Introduction

The total addressable markets ("TAM") for several industries and sectors have been expanded by global internet distribution. Conceptually, we can see this in the following example:

If you operate a gas station, your addressable market is restricted to travelers, car renters, and car owners in your locality.

If you operate a social network or online store, your theoretical addressable market is anyone that has access to the internet.

With massive distribution at scale with reasonably low variable costs, social commerce combines the network effects found on social media platforms and the growth of e-commerce to create a growing TAM. Placing numbers around this e-commerce narrative and growing TAM, FIS Worldpay estimates that global e-commerce spending may reach $7.3 trillion or more by 2024, which represents a significant increase from the ~$4.6 trillion in e-commerce spending in 2020.

In this newsletter, we explore the following 5 topics:

Social commerce and the “influencer economy”

E-commerce research from FIS Worldpay

Two roadmaps for value creation in e-commerce and financial payments

The rise in cashless payments in China

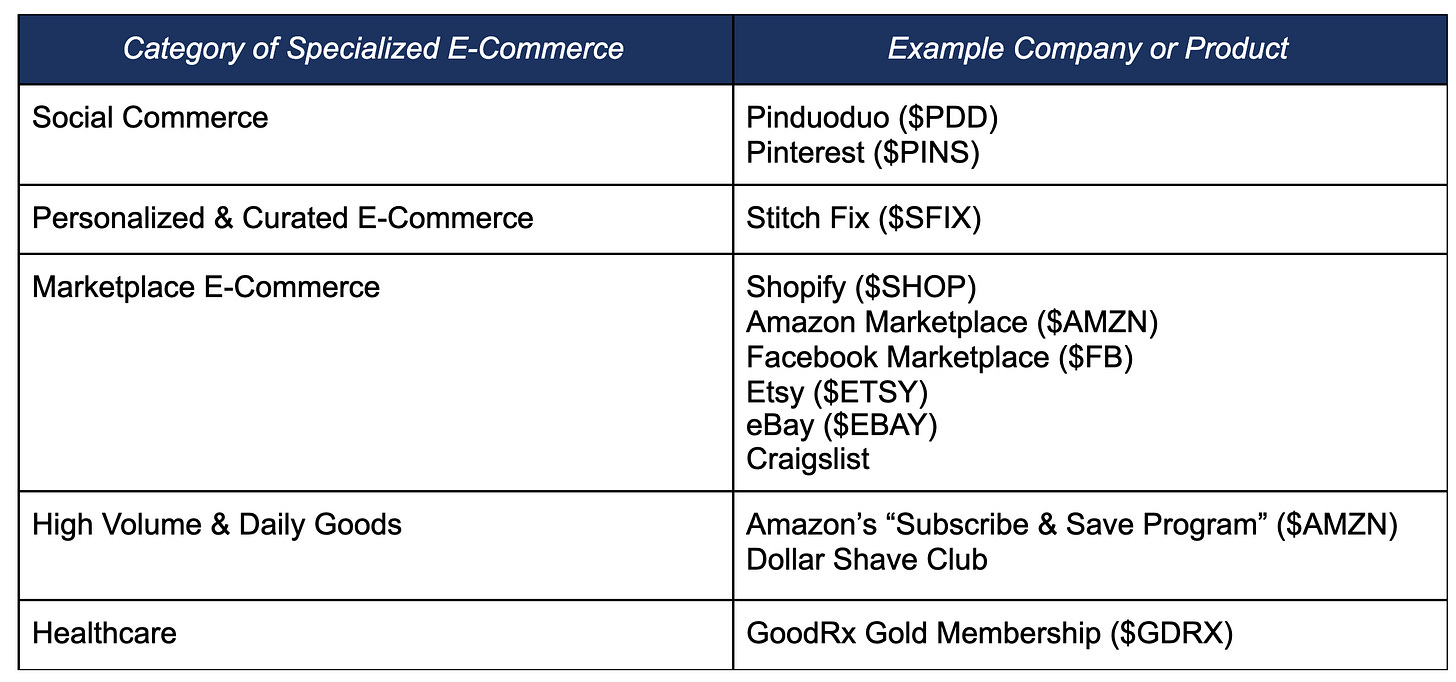

Curated list of sample e-commerce companies by e-commerce sub-category and geography.

