Introduction

This year on August 15th marked the 50th anniversary of the effective end of the Bretton Woods system, thereby moving the US Dollar off of the gold standard and re-categorized as a fiat currency.

Interesting historical context: Throughout the years, August 15th has experienced a series of important events. For example:

Panama Canal opened to traffic (1914)

Major resource rationing related to World War 2 in America ends (1945)

India celebrates its national independence day (1947)

Effective end of the Bretton Woods System (1971)

Bagram Airbase, Kabul, and Afghanistan are seized by Taliban (2021)

In this newsletter, we explore a series of charts that highlight the changing landscape after the effective end of the Bretton Woods System in August 1971. We also share an opinion about Bitcoin and its potential future.

Correlation or Causation?

Although correlation versus causation can be debated in the following charts, it remains conclusive that significant changes have happened since the end of the Bretton Woods system in August 1971.

The gap between the growth in productivity versus compensation to workers has widened since 1971. As a result, the growth in productivity has been increasingly captured by shareholders (capital) as opposed to allocated to employees (labor). Said differently, the S&P 500 Index has grown much faster than the growth rate in inflation-adjusted wages for many industries since 1971.

Labor’s percentage share of the economy’s total income has been steadily declining since 1971.

While total labor’s percentage share of the economy’s total income has steadily declined since 1971, the income for the top 10% has steadily increased since 1971:

Money supply in America has skyrocketed by about 30x since August 1971, contributing to monetary debasement, financial asset inflation, and an increasing amount of capital searching for positive returns:

Consumer Price Index (CPI), a popular measure of consumer price inflation, has experienced a steady upward trajectory since August 1971:

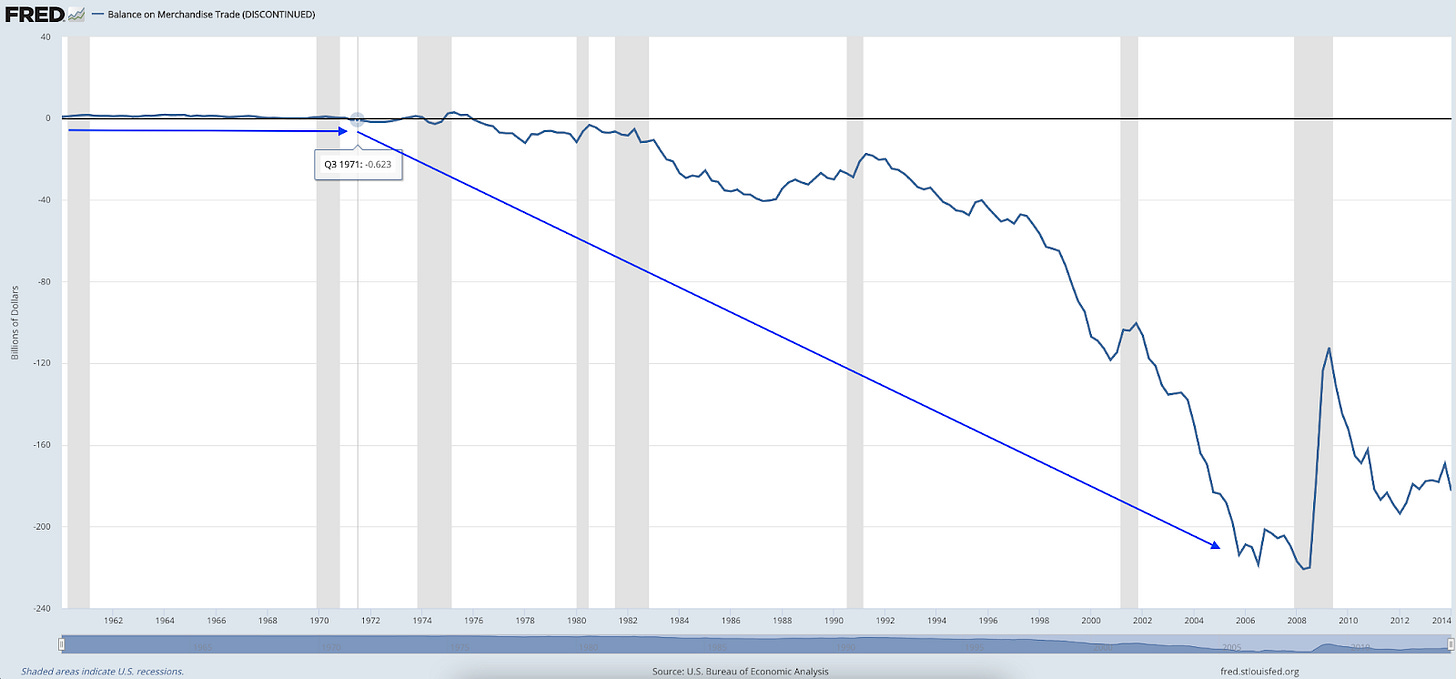

The merchandise trade balance value in America rapidly deteriorated since 1971:

