Overview

As a new part of Drawing Capital’s newsletter, we’ll be providing a monthly snapshot of popular technology company stocks. Readers and investors often ask for a “pulse check” on these parts of the market, so we now intend to provide that value at scale. Even if investors don’t have direct exposure through individual stocks, several of these names are present in popular ETFs, mutual funds, and stock market indices.

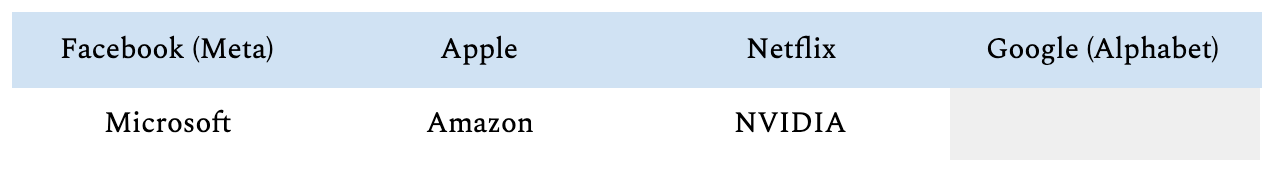

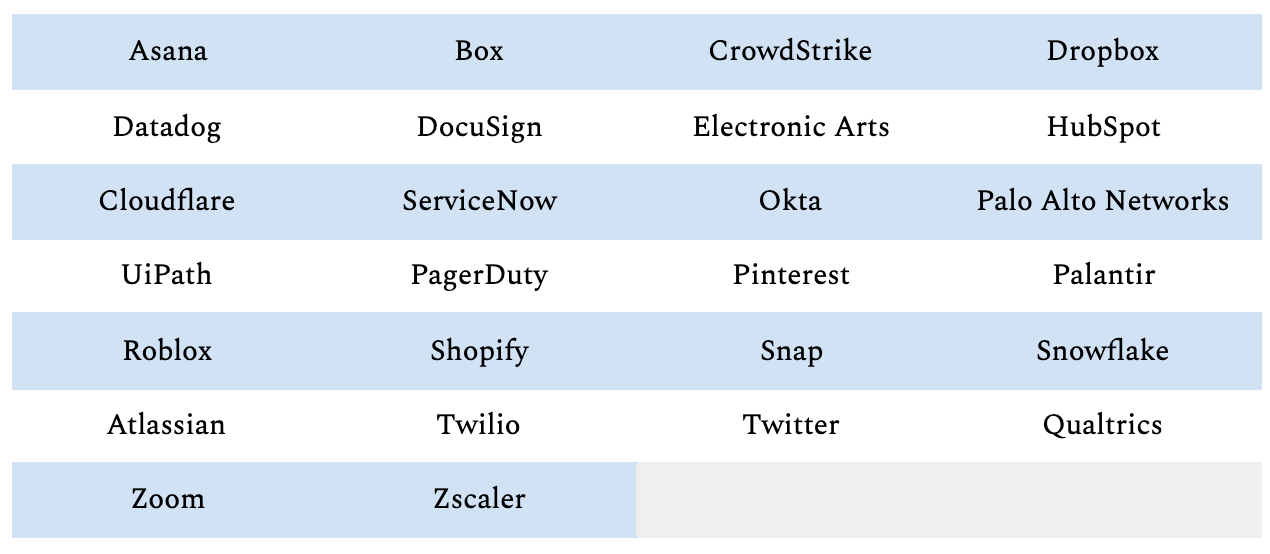

Company Cohorts

Cohorts are broken down into three categories: FANGMAN, Large Technology Companies, and Software Companies. The companies that comprise each category are as follows:

FANGMAN Companies

Large Technology Companies

Software Companies

*Note: Market data as of 1/14/2022; some values have been rounded to the nearest whole number for visual clarity. Data is from Koyfin.

