Introduction

In today’s newsletter, we enable you to learn the following investing topics:

Relationship between rates of return and multiple on invested capital

Historical stock returns of Big Tech companies

Risk mitigation and loss recovery

Investing rules: Rule of 72 and Rule of 240

The role of interest rates and leverage in a portfolio.

Relationship between Returns and Multiple on Invested Capital.

3 insights from the above chart:

Based on your desired multiple on invested capital, you can work backward to see your required rate of return to achieve your investment goal. If you desire to double your investment portfolio in 10 years, then you need a ~7.2% compounded annualized rate of return, which has historically been the approximate after-tax long-term return of an S&P 500 index fund.

For 5x returns in 10 years, you need a ~17.5% compounded annualized rate of return.

For 20x returns in 10 years, you need a ~35% compounded annualized rate of return.

Putting this knowledge into practice, let’s take a look at historical “Big Tech” returns for the past 10 years as of April 1, 2021. Clearly, Big Tech companies, as represented by the 7 FANGMAN companies in the chart below, have delivered significant returns to shareholders and stock-owning employees:

Rules of Returns

As an approximate investing measure, these 2 rules of return can quickly calculate required rates of return or the number of years necessary to achieve a specific outcome:

Rule of 72

The Rule of 72 represents the approximate number of years it will take for an investment to double based on an annualized rate of return. A higher rate of return implies a fewer number of years necessary to double an investment.

The Rule of 72 has the following formula: Number of years to double = 72 / rate of return.

E.g. If you buy a 2% yielding investment (such as a long-term CD today), then it would take about 36 years to double your investment. If you earn a 10% annualized rate of return, then it would take about 7 years to double your investment.

Rule of 240

The Rule of 240 represents the approximate number of years it will take for an investment to 10x based on a rate of return. A higher rate of return implies a fewer number of years necessary to 10x an investment.

The Rule of 240 has the following formula: Number of years to 10x your investment ~ = 240 / rate of return.

E.g. If you buy and hold a 2% yielding investment (such as a long term CD today), then then you will never have a 10x return on this kind of investment in your lifetime. If you desire a “10x return in 10 years”, then you should aim for a ~26% compounded annualized return.

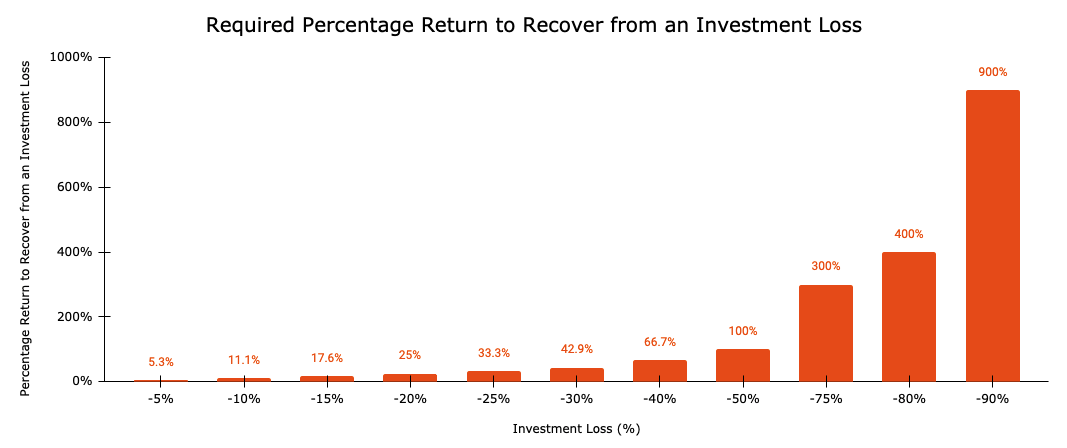

Investment Loss and Recovery

3 insights from the chart above:

After suffering from a percentage loss on an investment, you need to recover more than your percentage loss number in order to break even.

To recover from a 10% loss, you need a ~11.1% return to break even.

To recover from a 50% loss, you need a 100% return to break even.

The Debacle with Archegos Capital Management

Archegos Capital Management is Bill Hwang’s family office and recently made headlines regarding a multi-billion dollar margin call, block trades through investment banks, equity swaps, significant use of portfolio leverage in a concentrated portfolio, and more.

The Archegos Capital Management debacle serves as an important repetitive lesson to investors, which is that leverage does not imply genius. Nonetheless, while we should respect the privacy of the family office, at the same time, we can learn five important lessons from this event from an individual investor perspective.

Leverage magnifies gains and magnifies losses. In positive-trending markets, leverage works wonders, but being levered long on the downside can be particularly painful.

In the continued search for high returns in a low-interest rate world, the use of financial leverage has become commonplace for many hedge funds and family offices in an effort to magnify winnings.

Whenever borrowed money is used to finance the acquisition of investments or when complex non-retail-oriented investment products are used, there is additional risk and hurdle rates in the investment decision-making process.

Significant selling can impact stock prices, as seen by the recent stock price movements of ViacomCBS, Discovery, a few Chinese stocks, and other securities. During a deleveraging process in downward-trending markets, losses become magnified, margin calls occur, and more forced selling starts to occur.

Buying from dis-economic and distressed sellers can present a significant investment opportunity for patient investors.

