Drawing Capital Newsletter

September 10, 2020

For a bonus edition, this week will feature two newsletters from Drawing Capital. Today’s topic will focus on understanding Tesla’s key trends and business model. Tomorrow’s topic will feature the applications of artificial intelligence in medical imaging and radiology.

This newsletter should not be taken as advice, nor is it a recommendation to buy or sell Tesla stock.

Introduction

Mission Statement: Tesla’s mission is to accelerate the world’s transition to sustainable energy and transport.

Company Description: Tesla seeks to execute on its mission statement through three main verticals: electric vehicles, renewable energy generation, and managing energy storage and consumption. Tesla maintains factories in Fremont (in California), Sparks (in Nevada), Buffalo (in New York), Tilburg (in the Netherlands), and Shanghai (in China). Future factories are currently in development in Grunheide (in Germany) and Austin (in Texas).

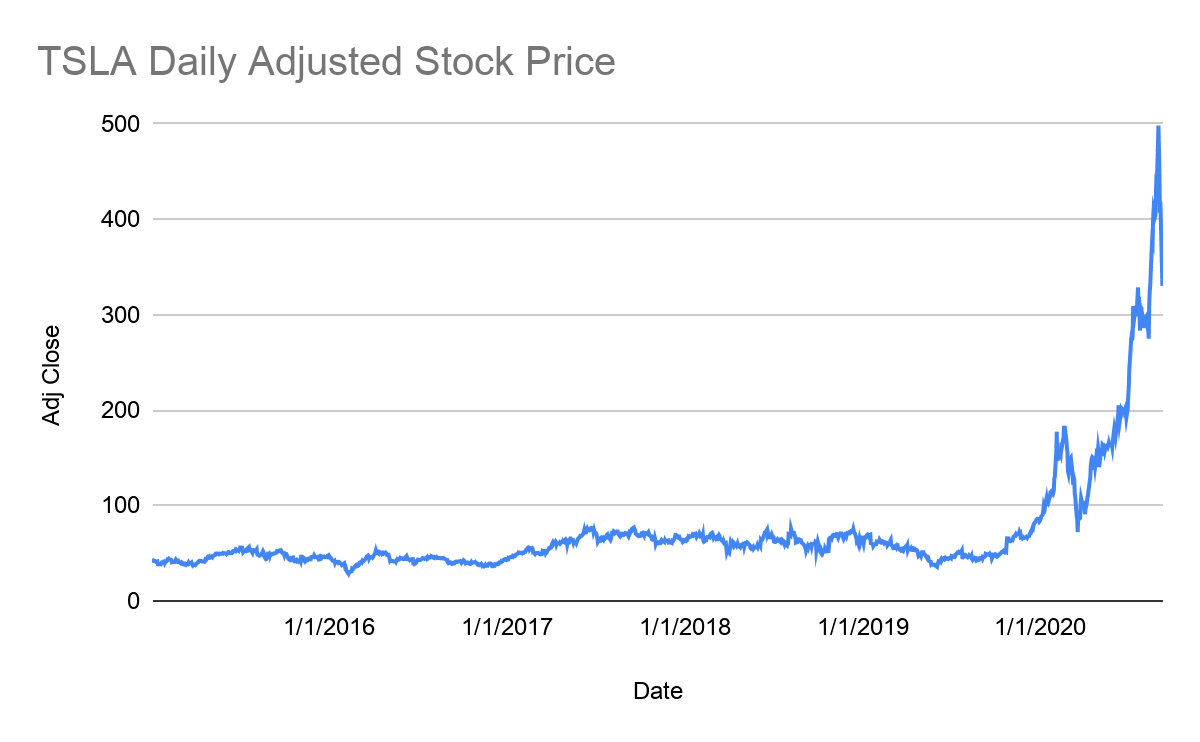

Chart showing Tesla’s parabolic price over 5 years.

