Macroeconomic Perspectives on Inflation and Portfolio Returns

Weekly updates on the innovation economy.

Introduction

Today’s analysis reviews the context, current status quo, and implications of the future outlook of a “high inflation, low yield world”.

It is quite possible that in the years ahead, America is headed towards a “high inflation, low yield” environment, which has multi-trillion-dollar implications for the GDP at the national level and personal implications in managing one’s personal finances. A “high inflation, low yield” environment may seem counterintuitive because inflation rates and interest rates are typically positively correlated.

Just like the unwinding of the Phillips Curve (defined as the inverse relationship between unemployment and wage inflation), a contrarian perspective is that there could be an unwinding of the historically positive correlation between inflation rates and interest rates.

Decline in Purchasing Power

The purchasing power of the US Dollar has declined over time due to inflation and monetary debasement. If an asset class is appreciating in value in US Dollar terms, then as a corollary, this implies that the US Dollar is depreciating relative to these asset classes. Here is a hypothetical illustration of the loss in purchasing power over 10 years when inflation rates are at 2%, 5%, and 10%:

At a 5% inflation rate, a surprising 40% of one’s purchasing power evaporates over 10 years.

At a 10% inflation rate, a shocking 65% of one’s purchasing power evaporates over 10 years.

While the Federal Reserve maintains a 2% inflation target, the reality for the lives of millions of Americans is that their personal inflation rate far exceeds 2% per year. For example:

American residential rent prices, house prices, healthcare costs, and education tuition & childcare costs have all increased at a faster rate than the consumer price index, which is a broad measure of inflation for a basket of consumer products and services.

Furthermore, while American healthcare spending per capita has more than doubled in the past 20 years, there have been only marginal improvements in average lifespans in America, as seen by the following 2 charts:

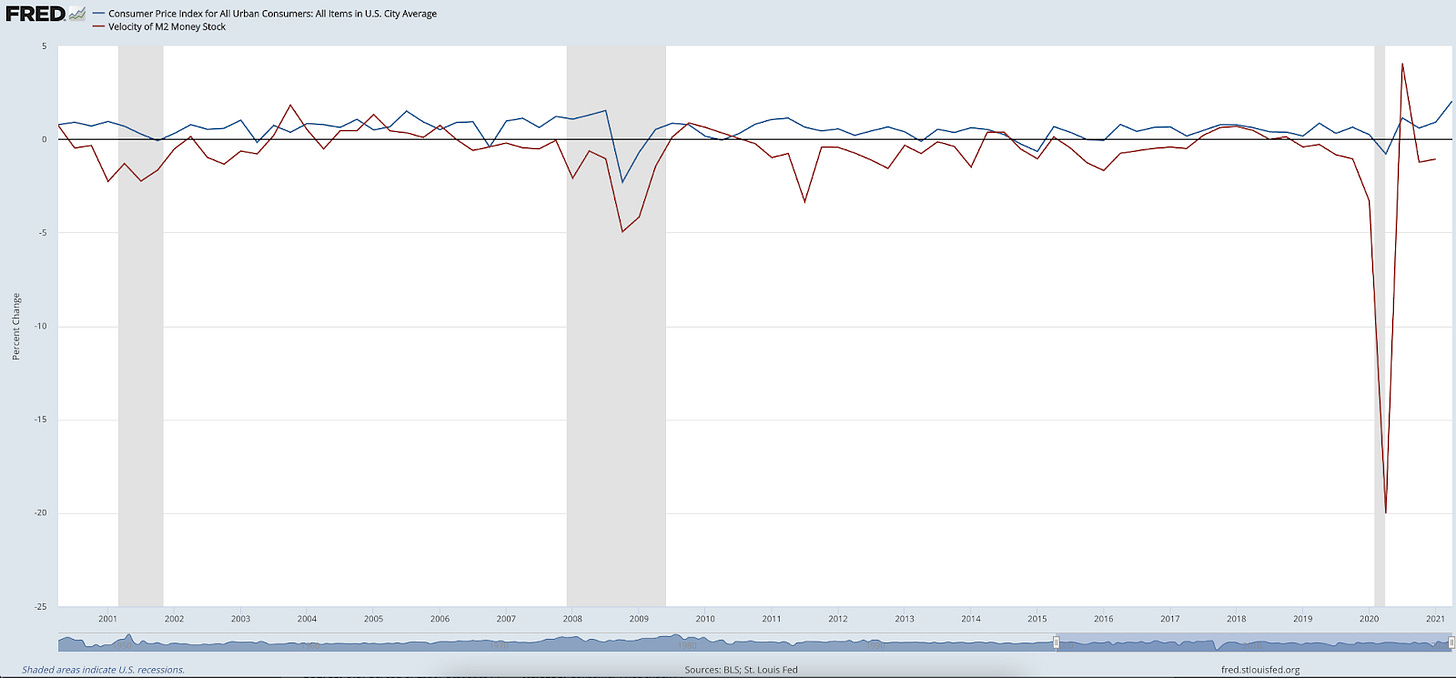

Economics Charts: Money Supply & Velocity of Money

The following charts from the Federal Reserve Economic Database highlight the growth in the Federal Reserve’s balance sheet, the upward trend of money supply, the declining trend of M2 money velocity since 1980, and the historical relationship between the consumer price inflation index (CPI) and money velocity. We will explore the impacts of these trends and relationships further below.

