For those who are focused on aggressively growing capital, venture capital is usually a subject of considerable focus. That is, investing in companies in an earlier stage of their life, prior to being publicly traded companies, which entails a greater degree of risk than usual stocks but can also yield greater results. Companies at this stage are more fragile, have a higher chance of failing, and there’s virtually no liquidity in the equity that you own - you’re in it for the long haul.

However, in exchange for an additional litany of risks, you have the chance of obtaining significant multiples on invested capital. As an example (see image above), Garry Tan of Initialized Capital invested $300,000 in Coinbase in 2012, and after its recent IPO, achieved a successful exit with the investment totaling $2 billion in equity, a 6,000x return.

You may be saying to yourself, “Great for Garry. Why does this matter to me?”

Well, until recently, investing in venture capital typically required a much greater upfront investment - often hundreds of thousands or millions of dollars, and was less accessible to the average investor.

Now, the emergence of private investment marketplaces is on the rise. This means that more people are gaining access to venture deals and can invest as little as a few hundred dollars in companies of their choice. There are also more opportunities to purchase shares in the secondary market, creating additional liquidity for everyone involved.

Venture investing also reached a decade high in 2020, totaling nearly $148 billion in total deal value, 4.6x more money than was invested just 10 years earlier.

Furthermore, over the past 5 years, there are only 20 companies in the S&P 500 that had annualized revenue growth rates that exceeded 25%. An investor may choose to invest in these companies or will need to explore companies outside of the S&P 500, both in public and private markets, in order to have a large selection pool of high-growth companies.

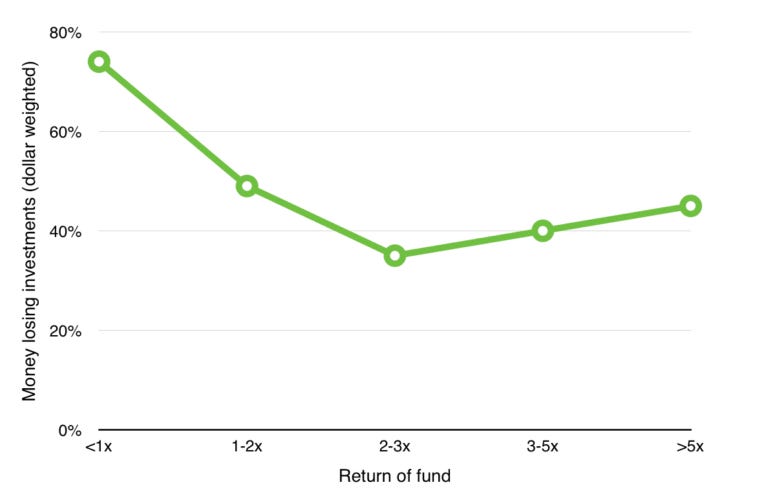

It is also important to note that while the appeal of these types of investments can be attractive, most professionally managed venture funds actually provide investors with suboptimal returns, especially after accounting for risk and fees. Even top returning funds need to accept the fact that statistically, many of their investments will fail (2).

However, the name of the game is “slugging percentage” and not “batting average”. An example provided by Chris Dixon, a General Partner at A16Z calls this the Babe Ruth Effect. Until 1964, Babe Ruth held the record for the most career strikeouts at 1,330. He also hit 714 home runs in his career, giving him the highest slugging percentage of all time. Said differently, instead of focusing on just the probability of winning, focus on the size of the prize: how likely is a victory, and if you win, how big is the victory?

Looking towards data, this is also confirmed by Abraham Othman, Ph.D. and Head of Data Science at AngelList, based on 684 non-negative investments in startups on the AngelList platform (3).

The solid blue line in the graph above represents the actual startup investment data. From this sample, we can observe that while there is a 10% chance that an investment will yield a return above 5x, the chances of achieving a 100x or more return are less than 0.1%, further highlighting the rare and phenomenal results of Mr. Tan in our initial example.

With a brief background on the opportunities in private company investing and the attractive returns that can be achieved, let’s take a look at new and innovative platforms that are helping to broaden access into the venture and startup investing community.

AngelList is a community that provides investment opportunities to accredited investors with minimums as low as $1,000. They assist with talent acquisition, fundraising, and product development. They are also the 800-pound gorilla in the room, having facilitated over $1 billion in investment with over 36% of all top-tier US venture capital deals funded on AngelList.