The median sale price of an American home has rapidly increased since 1971:

When the US Dollar is no longer backed by gold or other physical stores of value, significant fiscal deficits and government spending led to skyrocketing federal debt levels after 1971:

Optimism for Bitcoin

Individual and institutional investors are increasingly exploring Bitcoin and other crypto assets as a fundamentally uncorrelated asset in a portfolio with positive, asymmetric, upside potential.

Idea → Investment → Implementation:

Over the past decade, Bitcoin went from an idea to an investment. In the next decade, Bitcoin may advance further from an investment to implementation across several countries as a valid alternative currency. This idea is not completely fictional, as seen by the fact that El Salvador recently announced its intention to adopt Bitcoin as legal tender by September 2021.

Why now?

Part of Bitcoin’s price surge in 2020 can be attributed to increasing anxiety over the trillions in dollars in both fiscal deficits and money supply increases by central banks worldwide in an effort to financially combat the devastating economic impacts from the coronavirus crisis.

While many of the early fiscal and monetary stimuluses were necessary to help America, the ongoing and continuous money printing is worrisome for many people. Printing money does not automatically create wealth and does create monetary debasement. Wealth is created via ownership in assets and via productive economic activities.

Once thought of as a nascent and speculative asset, Bitcoin is moving along adoption and trending towards an eventual mainstream financial asset. Notable macro investors and market technicians, such as Stanley Druckenmiller and Paul Tudor Jones, have publicly announced portfolio allocations to bitcoin. Quantitative trading firms like Jump Trading and DRW are increasingly becoming very involved in the cryptocurrency space. Fidelity launched a Bitcoin Fund, and TD Ameritrade launched the ability to trade futures on Bitcoin contracts. In addition, the rise of tradeable fund products (such as the GBTC fund), the rise of brokerage, custody, and trading services for cryptocurrencies (such as Coinbase), and the increased involvement from companies (ex. Square, PayPal, Robinhood, MicroStrategy) allow family offices, retail investors, and companies to participate in the Bitcoin ecosystem.

Additionally, you can find Drawing Capital’s previous thoughts about Bitcoin, blockchain technology, and the crypto economy at these 2 links:

Drawing Capital’s previous webinar about Bitcoin and blockchain technology: https://ibkrwebinars.com/webinars/bitcoin-and-blockchain-technology/

Drawing Capital’s previous newsletter about Bitcoin:

Concluding Thoughts

Inflation and monetary debasement erode the purchasing power of money over time. Historically, common stores of value for depreciating currencies include stocks, real estate, gold, and Bitcoin.

Inflation impacts all people, although the magnitude of the impact varies based on socioeconomic factors.

Bitcoin and other decentralized protocols give more voice to the end user via a direct distributed system. Currently and due to a centralized (not decentralized) governance framework, the ordinary American has little voice in the composition of both monetary and fiscal policy.

In order to earn positive inflation-adjusted returns, the nominal returns on an investment must exceed the inflation rate. Interestingly, the majority of global government debt and the investment grade corporate bond index are both yielding interest rates below the consumer price inflation rate, suggesting negative inflation-adjusted yields.

While the supply of Bitcoin is known, the global money supply of US Dollars and other major currencies remains unknown and rapidly rising over the past 2 years.

References:

Economic Policy Institute: The Productivity Pay Gap. Updated May 2021. https://www.epi.org/productivity-pay-gap/. Accessed 18 Aug. 2021.

Public Economics and Inequality: Uncovering our Social Nature. Professor Emmanuel Saez. Updated January 2021. https://eml.berkeley.edu/~saez/saez-AEAlecture-slides.pdf. Accessed 18 Aug. 2021.

Federal Reserve Economic Database (FRED), Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/. Accessed 18 Aug. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.