Drawing Capital Newsletter

October 16, 2020

Introduction

In 2020, there has been a surge in the number of companies going public. Recently, you may have read or heard about three common methods of a company going public:

Initial Public Offering (“IPO”)

Direct Listing (“DL”) or Direct Public Offering (“DPO”)

Special Purpose Acquisition Corporation (“SPAC”)

In this week’s newsletter, we explore the use of SPACs for several companies going public, the recent commentary about the rise of SPACs from leading venture capitalists, and criticisms of the traditional IPO process.

The decision to choose which method of going public is important because this decision to provide liquidity to shareholders and employees can dilute the ownership of existing shareholders and impact key stakeholders (company’s balance sheet, company’s brand, employees, shareholders, bondholders, customers, etc.). Ultimately, the decision to pursue a public listing involves stakeholder management and finding an appropriate method of financing a company.

6 Common Methods of Financing a Company:

“Bootstrapping” via positive cash flow and revenue growth

Debt financing

Access to financing via venture capital funds, private equity funds, and late-stage crossover funds

IPO

Direct Listing

SPAC

Making a Decision to Go Public via an IPO, Direct Listing, or SPAC

As a growing company seeks access to public markets, a company’s choices often include an IPO, direct listing, or SPAC. A company’s choice of a public listing should ultimately depend on its key priority. Does a company need to raise financing via equity capital? Is a company simply looking to provide a liquid currency to its early investors and employees? Is a company searching for long-term capital partners and advice from thoughtful business operators and investors?

Importantly, in either of these three choices, a company’s public listing date represents just one day (albeit an important milestone day) in a company’s timeline. The company’s financials, business model, and growth trajectory, not the decision of an IPO vs. direct listing vs. SPAC, are the core characteristics that govern the future success and value of a company.

The following summary table below from Michael Mauboussin and Dan Callahan at Morgan Stanley highlight a comparison between IPOs, direct listings, and SPACs (1):

Benefits of Startups Going Public Earlier in Their Lifecycle:

Cleans up the equity cap table and can remove complicated fundraising terms from previous venture capital and private market financing rounds, such as liquidation preferences, super-voting shares, and recapitalizations.

Provides real liquidity to employees.

Allows companies to recruit and retain employees via the company’s shares as an alternative to cash compensation. Equity compensation allows employees to own and participate in a company’s growth. Equity compensation also allows companies to retain more cash on their balance sheet because equity compensation is a non-cash employee expense.

Allows a company to use its shares as public currency for making stock-based acquisitions of other companies.

Allows public market investors to participate in a company’s future growth.

Provides easier access to debt financing for companies.

Provides a branding event to the investment community and the general public.

Increases a company’s transparency with employees, customers, and investors.

Provides more equity capital and cash on a company’s balance sheet via an IPO or SPAC.

Enhances a fast-growing company’s valuation and increases the company’s price multiples, especially since there is a scarcity of high-growth companies in the public markets and because the illiquidity discount is removed.

