Exploration of Palantir: Data Integration, Data Protection, and Time-to-Value

Weekly newsletters on the innovation economy.

Introduction

From a “first principles thinking” perspective, Palantir helps answer the following question for public sector, government, and commercial enterprise clients: how can I minimize my time-to-value without compromising on the quality of the value? Said differently, how can I reduce the time it takes to gather data, process/clean datasets, and run analytical models on datasets in order to arrive at the concluding valuable insight and actionable next step?

Palantir’s 3 software platforms (Gotham, Foundry, and Apollo) are much more than a dashboarding service and seek to embody an information architecture that replaces hundreds of millions of dollars of expenditure on inefficient IT services. As we create data faster every day, the next phase is to store and manage fragmented datasets over time, followed by generating useful, practical, and actionable insights from datasets. Therefore, reducing time-to-value generates significant efficiencies and scalable impact. Time-to-value is the time it takes to create something of value or generate a valuable insight.

As a provider of government software to mission-critical functions of the US government and its allies, Palantir remains hyper-focused on serving this critical customer base. Palantir has significant market share in the government software contractor ecosystem.

As an enterprise software company, Palantir is differentiated from most enterprise software companies in two ways: Palantir places significant focus on serving governments, and Palantir provides a complete stack of software to an enterprise instead of providing a myriad of tools that are inefficiently merged together.

For a friendly reminder, this newsletter is for general educational purposes and should not be taken as advice nor a recommendation to buy or sell Palantir shares.