From an investor perspective, which is what we’re focusing on in particular today, those looking to fund early-stage companies have two core investment options. They may:

Invest deal-by-deal alongside notable investors, thereby acting in a self-directed manner to build their own portfolio while also piggy-backing on the diligence of people with more experience. This option is more attractive for those who hope to learn more about the process, feel as though they have a more direct impact, and would like to test and measure their own decision-making over time. Minimums per investment start at $1,000 but can increase for certain syndicates.

Utilize AngelList’s Access Fund, if the investor wishes to invest capital on a “passive” basis. For a higher minimum of $50,000, investors can pay to have a broad-based portfolio of early-stage companies. This is AngelList’s answer to the rise in popularity of index-based investing whereby individuals retain the decision of how much to invest in an asset class, and in return receive a blanketed exposure. This option can be more attractive for those who don’t want to spend the time building a diversified portfolio and would prefer to spread capital across a large number of companies in order to increase the chances of a higher slugging percentage.

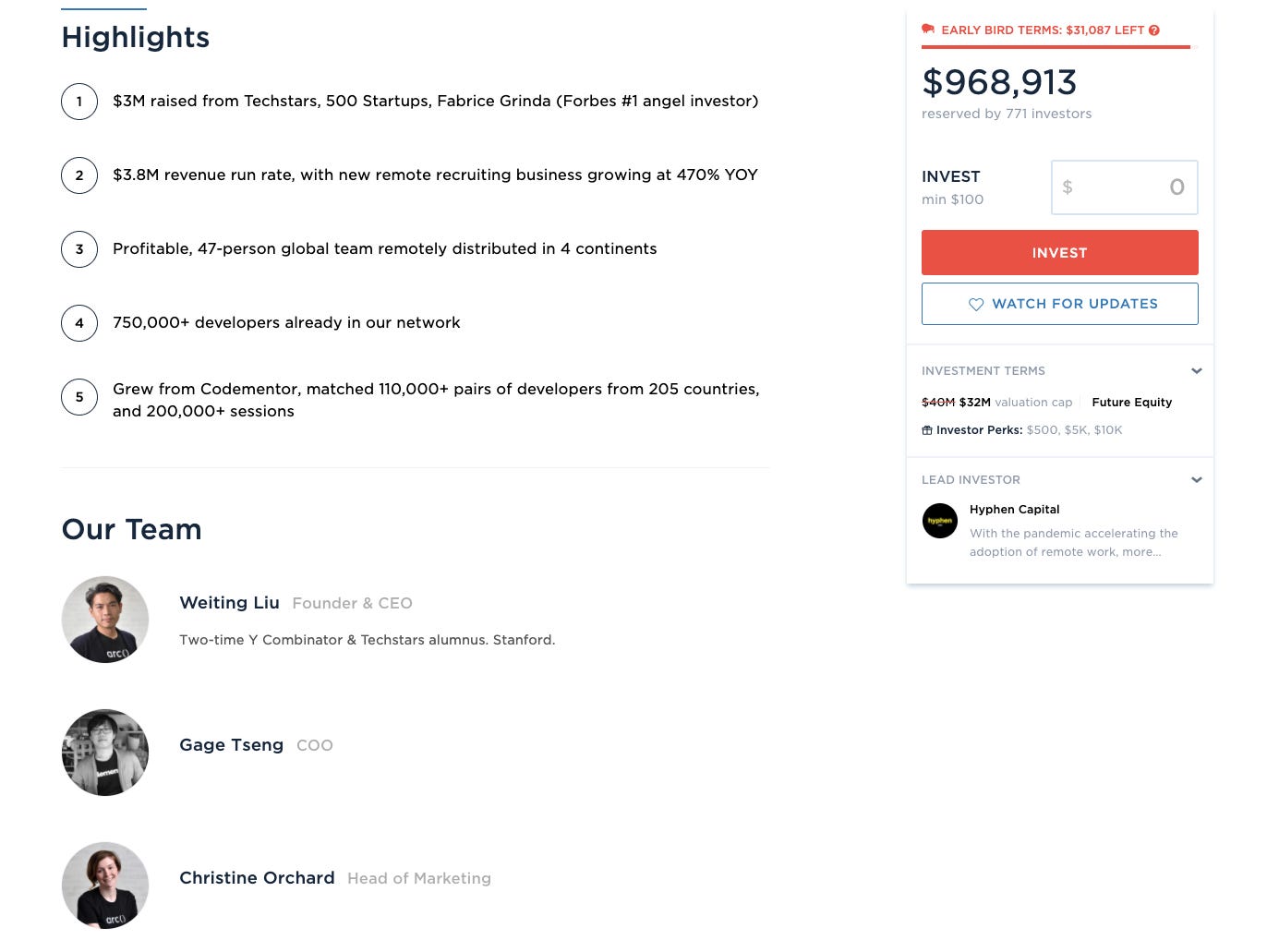

Republic is a rapidly growing platform that helps investors get access to high-growth opportunities in startups, real estate, video games, and crypto-assets. Notable deals on the Republic platform include Carta, Robinhood, and hundreds more.

Similar to the first deal-by-deal investing channel on AngelList, Republic is a self-serve model. Each investment has its own minimum, starting as low as $100, allowing investors to build a very diverse portfolio with less up-front capital commitment. Also, conversely to AngelList, Republic has investment opportunities for both accredited and non-accredited investors.

To date, Republic has helped facilitate over $200 million in investments with over 700,000 members across 250 deals. They also recently announced their Series A round of financing of $36 million in March 2021.

The images below provide a quick snapshot of what a deal looks like on their platform:

The final platform that we’ll mention today, Wefunder, is most similar to Republic of the two companies above. From a user standpoint, a key differentiator is that they provide greater selectivity and categorization, for those who prefer to search by specific themes such as YC-funded companies, “moonshot” ideas, and minority founders, to name a few.

Wefunder deals also start at $100, but again, remain company-specific. Below is an example of Wefunder’s search function specificity and one of their current investment opportunities.

From a capital fundraising perspective, Wefunder most recently completed their seed round and received $9.1 million in funding to date, as opposed to Republic, which raised over $64 million to date.