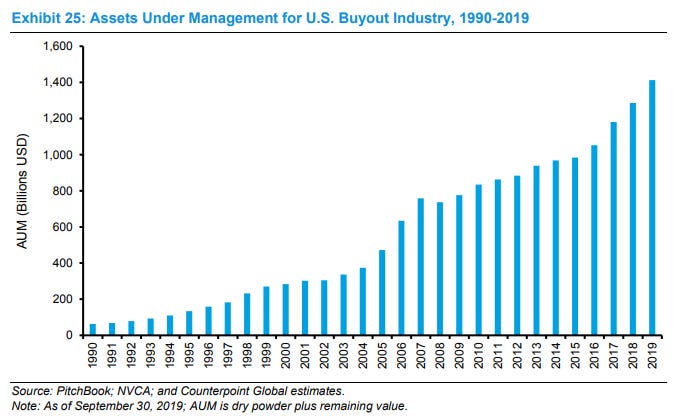

Historical Context and Its Setup for SPACs

Companies are taking longer to go public, there has been a substantial decline in the number of IPOs in America since 1996, and the number of publicly traded companies was cut by almost half between 1996 to 2019. As a result, this historical context led to a constrained supply of high growth companies in the public markets. With low interest rates reducing opportunities in fixed income markets and with a constrained supply of high growth companies in public markets, many institutional investors sought investments in venture capital and private equity funds in order to generate potentially higher returns. The recipe for an incredible demand of public market investors chasing high-growth investments is derived from the combination of this constrained supply of high growth companies in the public markets with the dual facts that an investor increasingly needs to look for high-return strategies to augment low government bond yields in a low interest rate environment. This setup has led to two phenomena: the rise of SPACs to support high-growth private companies seeking a public listing and the continued outperformance in the past decade of growth-oriented strategies against dividend-value-oriented strategies.

The following charts from Yardeni Research highlight S&P 500 company revenues and the growing delta between the S&P 500 Growth Index versus the S&P 500 Value Index. Interestingly and based on the charts, while S&P 500 company revenues grow in the long run, S&P 500 revenues per share have not exceeded a 20% yearly change in revenue growth in the past 25 years. (2,3,4):

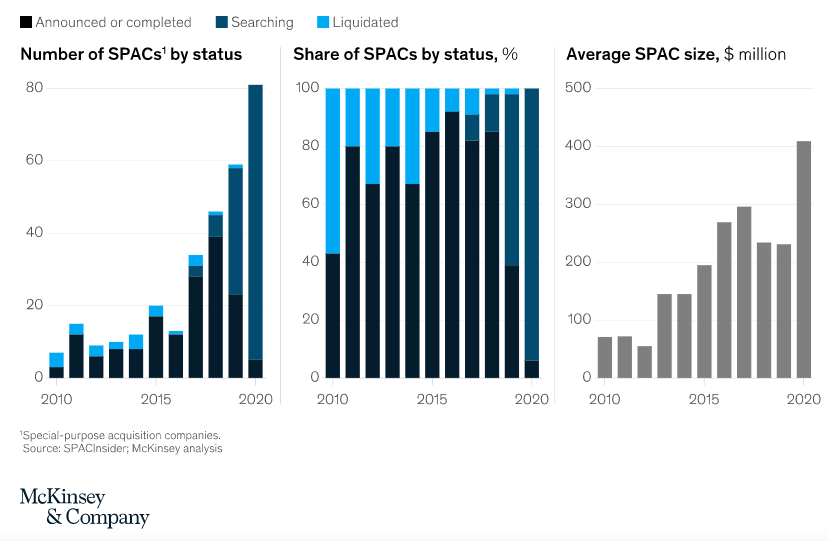

The following charts from McKinsey & Company highlight the growth in SPAC transactions and the historical performance alpha of operator-led SPACs compared to investor-led SPACs, as of September 23, 2020 (5):

The following charts from Michael Mauboussin and Dan Callahan at Morgan Stanley highlight the declining number of American IPOs and publicly listed companies since 1996, the growth of assets under management by the American venture capital and private equity buyout ecosystem, and the increasing duration in time it takes a company to go public (6):

Leading Venture Capitalists & Technologists Have Provided Commentary on the Traditional IPO Process and SPACs

Commentary from Reid Hoffman

(7)

Reid Hoffman recently co-launched a SPAC titled “Reinvent Technology Partners” (ticker: RTP). In Mr. Hoffman’s published LinkedIn post, he summarizes the SPAC movement as an alternative to a traditional IPO with the following quote, “The reason I think SPACs are hot right now is the lack of innovation in the IPO process. Most IPOs are managed by a handful of investment banks who run a roadshow to sell stock to risk-averse institutional investors. The result is a slow, expensive process that transfers value from the startups and their shareholders to the banks and their clients”. A key advantage that Hoffman perceives with SPACs is the committed financial relationship and operational expertise that a SPAC sponsor has with a corporate executive team during and after a company goes public. As companies find a way to “reinvest themselves”, SPACs offer a continuation of a “venture capital at scale” model with many “blitzscaling” benefits for rapidly growing companies.

