Drawing Capital Newsletter

December 22, 2020

With the holidays just around the corner, we decided to move this Friday’s newsletter forward. We hope that everyone has an enjoyable and relaxing end of the year and wish you all the best for 2021.

Introduction

We believe that one of the most impactful innovations of the decade is autonomous driving. The ability to transport passengers or cargo safely without human intervention will revolutionize the automotive industry as well as the younger ridesharing marketplace. Auto manufacturers and engineers have been working tirelessly to improve error rates and iterate on hardware and software to bring reliable products to market.

Today, we will be reviewing the types of autonomous driving technologies and major leaders in the space, as well as their set of challenges and opportunities ahead.

The Road to Full Automation

While the concept of fully autonomous vehicles is an idea that many people are still coming to terms with, supplemental automated features have been around for some time.

These features are commonly referred to as ADAS systems (“advanced driver-assisted systems”). The rise in ADAS systems impacts driver safety, influences consumer buying patterns, and highlights a consumer’s willingness to pay for enhanced safety features. These features - which you may be familiar with - include:

Backup camera and surround-view

Distance monitoring

Adaptive cruise control

Lane departure assist

Adaptive front lighting

According to a McKinsey survey (1), drivers, on average, are willing to spend an additional $500 to $2500 on ADAS features for added security and convenience.

Everything in the world of ADAS is now changing, with the proliferation of data combined with machine learning. Data is the lifeblood of machine learning, and machine learning is a primary component of autonomous driving. The new wave of ADAS features ranges from augmenting driver safety (e.g. lane departure, automated parking, and adaptive cruise control) to fully autonomous driving such as Tesla’s Smart Summon feature, allowing drivers to “summon” their car to their location within a 200-foot range.

For those who follow the semi-frequent autonomous driving updates in the news, you’ll notice that there are degrees of automation, measured by six different levels, adopted by the U.S. Department of Transportation:

Currently, the estimates for the rollout of autonomous technologies vary among experts. Forecasted by ABI Research (6), it is estimated that there will be 8 million semi-autonomous and autonomous vehicles on the road by 2025. According to International Data Corporation (IDC), the number of vehicles capable of at least level 1 autonomy will increase from 31.4 million (2019) to 54.2 million in 2024 - a compounded annual growth rate of 11.5% (7). Additionally, the IDC estimates that among the category of highly autonomous vehicles (levels 3-5), the industry is expected to achieve a level of output of 850,000 units by 2024.

Although forecasts vary widely for autonomous vehicle output, growth rates remain optimistic. Let’s take a look under the hood to see how this new technology works.

An Overview in Autonomous Technologies

Safe and successful driving requires pattern recognition. This is notable because people and technology-enabled autonomous driving platforms learn pattern recognition differently. A 16 year old that is learning to drive for the first time does not require millions of miles of real-time driving data to successfully drive a car, yet autonomous vehicles currently require billions of miles of data to learn from in order to make fully-autonomous driving decisions.

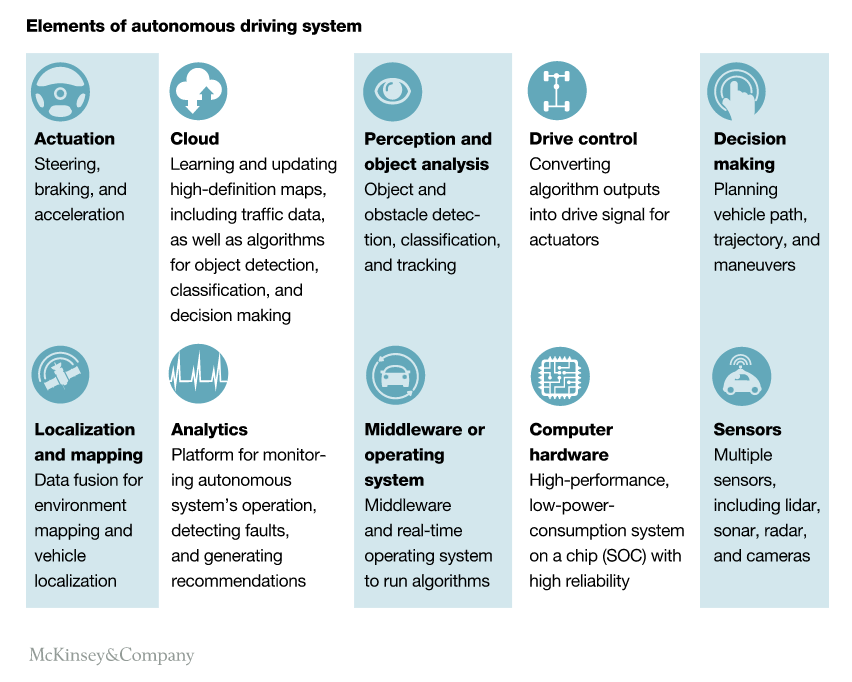

There are 10 main elements of autonomous driving systems:

While we could spend hours talking about any of the above elements, today we’d like to highlight the technology behind sensors.

