Today, we’re exploring soybeans under the ticker symbol $ZS_F. We wanted to start offering some content that helps educate our readers about specific assets that play a large role in the global economy. The most interesting fact about soybeans is that 77% of all soybeans grown are used for animal feed e.g. poultry, hogs, dairy, beef, and aquaculture. Here’s some quick stats about the soybean market.

Global Market Size: $127.81B

Price/Bushel: $10 - $15

Overview

Soybeans are edible beans native to East Asia but now consumed globally in various forms such as canned, dried, fresh, tofu, and soy sauce. Farmers began growing them about 5,000 years ago in China, but it wasn’t until the 1800’s that the U.S. began planting them. Today, the U.S. produces a whopping 50% of the global soybean production!

Soybeans can come in various colors, e.g. black, brown, yellow, etc. We are most familiar with the green kind, which you'll find in Asian restaurants serving Edamame. However, the most common type is actually light yellow.

Soybeans can take anywhere from 100-150 days to grow from seed to plant. The seeds contain 20% oil and 40% protein, which is partly why the two biggest use cases for it are animal feed and consumable oil (for cooking and baking).

The unit of measurement commercially used for soybeans is a bushel, which is equal to 64 U.S. pints as shown below.

Significance

Soybeans are traded as a commodity on multiple global commodity exchanges in the form of futures contracts (a.k.a. “futures”). Futures help producers and consumers hedge against unfavorable price changes by locking in prices ahead of time at the cost of potentially missing future price potential. For example, if soybeans are trading at $10 a bushel today, and farmers think soybean supply will climb because of new exports from South America, then they may want to lock in today's price by selling a future contract expiring at a later date. If the price drops to $8/bushel, the farmer still benefits from the $10/bushel price. However, if price increases to $12/bushel, the farmer misses out on $2/bushel of profits.

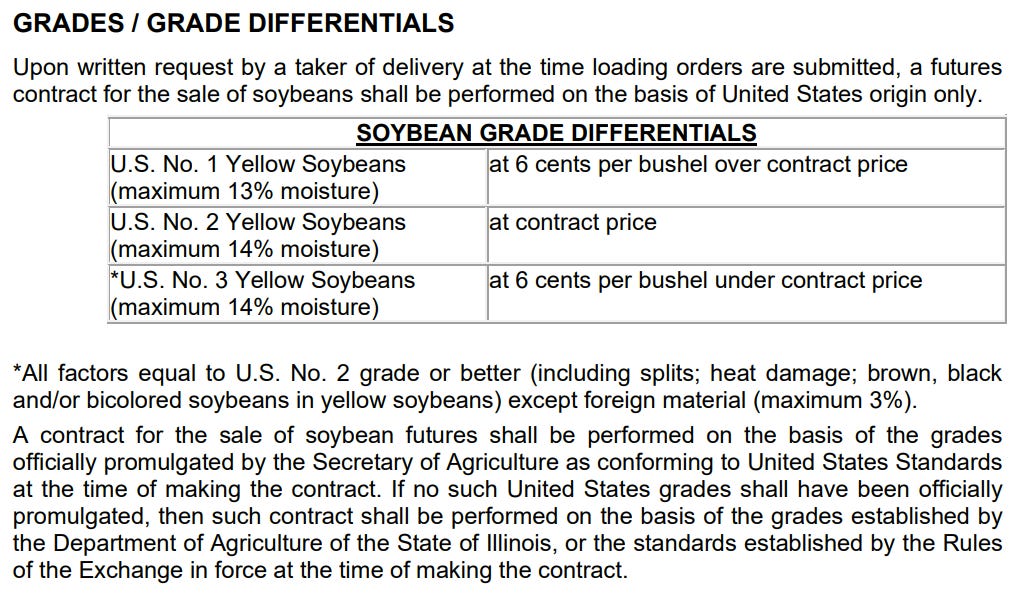

The primary market for soybeans is the CME Group which defines 1 contract as 5,000 bushels of soybeans. See this chart below for types of soybeans specifically traded.

For more info, see: https://www.cmegroup.com/content/dam/cmegroup/rulebook/CBOT/II/11/11.pdf and http://ussec.org/wp-content/uploads/2012/08/Chap2.pdf

It’s interesting to see the different quality standards set on each soybean grade. There are margins of error allowed for certain grades to have certain percentages of undesirable characteristics, such as heat damage (unusable kernels), foreign material (animal waste, glass, and stones), and split beans (25%+ of the bean is missing). Some undesired black, brown, or bicolored beans can also be in the mix, limited up to the percentage allowed by the U.S. Department of Agriculture.

Risks

Investing in or trading soybeans involves substantial risk due to various factors such as weather, politics, and substitutional commodities. Here’s some detailed examples:

Poor weather conditions like rain can delay field work and reduce transportation times or crop yield, which reduces effective supply, causing prices to rise.