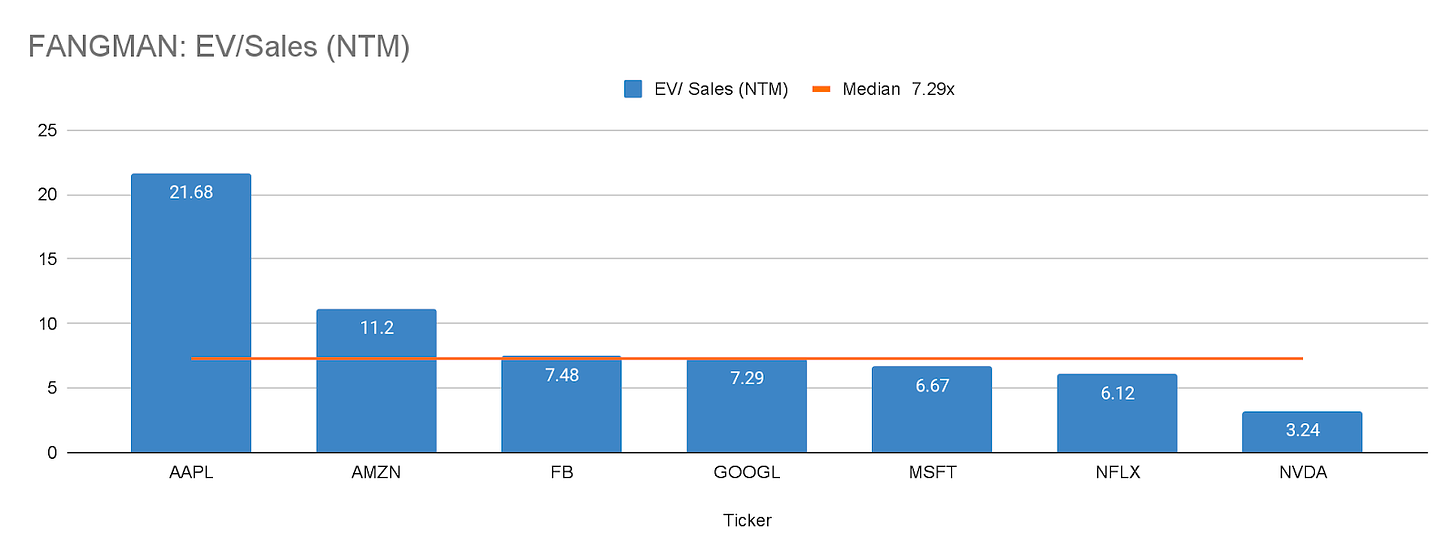

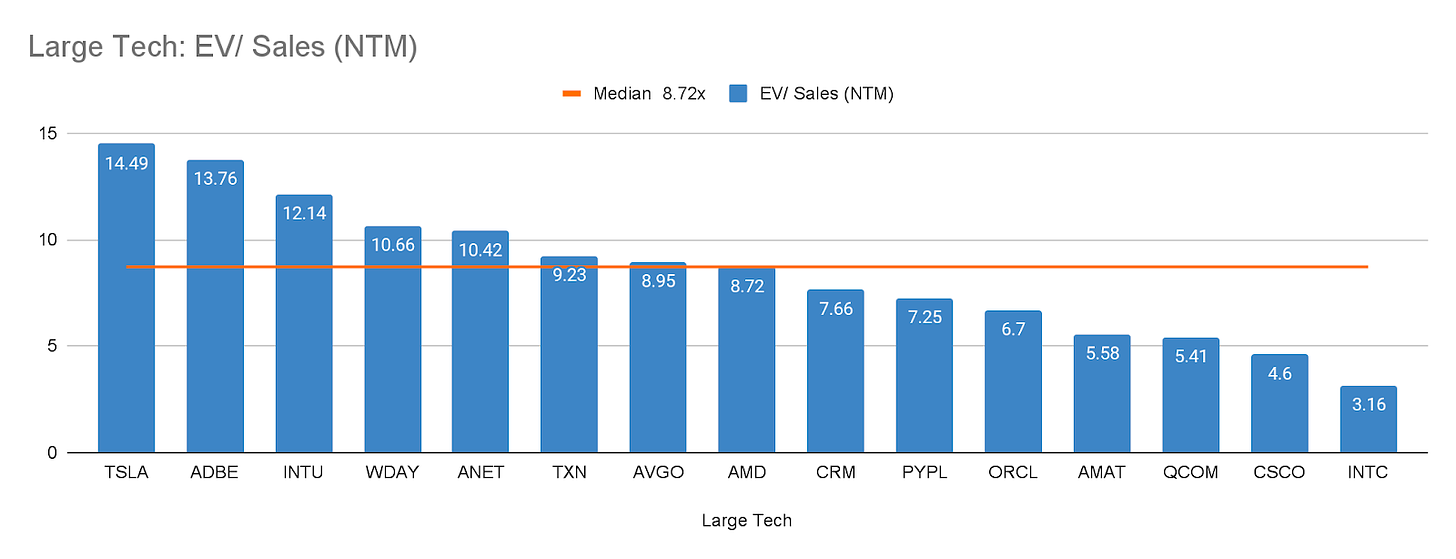

