Based on popular demand, we decided to dive deeper into individual companies to help our readers learn about new investment opportunities or expand their understanding of how the world works. We believe analyzing a single company is one of the best ways to start learning about a sector. Today, we’re exploring Montrose Environmental Group under the ticker symbol $MEG. It’s one of the fastest growing companies in a highly fragmented and growing $1.25 trillion global environmental industry.

Mission

Montrose has 2 missions depending on where you look. Both of these provide the simplest summary of what the company does.

“to provide our clients and communities with solutions to meet their environmental goals and needs”

“to protect the air we breathe, the water we drink, and the soil that feeds us.”

Stats

CEO: Vijay Manthripragada

Year Founded: 2012

Market Cap: $2.09B

YoY Revenue Growth: 78%

Gross Margins: 32.3%

Operating Margins: 5.5%

Net Income Margins: -7.7%

Free Cash Flow Margins: 4.2%

Vijay Manthripragada

Manthripragada has been CEO of Montrose since September 2015. His previous experience includes CEO of PetCareRx, VP at Goldman Sachs, and Director at The Advisory Board Company. He graduated with a BS in Biochemistry and Molecular Biology from Oxford and Duke followed by an MBA from UPenn (The Wharton School). His background in chemistry, biology, and business should be good for managing an environmental company dealing with air, gas, water, and soil. Vijay has a strong passion for a clean environment for all, which is conveyed in every earnings call.

Overview

Montrose primarily operates 3 types of services ranging from creation, maintenance, and decommissioning of various environmental projects.

Assessment, Permitting, and Response

scientific advisory and consulting services, audits, permits for current operations, facility upgrades, decommissioning projects. Additionally

help clients navigate regulations at local, state, provincial, and federal levels.

Measurement and Analysis

Test and analyze air, storm water, wastewater, drinking water, and soil to determine contaminants and impacts on flora, fauna, and human health.

Remediation and Reuse

provide clients with engineering, design, implementation and operations and maintenance services, primarily to treat contaminated water

remove contaminants from soil or create biogas from agricultural waste

Here are more detailed examples of their services from their S-1.

Strengths

Each one of Montrose's business segments is often the primary focus of any competitors. However, Montrose is tackling all 3 segments, so they have synergies and economies of scale for client projects. For example, a client can hire Montrose to both measure and also treat contaminated water rather than hiring two separate companies. Additionally, Montrose doesn't have to waste fixed costs per project like customer acquisition for measuring and treating water. That's a reduction in cost per project compared to incumbents who only offer one of the two services.

Additionally, Montrose grew their revenues through the COVID-19 pandemic, which is a huge accomplishment for any business whose success is largely contingent on in-person contact. Conversely, competitors like $TTEK and $EXPO (discussed later) saw negative growth and are trying to recover.

Lastly, we believe Montrose holds one of the highest revenue growths among its competitors.

Risks

When analyzing a company, it’s good to understand the risks involved in their business. Here are what we believe to be the 2 biggest risks.

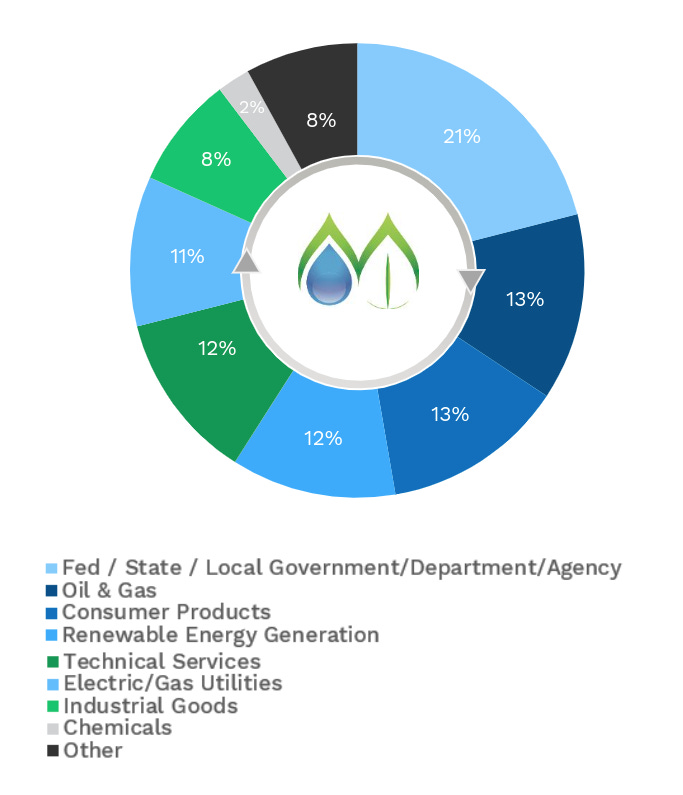

Change in government regulations such as discontinuation of the U.S. EPA’s plans could negatively impact the business. However, the CEO mentions their very diversified portfolio (image below) can withstand political cycles well.

