Introduction

This week’s Drawing Capital newsletter focuses on fintech payment providers, firms that create and license index data, and firms that both focus on growing assets under management and generating returns on investor’s assets. Colloquially, we refer to these categories as “payment processors, indexers, and asset managers”.

Categorization of Companies

The major licensors of indices and ratings include the following:

S&P Global ($SPGI)

MSCI Inc ($MSCI)

Moody’s ($MCO)

Nasdaq ($NDAQ).

Large private equity firms and asset managers that are publicly traded include the following:

Apollo ($APO)

KKR ($KKR)

Blackstone ($BX)

Carlyle Group ($CG)

BlackRock ($BLK)

Charles Schwab ($SCHW)

Large fintech providers in the payments industry include the following:

PayPal ($PYPL)

Visa ($V)

Mastercard ($MA)

Square ($SQ)

Adyen ($ADYEY)

Historical Stock Price Performance

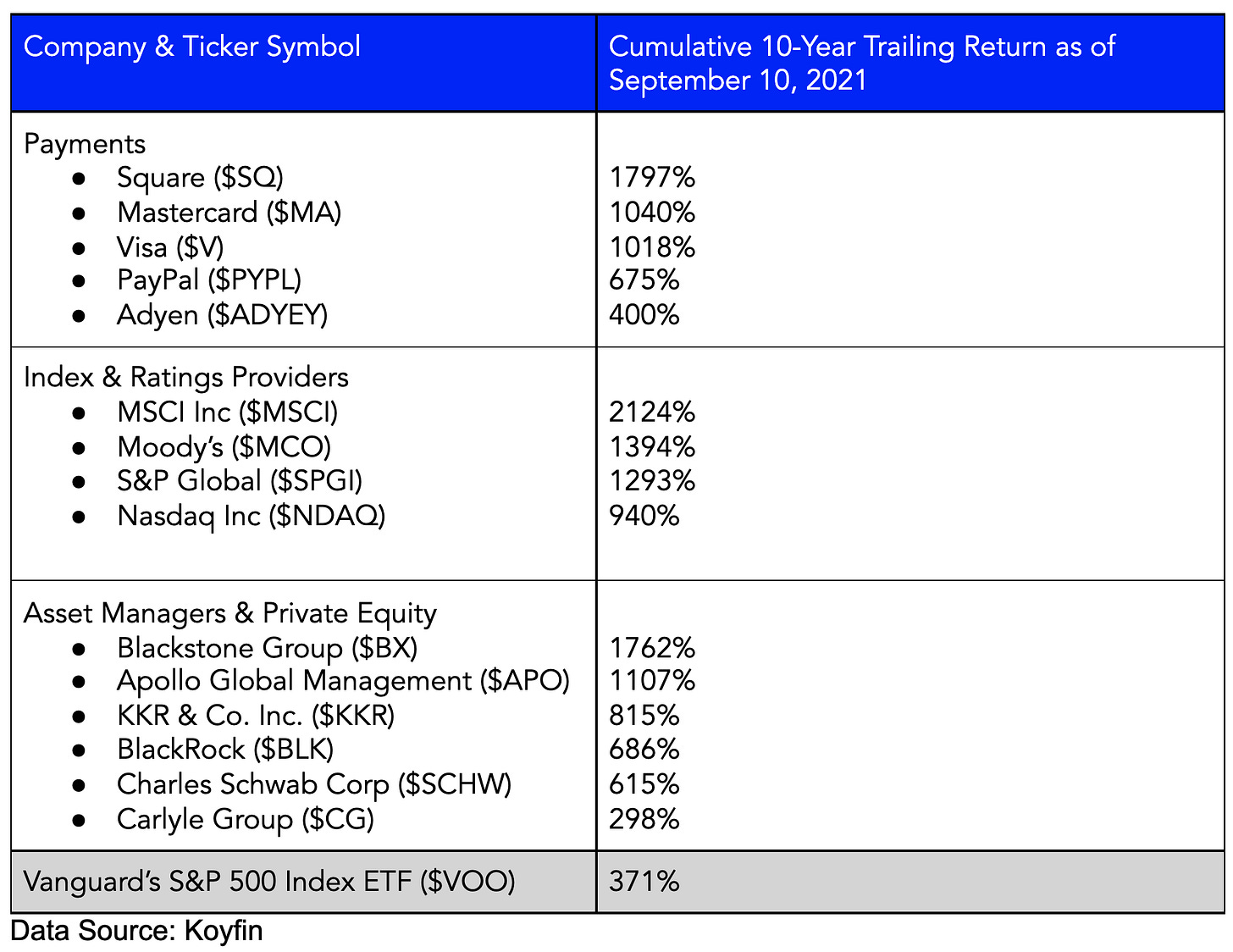

Over the past 10 years ending on September 10, 2021, the minimum compound annual growth rate (CAGR) for the stocks listed in the above chart by Koyfin was greater than 14%. Obviously, investors enjoy high returns, and how do high CAGRs translate into cash-on-cash returns or multiples on invested capital (MOIC)?

A 15% CAGR over 10 years implies a 4x return on invested capital (i.e, $1 becomes $4). For example, a historical 15% CAGR is nearly the historical trajectory of the stock price for Carlyle Group.

A 25% CAGR over 10 years implies a 9.3x return on invested capital. For example, a historical 25% CAGR is nearly the historical trajectory for the stock price of Nasdaq Inc.

A 35% CAGR over 10 years implies a 20.1x return on invested capital. For example, a historical 35% CAGR is nearly the historical trajectory of Square’s stock.

Of course, while future returns can vary from historical performance and while future returns are not guaranteed, reviewing historical performance can provide a lens through which investors can evaluate potential possibilities.

Notably, big technology companies aren’t the exclusive providers of large returns, and many of the companies discussed below within payment processing, indexing, and publicly-traded private equity firms have demonstrated significant returns to shareholders over the past decade:

A Quick Note on Valuation Metrics

While many of these financial companies may have elevated P/E ratios compared to the general banking sector peer group, we have the opinion that the P/E ratio is not a high-quality metric to use for high-growth companies and would rather use the following six metrics (among others) to evaluate these types of businesses:

Revenue growth rate

Revenue growth endurance

Contribution margin

Business moat with a strong competitive advantage

Total addressable market & market share

Free cash flow per share

Business Moat with a Strong Competitive Edge:

3 steps to understand if a business has a moat with a competitive edge:

High competitive win rate and high customer retention. Advantaged business models allow a select group of companies to win a lot more than they lose on a persistent and recurring frequency over time. Within the payment processing, asset gathering, and index licensing industries, each of these platform companies have significant market share, as demonstrated in the following examples:

Blackstone, KKR, Apollo, and Carlyle are large private equity firms with billions in assets under management, are alternative investment platforms that offer a range of investment products, and have significant fundraising capability to establish future multi-billion-dollar funds.

Visa and Mastercard are leading credit card companies with significant market share.

S&P Global and MSCI provide index licensing to index funds that collectively manage trillions of dollars. Additionally, both S&P Global and Moody’s are category-leading providers of credit ratings in the bond market.

A key distinction on why we consider these companies as “platform companies” is that they possess more than just an idea or a singular product; platform companies are enabled by exponential expertise or technologies with positive network effects and accumulating business advantages over time.

Pricing power translates the concept of “advantaged business model” in step 1 into actual revenue, gross margin dollars, and free cash flow. Good businesses have good pricing power. Companies in perfectly competitive industries have no pricing power, while companies that are monopolies or oligopolies have huge pricing power.

High returns on equity (ROE) and incremental invested capital (ROIIC) are financial performance measures. Great companies have solid returns on equity and know how to reinvest cash flows back into existing and new business units to pursue future growth opportunities, which enables positive compounding at scale over time. Companies that generate high and compounding returns at scale over time are lucrative for shareholders and stock-owning employees.

Summary

All in all, many of the companies discussed above within fintech payments, indexing, and publicly-traded private equity firms have demonstrated significant returns to shareholders over the past decade. We share the opinion in remaining optimistic about the future of these companies. These highlighted companies in this newsletter provide platform-level solutions with positive network effects to their customers as opposed to simply being an individual product producer. Learnings from one business unit can inform and influence better decision making in other business units, product lines, and customer satisfaction for these companies.

References:

"Koyfin | Advanced graphing and analytical tools for investors." https://app.koyfin.com/. Accessed 16 Sept. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.