In addition, Drawing Capital recently co-hosted a webinar with Interactive Brokers to discuss social commerce and the future of e-commerce in a post-pandemic world. You can view a recording of the webinar and the webinar presentation deck at this link: https://ibkrwebinars.com/webinars/e-commerce-in-a-post-pandemic-world/

Rise in Social Commerce

Social commerce represents the intersection of e-commerce and social media platforms. Social media platforms encourage multi-hour viewing of their apps on a daily basis. Spending hours of time per day on something will almost certainly influence a person’s behavior over time. If you played basketball 3 hours a day, you would probably be very good and actively put up stats in local basketball leagues. Conversely, if you scroll through photos and videos on Tik Tok and Instagram for 3 hours a day, the mind almost certainly starts to act differently in noticeable and nuanced ways.

The rise of the influencer economy and creator economy is influencing individual purchasing decisions. Especially in fashion and beauty products, influencers and celebrities are increasingly partnering with and getting paid by trending brands to advertise a specific set of products. Additionally, sites like Pinterest provide a source of inspiration to pin and save items that drive future consumption. In 2020, Grand View Research estimated that apparel and beauty products were the largest segment of social commerce:

Grand View Research estimates the growth rate for global social commerce to grow at a ~28% CAGR from 2021-2028. Global market size for social commerce was ~$475B in 2020.

Leading Apps in Social Commerce

Social commerce involves the proliferation of social media platforms and the “influencer economy” to promote and sell products and services. The biggest social media platforms for social commerce currently include Instagram, Pinterest, Tik Tok, Douyin, Sina Weibo, Taobao, WeChat’s Mini Programs, YouTube, Facebook, Snapchat, Poshmark, and more.

Notably, there are different marketing and distribution strategies across different social media platforms. Tik Tok favors informal musical content with short videos while YouTube is more accustomed to longer video formats. Twitter promotes re-sharing of information and virality of its broadcast platform via re-tweets, while Snapchat focuses on a more personalized ephemeral messaging and video experience based on your friends and contacts.

Adoption of Mobile Payments

The following illustration highlights the common parameters associated with adopting mobile payments:

First and foremost, the adoption of mobile payments starts with trust and convenience. If consumers do not understand or believe in the integrity of a mobile payment platform, then usage is likely to slow or be minimal over time. Consumers need a product hook to generate engagement, and an innovative distribution channel allows fintech payment providers to globally grow at scale.

Another common parameter is the necessity for network effects. For example in peer-to-peer payments, if a person is not on the Zelle network or Venmo app, then it’s difficult to transfer money across Zelle or Venmo. More users on the network create more value to existing and future users on quality networks, thereby creating accumulating benefits for the network owner. Additionally, a fintech provider generates network effects by connecting with more merchants and developing pattern recognition models as the fintech provider learns and gathers more data. In retail stores, the payment technology needs to be able to accept digital payments, debit cards, and credit cards in order for users to feel encouraged to adopt digital and cashless payments.

A third common parameter to highlight is convenience. When mobile payments are better, faster, cheaper, more secure, and more convenient to users, the adoption of mobile payments and digital wallets will continue to grow. Another example of convenience is the saving of address and account information in secure online accounts to reduce the time needed to complete online checkout for consumers. From a security perspective, Apple Pay uses a Device Account Number and a randomization engine to protect the security of a credit card number and also adds either fingerprint or FaceID authentication when an individual uses Apple Pay to pay.

2 Roadmaps for Value Creation in E-Commerce

The following chart highlights examples within 2 roadmaps of value creation in e-commerce and financial payments:

The first roadmap involves invention and creation, implying a re-imagination of an existing process, product, or a way of how something is done to drive value creation. Examples in this area include 2 factor authentication for user trust and security, the creation of digital wallets such as Apple Pay, AliPay, and Google Pay, credit cards and debit cards, and online payment infrastructure from Stripe, PayPal, and other companies. A neat fun fact is that in 1991, regulatory reform essentially allowed online shopping to exist in America. In 1992, the first text message was sent, and text messaging was a necessary precursor to 2 factor authentication.

The second roadmap on the right side of this slide involves optimization and convenience, implying improvement (either incremental or transformative) of existing ideas, products, and processes to drive value creation. For example, buy-now-pay-later enabled greater purchasing with less monetary friction with the ability for consumers to access the product before fully paying for it, i.e. paying for it over time through a series of monthly installment payments. While the concept of buy-now-pay-later is not necessarily new, the application of this concept into e-commerce has benefited several companies and consumers. Buying a house with a mortgage is another traditional method of buy-now-pay-later in that you gain access to the house now while paying for it over time via ongoing installment payments. Another example of optimization is the use of subscription membership services to promote customer loyalty and drive additional corporate revenue, such as Costco’s annual membership, Amazon Prime membership, and DoorDash’s DashPass.