Engagement

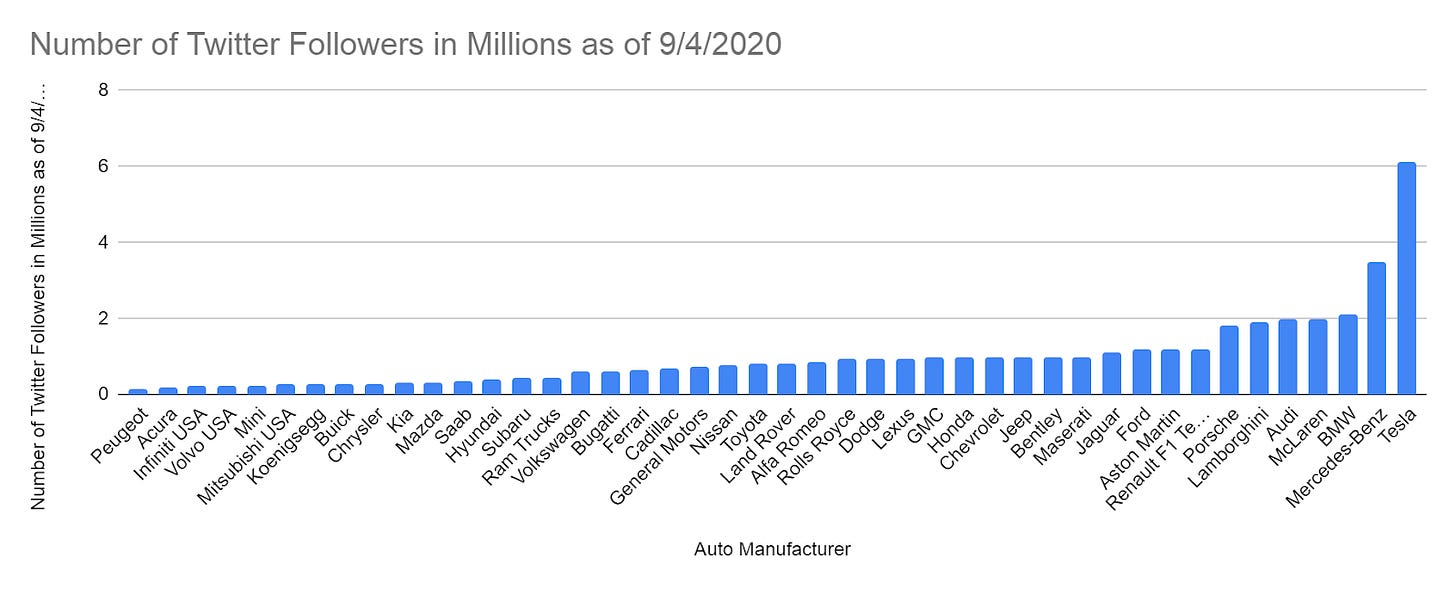

Out of all auto manufacturers, Tesla has the highest consumer engagement on Twitter with ~6 million followers (in addition to Elon Musk’s 38.6 million). Google Trends suggests this user engagement continues to rise with the popularity of various Tesla search queries growing.

The line chart above highlights the speculative nature forming in Tesla's stock in terms of consumer engagement. There has been a much bigger percentage increase in searches for "Tesla stock" versus "Tesla cars" over the past year. This is worrying for a few reasons:

Retail sentiment and forum traffic has a significant impact on Tesla's daily price movements.

When more people are interested in a company's stock price compared to the company's actual product lineup, this is speculative behavior in financial markets.

Growth

Tesla's vehicle production and variety of product offerings are increasing over time.

Battery range is increasing over time for Tesla vehicles.

Tesla vehicle sales are selling quicker and at a faster growth rate than competitor electric vehicles.

Consumer adoption of Powerwall and Powerpack is increasing over time.

Growing interest in solar panels and micro-utilities.

People, Management Team, Leadership, Strategy, and Competitive Advantage

Elon Musk is one of the most visionary and hardworking business executives and engineers in the past 50 years. He owns about 20% of Tesla’s common stock.

Ongoing management turnover remains an issue at Tesla.

The use of the Tesla guide-store model provides a better consumer experience and is far more capital efficient for the company compared to the traditional auto industry’s dealership model.

Aggressive deadlines may frustrate employees and investors.

