Navigating Financial Markets with Dynamic Asset Allocation, Treasury Yields, and the VIX

Weekly updates on the innovation economy.

Introduction

In today’s newsletter, Drawing Capital describes a series of macroeconomic insights in an effort to navigate the market cycle and implement dynamic asset allocation in a portfolio using a market-implied perspective via US Treasury yield curves and the VIX volatility index.

Successful dynamic asset allocation between risk assets that offer high return potential and assets with historically low downside risk helps to navigate the market cycle by providing a partial hedge against significant downside losses before economic crises while simultaneously providing the investor the opportunity to participate in rising markets.

By definition, intermarket analysis seeks to apply insights in one asset class (such as bonds) in order to make profitable investment decisions in another asset class (such as stocks or real estate). Market-implied dynamic asset allocation models based on US Treasury yields create a quantitative set of models to reduce the guesswork and forecasting errors of an emotionally-driven, narrative-seeking investor. Whether or not you invest in bonds or stocks (or both), US Treasury yields can provide investors with insights into how to dynamically rebalance the positioning of asset classes in a portfolio based on market conditions.

Treasury Yield Curve Charts

Key Insights from the US Treasury Yield Curve Spread Chart:

US Treasuries represent the debt that is issued by the federal government in America (specifically the Department of the Treasury) to finance government spending. The US national debt currently exceeds $28.6 trillion.

Conceptually, the US Treasury yield spread is the difference between long-term US Treasury interest rates and shorter-term US Treasury interest rates. There are 2 popular US Treasury yield spreads: The 10-year Treasury yield minus the 2-year Treasury yield, and the 10-year Treasury yield minus the 3-month Treasury yield.

When the Treasury yield spread is negative, this implies an inversion of the yield curve, which typically precedes significant market volatility and an economic recession.

The 10-year minus 2-year Treasury yield spread either approached zero or turned negative before the 1998 Asian financial crisis, the 2000 tech & telecom stock collapse, the 2008 financial and housing crisis, and the 2020 coronavirus crisis. As a result, the historical predictive power of the US Treasury yield spread is astonishingly very good in forecasting future significant market volatility and/or economic recessions.

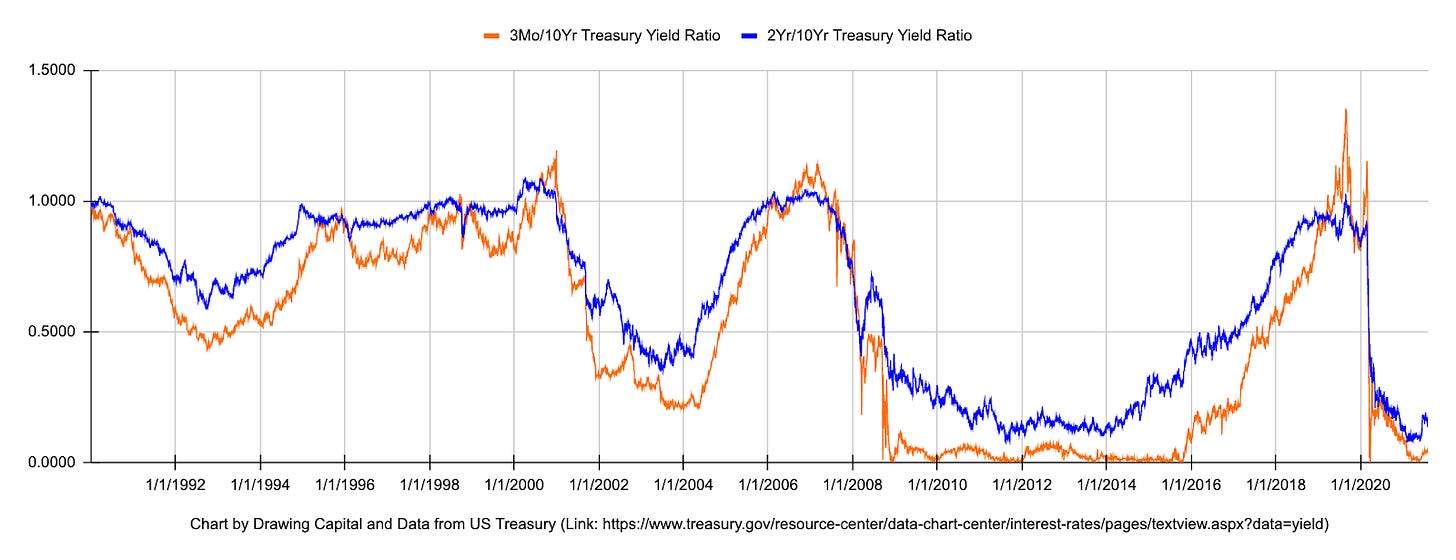

Key Insights from the Treasury Yield Curve Ratio Chart:

When short-term Treasury rates exceed longer term Treasury rates, the Treasury Yield Ratio is above 1, marking an inversion of the Treasury Yield Curve. A ratio above 1 is a leading indicator for a potential economic recession and potential severe market volatility event(s) over the next 6-24 months.

The 3Mo/10Yr Treasury Yield Ratio is calculated by dividing the 3-month Treasury yield by the 10-year Treasury yield. This yield ratio hovered near 0 for years between mid-2009 and early 2015. Coincidently, this time period was a great time to broadly invest in US equity markets.

Key Insights from the Market-Implied Dynamic Asset Allocation Chart:

Green line represents the dynamic asset allocation of a balanced investor's portfolio towards potentially-high-return assets, such as US stocks. Said differently, what percentage of a balanced portfolio should be invested in stocks at a given moment in time with this market-implied dynamic model?