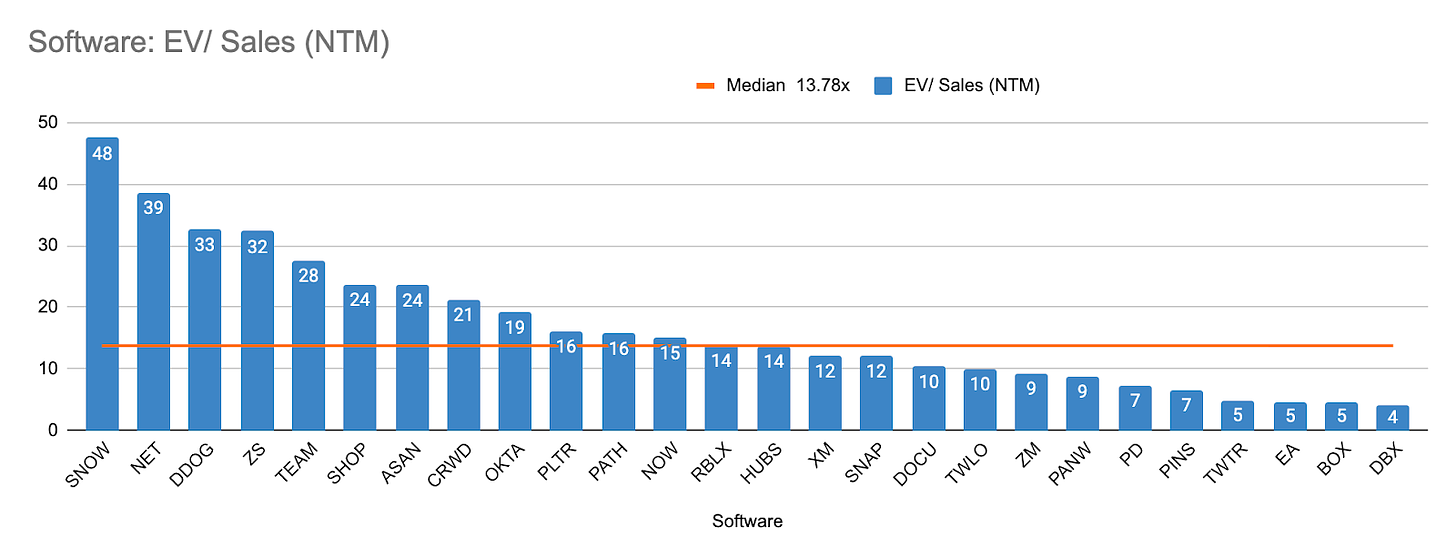

Multiples (EV/ NTM Sales) – Enterprise Value to Next 