Interest Rates and Portfolio Leverage

Low interest rates incentivize speculation and investments into “risk assets”, especially when investors seek high returns. “Risk-free assets” are academically risk-free from a default risk perspective, and “risk assets” are assets that have a possibility of principal loss on investment. When the yields on US Treasury bonds, CDs, and savings accounts are both low and below inflation rates, investors will place more emphasis on investments that produce positive inflation-adjusted returns as mechanisms for both a store of value and to grow wealth over time.

Low interest rates incentivize borrowing and the use of portfolio leverage. When the Federal Reserve lowers interest rates, this scenario increases the buying power for individuals in purchasing houses and stocks. When the cost of borrowing is only 1-3%, the temptation to use borrowed money to increase return on equity increases, especially when there is high predictability of stable or increasing future cash flows. In some instances, the tax code also incentivizes debt financing, as seen through mortgage interest tax deductions for individuals and interest deductibility for corporations.

Leverage is your friend when you use it with prudence, and one should seek to mitigate levered losses.

In an effort to reinforce this knowledge, let’s visualize 3 scenarios:

Scenario 1:

You have a $10,000 portfolio that is currently all in cash, and then you buy $10,000 worth of stocks. Since the amount of stock that you purchased does not exceed your cash balance, you did not incur a margin loan. Let’s suppose that over the course of the year, these stocks collectively gained 10%. At the end of the year, these calculations would be applicable for your portfolio return:

Portfolio Asset Value: 10% return on a $10,000 starting value = $11,000 ending asset value

Margin Loan Balance: $0 loan balance

Margin Loan Interest: $0

Portfolio Equity Value = Portfolio Asset Value - Margin Loan Balance - Margin Loan Interest = $11,000 - $0 - $0 = $11,000.

Portfolio Return in Scenario 1: (Ending Portfolio Value - Beginning Portfolio Value) / Beginning Portfolio Value = ($11,000 - $10,000) / (10,000) = 10%

In Scenario 1, you earned a 10% return on your $10,000 beginning portfolio value.

Scenario 2:

You have a $10,000 portfolio that is currently all in cash, and then you use leverage and buy $20,000 worth of stock. Because you only started with $10,000 in cash, you borrowed another $10,000 via a 3% margin loan to finance the total $20,000 stock purchase. Let’s suppose that over the course of the year, these stocks collectively lost 10% in price. At the end of the year, these calculations would be applicable for your portfolio return:

Portfolio Asset Value: -10% return on a $20,000 starting value = $18,000 ending asset value

Margin Loan Balance: $10,000 loan balance

Margin Loan Interest: 3% annual interest on $10,000 margin loan balance = $300 margin loan interest

Portfolio Equity Value = Portfolio Asset Value - Margin Loan Balance - Margin Loan Interest = $18,000 - $10,000 - $300 = 7,700.

Portfolio Return in Scenario 2: (Ending Portfolio Value - Beginning Portfolio Value) / Beginning Portfolio Value = ($7,700 - $10,000) / (10,000) = -23%

In Scenario 2, you generated a -23% return on your $10,000 beginning portfolio value.

Scenario 3:

You have a $10,000 portfolio that is currently all in cash, and then you use leverage and buy $20,000 worth of stocks. Because you only started with $10,000 in cash, you borrowed another $10,000 via a 3% margin loan to finance the total $20,000 stock purchase. Let’s suppose that over the course of the year, these stocks collectively gained 10%. At the end of the year, these calculations would be applicable for your portfolio return:

Portfolio Asset Value: 10% return on a $20,000 starting value = $22,000 ending asset value

Margin Loan Balance: $10,000 loan balance

Margin Loan Interest: 3% annual interest on $10,000 margin loan balance = $300 margin loan interest

Portfolio Equity Value = Portfolio Asset Value - Margin Loan Balance - Margin Loan Interest = $22,000 - $10,000 - $300 = 11,700.

Portfolio Return in Scenario 3: (Ending Portfolio Value - Beginning Portfolio Value) / Beginning Portfolio Value = ($11,700 - $10,000) / (10,000) = 17%

In Scenario 3, you earned a 17% return on your $10,000 beginning portfolio value.

With positive returns that exceed the costs of leverage, returns are amplified, as seen by Scenario 3’s returns exceeding Scenario 1’s returns.

Conclusion

We hope you enjoyed reading this newsletter. In summary, the topics discussed in this newsletter include:

The relationship between multiple on invested capital (MOIC) and annualized returns is good to understand, both from a knowledge perspective and also from an implementation perspective in matching your investment goals with your return targets. Higher annualized returns lead to higher MOIC.

Big Tech & FANGMAN companies have delivered significant returns to shareholders and stock-owning employees over the past decade.

When an investment loss occurs, it’s important to rationally understand the math behind the returns that are needed to break even and recoup the loss from an investment.

Do not put your portfolio in such an overly financially leveraged position to such a degree that tiny movements in the prices of portfolio investments lead to catastrophic losses.

Leverage is your friend when used appropriately and prudently.

In conclusion, understanding multiple on invested capital (MOIC), historical outcomes, risk mitigation of losses, a changing investing landscape and interest rate environment, and portfolio leverage can help more investors get the odds of investing success in their favor.

References:

"Trailing Returns - XNAS | Morningstar." https://www.morningstar.com/stocks/xnas/nvda/trailing-returns. Accessed 3 Apr. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.