Meat demand determines animal demand (e.g. high pork demand increases the number of lean hogs on farms which requires more soy meal for animal feed). This would increase demand for soybeans, thus driving prices up.

Tariffs between the U.S. and China were placed on many products including soybeans. In 2018, China imposed an import tariff on U.S. soybeans, which increased prices in China but lowered prices in the U.S. This would cause opposite price movements in the commodity exchanges for each country (e.g. Chicago Mercantile Exchange vs the Dalian Commodity Exchange).

Corn is a substitutional crop for soybeans because it’s also used as animal feed. If corn prices rise because of increased demand or lower production volume, then we may expect soybean demand and price will consequently rise as corn demand converts into soybean demand.

Input costs such as the price of fertilizer or natural gas used to produce fertilizer will affect soybean production costs. Recently, there's been a fertilizer shortage, which threatens the prices of a lot of plants, including vegetables and legumes like soybeans.

There are various other factors that affect commodity prices and specifically soybeans, such as diseases and more obviously the current supply chain crisis.

Performance

Since soybean futures first began trading, soybean prices have risen steadily from about $2.50/bushel in 1970 to about $13.00/bushel in 2021. That's about a 3.2% average growth rate per year from 1970 to 2022 and almost in line with inflation in the US Dollar as shown in the chart below.

Relative to corn futures, performance has been roughly stagnant because these are substitutional commodities where a majority of usage is in animal feed. Here's a chart depicting relative performance of soybeans ($ZS_F) vs corn ($ZC_F).

Future

With growing demand for soy-based products as people search for alternatives to meat and dairy, soy milk and soy-based meats are growing in demand for lactose-intolerant and vegetarian diets, respectively.

We expect soybean demand to grow, but soybean supply may also rise quickly with South America partaking more in soybean production. Today, the U.S. and Brazil dominate soybean exports, as seen in the chart below.

Brazil in particular has been growing exports the fastest, as supported by their aggressive growth in soybean production shown in the chart below.

Finally, here’s another chart showing each country’s consumption growth of soybeans since 1990. Although China’s production hasn’t grown significantly, their consumption has climbed the fastest globally.

Conclusion

Demand for soybeans is continuously growing for a variety of reasons, ranging from increased animal byproduct production to increased demand for soy products. The fact that soybeans and corn are substitutional products further emphasizes the necessity to grow soybeans in case of a drop in corn supply. Lastly, the rise of Brazil’s soybean production will increase competition with the U.S. and China for control in this growing market.

Resources

Soybean Prices: The top 10 most important drivers - Materials Risk, https://materials-risk.com/soybean-prices-top-10-important-drivers/

Economic Factors that Influence Soybean and Canola Prices, https://digitalcommons.library.umaine.edu/cgi/viewcontent.cgi?referer=&httpsredir=1&article=1567&context=etd#:~:text=Our%20results%20indicate%20that%20soybean,year%20lagged%20soybean%20price%2C%20one%2D

What Are Soybeans and How Are They Used?, https://www.thespruceeats.com/what-are-soybeans-1328635

Uses of Soybeans - North Carolina Soybeans, https://ncsoy.org/media-resources/uses-of-soybeans/

What Are Soybeans Used For? - United Soybean Board, https://www.unitedsoybean.org/hopper/what-are-soybeans-used-for/

Soybean Mar '22 Futures Contract Specifications - Barchart.com, https://www.barchart.com/futures/quotes/ZS*0/profile

Uses for Soybeans - Missouri Soybean, https://mosoy.org/check-off-at-work/domestic-marketing/

Soybeans Futures Trading Basics | The Options & Futures Guide, https://www.theoptionsguide.com/soybeans-futures.aspx

Soybean Overview - CME Group, https://www.cmegroup.com/markets/agriculture/oilseeds/soybean.html#

Soy | WWF, https://wwf.panda.org/discover/our_focus/food_practice/sustainable_production/soy/

USDA Coexistence Factsheets - Soybeans, https://www.usda.gov/sites/default/files/documents/coexistence-soybeans-factsheet.pdf

Global Soybean Market & Volume (2021 to 2027), https://www.globenewswire.com/news-release/2021/10/11/2311593/28124/en/Global-Soybean-Market-Volume-2021-to-2027-by-Consumption-Production-Import-Export-Countries-and-Company-Analysis.html

Soybean Prices - 45 Year Historical Chart | MacroTrends, https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

Long-Term World Soybean Outlook - U.S. Soy, https://ussoy.org/long-term-world-soybean-outlook/

Corporate actors in the South American soy production chain, https://awsassets.panda.org/downloads/southamericansoybeanactorswwf021126.pdf

Global major soybean exporting countries share 2020 | Statista, https://www.statista.com/statistics/961087/global-leading-exporters-of-soybeans-export-share/

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.