Annual US Government IT Spending

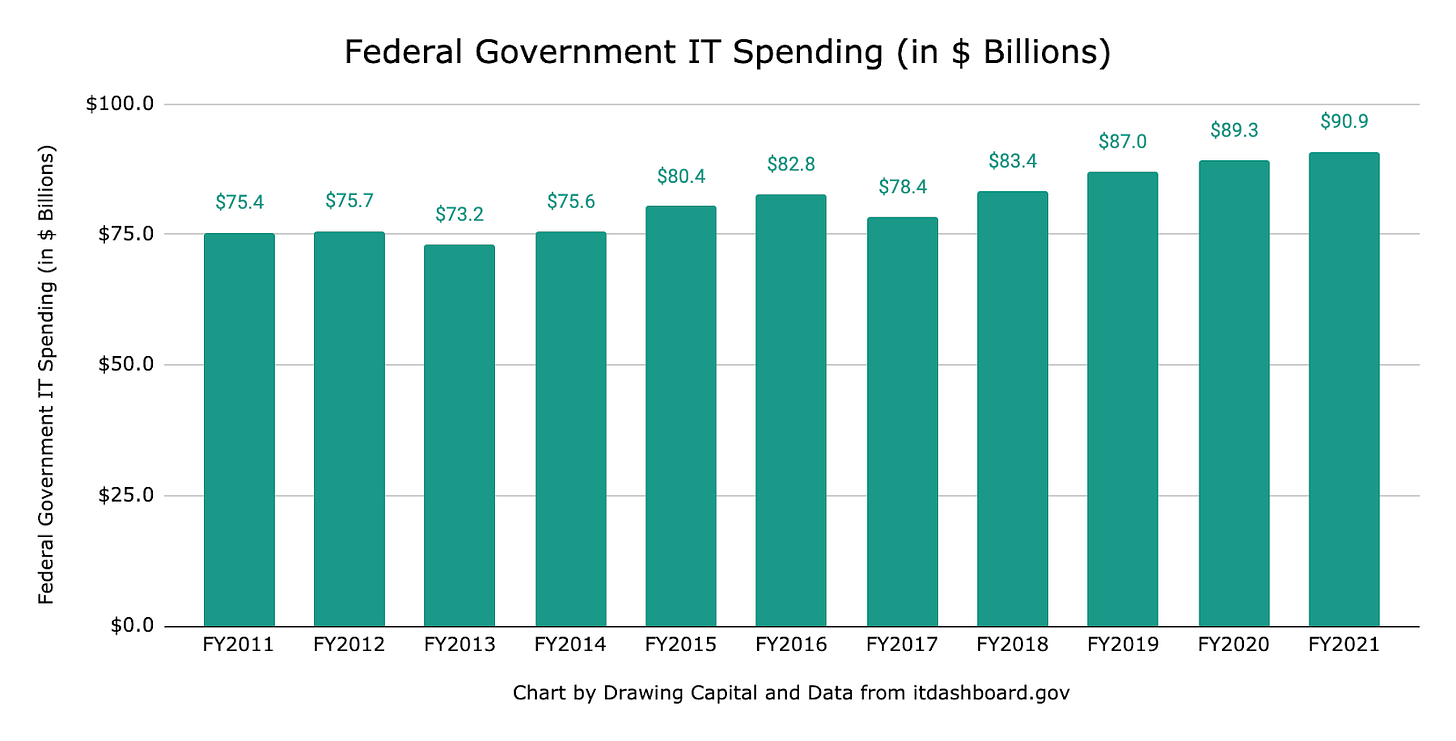

Understanding the US government’s historical IT spending and key trends per department helps to visualize the potential total addressable market (“TAM”) for software-related and IT-related project spending. In Palantir’s S-1 filing, Palantir estimates that the TAM for its software products across government and commercial sectors is $119 billion.

Viewing the chart above, IT spending for the US federal government in fiscal year 2021 is estimated to be nearly $91 billion.

Viewing the chart above, it’s clear that the Department of Defense and Department of Homeland Security dominate the amount of IT spending per department in fiscal year 2020. Interestingly in fiscal year 2020, the IT spending from both of these two departments is almost equivalent to the cumulative sum of IT spending in dollars for all remaining departments in the above table.

There’s a lot of data in this chart, and here are a few highlights:

FY = Fiscal Year. FY2020 represents the government's fiscal year from October 1, 2019 to September 30, 2020.

Several government departments had less than 75% of its IT projects on schedule (blue bars) and on budget (orange bars) in FY2020. According to the federal government’s IT Dashboard, the Department of Defense only had 35% of its IT projects on budget in FY2020.

Social Security Administration, US Army Corps of Engineers, National Science Foundation, and US Agency for International Development were leaders in their percentages of IT projects that were on schedule in FY 2020.

Use of software and data science from high quality providers can help improve project timelines and create better outcomes.

Qualitative Investment Framework

Criticality and Customer Value: How important are the company’s products and services to current and future customers? Are they a “nice to have” or a “need to have”?

Palantir’s ambition is to be the central operating system for the modern enterprise.

Palantir focuses on data integration, data visualization, data protection, and secure collaboration of mission-critical systems for governments and corporations.

Palantir emphasizes delivering alpha (bespoke software creations that add meaningful value) to its customers instead of providing beta (commoditized enterprise products).

Palantir has clients in the military and clandestine operations. “Palantir defends the people that defend us”. Palantir is focused on solving problems for the US government, its allies, and multinational corporations.

Palantir software was used during the coronavirus crisis and is actively used for counter-terrorism efforts.

Large and Growing Total Addressable Market (“TAM”)

Palantir estimates that its TAM for its software in the commercial sector and government sector is $56B and $63B respectively, which totals to about $119B. (1)

Governments are increasingly looking towards the private sector and academia for innovation and partnerships.

Modern software has the ability to transform several manual tasks and increase the efficiencies in many government processes.

Increased scrutiny and governmental regulation regarding data collection and data privacy adds complexity to global companies. The ability to analyze datasets that are high in volume and complexity in order to generate meaningful inferences is a differentiated competitive edge for companies.

Governmental monitoring and surveillance of citizens and residents are increasing over time, and Palantir places significant importance on data privacy and secure collaboration tools.

High Quality Management Team

The founding team at Palantir has exceptional talent. There exists a founder-CEO, differentiated thinking, high insider ownership of the company, and a distinct share voting class structure.

