Introduction

In this week’s newsletter, Drawing Capital explores the development of electronic trading, payment for order flow, securities lending, the implications of the rise in retail trading, and more.

We conclude that while commission-free stock trading may have the appearance of being “free to trade” for retail investors, the reality is that several brokerage firms continue to monetize trading activity via commissions on options trading, securities lending programs, payment for order flow, and other methods.

In addition, while stock trading at several brokerage firms is commission-free, customary transaction costs, such as illiquidity in specific securities and the size of bid-ask spreads of securities, contribute to an investor’s total transaction costs when buying or selling stocks.

Historical Context

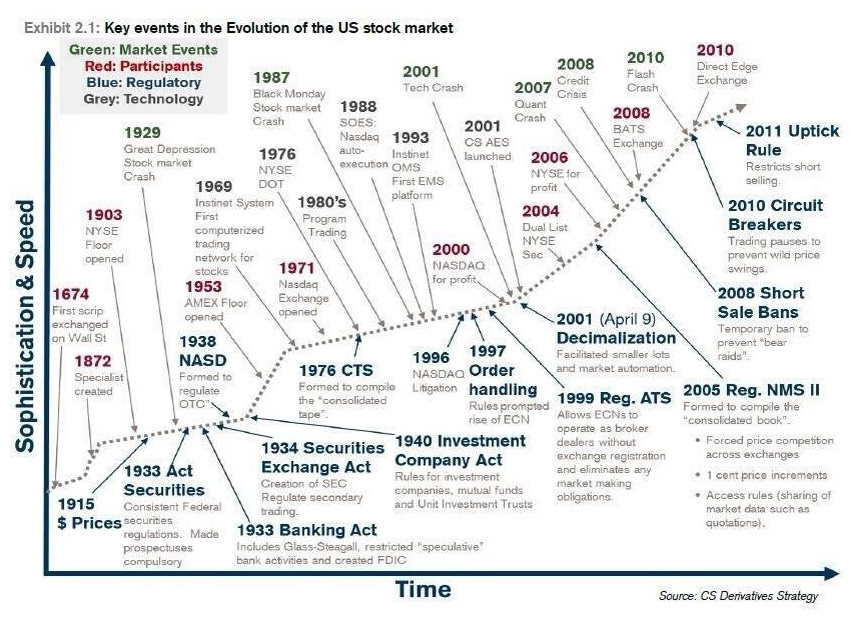

The following chart from Credit Suisse highlights several of the key developments in US equity market trading from 1903 to 2011.

Sample Diagram of How a Trade Order Gets Routed for Execution

The following diagram demonstrates the flow from a client-directed order through a brokerage firm in order to execute a stock trade. Once the brokerage firm receives a trade order from a client, the brokerage firm has a variety of choices that it can use to actually execute a stock trade.

Rise of Retail Investing

A podcast from Goldman Sachs on February 4, 2021 described the rise of retail investing and implications for equity markets. Here are the following summary highlights from the podcast:

Approximately 24 billion shares were traded across US exchanges on January 27, 2021, which surpassed the previous record that was set in October 2008.

Retail households own about 35% of the US equity market.

The dollar value of retail trades is up about 85% over the past year.

Retail trading volume accounts for about 20% of market trading in US equities on an average day, which is higher than the 10% number from a year ago.

Retail ownership in ETFs and index funds is growing steadily, particularly through buy-and-hold activity with a diversified investment framework.

Many large online brokerages experienced a tripling in the number of daily active trades (DARTs) since 2019, which is mainly driven by a small portion of the total customer base at large online brokerage firms.

4 reasons for the recent increase in retail investing:

Work-from-home trend allows more people more time to watch financial markets.

Ongoing market volatility attracts more people to watch financial markets.

Zero-commission stock trading, option trading, and fractional share trading with user-friendly mobile apps reduce cost hurdles and enable more investors to invest across a variety of dollar amounts.

Notable stock performance from high-flying companies, like Tesla, whose returns exceeded 700% for 2020, attracts interest in opportunities. These excess returns enticed investors to try and capture advantageous upside volatility.

The rise in trading activity is not exclusive to retail investors. Both retail and institutional trading activity has been steadily increasing over the past year.

In aggregate, retail investors generally buy stocks when 2 conditions are both present:

Stock market attracts positive retail attention

When retail investors have money to invest

Retail trade orders are routed to market makers, which do 1 or 2 things with the trade order:

1. Execute the order through internationalization by matching up a buyer and seller of shares

2. Route the order to an exchange or alternative trading venue to execute the trade

Potential future market implications in US equity markets from the short squeezes in January 2021:

The “short squeeze” events in GameStop, AMC, and other stocks in January 2021 suggest that more retail investors are increasingly causing short squeezes and gamma squeezes, which can create significant stock price changes.

In response to short squeezes in specific stocks, many hedge funds will need to evolve their risk models and trading practices when short-selling individual securities.