12-Months Sales

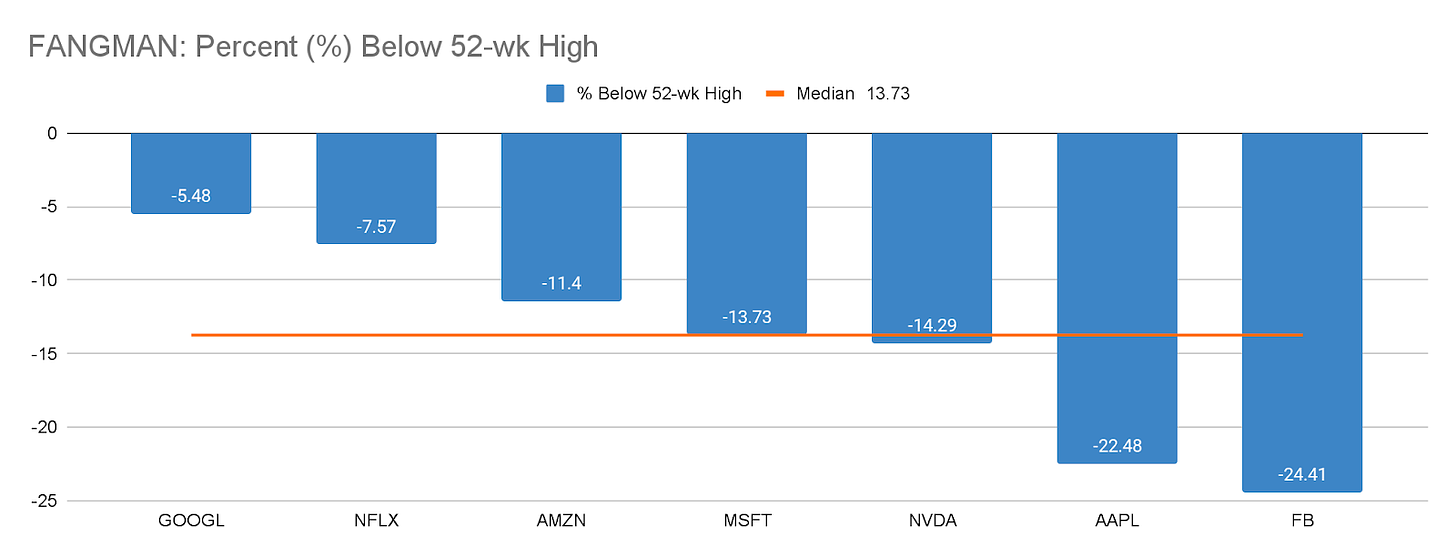

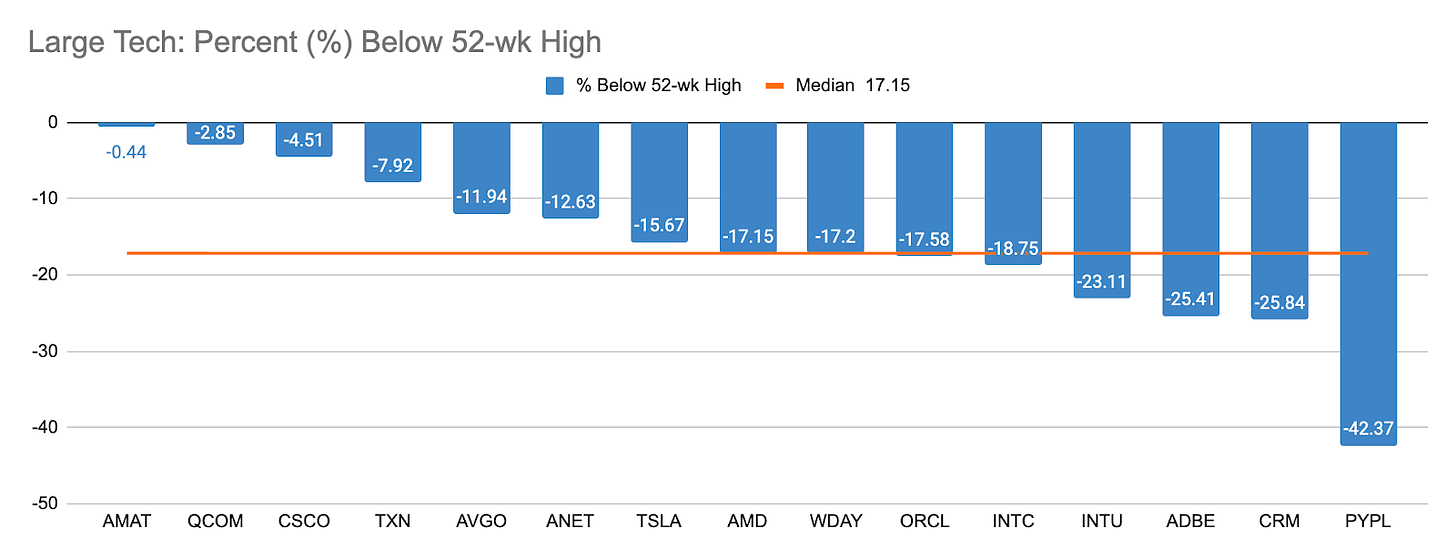