AngelList, Republic, and Wefunder all provide more accessible means to investing in early-stage and private companies across a number of different themes and categories. These innovators are all helping to fuel the trend of greater access and lower friction across the financial services industry.

As secondary markets are created, liquidity is increased, and the venture capital landscape becomes less opaque and more widely distributed. Through these means, investors who have a greater appetite for risk can enjoy more reliable platforms to broaden their growth portfolios, previously constrained to public market equities only.

A tip on tax-efficient investing

While many investors focus on gross returns, because they often look the best on paper, the true benefit is captured net-of-fees and net-of-taxes. For those reasons, many investors would elect to have investments with high return potential in tax-advantaged accounts. While losses cannot be recognized in order to offset gains or income for tax purposes, a game of slugging percentages can be more conducive to tax-advantaged accounts, since investors plan on future gains significantly outweighing any incurred losses.

One company that is making significant headway in this space is AltoIRA (https://www.altoira.com/). (Note: AltoIRA and Drawing Capital are unaffiliated entities).

Investors can open and fund a retirement account with Alto and immediately gain access to venture investing, cryptocurrencies, real estate, and other asset classes all through their IRA and Roth IRA accounts. Conveniently, AngelList, Republic, and Wefunder are all listed on Alto’s platform as investment partners. So, once your account is funded, you can immediately start investing in high-growth opportunities in a tax-advantaged manner.

Should you have an incredible outcome like Garry Tan with Coinbase or Peter Thiel with his angel investment in Facebook, those gains can either be tax-deferred or tax-free, if invested through a Roth IRA.

If you’d like to learn more about Drawing Capital’s strategy, contact us here.

References

“The year in charts: VC defies 2020 expectations despite the pandemic”. https://pitchbook.com/news/articles/2020-vc-in-charts#:~:text=VC%20fundraising%20showed%20continued%20strength,and%20fund%20count%20since%202010. Accessed 27 April. 2021.

“What is Venture Capital (VC) & How Does it Work?”. https://www.cbinsights.com/research/report/what-is-venture-capital/. Accessed 27 April. 2021.

“Startup Growth and Venture Returns”. https://angel.co/pdf/growth.pdf. Accessed 27 April. 2021.

“Wefunder”. https://www.crunchbase.com/organization/wefunder. Accessed 27 April. 2021.

“Republic”. https://www.crunchbase.com/organization/republic-co. Accessed 27 April. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.