In order for vehicles to drive better than humans, they will need to observe, interpret, and act upon different variables more effectively than humans. While there are a number of different sensors on the market today, the answer to this hurdle is to provide diversity across sensors. This sensor diversity enables higher accuracy of understanding the vehicle’s environment. An effective system is comprised of three primary sensors (10):

Cameras

The most accurate way to create a visual representation of the surrounding environment

A variety of lenses are combined (wide-angle and short depth; narrow-angle long depth) to provide a detailed 360-degree view

Cameras can distinguish detail in the surrounding environment but lack the ability to help gauge adequate depth perception

Radar

Help supplement cameras in low-visibility environments

Similar to cameras, radars are also placed on every angle of the car

While helpful for supplementary purposes, radar and camera together are not enough to allow a fully autonomous system

Lidar

Measures distances by pulsing lasers

Allows for a full 3D view of the environment

Provides shape and depth to surrounding objects including other cars, pedestrians, and even road geography

Like radar, lidar also works well in low-visibility conditions

Drawbacks of lidar systems included limited range, and are roughly 10x the cost of radar/ camera systems

Industry Leaders

Published by Navigant in March of 2020, a group of roughly two-dozen companies developing autonomous vehicle technologies was ranked based on a number of factors including product strategy, marketing, capability, staying power, and reliability. The groups were then ranked on a map with axes for strategy and execution.

Tesla fans may be confused by the competitive chart above, given that the company arrived in the last place. In response to this question, Navigant commented, “Tesla continues to make high-profile promises, including having one million robotaxi-capable vehicles on the road by the end of 2020… However, the performance of its systems remains inconsistent and its products do not match its proposed mobility business model."

A few members of the above cohort worth highlighting are (12):

Waymo (Alphabet) - widely regarded as the industry leader, Waymo has reported some of the lowest inefficiencies in their autonomous driving software with the need for a driver to interrupt just once every ~5,100 miles. Bloomberg also reports that as of May 2020, Waymo is in deals to buy 82,000 more vehicles to expand their existing fleet of 600. To date, Waymo has compiled over 20 million self-driving miles on public roads across 25 cities, including 74,000 driverless miles (13).

Cruise (General Motors) - utilizing the manufacturer’s Chevy Bolt, GM Cruise has the world’s second-largest autonomous vehicle inventory at 180 units. They have also partnered with ride-hailing service, Lyft, to roll out their autonomous vehicles atop an existing platform. Comparatively, General Motors Cruise has clocked over 2 million self-driving miles over the past 5 years (14).

Tesla - Although in the “challenger” quadrant of the above diagram, Elon Musk has provided some lofty goals, and if achieved, could push Tesla well into the front of the pack. To date, they have accumulated roughly 3 billion miles of real-time self-driving data on which machine learning algorithms are trained - largely due to cultivating data through existing Tesla owners. Musk has also stated publicly that “full self-driving” capabilities are “very close.” Tesla also retains a competitive advantage due to its vertical integration as a business model (growing data collection, in-house battery and software production, in-house designed computer hardware, and electric vehicle manufacturing).

Baidu - in first place among China’s autonomous vehicle developers, Baidu has roughly 300 Level 4 test vehicles across 23 cities and has collected about 2 million miles in driving data. It was also the first company in China to secure government approval for road testing. In Changsha, Hunan province, local residents are able to hail a free ride from one of 45 autonomous vehicles through Baidu Maps or Baidu App’s Smart Mini Program Dutaxi. The “Apollo” autonomous taxis operate in a 130-square-kilometer area in the city, covering both residential and industrial/commercial areas.

