Short Squeezes, GameStop, and Trending Market Dynamics

Weekly updates on the innovation economy.

Drawing Capital Newsletter

February 5, 2021

Investors and non-investors alike have been captivated by the recent activity in the stock market, particularly regarding shares in GameStop, AMC, Blackberry, and other trending stocks on online message boards and forums. Specifically, there is a vicious battle between several multi-billion dollar hedge funds maintaining short positions and both retail investors and institutional investors seeking higher stock prices. Notably, there are millions of retail investors having discussions on online message boards, such as on Reddit’s subreddit titled “Wall Street Bets” (link: https://www.reddit.com/r/wallstreetbets/), to discuss individual stocks and options trading. To note the most prominent case, GameStop (ticker symbol: GME), rose from a closing price on January 4, 2021, of $17.25/share to $483/share at its January peak on January 28th, representing roughly a 2,700% increase in price (see chart below).

As the GameStop story has now been covered ad nauseam, today, in particular, we would like to review some of the mechanics of short squeezes and gamma squeezes, discuss the secondary impacts these have on markets, and briefly mention some of the effects of this type of trading on other participants thus far.

These dynamics may continue to play an interesting role in the coming year(s), and it is important for investors to be aware of how these processes work and what the potential implications might be, whether directly or indirectly participating.

First, Some Basics

Before diving deeper, it is important to understand a few basics. In the context of financial markets, a “squeeze” typically refers to dramatic changes in a company’s stock price that forces investors to make material changes to their position that wouldn’t otherwise be necessary. In making these changes, a continuous ripple effect can be felt across asset prices that are both directly and indirectly involved. Simply stated, a “squeeze” involves a significant imbalance between supply and demand, causing sudden price changes. For purposes today, this squeezing involves forcing the price of the stock higher, of which there are two prevalent types of squeezes:

Short Squeeze - A rising stock price forces short sellers (investors betting that a stock price will decline) to buy back shares that were previously sold, contributing to a further increase in the stock’s share price due to increased demand in buying shares. Short squeezes can increase in intensity when there is high short interest on a company stock. Short interest percentage is the percentage of shares that have been sold short as an open position.

Gamma Squeeze - A high volume demand in buying call options causes investors or market makers that wrote/sold the call options to the buyer to buy shares in the stock in order to hedge the short call option position. As a call option becomes more “in the money”, its option delta typically increases, thereby forcing the investor with the short call option position to buy more shares to maintain a delta-neutral portfolio. Notably, options contracts are leveraged instruments.

The combination of both short squeezes and gamma squeezes can have astronomical effects. This is exactly what we saw with GameStop.

A market maker (MM) typically sells a high volume of options contracts to option buyers and, let's look at a sample scenario:

Suppose person X wants to buy a call option on a company’s shares, and let's assume that a market maker (MM) is willing to sell the call option to person X. When person X buys a call option, person X is synthetically long the underlying shares, and MM is synthetically short the underlying shares. To cover/hedge the risk that a short/naked call option moves wildly against MM's favor, the MM will typically buy shares in the company when selling a call option to person X. This creates a reinforcing feedback loop in which more call option buying from person X and others causes MM to buy more shares to cover the risk of selling call options, thereby further increasing the underlying stock price. The propensity and intensity of this situation with herd behavior in epic proportions, combined with high levels of short interest, can contribute to massive stock price surges.

For short-sellers, either of these events can pose significant losses, impacting the capital of both individuals and major institutions (including hedge fund clients like university endowments, pension funds, charitable foundations, other organizations, and affluent individuals).

New Year, New Squeeze?

Despite the surge in interest in short selling that we’ve seen over the past few weeks, short squeezes and gamma squeezes are not a new nor novel occurrence. Though the “Great GameStop Squeeze” is now the most noteworthy, the stocks of Tesla, Beyond Meat, Tilray, and others have all experienced similar events in recent years.

To recap those events briefly:

December 2020: Tesla’s short-sellers lose nearly $38 billion with share prices soaring 730% for the year. Short interest falls from 20% of the float to 6%. (1)

June 2019: Beyond Meat’s share price jumps nearly 69% in two days with short interest representing 50% of the stock’s float. (2)

September 2018: Shortly after the IPO, Tilray shares skyrocketed 1,400% over the prior 2-month period, leaving short-sellers with losses of $608 million. (3)

Engineered originally by traders on Wall Street Bets, a forum filled with investing ideas, speculative trading strategies, memes, and other content on Reddit, the impacts of the GameStop and AMC squeezes on established funds has been detrimental.

According to Bloomberg, some multi-billion dollar hedge funds, such as Melvin Capital, Point72, D1 Capital, and Maplelane Capital were affiliated with having short positions on Gamestop (GME) shares. When multi-billion dollar hedge funds and their access to leveraged capital start selling existing portfolio positions in order to maintain and rebalance their short positions to avoid a margin call, this multi-billion dollar selling of securities in a single day impacts market prices. (4,5)

Broader Impacts

Although most investors don’t participate in speculative options trading to force a gamma squeeze, there can still be broader implications for the average investor when major players are involved.

According to Bloomberg and the chart below from Morgan Stanley, there was a recent significant deleveraging event among several hedge funds. This deleveraging, combined with all of the investing strategies that follow/track these funds, has led to an unwinding of some portfolio positions and rapid selling of equity positions in several portfolios, which then spread into and impacted broad-based equity markets, such as the stock prices of companies in the S&P 500 Index. As this situation continues to unfold, it is possible to see significant price variability and volatility in specific securities in the short term.