Delays in projects due to natural disasters like hurricanes or pandemics can shift revenues an entire quarter, which can manifest as missing earnings estimates on a quarterly basis but not in the long term.

Competitors

Here are some notable competitors to $MEG operating in one or more of their businesses.

Tetra Tech ($TTEK) - provides consulting, engineering, program management, and construction management services in the areas of water, environment, infrastructure, resource management, energy, and international development. Comparatively, Tetra Tech's revenues are only growing at ~15% year-over-year.

AECOM ($ACM) - They engage in planning, consulting, architectural, engineering, and construction management services for commercial and government clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. They also invest in and develop real estate projects and building construction and energy services across the transportation, water, government, facilities, environmental, and energy sectors.

Exponent ($EXPO) - They operate a worldwide science and engineering consulting company. The company operates in two segments, Engineering and Other Scientific (biomechanics, biomedical engineering, civil engineering, construction consulting, data sciences, electrical engineering and computer science, materials and corrosion engineering, polymer science, vehicle engineering, etc), and Environmental & Health (chemical regulation and food safety, ecological and biological sciences, environmental and earth sciences, and health sciences).

Catalysts

So what are the reasons for Montrose’s growth? Here’s 3 catalysts:

Covid-19, rising AQI levels, and wildfires in California (and other states) caused a heightened focus on air quality.

Public demands, industrial activity, aging infrastructure, climate change and regulations each increase the need for environmental services

The environmental services industry is highly fragmented and complex

ESG is an ever-growing concern for investors and consumers as the U.S. government continues to incentivize companies to become more environmentally friendly.

Diving deeper into the regulations, the U.S. EPA recently announced that it is advancing new methane regulations which will affect the production, processing, storage, and transmission for new and existing petroleum infrastructure which leads to more customers for Montrose needing to follow more regulations.

Similarly, the U.S. EPA is also planning to regulate PFAS (Perfluoroalkyl and Polyfluoroalkyl Substances) which are toxic chemicals used to make everyday products. Now, manufacturers will need to monitor toxicity levels and potentially become new customers of Montrose. This is an example of how regulation can create revenue for Montrose.

Future

Montrose's revenues continue to grow at a high rate of 70%+, and they continue to raise guidance as demand for environmental solutions grows long after the pandemic started.

Their largest growth potential comes from expanding existing local relationships into national and international relationships. Clients often have a desire to standardize their programs across geographies, which requires their environmental services providers to have the scale, reach and capabilities to match their footprint.

More recently, Montrose has been using drones to survey plants for problems like emission leaks. Compared to humans, drones can cover larger areas faster and cheaper while also reaching hard-to-reach areas (plus, drones don’t get Covid). Montrose can also install 24/7 monitors if the client desires real-time alerts to prevent issues like damages or resource leaks.

The company mentioned they have no intention to shift strategies anytime soon; they see large opportunities left in their current target markets.

Conclusion

We believe Montrose could provide an interesting opportunity to invest in the environmental safety and maintenance sector while meeting the ESG requirements. The CEO is highly passionate about the company, and his academic and professional background supports that thesis. Additionally, it’s great to see that Montrose is utilizing the latest technologies like drones to grow their business and provide new and highly desired products for customers.

Resources

S-1, https://www.sec.gov/Archives/edgar/data/1643615/000119312520182614/d792332ds1.htm

Montrose Environmental: Environmental Solutions & Engineering Services, https://montrose-env.com/

Montrose Environmental - Presentations & Events - Presentations, https://investors.montrose-env.com/presentations-and-events/presentations/default.aspx

TIKR, https://app.tikr.com/

PFAS Strategic Roadmap: EPA's Commitments to Action 2021-2024 | US EPA, https://www.epa.gov/pfas/pfas-strategic-roadmap-epas-commitments-action-2021-2024

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal. At the time of publishing this blog post, Drawing Capital does not directly own shares in Montrose Environmental Group ($MEG).

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.