Overview

One of the prevailing topics of interest in headline news and social circles is inflation, with the core Consumer Price Index (CPI) reaching levels not seen in 40 years. In today’s newsletter, we’ll review the key impacts of inflation and its distant cousin, interest rates, on equity markets.

Specifically, we seek to answer the following questions:

Historically, how have these different factors impacted equity prices?

Which asset classes performed the worst/ best during these time periods?

How should investors think about tactically adjusting their portfolios in light of the data we have available today?

Here, we can observe the rate of inflation dating back to January 1960. Again, noting that the last time we saw inflation of 7.5% while the figure was also rising was the summer of 1978.

Inflation and Stock Market Indices

Over these periods of high and rising inflation, how have equity markets performed? To answer this question, we have illustrated the periods of time when inflation was both high and rising.

In order to properly provide context for this data, we must note that two recessions occurred from November 1973 to March 1975 and January 1980 to July 1980. So, when reviewing this data, it is important to note that recessions occurred over both time intervals, with varying duration and magnitude. Important takeaways can be summarized as follows:

During periods when inflation was initially lower and rose more rapidly, coupled with contracting GDP, the Nasdaq index suffered the worst losses while the Dow Jones was the most resilient.

During periods when inflation was rising but already high, the inverse outcome took place, whereby the Nasdaq handily outperformed the Dow Jones.

Given that the year-over-year percentage change in inflation was measured at a rate of 0.24% in May of 2020, and is currently above 7.5%, we believe that our current inflationary backdrop shares more similarities with the environment of 1972-1974 as opposed to 1978-1980.

In periods of sharply rising inflation, monetary policy decision-makers tend to favor raising interest rates and combatting inflation through a series of policy decisions. As a result, rising interest rates favor companies that generate positive cash flows today and in the near future.

Inflation Impact on Broad Asset Classes

As investors review their asset allocation holistically, it is important to both consider what historical norms have been, and how those have changed over time with a shifting market structure. Below is a chart from the American Institute of Economic Research that highlights the real (inflation-adjusted) total returns on U.S. asset classes under low, moderate, and high inflation conditions from November 1971 to November 2021. (5)

While commodities have displayed strong resiliency, historically, in high inflation environments, and bonds and equities have appeared to be more favorable in low-inflation environments, we always want to consider second-order effects.

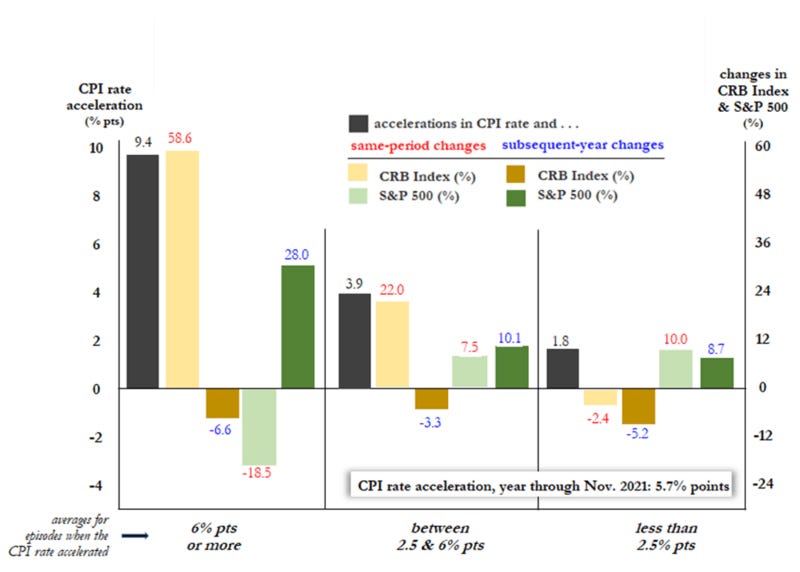

Below we can observe the acceleration in CPI in addition to the subsequent year changes that have occurred in both commodities and equity prices from 1958 to 2021. (5)

While commodity prices have been advantageous in years that CPI is surging, the subsequent year has nearly always provided mediocre results when compared to equity prices. As a result, a dynamic investor has historically benefited from being overweight equities and underweight commodities after a surge in CPI has taken place and when CPI is anticipated to either slow down or contract.

Interest Rates as an Economic Indicator

Interest rates, and specifically, the yields of US Treasury bonds, can provide strong insights as a market-implied indicator. There are many different variations of interest rate spreads that can be used for different purposes. However, today, we want to highlight the ratio of the 2-year US Treasury yield to the 10-year US Treasury yield.

Below we can see the visualization of a “yield curve inversion” whereby the yield of a 2-year UST exceeds the yield of the 10-year UST. In every case in modern history, this has subsequently pre-dated a recession in the United States, as indicated by the red boxes in the chart.

Of course, during recessionary periods, there is a flight of capital from risk-based assets (such as stocks) to protective assets (such as high-quality bonds and savings accounts). As such, we can use indicators like the 2Y/10Y UST spread as a barometer for measuring and assessing macroeconomic risks and business cycles.

In the following table, we can observe the corresponding returns of major US stock indices throughout these recessionary periods (note: the time frames measured below map directly to the shaded boxes above and not the peak-to-trough performance of market indices).

Summary

In summary, we’d like to wrap up this overview of inflation, interest rates, and their impact on equity markets with the key takeaways:

Historically, the impact of inflation on equity market prices has been most detrimental when there is a rapid spike, as inflation in the cost of goods sold without pricing power negatively impacts corporate earnings and consumer spending, among other factors.

Commodities have provided better inflation protection on initial onset when compared to equity markets, though equities are more favorable as inflation slows and subsequently declines.

Interest rates, and more specifically, interest rate spreads based on US Treasuries can provide helpful market-implied indicators when assessing portfolio risk. Surges in the 2-year UST yield relative to the 10-year UST yield can imply more defensive posturing, as a 2Y/10Y UST ratio of >1.0 predates economic recessions.

As the Federal Reserve’s Federal Open Market Committee (FOMC) discusses future interest rate increases, investors should consider the fine balance of monetary policy and market-related risks, as increases in short-term rates can cause yield curve inversion, as discussed in point #3 above.

References:

U.S. Bureau of Labor Statistics, https://fred.stlouisfed.org/graph/?g=rocU.

Dow Jones 100 Year Historical Chart by Macrotrends, https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart.

S&P 500 Historical Chart Data by Macrotrends, https://www.macrotrends.net/2324/sp-500-historical-chart-data.

Nasdaq Composite - 45 Year Historical Chart by Macrotrends, https://www.macrotrends.net/1320/nasdaq-historical-chart.

The Impact of Higher Inflation on US Asset Classes by Richard Salsman, American Institute of Economic Research, https://seekingalpha.com/article/4477999-the-impact-of-higher-inflation-on-us-asset-class-returns.

NBER based Recession Indicators for the United States by St. Louis Federal Reserve, https://fred.stlouisfed.org/series/USREC.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.