Final Comments

According to Allied Market Research (15), the global autonomous vehicle market size is projected to be valued at $54.23 billion in 2019, forecasted to grow to $556.67 billion by 2026, a CAGR of 39.47% from 2019 to 2026. The total addressable market for autonomous vehicles and robo-taxis is enormous and we’ve recently felt the impact of these changes through the proliferation of ride-sharing. Now, with the prospect of such services continuing without employing drivers, there are a number of considerations, both positive and negative. The positives include:

Cheaper rides for the end-user

Supply of available cars during unusual ride-hailing hours

Elimination of risk in assault or contracted driver-related issues

Easier to predict costs and profitability (see image from Tesla below)

Ability for regional self-driving taxi startups to enter the market

Enhanced last-mile delivery and the ability to create transportation networks of autonomous vehicles for delivering products

Some of the main risks and consequences include:

Litigation liability from faulty hardware and software

Government regulation

Public adoption and perceived reliability in new technologies

Displacement of jobs

Thankfully, executives at autonomous driving companies have some time to ponder their execution around these risks as the incremental improvements in technology will take a few more years (until larger demand for production). Overall, we see the adoption of autonomous vehicles as a big net-positive contributor to society, and the effective rollout will help increase efficiency and reduce the cost of local travel.

Get in touch to learn more about Drawing Capital’s strategy:

References

“Self-driving car technology: When will the robots hit the road?” https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/self-driving-car-technology-when-will-the-robots-hit-the-road/de-de. Accessed 21 Dec. 2020.

“Tesla drops a bunch of new Autopilot data, 3 billion miles and more.” https://electrek.co/2020/04/22/tesla-autopilot-data-3-billion-miles/. Accessed 21 Dec. 2020.

“FCA & Waymo Expand Autonomous Driving Partnership To Include Light Commerical Vehicles.” https://www.autovision-news.com/business/ma-activity/fca-waymo-commerical-vehicles/. Accessed 21 Dec. 2020.

“Tesla's Smart Summon – Gimmick Or Greatness?” https://hackaday.com/2019/11/07/teslas-smart-summon-gimmick-or-greatness/. Accessed 21 Dec. 2020.

“The 6 Levels of Vehicle Autonomy Explained.” https://www.synopsys.com/automotive/autonomous-driving-levels.html. Accessed 21 Dec. 2020.

“ABI Research Forecasts 8 Million Vehicles to Ship with SAE Level 3, 4 and 5 Autonomous Technology in 2025.” https://www.abiresearch.com/press/abi-research-forecasts-8-million-vehicles-ship-sae-level-3-4-and-5-autonomous-technology-2025/. Accessed 21 Dec. 2020.

“Autonomous driving: Safety through sensor fusion.” https://www.zf.com/site/magazine/en/articles_13632.html. Accessed 21 Dec. 2020.

“Meet the 6 Frontrunners in the Self-driving Car Race.” https://www.thomasnet.com/insights/meet-the-6-frontrunners-in-the-self-driving-car-race/. Accessed 21 Dec. 2020.

“A New IDC Forecast Shows How Vehicles Will Gradually Incorporate the Technologies that Lead to Autonomy.” https://www.idc.com/getdoc.jsp?containerId=prUS46887020#:~:text=According%20to%20a%20new%20forecast,(CAGR)%20of%2011.5%25. Accessed 21 Dec. 2020.

“How Does a Self-Driving Car See?” https://blogs.nvidia.com/blog/2019/04/15/how-does-a-self-driving-car-see/#:~:text=Camera%2C%20radar%20and%20lidar%20sensors%20give%20autonomous%20vehicles%20superhuman%20vision.&text=The%20three%20primary%20autonomous%20vehicle,as%20their%20three%2Ddimensional%20shape. Accessed 21. Dec. 2020.

“Tesla trails Waymo, Cruise and others in self-driving strategy, study claims - Roadshow.” https://www.cnet.com/roadshow/news/self-driving-study-navigant-research-tesla-waymo-cruise/. Accessed 21 Dec. 2020.

“When Will Self-Driving Cars Be Available 2020?” https://www.bloomberg.com/features/2020-self-driving-car-race/. Accessed 21 Dec. 2020.

“Waymo Safety Methodologies and Readiness Determinations.” https://storage.googleapis.com/sdc-prod/v1/safety-report/Waymo-Safety-Methodologies-and-Readiness-Determinations.pdf. Accessed 22 Dec. 2020.

“GM's Cruise begins testing autonomous vehicles in San Francisco.” https://www.cnbc.com/2020/12/09/gms-cruise-begins-testing-autonomous-vehicles-without-human-drivers-in-san-francisco.html. Accessed 22 Dec. 2020.

“Autonomous Vehicle Market by Level of Automation (Level 3, Level 4, and Level 5) and Component (Hardware, Software, and Service) and Application (Civil, Robo Taxi, Self-driving Bus, Ride Share, Self-driving Truck, and Ride Hail) - Global Opportunity Analysis and Industry Forecast, 2019-2026.”https://www.alliedmarketresearch.com/autonomous-vehicle-market#:~:text=The%20global%20autonomous%20vehicle%20market,39.47%25%20from%202019%20to%202026. Accessed 22 Dec. 2020.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.