Other examples of e-commerce and payment conveniences include easy return policies, free shipping, consistency and repeatability of service, good user interfaces and intuitive design on online shopping websites and mobile apps, and the use of login credentials to save account info, credit card info, and shipping addresses, which simultaneously reduces friction for consumers when making new purchases and allows the e-commerce provider to learn more about their individual customers.

Research from FIS Worldpay

From the FIS Worldpay e-commerce research report that was published in February 2021, we summarize 5 important highlights:

2020 was a milestone year for digital wallet usage compared to in-store point-of-sale payments. 2020 was the first year that digital wallet usage exceeded the utilization of cash for the first time for in-store point-of-sale payments. In France, Norway, Sweden, Australia, Canada, and the UK, the use of cash for in-store payments fell by 50% or more. In America, cash payments dropped by ~$400 billion to reach $1.0 trillion in the value of cash-based in-store payments in 2020.

Buy-now-pay-later products are estimated to double its market share by 2024 from the current ~2.1% market share level.

Digital wallets are estimated to be more than half of all e-commerce payments worldwide by 2024 to become the dominant global e-commerce payment method. Consumers are increasing their willingness to adopt digital payments and enjoy their financial benefits and non-financial benefits.

The combination of digital wallets, credit cards, and debit cards are estimated to exceed 75% in market share for e-commerce payment methods by 2024 in North America. On the other hand, usage of charge cards, cash-on-delivery, bank transfers, and prepaid cards is estimated to decline in market share in 2020-2024.

Mobile and social commerce, combined with changing consumer preferences, continue to drive greater e-commerce adoption and spending. Total e-commerce spending in 2020 was worth about $4.6 trillion in value, and FIS Worldpay estimates suggest that this number could increase to $7.3 trillion or more by 2024.

Sample E-Commerce Companies

Leading E-Commerce Companies by Geography

Closing Thoughts

The totality of consumer expenditure is measured in the trillions of dollars annually and represents the majority of America’s GDP.

Consumer spending has increased with mobile-friendly shopping apps, subscription service business models, social media algorithms that amplify and recommend products and services to consumers, and the concept of the “buy now, pay later” phenomenon.

The e-commerce tailwind for numerous companies will continue because e-commerce can increase price uniformity, provide more transparency and information to consumers in a decentralized method with the internet, make online prices more sensitive to change due to competitive forces, and alter the price level of certain goods and services for the benefit of consumers.

For investors, significant opportunities exist to surf the multi-trillion-dollar e-commerce wave. For founders and entrepreneurs, there are tremendous opportunities to build e-commerce companies that address specific industry verticals or existing pain points in order to drive value creation.

Across major countries, there is a repeated trend towards cashless payments in transactions, which can be measured as a decreasing percentage of cash used in payment transactions by volume.

When e-commerce provides a cheaper, faster, and more convenient experience to consumers, then consumers will increasingly choose e-commerce in lieu of in-person commerce.

A combination of both invention and optimized convenience in the e-commerce ecosystem will continue to drive increasing e-commerce market penetration as a percentage of total sales.

Social commerce and improved consumer experiences on mobile devices are driving the next wave of e-commerce spending. Retailers that connect with influencers and celebrities can leverage their personal brand and distribution channels to create viral product adoption and revenue growth.

Companies that are combining a social element to e-commerce with the “influencer economy” or “attention economy” are seeking faster sales growth and user engagement.

E-commerce purchases are increasingly being made on mobile devices and digital wallets. In fact, mobile-based e-commerce transaction dollars are more than twice the amount of desktop-computer-based e-commerce transaction dollars. As a result, it has now become necessary for retailers to have a comprehensive and competitive e-commerce strategy with an excellent user experience on mobile devices.

References:

(1) "Social Commerce 2021 - Insider Intelligence Trends ... - eMarketer." 3 Feb. 2021, https://www.emarketer.com/content/social-commerce-2021. Accessed 2 Mar. 2021.

(2) "Social Commerce Market Size Worth $3,369.8 Billion By 2028." https://www.grandviewresearch.com/press-release/global-social-commerce-market. Accessed 2 Mar. 2021.

(3) "Social Commerce Market Share Report, 2021-2028." https://www.grandviewresearch.com/industry-analysis/social-commerce-market. Accessed 2 Mar. 2021.

(4) "Digital Wallets Eclipse Cash Globally at Point of Sale for First Time ...." 24 Feb. 2021, https://www.businesswire.com/news/home/20210224005222/en/Digital-Wallets-Eclipse-Cash-Globally-at-Point-of-Sale-for-First-Time-During-Pandemic-FIS-Study-Finds. Accessed 2 Mar. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.