Orange line represents the dynamic asset allocation of an aggressive investor's portfolio towards potentially-high-return assets, such as US stocks.

Blue line represents the dynamic asset allocation of an aggressive investor's portfolio with 30% leverage towards potentially-high-return assets, such as US stocks. Of course, adding leverage to a portfolio amplifies both potential upside and downside in financial performance returns.

As of August 6, 2021, the green line, orange line, and blue line are respectively at ~84%, ~95%, and ~124%. Said differently, market-implied dynamic asset allocation models based on US Treasury yields suggest that it continues to be an attractive environment for US stocks and other risk assets.

The chart above is a market-implied dynamic asset allocation model based on US Treasury yields. As a quantitative model, it reduces errors associated with guesswork, forecasting, and emotionally-driven “gut feeling” investing decisions.

In the chart above, notice how all three lines conveniently implied a lower percentage allocation to risk assets before the significant market drawdowns and economic recessions in the 1998 Asian financial crisis, 2000 tech and telecom stock collapse, 2008 financial and housing crisis, and the 2020 coronavirus crisis. Of course, while US Treasury yield curves would not have forecasted the coronavirus pandemic, the yield curves did imply that the economy would potentially experience an economic growth deceleration near 2020-2021 regardless of if the coronavirus crisis occurred.

Successful dynamic asset allocation between potentially-high-return assets and low-downside-risk assets helps to navigate the market cycle by providing a partial hedge against significant downside losses while simultaneously providing the investor the opportunity to participate in rising markets. Examples of risk assets that have the potential to deliver high returns include US stocks, private equity, venture capital, private market investments, Bitcoin, and the economically cyclical areas within real estate. Examples of assets with historically low downside risks include short-term US Treasuries, investment-grade corporate bonds, CDs, money market funds, and cash in a savings account.

VIX Charts

Key Insights on Volatility Ratio:

When this volatility ratio exceeds 1, there is typically significant market volatility.

This volatility ratio tends to stay between 0.7 and 1 until a breakout occurs that either amplifies and dampens volatility.

From 2008 to August 4, 2021, the volatility ratio is between 0.7 and 1 on an end-of-day daily frequency about ~88.6% of the time.

Key Insights on Volatility Spreads:

When this volatility spread drops below 0, there is typically significant market volatility. For example, notice the steep plunge in the blue line in Q1 2020, which coincided with nearly unprecedented levels of stock market turbulence in February and March 2020.

This volatility spread tends to stay between 0 and 6 until a breakout occurs that either amplifies and dampens volatility.

From 2008 to August 4, 2021, the volatility ratio is between 0 and 6 on an end-of-day daily frequency about ~81% of the time.

10 Concluding Thoughts

Data for US Treasury yields and the VIX volatility index is helpful in providing market-implied perspectives for stock market investing via intermarket analysis.

Successful dynamic asset allocation between risk assets that offer high return potential and assets with historically low downside risk helps to navigate the market cycle by providing a partial hedge against significant downside losses before periods of significant financial market turbulence while simultaneously providing the investor the opportunity to participate in rising markets.

Market-implied dynamic asset allocation models based on US Treasury yields create a quantitative set of models. The goal of quantitative modeling is to reduce the guesswork and forecasting errors of an emotionally-driven narrative-seeking investor and instead, move towards a programmatic and analytical approach with a series of guidelines in making investment decisions within a strategic or tactical asset allocation framework.

Based on data from US Treasury yields, the market-implied dynamic asset allocation models imply a favorable investment environment today for risk assets that have high-return potential.

An asset allocation model in a portfolio is a framework for determining the percentage weights of various asset classes and investment categories. For example, a traditional 60/40 balanced portfolio allocates 60% into stocks and 40% into bonds.

While a static asset allocation approach seeks to maintain the same percentage allocation to different assets over time, a dynamic asset allocation approach seeks to rebalance and change its percentage allocation over time based on financial market conditions, Federal Reserve monetary policy, and the economic cycle.

When the VIX volatility spread drops below 0, there is typically significant market volatility. The typical range for the VIX volatility spread, as displayed above via the 6-Month VIX minus the VIX, is between 0-6.

When the VIX volatility ratio exceeds 1, there is typically significant market volatility. The typical range for the VIX volatility ratio, as defined above as the VIX / 6-Month VIX, is between 0.7-1.

The historical predictive power of US Treasury yields is astonishingly very good in forecasting future significant market volatility and/or economic recessions. For example, the 10-year minus 2-year Treasury yield spread either approached zero or turned negative before the 1998 Asian financial crisis, 2000 tech & telecom stock collapse, the 2008 financial and housing crisis, and the 2020 coronavirus crisis.

When short-term US Treasury interest rates exceed longer-term US Treasury interest rates, the Treasury Yield Ratio is above 1, marking an inversion of the Treasury yield curve. A ratio above 1 is a leading indicator for a potential economic recession and potential severe market volatility event(s) over the next 6-24 months.

References:

"Daily Treasury Yield Curve Rates." https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield. Accessed 8 Aug. 2021.

“US Debt Clock”. https://www.usdebtclock.org. Accessed 9 Aug. 2021.

"VIX Index Historical Data - Cboe Global Markets." https://www.cboe.com/tradable_products/vix/vix_historical_data/. Accessed 8 Aug. 2021.

"VIX6M Index Dashboard - Cboe Global Indices." https://www.cboe.com/us/indices/dashboard/vix6m/. Accessed 8 Aug. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.