Palantir’s management team prides itself on having a long-term focus with the ability to build and test products years in advance before their immediate need by customers.

High Quality Early Investors and VCs

Palantir’s first angel investing round was near a $800,000 company valuation (2)

Early investors in Palantir include Peter Thiel, Keith Rabois, David Sacks, Chamath Palihapitiya, Stanley Druckenmiller, George Soros, Founders Fund, In-Q-Tel, and Tiger Global. (3-6)

Customer Engagement, Growth, and Retention

A number of tech companies are increasingly shying away from future government software contracts, thereby providing an opening for Palantir with less competition.

Palantir has high net dollar retention (NDR) and customer satisfaction with its government sector clients.

A growing average revenue from Palantir’s top 20 customers suggests that Palantir’s top customers like Palantir’s product offerings and spend more over time.

Use of a differentiated scientific advancement, disruptive innovation, or technology-enabled software

Palantir Gotham (“PG”) is Palantir’s software platform for government and public sector clients.

Palantir Foundry is an enterprise software platform built for commercial applications.

Palantir Apollo is Palantir’s back-end continuous-delivery infrastructure platform with a modern software framework and data observability tools. Apollo reduces installation time from weeks to hours, thereby creating significant efficiency gains for Palantirians. Also, Apollo helps reduce vendor lock-in and runs on both multi-cloud and multi-classification levels.

Palantir’s software platforms are disruptive innovators in that they:

can promote a declining cost curve by reducing wasteful spending on existing legacy software packages that were previously merged together in a byzantine manner

improve customer outcomes beyond simple incremental improvement

can be utilized by a variety of customers across multiple sectors and industries

can serve as a foundational platform to build more features and services on top of the platform over time

High Revenue Growth

Palantir’s annual revenue increased by 47% YoY to exceed $1B in revenue in 2020.

In the Q4 2020 Business Update, Palantir provided guidance in hopes to grow this 2020 revenue number by at least 30% for 2021. In addition, Palantir provided guidance with a goal of reaching $4B or more in revenue in 2025, which represents about a 4x increase from Palantir’s 2020 revenue.

Since 2008, Palantir’s annual revenue has grown every year. Since 2010, Palantir’s average revenue from its top 20 customers has grown significantly each calendar year.

If Foundry and Apollo effectively scale, this would bring more recurring SaaS business economics to Palantir. Because investors often reward companies with recurring revenue and SaaS business economics with higher valuation multiples (price multiples such as price/revenue multiple), having an increasing share of revenue being derived from a growing recurring revenue model can lead to a higher company valuation.

Great Unit Economics and Margins

Contribution margins have been rising since early 2019.

As more clients reach the “Scale” phase in Palantir’s 3-phase business model for customer relationships (Acquire, Expand, and Scale), Palantir expects its revenue and contribution margins to increase over time.

Apollo was built to help scale Palantir's work for clients without a need for scaling the number of Palantir employees ("Palantirians"). If Apollo works, this would imply that Palantir costs can eventually stabilize while revenue increases over time.

Productizing many Foundry features into an enterprise SaaS platform can automate away lots of human involvement and can simultaneously increase Palantir’s scalability, revenue expansion, customer expansion, and margins.

Note: Palantir defines its “adjusted gross margin” as gross margin excluding stock-based compensation. Palantir defines its “contribution margin” as revenue minus cost of revenue minus sales & marketing expenses, excluding stock-based compensation, all divided by revenue. Adjusted gross margin and contribution margin are non-GAAP financial measures.

Build vs. Buy Framework

Palantir’s 3 main software platforms (Gotham, Foundry, and Apollo) were built inside Palantir, suggesting a preference for organically building software platforms. The following chart below highlights Palantir’s continued commitment to research and development (R&D):

On occasion, Palantir has acquired other companies to complement its software platforms and tools, such as (7-10):

Silk (data visualization cloud software)

Propeller (mobile app development tools)

Kimono Labs (web-scraping tool)

Poptip (social polling and natural language processing)

Risk Factors

Governance associated with Class F Founder Shares may create issues. However, the Class F Founder Shares allow Palantir to maintain long-term commitments (particularly to its government and intelligence agency contracts) regarding control of the company over the long term without significant activist pressure from short-term activist investors and foreign investors with different priorities.