Percent Below 52-week Highs

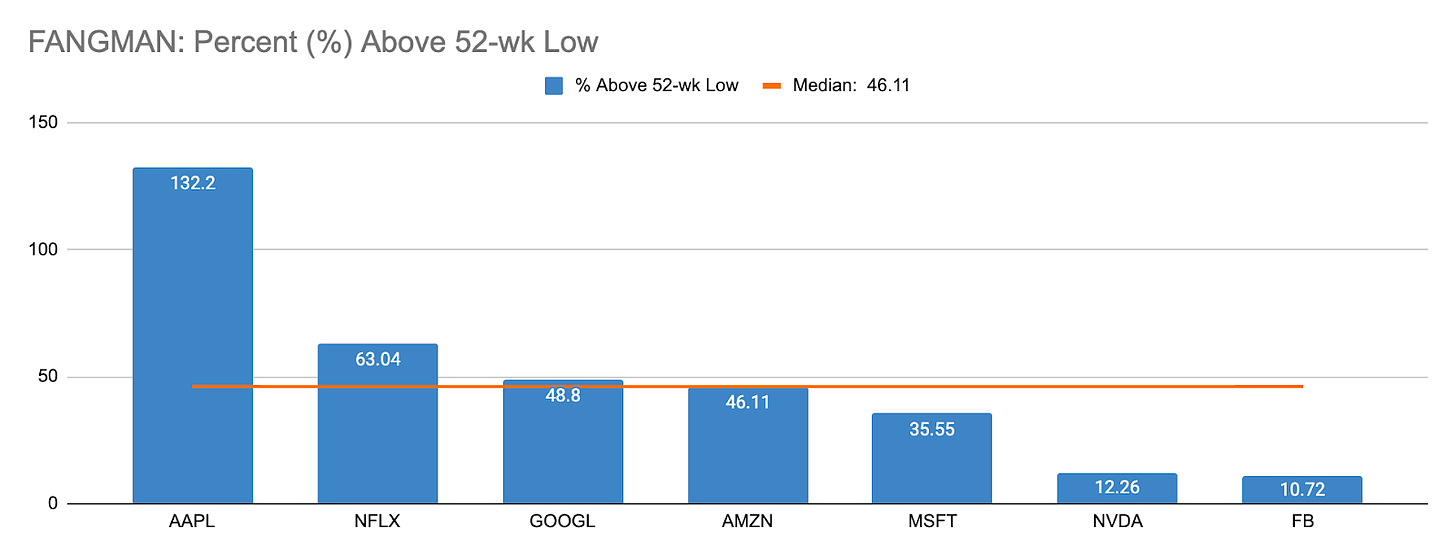