Tesla is fundamentally an energy company, not just a car company. Tesla’s cars (Model S, Model 3, Model X, Model Y, Semi, Roadster, Cybertruck) provide electric transportation. Tesla’s energy solutions include Powerwall, Powerpack, and Solar Roof.

Issuance of substantial stock-based compensation to employees is a source of capital financing for Tesla and incentivizes employee productivity.

Tesla is the clear leader in both the electrification of transportation and in-vehicle crash test safety ratings.

Expansion of enabling consumers and businesses to operate their own micro-utilities may disrupt the utility industry.

Superchargers exhibit positive network effects, meaning that an increase in Tesla owners and users of the Supercharger network increases the overall value of the Supercharger network (as shown by Metcalfe's Law).

Tesla’s used cars have lower price depreciation over time compared to peer luxury auto manufacturers in similar price ranges e.g. BMW, Audi, and Mercedes-Benz. This implies that American consumers value used-Teslas over used-German cars.

Tesla vehicles have a significantly greater driver range compared to most competitor electric vehicles.

Autonomous driving continues to improve. Tesla has a clear competitive advantage in adoption compared to Waymo, Rivian, etc. Tesla has millions of miles in driving data, driver behavior, and crash diagnostics.

Partnerships and M&A Framework

Partnership with Panasonic for battery production in Gigafactories.

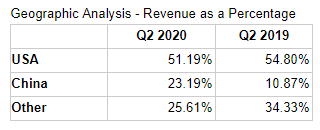

Partnership with the Chinese government regarding approval for constructing the Shanghai factory.

Previous partnership and loan from the US government.

Tesla’s SolarCity acquisition caused anxiety and skepticism for many investors.

Tesla’s “bolt-on” acquisitions have a tendency to focus on very specific technologies. Examples: Hibar Systems, DeepScale, Maxwell Technologies, Riviera Tool LLC.

Review of Porter’s 5 Forces

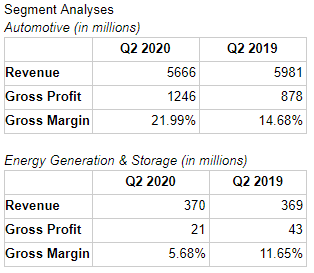

Financials

What Can Go Wrong?

Tesla operates in capital intensive business segments that require high fixed costs. A potential inability to finance these high fixed costs could create the need for extra financing from equity and debt markets, or worse, lead to financial turmoil. Equity financing is expensive and dilutive to existing common shareholders. Debt financing increases a company’s debt and can increase financial leverage.

In its corporate history, Tesla has faced the possibility of bankruptcy on several occasions.

Price multiples represent investor sentiment and the degree of confidence or uncertainty for a company’s stock price and future business prospects. High valuation multiples indicate a high degree of confidence by the investment community in the future growth of a company. Conversely, low valuation multiples reflect added investor uncertainty about the durability of future cash flows for a company. Even if the company continues with its existing business operations, a significant decrease in acceptable price multiples from the investment community would put downward pressure on Tesla’s stock price in a meaningful way.

The car industry is historically very competitive and subject to external economic pressures.

Convertible debt owners may transition to equity ownership in Tesla, which would dilute existing common shareholders and may place temporary downward pressure on Tesla’s stock price.

It is critical for Tesla’s core businesses to deliver operating cash flows that can be reinvested back into new and existing business segments in order to establish a strong and enduring business model.

Positive Catalysts and Cautionary Headwinds

Positive Catalysts

Launch of new products, such as the Tesla Semi, Tesla Cybertruck, and the new Tesla Roadster

The successful launch of production factories in Germany and Texas is important for 3 key reasons:

Increasing production can satisfy the high demand for Tesla vehicles, which increases Tesla’s revenue with increased production

Having global manufacturing facilities and distribution centers provides Tesla with the ability to reach and deliver more Tesla vehicles to customers at a faster and more cost-efficient manner

It provides some degree of flexibility to Tesla to navigate geopolitical constraints

High demand and enthusiasm for investors seeking high growth potential in their investments.