Commentary from David Sacks

(8)

David Sacks compared and contrasted IPOs, direct listings, and SPACs in a recent podcast. In private funding rounds, founders and the startup’s executive management team know the dilution, the company’s market valuation, and the amount of capital that is raised. In an IPO, all three of these traits are unknown to the company executives that are taking a company public. As an alternative to an IPO, a SPAC provides certainty on these three traits. In a way, one can picture a SPAC as a combined hybrid between a late-stage venture capital financing round and a direct listing. As a result of some of the recognized benefits associated with SPACs and direct listings and due to the frequent discussions in the Silicon Valley ecosystem regarding these topics, there is rising popularity for both SPACs and direct listings in 2020 that is put into action. For example, Asana and Palantir both went public via a direct listing in September 2020.

Commentary from Alex Rampell and Scott Kupor

(9)

There is no panacea that solves all issues associated with the traditional IPO process. For all of the criticism that a traditional IPO process receives, Rampell and Kupor argue that an IPO process is certainly a valid approach for a company going public. Notably, Rampell and Kupor offer a few key suggestions for improving the traditional IPO process:

Reduce information asymmetries and increase transparency in the IPO process.

Bring more innovation on blurring the lines between private and public investments.

Reduce the significant supply/demand dynamics that are reinforced by traditional 6-month lockups for private investors and employees.

Improve the aggregation of an accurate demand curve from IPO investors in an effort to improve the price discovery process, which also reduces the severity of a company’s dilution with low-priced IPO shares.

Commentary From Bill Gurley

(10,11)

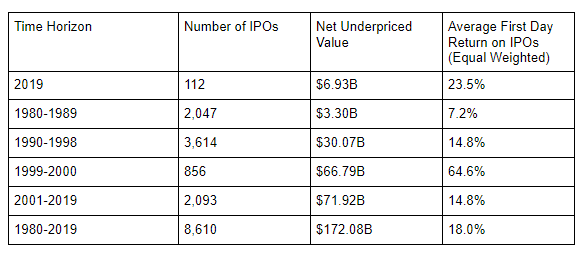

Bill Gurley, Benchmark Capital, and Professor Jay Ritter have organized and analyzed IPO data. Their analysis indicates that in aggregate, the process of pursuing a traditional IPO is costly and inefficient. In September 2019, Bill Gurley presented compelling IPO data on CNBC, with a focus on answering 2 key questions:

From Professor Jay Ritter’s IPO dataset, what is the value of an underpriced IPO?

Net underpriced value is defined as: net underpriced value = closing stock price on IPO date – offering price of IPO.

According to a CNBC interview with Bill Gurley, which lead underwriting investment bank underpriced IPOs the most over the past 10 years ending September 2019?

Surprisingly, if a startup chooses the best investment bank to work with for an IPO (arguably Goldman Sachs and Morgan Stanley), then the startup gets the worst execution in terms of underpricing the shares during the IPO.

Bill Gurley’s common criticisms of the traditional IPO process include the following:

Investment banks are increasingly under scrutiny about their multiple-agency problem of trying to satisfy both their corporate client and their buy-side clients during a traditional IPO process. If an investment bank dramatically under-prices an IPO, then it has an easier endeavor in marketing the IPO, and its buy-side clients have the ability to buy these IPO shares at a deeply discounted price, with the tradeoff being that the company engaging in an IPO raises money on terms that are below market prices. Inefficient capital markets transfer wealth towards advantaged parties, impact discount rates in valuation methods, and impact a company’s financing and cost of capital.

Many investment banks have little to none of their own monetary capital that is being invested in IPOs. Many investment banks are agents that facilitate the selling of IPO shares, and the “greenshoe” provision that is available for IPO price stabilization may actually generate more profits for the underwriting investment bank in an IPO.

There is a significant supply-demand issue at the time of the IPO. The scarcity of shares being offered in the IPO process, oversubscribed IPO offerings, the lock-up provisions for existing employees and early investors, and the hand-picking of share allotments to key public market investors are all factors that often lead to a constrained supply of shares for a company at the time of the IPO. Combining constrained supply with high demand from public market investors leads to a manufactured price appreciation on the day of the IPO.