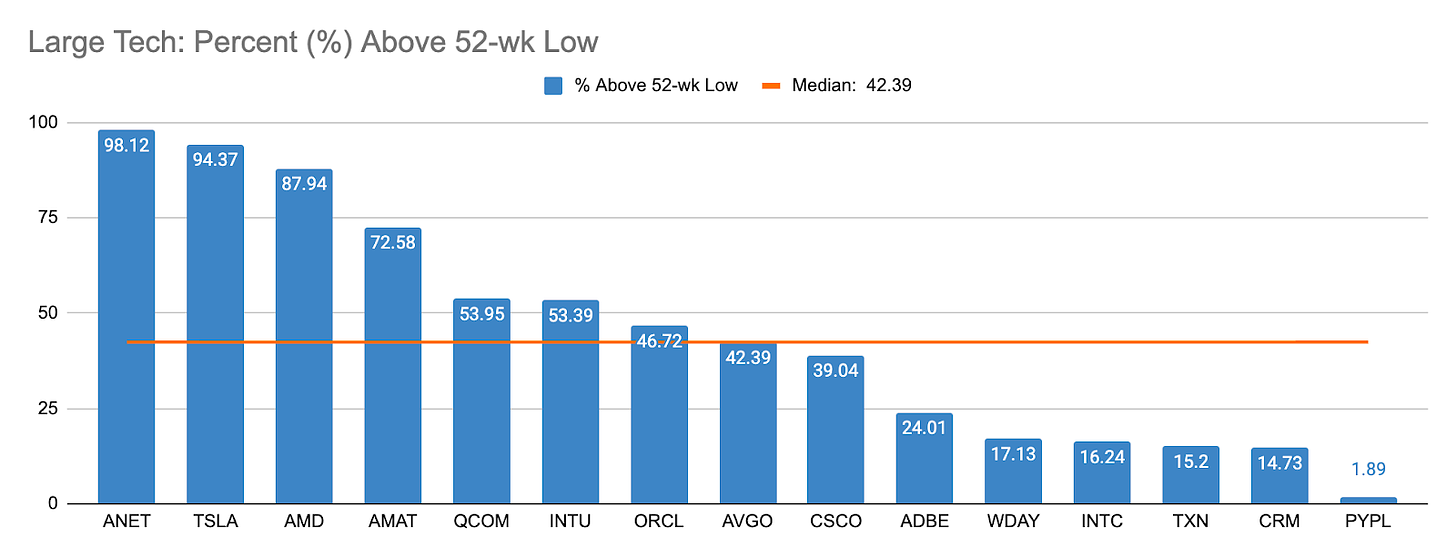

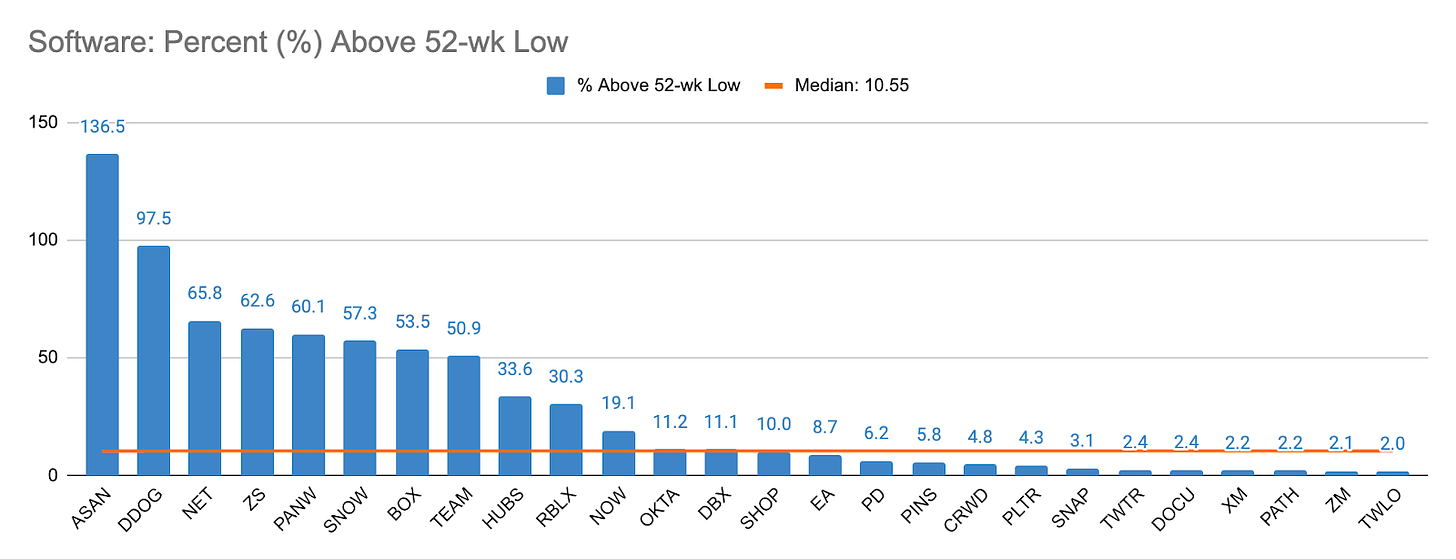

