Introduction to Global Supply Chains

This week, we are discussing the chaos in freight shipping that is causing massive slowdowns in overseas shipping times across the world. Freight ports in China and the USA are clogging up, making it difficult for ships to enter, unload, reload, and exit. The increased demand (or really the outlay of backed-up demand due to the pandemic) is now overloading the supply of available cargo ships.

Almost all customers of a business also have their own customers. And, all the downstream customers’ aggregate demand sums up to huge demand for upstream businesses. This increased demand across the board has resulted in increased prices for a range of products including cars, steel, food, clothing, accessories, and more. Higher prices unfortunately hurt smaller businesses because it enables large corporations who have pricing and purchasing power to be prioritized due to larger and more lucrative orders.

Here’s a basic example of a steel supply chain with a cycle. It is clear that a steel supplier will need to supply enough material for all downstream customers even if they don’t directly work with truck drivers and car buyers. It is also clear that there are cycles in supply chains, such as how steel is needed to build trucks which are needed to transport steel. The problem this causes for supply chains when there’s a slowdown is that it magnifies the impact over time. When the steel supply is uncertain, then the auto industry becomes uncertain about when their truck buyers will get cars. This can additionally cause uncertainty and delays in shipping steel to the auto industry, which further reduces the production speed of trucks.

The Bullwhip Effect

The situation described above is colloquially known as the Bullwhip Effect, because the series of increasing delays compounds to form a bullwhip pattern as seen above. When customers increase orders quickly, then retailers over-order from manufacturers who over-order from suppliers. Demand and supply are in dissonance as supply inherently lags demand and businesses try to predict demand to maximize profits. Now that you understand how delays in one part of a supply chain can exacerbate delays downstream, let’s look closer at the freight industry.

Freight Supply Chains

Almost all transportation of goods begins with a shipping container, the standardized method of shipping large quantities of goods across the world. There are over 16 types of containers, a few of which are described below.

Dry Storage Container - Standard container; Comes in 20ft and 40ft lengths.

Insulated Container - Great for produce, pharmaceuticals, chemicals, electronics, leather, etc

Tank Container (also called ISO) - For shipping liquids, fuels, gases, and powders

Car Container - Fits 2-4 cars depending on size.

Special Purpose Container - For special cargo including military, confidential, or top-secret items

According to Bloomberg, 226 million container boxes are shipped every year via freight ships, and about 1300 are lost at sea annually. Here’s a map of global ports from 2011 sized by cargo volume with their trade routes in blue.

It’s clear from this map that China holds the largest influence over the container shipping industry. In fact, the top 10 busiest ports in the world as of 2021 are as follows.

Shanghai Port, China

Singapore Port

Shenzhen Port, China

Ningbo Port, China

Port of Busan, South Korea

Port of Hong Kong, China

Port of Guangzhou, China

Port of Qingdao, China

Port of Dubai

Port of Tianjin, China

Chinese ports have the largest volume, followed by ports in South Korea, Singapore, and Dubai. Although Rotterdam, Netherlands is the biggest port outside of East Asia, it is not as busy relatively.

Each type of container has a specific weight and volume limit, which incentivizes buyers to maximize container utility by rearranging combinations of products between containers to maximize weight and volume. For example, you want to put high-density (small+heavy) items in a small container while putting low-density products in larger containers.

Once containers are packed, they sit in a container port waiting to be picked up by freight or truck. Currently and as a result of the pandemic, when ships arrive at port, the crew must be tested at each port. If even a single crew member tests positive for Covid-19 or other contagious diseases, the terminal is closed, thus blocking further freights. China requires ships to quarantine for 14-28 days if coming from India (due to high covid cases) or if the crew changed in the last 48 days. This is the price of safety for the global supply chain.

To give you an idea of which companies are impacted by this traffic, here are the world’s largest shipping companies ranked by Twenty-foot Equivalent Unit (TEU), also known as a 20-foot general-purpose container:

