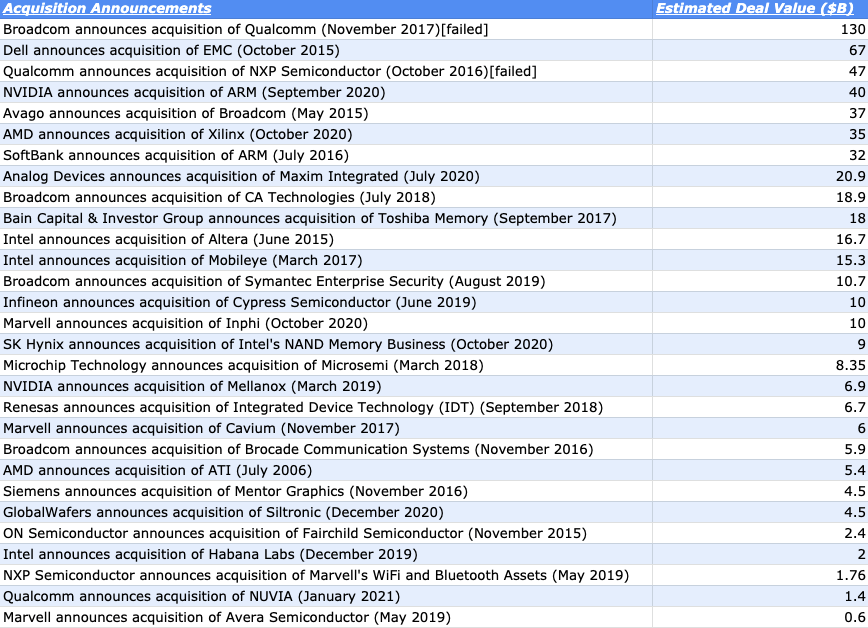

Select M&A in the Semiconductor Industry

The first chart displays notable M&A semiconductor deals in chronological order. The two orange-colored bars in the first chart indicate that these two acquisition offers ultimately failed to materialize into closed transactions due to regulatory scrutiny. The second chart displays the same data that is organized by deal value. (4)

Significant multi-billion dollar acquisitions in the semiconductor industry in the past 5 years with acquisition price premiums display 2 key attributes:

Increasing industry consolidation and corporate expansion, often via conglomerate mergers (merger of firms with related adjacent business lines with minimal overlap) and horizontal mergers (merger of firms operating in the same industry)

Increasing enthusiasm for semiconductors and hardware engineering

The US Treasury’s CFIUS has Increased the Number of Investigations in the Past Decade.

(5)

Despite large mergers and acquisitions (M&A) in the semiconductor industry, CFIUS has increasingly been more watchful on acquisitions, particularly when involving concerns regarding America’s national security. Notably, Broadcom’s proposed acquisition of Qualcomm and Qualcomm’s proposed acquisition of NXP Semiconductor were both effectively denied by government regulators.

Why Now, and What Makes Semiconductors Especially Interesting Today?

The success of Apple, Qualcomm, NVIDIA, AMD, and other companies demonstrate that a pioneering focus on engineering, high product quality, and innovation can successfully co-exist in a fabless environment.

Intel’s recent hiring of Pat Gelsinger as Intel’s new CEO supports a return back towards a “hardware engineering mindset” as opposed to a “financial engineering mindset”.

Given the tensions between America and China and given the necessity of how semiconductors are interwoven to the fabric of the everyday lives of billions of people, maintaining semiconductor excellence in America is both a key source of intellectual capital, national pride, and a protector of national security.

As mentioned earlier and due to significant industry consolidation over the recent years, the top 2-3 companies in each semiconductor industry category have significant market share. It is easier for companies to maintain pricing power, revenues, and margins with dominant market share.