Percent Above 52-week Lows

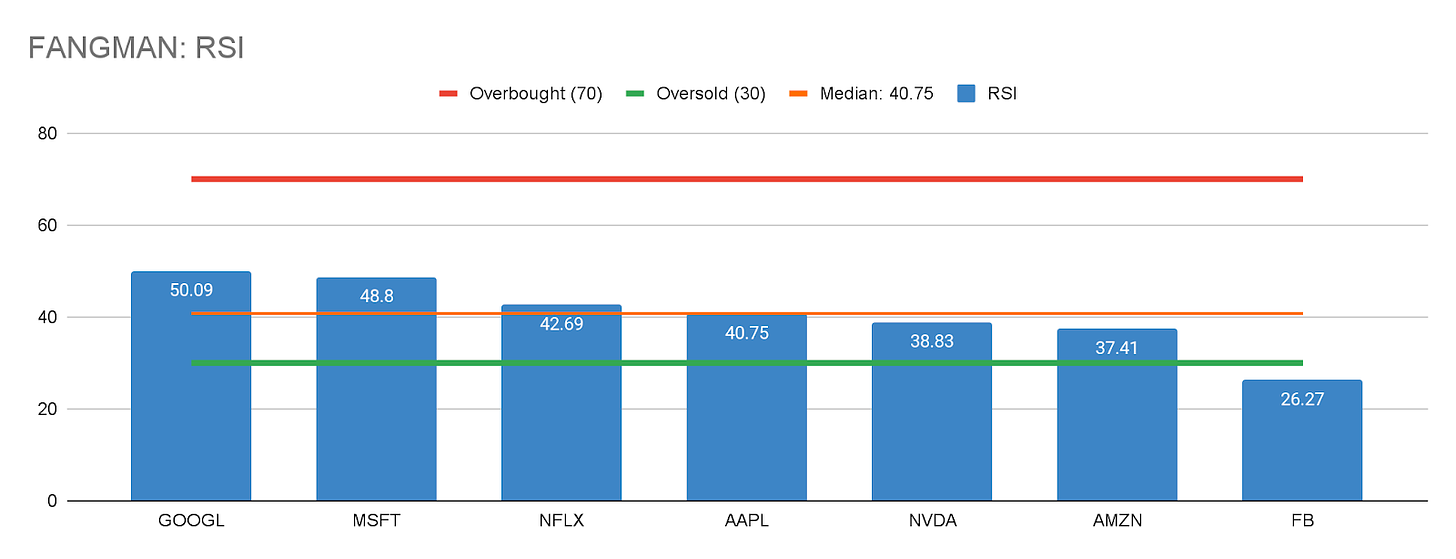

Relative Strength Index (RSI)