From May 1983 to May 2021, the M2 money supply has increased by about 10x.

From May 2011 to May 2021, the M2 money supply had an annualized growth rate of about 8.4% per year.

If someone assumes that monetary debasement (as seen by the rising M2 money supply) equals total inflation rate (this assumption is probably inaccurate since people’s personal inflation rate varies based on their consumption, spending, investing habits across other people and over time), then the market-implied inflation rate via monetary debasement has been 8.4% per year.

Since September 2019, the size of the Federal Reserve’s balance sheet has more than doubled. Significant balance sheet expansion is a form of expansionary monetary policy in an effort to stimulate the economy.

The velocity of M2 Money Stock appears to be a leading indicator for CPI inflation.

Economic Perspectives on Monetary Policy, Interest Rates, Portfolio Returns, and Supply & Demand Curves

Bond yields and bond prices are inversely related. As money supply increases, interest rates decrease due to increased demand for buying bonds from central banks, and increased demand leads to increased bond prices, which artificially reduces interest rates. We can see this in the following chart that showcases a rightward shift in the demand curve with the Federal Reserve buying bonds, and a rightward shift of the demand curve along the same supply curve leads to higher prices.

Bond investors, which represent the supply curve in the following graph, earn higher yields as interest rates increase. On the other hand, the demand curve is downward sloping, and governments and corporations can borrow more money when interest rates decrease. Interest rates represent the cost of borrowing. Said differently, the demand for money via debt financing increases as the price of borrowing money decreases. Increased availability and volume of capital due to expansionary monetary policy causes a rightward shift in the supply curve, causing a lower intersection point with the demand curve. A lower intersecting equilibrium point implies lower returns to bond investors.

The next chart graphs the savings and investment curves. One can think of savings as the supply of capital, and one can think of the investment curve as a downward sloping curve that increases in demand as the cost of capital financing decreases. In a high interest rate environment, savers can earn decent returns on cash savings, money market funds, CDs, and Treasury Bills. As a result, savers enjoy a high interest rate environment. When the Federal Reserve institutes a low interest rate policy, the resulting policy penalizes savers and favors consumption (spending) and investment.

When central bank expansionary monetary policy occurs, there is government intervention in financial markets, and central banks artificially lower interest rates below the market-clearing equilibrium price of risk. As a result, a shortage occurs because quantity demand for investment at a low cost of capital is greater than the quantity supplied by savers at low yields as savers increasingly do not find low yields attractive.

Since many investors do not find negative inflation-adjusted yields to be attractive in the investment-grade bond market, they expand their risk tolerance by increasing their investment allocation to “risk assets” (such as equities, real estate, and private investments in venture capital) and “scarce assets” (such as Bitcoin, artwork, and precious metals) in hopes of seeking higher returns.

The chart below from Portfolio Visualizer highlights the “efficient frontier” of various asset classes by graphing volatility (standard deviation) on the x-axis and historical returns on the y-axis.

Notice that as investors chase higher returns, the acceptance of potentially elevated volatility and uncertainty must be present. Notably, simply adding risk to a portfolio does not automatically translate into higher returns. This financial nuance is important, and said differently, we believe that investors can target returns subject to a risk constraint as opposed to blindly adding more risk and volatility into a portfolio in hopes of chasing higher returns.

We assume that bonds and stocks are substitute goods (not complement goods) in a portfolio because both are used to generate returns, and both are liquid asset classes. Quantitatively, the capital asset pricing model supports this assumption: as risk-free interest rates increase, an investor needs to increase their market risk exposure and/or earned risk premiums in order to earn higher returns. Due to the behavioral anchoring bias, many investors use historical data to guide subsequent judgements on decision making. As a result of this “substitute goods assumption” and the behavioral anchoring bias, high bond prices (said differently, low bond yields) cause greater demand for stocks by investors.

Furthermore, some institutional investors and robo-advisers have strict mandates on asset class allocations in a portfolio (such as maintaining a portfolio of 60% in stocks and 40% in bonds). When the Federal Reserve lowers interest rates and engages in expansionary monetary policy with quantitative easing and asset purchasing programs, this policy decision automatically increases bond prices, which causes more buying demand for stocks for at least these 4 reasons:

Since bond prices and bond yields are inversely related, the lowering of bond yields via Federal Reserve monetary policy directly increases bond prices. Higher bond prices may increase a portfolio’s percentage allocation to bonds beyond the stated investment policy statement, which causes a rebalancing effect of buying more stocks to maintain the stated target asset allocation model.

The lowering of interest rates decreases the weighted average cost of capital and discount rate for many companies. For fundamental investors that value assets as the present value of discounted future cash flows, a lower discount rate implies a higher present value for the asset, thereby enabling or encouraging more investors to buy stocks.