By shining a light on the traditional IPO process, it is the hope of many parties involved to have a more efficient and quicker IPO process or pursue alternatives to an IPO, such as a direct listing or a SPAC.

Commentary from Chamath Palihapitiya

(12, 13, 14, 15,16)

In November 2017, Chamath Palihapitiya articulated that fewer companies are seeking a public listing or delaying a public listing towards a later point in a company’s lifecycle. Illiquidity is one concern, but the second concern involves a lack of technology-driven, API-based “knowledge as a service” (“KaaS”) and “capital as a service” (“CaaS”) systems for startups. As a corollary to Amazon Web Services (“AWS”) providing cloud computing services to companies via an “infrastructure as a service” (“IaaS”) or “platform as a service” (“PaaS”) model, SPACs can simultaneously solve the illiquidity problem and provide both KaaS and CaaS platforms to startups by partnering with committed sophisticated capital providers that have deep domain expertise in a specific industry.

In terms of SPAC transactional activity, Mr. Palihapitiya has certainly gained investor and media fanfare and provided leadership to the Silicon Valley ecosystem. Mr. Palihapitiya’s successful IPOA & Virgin Galactic SPAC transaction both provided validation to his “IPO 2.0 Movement” and triggered a wave of new SPAC transactions. Mr. Palihapitiya has reserved NYSE ticker symbols IPOA through IPOZ, indicating that Social Capital Hedosophia Holdings intends to sponsor 26 SPAC transactions. IPOA completed a SPAC transaction with Virgin Galactic, Opendoor announced a SPAC transaction with IPOB, and Clover Health announced a SPAC transaction with IPOC.

Mr. Palihapitiya feels that the best SPAC sponsors have both deep domain expertise in building companies and extensive knowledge of sophisticated public market investors. As a result, he implies that operator-led SPACs often outperform SPACs with SPAC sponsors that are simply financially-engineered arbitrageurs or self-enriching middlemen.

The previous chart from McKinsey & Company’s SPAC analysis confirms this finding regarding operator-led SPACs versus investor-led SPACs.

Reviewing Mr. Palihapitiya’s recent five SPAC transactions in ticker symbols $IPOA, $IPOB, $IPOC, $TRNE, and $FVAC, one can deduce a list of implied parameters that Mr. Palihapitiya seeks when evaluating SPAC transactions:

Find large markets with a significant incumbent-dominated market. Often, these incumbent-dominated markets have mediocre or low customer satisfaction scores and inadequate technological progress. Examples of these markets include healthcare, education, space travel & tourism, residential real estate, decarbonization, financial services, manufacturing, and other industries.

Look at companies with reasonable valuations. Forward projected EV/revenue ratios and other price multiples should be modest, especially when compared to other high-flying software and cloud computing companies.

Look for a virtuous cycle with potential future flywheel effects.

Look to leverage technology and operating expertise to scale businesses.

Look for disruptive technologies that enable durable moats in businesses. These types of technologies enhance consumer experiences, can decrease costs, can increase the speed of delivery to consumers and enterprises, and questions an incumbent company’s business model.

Look for a margin of safety based on both modest valuation multiples and strong underlying industry tailwinds.

Focus on companies and technologies that have the asymmetric potential to provide transformative experiences, advance humanity forward, and solve hard problems.

Democratize investor access and improve liquidity by allowing public market investors to finance and invest in the long-term growth of iconic technology companies.

Avoid companies that spend large customer acquisition costs on Google and Facebook.

Avoid companies that do not have strong projected future revenue growth rates.

Build a portfolio of companies with the possibility of generating a 10X return in 10 years.

The summation of the above factors provides high conviction to warrant a minimum investment of $100M of his personal capital. There is greater alignment of interests when the SPAC sponsor acts as a “principal” rather than as an “agent”.

Conclusion

The decision for a company to seek a public listing of its shares on a stock exchange represents an important milestone in a company’s journey. The recent rise in direct listings and SPACs as formidable alternatives to the traditional IPO process demonstrates the growing need for enhanced transparency, efficiency, prioritization of goals, and stakeholder management. We hope you enjoyed reading these data-driven and qualitative dialogues regarding public listings and their historical context.