P. Moller–Maersk – 4.1m TEU

Mediterranean Shipping Company – 3.8m TEU

COSCO Shipping Lines – 3.1m TEU

CMA CGM Group – 2.7m TEU

Hapag-Lloyd – 1.7m TEU

Ocean Network Express – 1.5m TEU

Impact on Freight Logistics

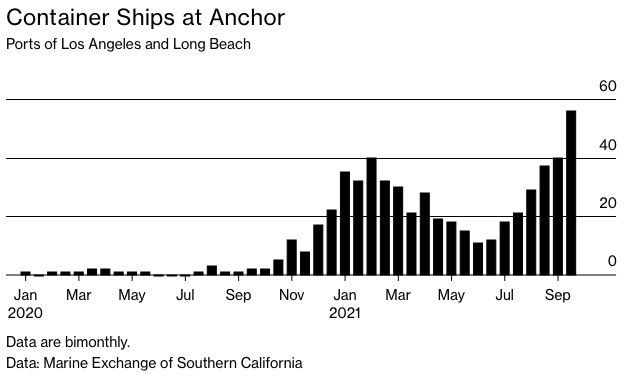

This chart below shows how the Port of Los Angeles has seen drastic rises in anchored ships waiting their turn to transport containers. From just 3-5 ships anchored at any given time in mid-2020, we now see close to 60 in September 2021. What’s worse is that as more ships anchor, the slower the traffic moves, meaning that more and more ships will continue to anchor just like how a traffic jam gets increasingly slower with each additional car.

The reason for this traffic build up can be explained by 5 reasons.

Inefficient response to trends and emerging technology

“Force majeure” occurrences like the COVID-19 pandemic

Poor planning and forecasting

Changes in regulations or policy

Changes in transport costs

The result of such slowdowns means there’s a very large backorder of demand for a constrained supply of containers and ships, which causes shipping costs to rise by up to 400% since 2020. Drewry’s Composite World Container Index shows the average shipping cost of a 40ft container. From 2019 to 2021, prices rose from under $2,000 to above $10,000.

The chart below shows the price of some of the more popular freight routes over time, changing up to 7% in just one week.

If you’re curious about following more shipping prices, take a look at the following indices.

WCI.SHALAX – Shanghai to Los Angeles

WCI.SHANYC – Shanghai to New York

WCI. RTMNYC – Rotterdam to New York

WCI.NYCRTM – New York to Rotterdam

WCI.SHARTM – Shanghai to Rotterdam

WCI.SHAGOA – Shanghai to Genoa

WCI.GLOBCOMP – Global composite of all trade lanes

Sample Companies

ZIM Integrated Shipping Services Ltd ($ZIM) - publicly held Israeli international cargo shipping company, and one of the top 20 global carriers.

A.P. Møller – Mærsk A/S ($AMKBY) - a Danish integrated shipping company, active in ocean and inland freight transportation and associated services, such as supply chain management and port operation.

Costamare ($CMRE) - a Greek and Marshall Islands corporation and one of the world's leading owners and providers of containerships for charter.

Matson ($MATX) - an American transportation services company founded in 1882. Matson, Inc.'s subsidiary Matson Navigation Company provides ocean shipping services across the Pacific to Hawaii, Alaska, Guam, Micronesia, the South Pacific, China, and Japan.

Data from YCharts and Investopedia displays that some shipping companies are seeing more than 200% revenue growth in 2021.

Maersk is on a path towards more than doubling its EBITDA in 2021.

Hapag-Lloyd seeing over a 300% growth in EBITDA.

Conclusion

Opinions on whether these shipping costs are permanent or temporary vary greatly. We believe that costs may not stabilize until 2023 when more container supply is put into effect. Additionally, there is little incentive for freight companies to drop prices to pre-coronavirus levels since they are now seeing revenue growth over 200%. Shipping costs are input costs, and when shipping costs and time delays increase, then total production costs for companies increase, at which point, a company can either decide to accept lower profit margins or pass on the higher input production costs in the form of higher prices to consumers and customers. As a result, the real impact of this shock may simply be higher inflationary effects as prices of goods ranging from semiconductors, to cars, to homes all rise.

References:

“16 Types of Container Units and Designs for Shipping Cargo.” Marine Insight, 24 Aug. 2019, www.marineinsight.com/know-more/16-types-of-container-units-and-designs-for-shipping-cargo/. Accessed 17 Oct. 2021.

“What’s the Deal with Freight Shipping Delays? | USA Truckload Shipping.” Truckload Shipping, Global Logistics, 30 June 2021, usatruckloadshipping.com/whats-the-deal-with-freight-shipping-delays/#Is_COVID-19_Causing_Shipping_Delays. Accessed 18 Oct. 2021.

Chambers, Sam. “Ships Divert from Ningbo with No Timeframe given for Terminal to Reopen.” Splash247, Splash, 12 Aug. 2021, splash247.com/ships-divert-from-ningbo-with-no-timeframe-given-for-terminal-to-reopen/. Accessed 18 Oct. 2021.

Mathew, Bency. “International-Ports: COVID-19 Quarantine for Chinese Ships Vexes Indian Port Flow.” Journal of Commerce, Journal of Commerce Online, 2 Oct. 2020, www.joc.com/port-news/international-ports/covid-19-quarantine-chinese-ships-vexes-indian-port-flow_20201002.html. Accessed 18 Oct. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.