Drawing Capital Newsletter

October 2, 2020

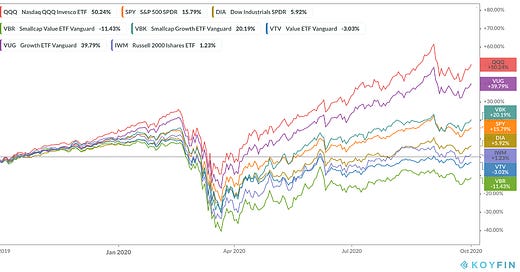

(Figure 1)

For those who are displeased with their index funds and over-diversified allocations, you are not alone.

The world’s response to COVID-19 has fueled the adoption of new technologies and forced adjustments in consumer and corporate spending. As a result of a drastic shift in behavior and norms, pricing asymmetries and divergence can be seen across the board. Value-oriented stocks have continued their trend of underperformance, creating a drag on indices while shareholders in mega-cap tech stocks reach a new level of confidence. We see this represented in 1-year equity returns above (Figure 1).

1-Year Returns of Major Index ETFs

Nasdaq-100 (QQQ): +50.24%

Vanguard Growth (VUG): +39.79%

Vanguard Small-Cap Growth (VBK): +20.19%

SPDR S&P 500 (SPY): +15.79%

SPDR Dow Jones Industrial Average (DIA): +5.92%

iShares Russell 2000 (IWM): +1.23%

Vanguard Value (VTV): -3.03%

Vanguard Small-Cap Value (VBR): -11.43%

As a result of this explosive growth, one of the most common questions we receive is: “Is this just another tech bubble?”

Let’s focus on the top 4 companies in the Nasdaq-100 Index.

Figure 2 below illustrates the change in price and earnings (last 12 months) over a 5-year period from September 29, 2015, through September 30, 2020.

(Figure 2)

The data over this 5-year period can be further interpreted by more closely reviewing the changes in the metrics below.

To draw on some of the key points, as shown above:

Although there has been significant price appreciation over the last 5 years, those prices are largely supported by earnings growth.

In addition to earnings, each of the companies identified above proves to have strong balance sheets with thoughtful use of debt.

The NASDAQ leaders referenced above exhibit strong revenue growth, significant market share in their primary business segments, and the ability to reinvest billions of dollars of capital into R&D and further innovation.

In conclusion, we do not believe that the recent price appreciation of the stock prices of big tech names is unwarranted, nor do we believe that this is a price bubble. This is contrasted with the 2000 Tech Bubble, in which stocks were soaring with no support of underlying revenue growth or free cash flow to support their wild valuations.

Broad-based index funds have served most investors well since the recovery of the 2008 Financial Crisis. However, we expect that over the next few years, a more targeted approach with sophisticated business acumen will be able to deliver performance alpha above the common benchmarks.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.