Stock Trade Order Execution Quality

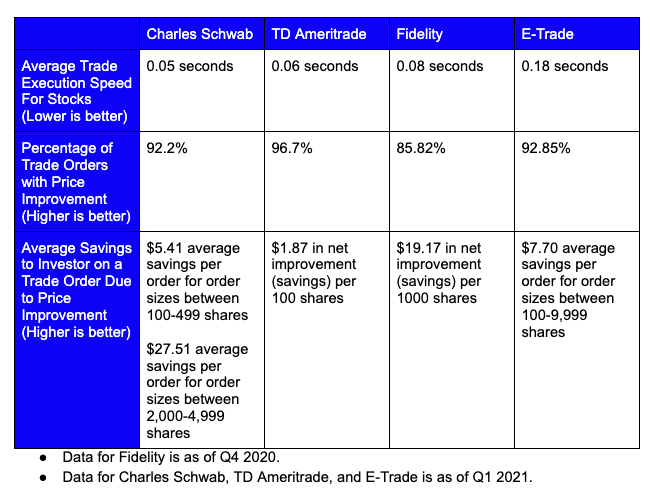

3 key insights from the above chart:

With electronic trading and algorithmic market making, the average trade execution speed for stock trades is measured in milliseconds.

These 4 firms provide price improvement on the overwhelming majority of trade orders and pass on savings from price improvements to customers.

Investors should evaluate both the trading cost and trade execution quality. Making a trade-off of poor trade execution quality to save a few commission dollars per trade is irrational when trading in large quantities. In an ideal scenario for investors, commissions are low (or zero) and trade execution quality is excellent. For example, firms such as Interactive Brokers score favorably on quality of trade execution for customers and implementation of API-based and algorithmic trading strategies.

Payment for Order Flow

Payment for order flow is the practice of market makers paying for access to order flow in order to execute stock trades, particularly for retail clients. Even though several brokerage firms with online trading platforms, such as Charles Schwab, E-Trade, and Robinhood, do not currently charge stock trading commissions, these brokerage firms can still monetize a client’s trade order via payment for order flow from a market maker or other trading venue.

Popular venues for executing US stock trades for these 3 mentioned brokerage firms include Citadel Securities, Two Sigma Securities, Virtu Americas, G1 Execution Services, UBS Securities, Citigroup, Jane Street Capital, Wolverine Securities, CBOE EDGX Exchange, and NASDAQ Execution Services, and others. Additional details about payment for order flow can be found on a retail brokerage firm’s Quarterly 606 Trade Order Routing Report.

There are 3 reasons why market makers exist:

Improve the efficiency and price discovery process of capital markets

Provide improved trade execution quality and save money on exchange fees versus trading on stock exchanges

Provide a source of liquidity to retail and institutional investors to transact in investments, and highly liquid markets provide greater confidence to companies seeking a public listing or additional sources of funding.

In Q1 & Q2 2020, payment for order flow was more lucrative for options trading than equity trading. The data is from CNBC, Piper Sandler, and various SEC filings.

From this above chart of these brokerage firms, TD Ameritrade earned the most amount of revenue from the practice of “payment for order flow” in 2020.

From this above chart of market makers, Citadel Securities paid the greatest amount to gain access to trade order flow in 2020.

Securities Lending Revenue

Another method for a brokerage firm in generating revenue from a client’s existing investments is a practice called securities lending, whereby securities (such as shares or bonds) are lent out to short sellers and earn interest.

Based on the chart above from IHS Markit, global securities lending revenue totaled $9.3 billion in 2020.

Conclusion

We conclude that while commission-free stock trading may have the appearance of being “free to trade” for retail investors, the reality is that several brokerage firms continue to monetize retail trading activity through various methods.

Nonetheless, there are a number of key benefits for consumers of commission-free trading, including:

While well-designed mobile trading apps may amplify the negative effects of the “gamification of trading”, well-designed mobile trading apps are better user experiences for investors compared to poorly-designed legacy apps.

With commission-free stock trading, it is possible to build a diversified portfolio in a cost-efficient manner.

A reduction in the friction to trade and a democratization of access to stock trading is beneficial to retail investors and promotes financial inclusion.

Promoting access to financial markets by reducing barriers to entry for retail investing empowers more Americans to seek financial wellness and build wealth through the benefits of investing and compounded returns over time.

References:

"The Evolution of the US Stock Market - All Star Charts - Credit Suisse Derivatives Strategy." 10 Jun. 2014, https://allstarcharts.com/evolution-us-stock-market/. Accessed 10 May. 2021.

"ATS Transparency Data Quarterly Statistics | FINRA.org." https://www.finra.org/filing-reporting/otc-transparency/ats-quarterly-statistics. Accessed 10 May. 2021.

"Trade execution quality | Charles Schwab." https://www.schwab.com/execution-quality. Accessed 10 May. 2021.

"Market Order Execution | TD Ameritrade." https://www.tdameritrade.com/tools-and-platforms/order-execution.page. Accessed 10 May. 2021.

"Commitment to Execution Quality - Trading with Fidelity." https://www.fidelity.com/trading/execution-quality/overview. Accessed 10 May. 2021.

"Learn about Execution Quality | E*TRADE - ETRADE Footer." https://us.etrade.com/trade/execution-quality. Accessed 10 May. 2021.

"How Robinhood makes money on customer trades despite making it ...." 13 Aug. 2020, https://www.cnbc.com/2020/08/13/how-robinhood-makes-money-on-customer-trades-despite-making-it-free.html. Accessed 10 May. 2021.

"Wall Street firms paid almost $3bn last year for ... - Financial Times." 5 Feb. 2021, https://www.ft.com/content/6651f34a-0d8d-4d68-bdf9-23b355f8c9db. Accessed 10 May. 2021.

"Securities Finance 2020 Snapshot | IHS Markit." 31 Dec. 2020, https://ihsmarkit.com/research-analysis/securities-finance-2020-snaphsot.html. Accessed 5 Feb. 2021.

"Special Episode: The Rise of Retail Investing and Its ... - YouTube." 4 Feb. 2021,

. Accessed 10 May. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.