Income-seeking investors that are willing to accept price fluctuations may begin allocating more funds into dividend-paying stocks and rental properties when the yields on these assets are higher than bond yields.

For investors and home-buyers that use financial leverage (debt financing), lower interest rates both increase buying power and reduce the minimum required hurdle rate that is needed to achieve the positive potential benefits on amplifying returns on equity.

Due to increased volume in the supply of equity capital, decreased production costs, and increased technology, there is a rightward shift of the supply curve in the graph below. Increased technology and innovation in financial markets, the rise of ETFs and index funds, fractional share investing, and the improvements in mobile and desktop investing apps that reduce friction compared to calling a broker make it easier than ever for investors to participate in public equity markets today. There are reduced “production” costs associated with stock investing in “producing” equity returns due to zero-commission stock trading, online distribution of information, the proliferation of no-load mutual funds, and increased accessibility of free financial literacy courses and quality investing knowledge online. The volume of money that is interested in investing in equities increases due to several key reasons:

Changing forecasted capital market expectations by wealth advisors, endowment funds, pension funds, and financial brokerage firms place pressure on the traditional 60/40 portfolio.

Investors desire positive inflation-adjusted returns, and when trillions of investment grade bonds have negative real yield to maturities, investors will seek greater investment allocations in “risk assets”, such as stocks and real estate, in hopes of achieving positive inflation-adjusted returns. The search for achieving positive inflation-adjusted returns will cause more money to be invested in equity markets, thereby increasing the supply of equity financing.

Combination of rising costs, fears of Social Security and pension income being insufficient for retirement needs, and stagnation in middle class labor income is a forcing function to increase capital income in order to keep up with rising costs. Notably, the costs of quality healthcare, housing, and education are increasing much faster than the consumer price inflation index. Evidence of stagnating wages for millions of Americans include high unemployment and underemployment rates after the coronavirus crisis and low growth in median household income over the past decade.

One can think of labor income as the wages and compensation earned for hours worked. One can think of capital income as the totality of investment profits, dividends, interest income, and rental income. One method of seeking higher capital income is to invest in risk assets as opposed to academically risk-free and low-risk assets, and a consequence of this decision is that the possibility and magnitude of potential investment losses may increase when increasing investment exposure into risk assets. The desire to seek higher capital income will cause more money to be invested in equity markets, thereby increasing the supply of equity financing.

Due to the rightward shift in the supply curve associated with increasing supply of capital financing of risk assets, such as equities, there is a corresponding decrease in the price of future equity returns. One can think of the price of future equity returns as the cost of equity, which is the perceived rate of return that companies pay to equity investors (shareholders). Lower equity risk premiums and lower cost of equity imply lower prospective future returns for equity investors in terms of long term capital market expectations. Furthermore, lower cost of capital and lower cost of debt leads to a lower weighted average cost of capital (“WACC”), which increases equity market prices due to a lower discounting rate in discounted cash flow analysis.

Concluding Insights in Applying These Inflationary Perspectives to Investing

Inflation represents a decrease in purchasing power, which implies that more US Dollars are needed to purchase the same product or service over time.

The importance of understanding inflation is necessary to maintain and even grow one’s purchasing power over time.

Technological advancement and a high degree of competition are deflationary forces that promote lower prices per unit of value creation over time.

There are 5 methods of increasing portfolio returns in a high inflation, low yield environment, although each of these methods carry a degree of risk and uncertainty:

1. Find a differentiated thesis that focuses on exponential growth as opposed to tepid linear growth. Often, this differentiated thesis comes from investing in technology-enabled companies with innovative and transformative technologies.

2. Increase portfolio beta via increasing market risk exposure and/or increasing portfolio leverage.

3. Add risk premiums to a portfolio that have the possibility of earning higher returns:

Illiquidity risk premium: Invest in illiquid assets, alternative investments, venture capital, and private markets that can earn the illiquidity risk premium

International and currency risk premium: Invest in high-growth foreign markets that earn additional returns to compensate the investor for accepting additional risks and uncertainties associated with investing in international markets.

Duration risk premium: Look into long-duration assets, which are assets that provide potential positive cash flows many years into the future, such as growth stocks, technology companies, venture capital investments, and long-term real estate.

4. Look at assets that are scarce or digital, such as physical land, Bitcoin, non-fungible tokens (NFTs), collectibles, and certain precious metals and minerals.

5. Find a way to add material value to existing portfolio companies.

References:

"FRED - Federal Reserve Bank of St. Louis." https://fred.stlouisfed.org/. Accessed 23 Jul. 2021.

"Portfolio Optimization - Portfolio Visualizer." https://www.portfoliovisualizer.com/optimize-portfolio. Accessed 25 Jul. 2021.

"Current health expenditure per capita" https://data.worldbank.org/indicator/SH.XPD.CHEX.PC.CD. Accessed 25 Jul. 2021.

"Covid-19 Takes Dramatic Toll on U.S. Life Expectancy - Bloomberg." 20 Jul. 2021, https://www.bloomberg.com/news/articles/2021-07-21/covid-19-takes-dramatic-toll-on-u-s-life-expectancy. Accessed 25 Jul. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.