References:

(1) "Public to Private Equity in the United States: A Long-Term Look." 4 Aug. 2020, https://www.morganstanley.com/im/publication/insights/articles/articles_publictoprivateequityintheusalongtermlook_us.pdf?1596549853128. Accessed 7 Oct. 2020.

(2) "Market Briefing: S&P 500 Revenues, Earnings, & Dividends." 30 Sep. 2020, https://www.yardeni.com/pub/stmktbriefrevearndiv.pdf. Accessed 7 Oct. 2020.

(3) "S&P 500 Revenues & Earnings Growth Rates - Yardeni ...." 30 Sep. 2020, https://www.yardeni.com/pub/sp500revearngr.pdf. Accessed 7 Oct. 2020.

(4) "S&P 500 Revenues & Earnings Growth Rates - Yardeni ...." 30 Sep. 2020, https://www.yardeni.com/pub/sp500revearngr.pdf. Accessed 7 Oct. 2020.

(5) "Earning the premium: A recipe for long-term SPAC success ...." 23 Sep. 2020, https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/earning-the-premium-a-recipe-for-long-term-spac-success. Accessed 7 Oct. 2020.

(6) "Public to Private Equity in the United States: A Long-Term Look." 4 Aug. 2020, https://www.morganstanley.com/im/publication/insights/articles/articles_publictoprivateequityintheusalongtermlook_us.pdf?1596549853128. Accessed 7 Oct. 2020.

(7) "Reinventing the SPAC - LinkedIn." 5 Oct. 2020, https://www.linkedin.com/pulse/reinventing-spac-reid-hoffman. Accessed 7 Oct. 2020.

(8) “SPAC Talk With Chamath Palihapitiya, David Friedberg, David Sacks & Jason Calacanis from Episode 7”. All In Podcast. 29 Sept. 2020. All In Podcast. 29 Sept. 2020,https://www.youtube.com/watch?v=ichI8T-QuCE. Accessed 7 Oct. 2020.

(9) "In Defense of the IPO, and How to Improve It." 28 Aug. 2020, https://a16z.com/2020/08/28/in-defense-of-the-ipo/. Accessed 7 Oct. 2020.

(10) "Tech investor Bill Gurley says top-tier banks ... - YouTube." 10 Sep. 2019, https://www.youtube.com/watch?v=6K3agvxaJlc. Accessed 7 Oct. 2020.

(11) "Jay Ritter's IPO Data - University of Florida." https://site.warrington.ufl.edu/ritter/files/IPOs2019_Underpricing.pdf. Accessed 15 Oct. 2020.

(12) "Palihapitiya in $4.8 billion SPAC deal for real estate start-up ...." 15 Sep. 2020, https://www.cnbc.com/2020/09/15/palihapitiya-finds-next-10x-idea-with-4point8-billion-spac-deal-for-real-estate-start-up-opendoor.html. Accessed 7 Oct. 2020.

(13) "High space tourism demand for Blue Origin and ... - CNBC.com." 28 Oct. 2019, https://www.cnbc.com/2019/10/28/high-space-tourism-demand-for-blue-origin-and-virgin-galactic-ceo-says.html. Accessed 7 Oct. 2020.

(14) "Chamath Palihapitiya to take Clover Health public in $3.7B ...." 6 Oct. 2020, https://www.cnbc.com/2020/10/06/chamath-palihapitiya-to-take-clover-health-public-in-another-spac-deal-worth-3point7-billion.html. Accessed 7 Oct. 2020.

(15) "E776: Social Capital Chamath Palihapitiya: VC ... - YouTube." 8 Nov. 2017,https://www.youtube.com/watch?v=3YMq_YFSaUI. Accessed 7 Oct. 2020.

(16) “SPAC Talk With Chamath Palihapitiya, David Friedberg, David Sacks & Jason Calacanis from Episode 7”. All In Podcast. 29 Sept. 2020. Accessed 7 Oct. 2020.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.