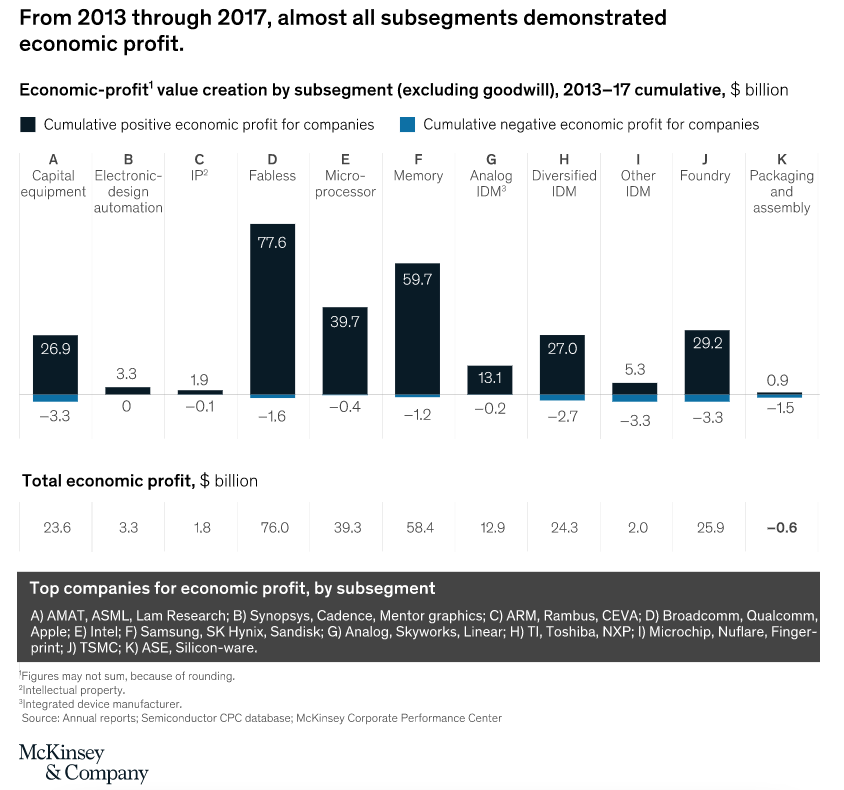

After a relatively difficult period that lasted greater than a decade for many hardware engineering companies, semiconductor companies in aggregate are beginning to demonstrate both improved cost rationalization and strong value creation with economic profit. We can see evidence of this situation via the following 3 charts from McKinsey & Company (6):

During this measured time period of 1997-2012, many non-microprocessor companies and non-fabless semiconductor companies failed to generate significant positive economic profits and faced difficulty, especially after the bursting of the tech, telecom, and dot com bubbles in 2000-2002. While accounting profit equals revenues minus expenses, economic profit subtracts opportunity costs from accounting profit.

This chart from McKinsey & Company highlights that among many factors, improved cost rationalization, wider adoption of fabless business models, and increasing hardware demand due to increasing amount of data storage, compute power, and data science demand led to strong value creation with economic profit. Analyzing these two charts together from McKinsey & Company, fabless business models generated the highest cumulative economic profit in 1997-2017 when compared to the other listed semiconductor categories.

Reviewing this chart from McKinsey & Company, 2017 showed the highest cumulative economic profit for semiconductor companies between 1997-2017. Greater adoption of fabless business models with outsourcing of chip manufacturing services to TSMC reduces the high up-front capital expenditure requirements for individual semiconductor companies, thereby both reducing the cyclicality of semiconductor business models and improving the focus on chip design and core technical competencies.

Significant demand for semiconductors exist in the modern world, and semiconductors are necessary to power anything in the digital world and expand the power of computing.

A key consequence of a work-from-home/work-from-anywhere environment during the coronavirus pandemic stressed the importance of collaborative workplace apps, online commerce, internet-enabled social interactions, and the digitization of previously non-digital industries. After all, all of these software applications need to run on a hardware device somewhere, regardless of the system or device being on-premise or in the cloud.