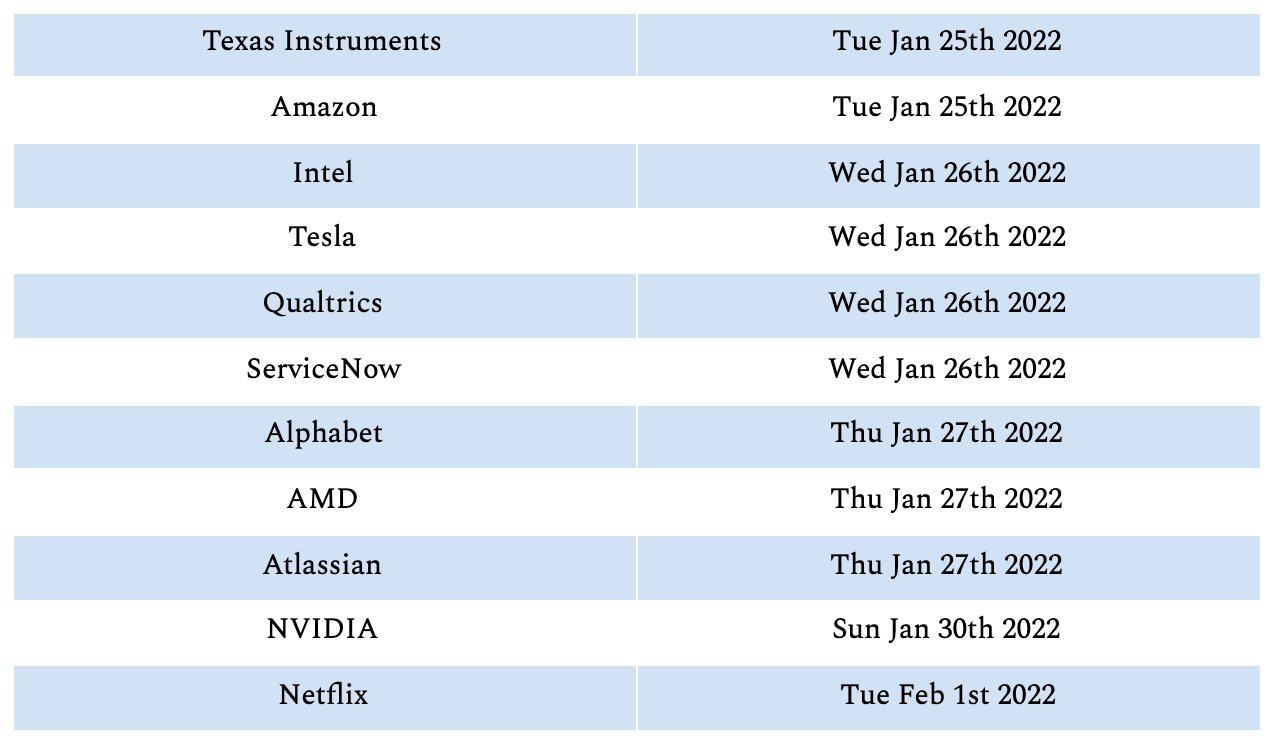

Upcoming Earnings Dates (Jan 2022 - 1st week of February)

Closing Thoughts

Buying opportunities in the technology sector appear to be increasing.

This is especially true for quality companies trading at lower-than-median multiples with consistently strong fundamentals.

Recent market volatility in the technology sector, with particular emphasis on the software industry, has given way to more attractive entry points.

Several high-quality software companies are just slightly above their 52-week lows.

Using the RSI level as a technical indicator, the number of popular technology companies that are at or approaching an “oversold” RSI level has increased substantially since the end of 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.