Sales & marketing expenses are relatively high compared to other enterprise software companies, particularly due to long and variable sales cycles for government and public sector contracts. Nonetheless, one way to reduce this risk factor is that government and public sector clients are generally sticky with low payback periods.

As operating expenses increase and due to continued investment to update and improve its suite of products and services, Palantir historically has not shown sustained net income profitability over time.

Expansion of Big Tech companies and other competitors into government software contracts may lead to increased competition.

A substantial decrease in revenue growth compared to investor expectations could cause compression in its price multiples for the stock.

Palantir is heavily reliant on its top customers for a significant portion of its total revenues. For example, Palantir’s top 3 customers accounted for 28% of Palantir’s total revenue in 2019.

3 common criticisms of Palantir that are cited in the media:

1. It's a consulting service and a defense contractor that requires lots of people as opposed to being a SaaS company.

2. Palantir primarily makes a data visualization platform.

3. It's a secretive organization with involvement in government contracts.

These common criticisms can be addressed by the following:

Real world data is messy and often requires lots of people to clean and integrate datasets. As Palantir scales its Foundry platform, the company can experience expanding contribution margins and SaaS-like business economics.

Palantir has invested tremendous resources in their platforms, Apollo infrastructure layer, internal tools for secure collaboration, data protection, data aggregation, data visualization, and a platform that drives actionable insights.

Yes, it is true that Palantir was a private corporation for 17 years before going public via a direct listing in September 2020. Yes, the Class F Founder Shares poses a possible dilemma for corporate governance. Yes, it's also true that PG is a government-focused tech platform. At the same time, government contractors and the military industrial complex enhance America's ability to compete globally and protect its core values. As a growing number of technology companies are somewhat relinquishing their role in government work due to employee uprisings, Palantir helps fill this void. There is plenty of blank space to innovate and both save government costs and improve government outcomes with Palantir products.

Announced Current & Future Projects from Palantir:

AI-enabled mission control feature for PG in order to transform datasets into actionable intelligence and insights

R&D in cloud computing and edge computing

Emphasis on modularity to productize many parts of Palantir’s products, have improved flexibility and integration, and deliver better distribution to customers, which thereby improves customer satisfaction, delivery of alpha to customers, and Palantir’s revenue prospects from providing value to customers.

Simulation analysis with what-if outcome analysis

Development of 2 Foundry layers: Ontology Layer and Simulation & AI Layer

3 future plans for Foundry:

Reach more customers

Reach more users inside the enterprise

Utilize AI to improve operations and reduce time-to-value

3 focus topics for Foundry’s product development teams:

Modularity and interoperability

Connectivity, collaboration, and mobile app launch

Model training, model performance analysis, and AI technology

Perspecta vs. Tyler Technologies vs. Palantir. All three are software-enabled government contractors.

In addition to software-focused government contractors such as Perspecta, Tyler Technologies, and OpenGov, Palantir also competes with large technology companies, software divisions inside defense companies, government software consulting companies, and even sometimes its own customers.

Interestingly and as a fun factoid, Palantir is far more popular on Twitter compared to Perspecta and Tyler Technologies, as seen by the chart below.

The following chart below from Koyfin highlights the comparison in stock price performance between Palantir, Tyler Technologies, and Perspecta. Notably, Palantir went public in late September 2020 via a direct listing, and Peraton (a Veritas Capital portfolio company) announced an acquisition in January 2021 to acquire Perspecta for $7.1B.