Furthermore, the incredible importance of artificial intelligence, machine learning, deep learning, neural networks, and data science techniques places renewed emphasis on GPUs, TPUs, custom AI-specific chips, and faster computational power, thereby creating a positive demand shock for the semiconductor industry.

High GPU demand and demand for other semiconductor categories currently exist, particularly in trending fields like machine learning, artificial intelligence, high-performance computing, self-driving cars, collaborative robots, autonomous systems, gaming and esports, cryptocurrency mining, computational biology, and genomics research.

Given significant investments in innovation at scale, companies with a high return on invested capital (ROIC) are increasingly able to maintain their high ROICs in the long term due to distinct advantages, such as intellectual property protection, high employee talent, network effects, financing advantages, high-quality management teams, flywheel business endeavors, benefits from the returns from compounded knowledge over time, and increasing returns to scale on certain types of business models.

A virtuous cycle exists with internet companies and digital businesses, and this cycle is amplified by these three key characteristics:

1. There exists a strong relationship between data quantity and quality of artificial intelligence and machine learning models.

2. Data is a valuable asset, and access to diverse and high-quality datasets generates compounding benefits.

3. The combination of network effects, asymmetric information, increasing returns to scale, and technological advantages have enabled many internet companies and digital businesses to experience a “winner take most” market environment.

The custom development and design of chips via an in-house arrangement by large technology companies emphasize the importance of the following:

Unbundling generalized chips into specialized chips

Speed to market

High demand for custom hardware chips

High demand for innovation with cost declines

The ability to better integrate hardware and software together, which can enhance engineering quality, computing performance, and the company’s ability to potentially capture better financial margins. For example, Apple designed the M1 chip for its new 13’’ MacBook Pro laptops, Apple developed custom chips for its iPhones and iPads, Google made TPUs, Tesla designed its own custom autonomous driving chip, and Microsoft is exploring the possibility of custom-designed ARM-based chips for its Azure servers and Surface computers.

A vibrant ecosystem of startup and private semiconductor companies exist today. For example, companies such as SambaNova, Mythic, Graphcore, Groq, Cerebras Systems, and Wave Computing are making significant developments in AI-specific chips. To help support these types of companies, there is increasing interest by corporate venture arms and venture capital firms to provide financing in exchange for potentially very lucrative returns. The ability to recognize and understand innovation in private companies can help “see the future”.

Summary

We believe that this is one of the most exciting times in the semiconductor industry today. From an investing perspective, a diversified semiconductor ETF like $SOXX or an individual company like NVIDIA ($NVDA) can present potential opportunities in participating in the excitement and enthusiasm for the semiconductor industry. The intersection between rationalized business models, high demand for innovation, significant tailwind in GPUs from high demand in specific fields (such as artificial intelligence, machine learning, gaming, computational biology, cryptocurrency mining, self-driving cars, and more), an active M&A market, and the unbundling of generic chips into specialized chips presents a very compelling opportunity set for the engineering community.

Get in touch to learn more about Drawing Capital’s strategy:

References:

(1) “Steve Jurvetson: Forging the Future: What’s Next?”. Silicon Valley Open Doors. www.youtube.com/watch?v=zGN6dR5ZeSg. 8 Jun 2018. Accessed 22 Jan. 2021.

(2) "Technological Progress - Our World in Data." https://ourworldindata.org/technological-progress. Accessed 22 Jan. 2021.

(3) "Koyfin." https://www.koyfin.com/. Accessed 22 Jan. 2021.

(4) Various corporate press releases regarding M&A announcements

(5) "Annual Report - Treasury." https://home.treasury.gov/system/files/206/CFIUS-Public-Annual-Report-CY-2019.pdf. Accessed 22 Jan. 2021.

(6) "What's next for semiconductor profits and value ... - McKinsey." 9 Oct. 2019, https://www.mckinsey.com/industries/semiconductors/our-insights/whats-next-for-semiconductor-profits-and-value-creation. Accessed 22 Jan. 2021.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.