This rapid and forced selling (usually the selling of leading and liquid portfolio positions) in turn contributes to price volatility in stocks that the average investor might hold. This volatility may further influence investor behavior in the short-term, spanning across equity markets.

Short Interest

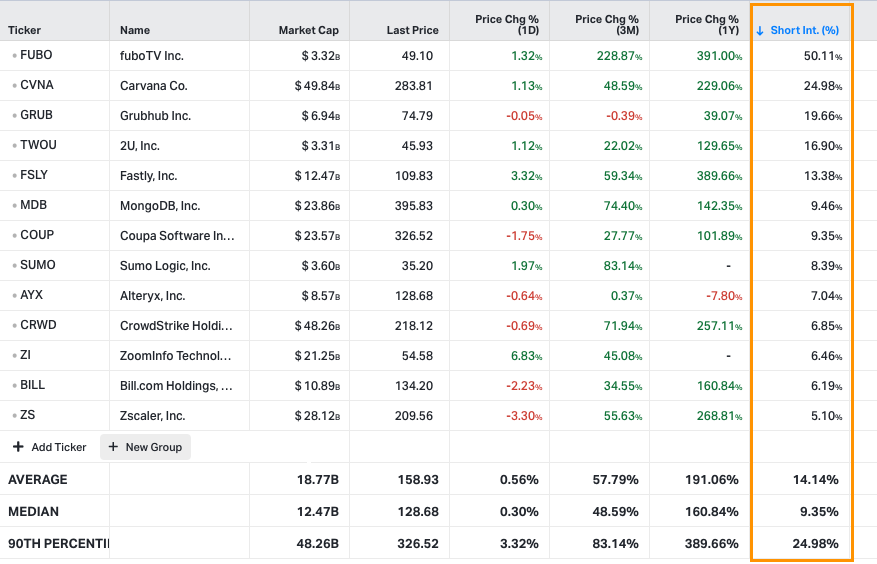

As seen from the chart below (likely skewed due to AMC and GameStop outcomes), appreciating stock prices coupled with high short-interest have produced significant returns in the first month of 2021. In fact, some of the most substantial gains have been made in stocks with material outstanding short interest.

As a reference point, the chart below also depicts outstanding short interest in high-growth technology companies. Many of these stocks have also handily outperformed broader stock indices in the last 3 months, with a median return of over 48% and a short interest of nearly 10%.

Finally, if these targeted short squeezes and gamma squeeze events are likely to persist in the future, it could force those who hope to profit from selling short into other methods and evolve their risk models. It could, on the other hand, simply exacerbate the short-term volatility we’ve recently experienced in the market as the cycle of artificially inflating prices and covering of short positions continue.

Conclusion

Short selling can have significant investment risks. While investors should conduct their own due diligence and base decisions around their own risk appetite and goals, forced selling in high-quality names can present buying opportunities in the near-term. While there is likely to be further deliberation by regulatory authorities surrounding acceptable practices given these extreme recent cases, organized groups may continue to rally behind high-short-interest stocks to drive outsized returns.

Overall, the combination of high short interest, a short squeeze, and a gamma squeeze can create a significant supply-demand imbalance that causes a significant price change in a stock.

It is important to build an investment plan, adapt over time, and implement an investment plan based on your personalized time horizon, risk tolerance, tax preferences, and return targets.

Get in touch to learn more about Drawing Capital’s strategy:

References

“Tesla Short Sellers Lost $38 Billion in 2020 as Stock Surged.” https://www.bloomberg.com/news/articles/2020-12-31/tesla-shorts-sellers-lost-38-billion-in-2020-as-stock-surged. Accessed 3 Feb. 2021.

“Beyond Meat has hit the ‘short-squeeze trifecta’ as borrow fees keep soaring.” https://www.marketwatch.com/story/beyond-meat-has-hit-the-short-squeeze-trifecta-as-borrow-fees-keep-soaring-2019-06-10. Accessed 3 Feb. 2021.

“This chart shows what could really be behind the crazy run in pot stock Tilray.” https://www.cnbc.com/2018/09/20/this-chart-shows-whats-really-behind-the-crazy-rally-in-pot-stock-tilray.html. Accessed 3 Feb. 2021.

“Hedge-Fund Titans Lose Billions to Reddit Traders Running Amok.” https://www.bloomberg.com/news/articles/2021-01-28/cohen-sundheim-lose-billions-to-reddit-traders-running-amok?sref=qE6fM3SJ. Accessed 3 Feb. 2021.

“Loeb’s Third Point Made Money in January Amid Hedge Fund Turmoil.”https://www.bloomberg.com/news/articles/2021-01-30/loeb-s-third-point-made-money-in-january-amid-hedge-fund-turmoil?srnd=premium&sref=qE6fM3SJ. Accessed 3 Feb. 2021.

“Hedge Funds Slashing Equity Exposure At Fastest Pace Since 2014.” https://www.bloomberg.com/news/articles/2021-01-27/hedge-fund-favorites-are-telltale-leaders-in-broad-stock-selloff?sref=qE6fM3SJ. Accessed 3 Feb. 2021.

@chamath. “A children’s book explanation of what’s happening.” Twitter, 28 Jan. 2021, 12:04 pm.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice. At the time of publishing on February 5, 2021, Drawing Capital does not have a long position nor short position in GameStop.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.