Summary

Overall, Palantir’s software platforms provide a valuable set of tools and software experiences in helping its customers achieve their core objectives. Palantir’s ambition of becoming the central operating system for the modern enterprise is exciting. AI software can learn, adapt, and improve over time, thereby upgrading Palantir’s platform and the capabilities that it can deliver to its customers. Empowered with data science models, information architecture, and user-friendly dashboards, a rich data-informed operating system allows an organization to become smarter, be more capable and ambitious, learn from previous patterns, and improve both the quality and speed in organizational decision-making. Clearly, minimizing time-to-value has benefits in material improvement of outcomes, cost reduction, and enhancements in process efficiency.

Get in touch to learn more about Drawing Capital’s strategy:

References:

"S-1/A - SEC.gov." https://www.sec.gov/Archives/edgar/data/1321655/000119312520250103/d904406ds1a.htm. Accessed 16 Feb. 2021.

"Peter Thiel on being a contrarian - YouTube." 16 Mar. 2015, Accessed 16 Feb. 2021.

"Palantir: The Next Billion-Dollar Company Raises $90 Million ...." 25 Jun. 2010, https://techcrunch.com/2010/06/25/palantir-the-next-billion-dollar-company-raises-90-million/. Accessed 16 Feb. 2021.

"Palantir's long route to public listing exhausts ... - Financial Times." 14 Jul. 2020, https://www.ft.com/content/f3bc8f40-4f7f-4438-8d37-063036d63d44. Accessed 16 Feb. 2021.

"David Sacks - General Partner - Craft Ventures." https://www.craftventures.com/team/david-sacks. Accessed 16 Feb. 2021.

"CNBC Exclusive: CNBC's Scott Wapner Interviews Chamath ...." 30 Sep. 2020, https://www.cnbc.com/2020/09/30/cnbc-exclusive-cnbcs-scott-wapner-interviews-chamath-palihapitiya-from-cnbc-instit.html. Accessed 16 Feb. 2021.

"Palantir acquires data visualization startup Silk | TechCrunch." 10 Aug. 2016, https://techcrunch.com/2016/08/10/palantir-acquires-data-visualization-startup-silk/. Accessed 16 Feb. 2021.

"Palantir Acquires Kimono Labs For Its Web-Scraping Service ...." 15 Feb. 2016, https://techcrunch.com/2016/02/15/palantir-acquires-kimono-labs-for-its-web-scraping-service/. Accessed 16 Feb. 2021.

"Palantir Acquires App-Making Startup Propeller | TechCrunch." 31 Jul. 2014, https://techcrunch.com/2014/07/31/palantir-acquires-propeller/. Accessed 16 Feb. 2021.

"PopTip Launches Zipline, An Analytics Tool For ... - TechCrunch." 23 Oct. 2013, https://techcrunch.com/2013/10/23/poptip-zipline/. Accessed 16 Feb. 2021.

"Perspecta (@Perspecta), Palantir Technologies (@PalantirTech), Tyler Technologies (@tylertech) | Twitter." https://twitter.com/perspecta, https://twitter.com/palantirtech, andhttps://twitter.com/tylertech. Accessed 16 Feb. 2021.

"Veritas Capital to acquire Perspecta in all-cash transaction valued at ...." 27 Jan. 2021, https://investors.perspecta.com/News-and-Events/News/news-details/2021/Veritas-Capital-to-acquire-Perspecta-in-all-cash-transaction-valued-at-7.1-billion/default.aspx. Accessed 18 Feb. 2021.

"IT Dashboard." https://itdashboard.gov/. Accessed 16 Feb. 2021.

"10-Q - SEC.gov." https://www.sec.gov/Archives/edgar/data/1321655/000119312520292177/d31861d10q.htm. Accessed 16 Feb. 2021.

"Q4 2020 Business Update." https://s26.q4cdn.com/381064750/files/doc_presentations/2021/Q4-2020-Business-Update.pdf. Accessed 16 Feb. 2021.

"Palantir - Investor Relations." https://investors.palantir.com/home/default.aspx. Accessed 16 Feb. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal. At the time of publishing this newsletter, Drawing Capital owned shares in Palantir Technologies.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.