The recent meteoric rise in Tesla’s stock price in the first 8 months of 2020 allows the company to issue equity financing in a cheaper manner. Lower cost of equity reduces the company’s weighted average cost of capital, which thereby increases the company’s intrinsic value.

Battery Day on September 22, 2020, will provide an update to battery technology and Tesla vehicle range.

Positive surprise announcements and product offerings can create additional excitement and earnings power, such as ride-sharing partnerships, delivery, micro-utility features, extended battery ranges on Tesla vehicles, enhanced car manufacturing efficiencies.

Positive contribution margin and operating leverage allow Tesla to financially generate a greater percentage profit increase as revenue increases over time.

A Tesla vehicle’s true total cost of ownership has been modeled to be on parity or even cheaper than traditional gas combustion cars.

Corporate and Industry Headwinds

If Tesla products become inelastic goods, then continued price decreases for its vehicles may not stimulate substantial consumer demand.

Continued reliance on additional equity issuance and convertible debt securities dilutes existing common shareholders.

Tesla stock activity demonstrates somewhat speculative behavior, particularly in the retail investment community. If such sentiment changes, Tesla’s stock may face significant contraction in its price multiples, which would place significant pressure on its stock price.

Tesla was not included during the S&P 500 Index’s recent index rebalancing announcement.

If global economic recovery after the COVID-19 crisis takes significantly longer than anticipated, fewer consumers will have the affordability to purchase new Tesla cars.

A failure to expand the Tesla brand worldwide would curtail its global expansion plans.

In certain geographies, such as affluent Bay Area communities, there already exists significant market penetration for Tesla vehicles. In order to justify this current extraordinary price multiples and market-implied valuation, Tesla will need to both expand its market penetration in well-served communities and expand its market share across America. An expansion failure would be detrimental to its stock price.

Legacy incumbent auto manufacturers may utilize their large balance sheets to promote a major initiative towards electrification R&D and manufacturing electric vehicles. While more competitor electric vehicles exist, many legacy incumbent auto manufacturers are very reliant on sales revenue and servicing revenue from gas/combustion-engine-powered cars.

Options and Volatility

Google Search interest in “options trading” over the last 5 years.

Chart showing volatility increases over time.

Increased retail options activity is believed to have caused increased volatility in stocks such as Tesla with large herd-like followings on Twitter and Reddit. Market Makers hedge short option positions by purchasing more equity as OTM options become more ITM. Note: OTM = “out of the money”, and ITM = “in the money”

Per a recent discovery, Softbank seems to be a culprit behind the recent large NASDAQ rally. Softbank purchased billions in OTM options which forced Market Makers to hedge their positions with equity. Typically one Market Maker acts as a counterparty in such a scenario which allows the MM to control the playing field. However, with Softbank’s position size, multiple MMs were involved which caused a prisoner’s dilemma situation to ensue. As a result, MMs cover their own risks by purchasing massive amounts of equity.

Funds running a short gamma strategy are short volatility. They sold naked options at deep out-the-money strikes (high above the current spot price). However, these positions have virtually 0 delta so there is no hedging needed usually. Tesla stock rose so fast, though, that Market Makers were caught unhedged when their deep OTM options gained delta surprisingly quickly. This forced MM’s to purchase large amounts of equity to hedge their short OTM call (short gamma) positions.

Conclusion

While our analysis suggests that we are incredibly optimistic about the future of Tesla, the recent rapid increase in Tesla’s stock price over the past six months appears to be speculative in nature.

Tesla is a mission-driven company on a path towards enhancing the sustainability of energy and transport. Tesla’s products are incredible, the CEO is a visionary leader, Tesla’s balance sheet and revenue are rapidly growing with no signs of material slowdowns, and the addressable markets are measured in the trillions in both automotive manufacturing and energy & utilities.

References:

Financial data is from Tesla financial statements, Tesla investor relations webpage, Yahoo Finance, and CFRA Equity Research

Trending search query data is from Google Trends

Twitter follower chart data is from Twitter

Softbank call option investment data is from a CNBC article (hyperlink)

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (the “Drawing Capital”).

This letter is for informational and educational purposes. This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice. Drawing Capital currently does not own Tesla common shares nor related securities.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.