Introduction

In this week’s newsletter, we explore the following 3 topics:

Recent launch of Drawing Capital’s new business arm, DC Ventures

Unicorns

Trends in the venture capital ecosystem

DC Ventures

Drawing Capital recently launched DC Ventures, a new business unit dedicated to making venture capital investments in startups and private companies. We believe our network of knowledge, founders, and expertise will be immensely helpful for the growth of DC Ventures. To learn more about DC Ventures and to sign up to receive ongoing announcements for deal flow and potential deal-by-deal startup investing opportunities, please visit the DC Ventures website at

https://ventures.drawingcapital.com/

Unicorns

Previously thought of as a fantasy for children, the term “unicorn” was coined by the technology and venture capital ecosystem to describe a private company with a value greater than $1 billion. The following chart below from CB Insights demonstrates that there exists over 700 unicorns worldwide, which exceeds the number of companies in the S&P 500 Index. Given the variety of industries referenced in the chart below, it is increasingly obvious that software is permeating across different industries to drive customer satisfaction, product development, scalable growth, and ultimately, value creation for shareholders and other stakeholders.

Key Insights:

The first key insight from Packy McCormick’s “Not Boring” newsletter displays the enormous size, scale, and scope of Apple and its market cap.

The second insightful commentary is from Packy McCormick: “You could buy all of the unicorns in the world for less than Apple. The 750 unicorns have a combined valuation of $2.37 trillion. Apple’s market cap is $2.42 trillion. If just one of those companies ends up being worth more than Apple one day, you get the other 749 for free.”

ByteDance, Stripe, and SpaceX are among the 3 largest private companies in the world.

PitchBook-NVCA Venture Monitor Report

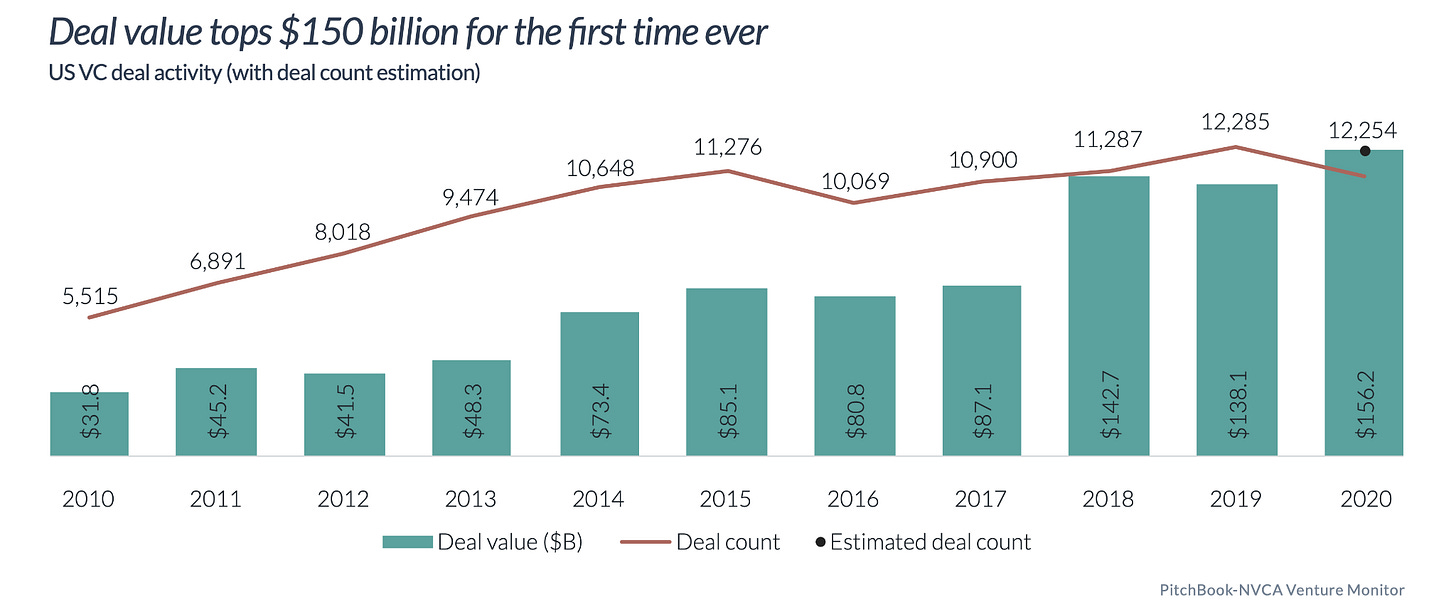

The following charts from PitchBook-NVCA highlight several key trends in the expansion of capital into the venture capital ecosystem:

Venture capital investment activity exceeded $150 billion for the first time ever.

Despite the coronavirus crisis in 2020, innovation did not stop. In specific instances, the pandemic actually accelerated technological trends and created a significant demand for the products and services of technology companies and companies that solved problems for other individuals and enterprises.

~98% of enterprise software companies are private companies. Said differently, if an investor only invests in public companies, then choosing to ignore private software companies is explicitly screening out and losing out on ~98% of enterprise software companies.

The sizes of venture capital funds continue to increase, which reflects both the growing opportunity set in investing & building category-leading companies as well as growing investor demand to seek large returns from the venture capital asset class. The majority of money allocated to venture capital is going towards existing established firms. In 2020, less than half of newly-established venture capital funds had less than $50 million in committed capital.

Hedge funds, select pension funds, family offices, and other large institutional investors are increasingly making both public and private market investments. In particular, crossover tech investing has gained immense popularity over the past few years, which is the strategy of finding, supporting, and investing in top-tier publicly-traded and privately-owned tech companies. Many of these crossover tech investors also manage significantly larger pools of capital compared to a traditional venture capital fund and therefore can finance growth-stage private companies, help guide growth-stage private companies into the public markets, and continue to be long-term investors in the company for years after an IPO.

Along with tech startups, biotech and pharma startups have experienced record deal activity in aggregate.

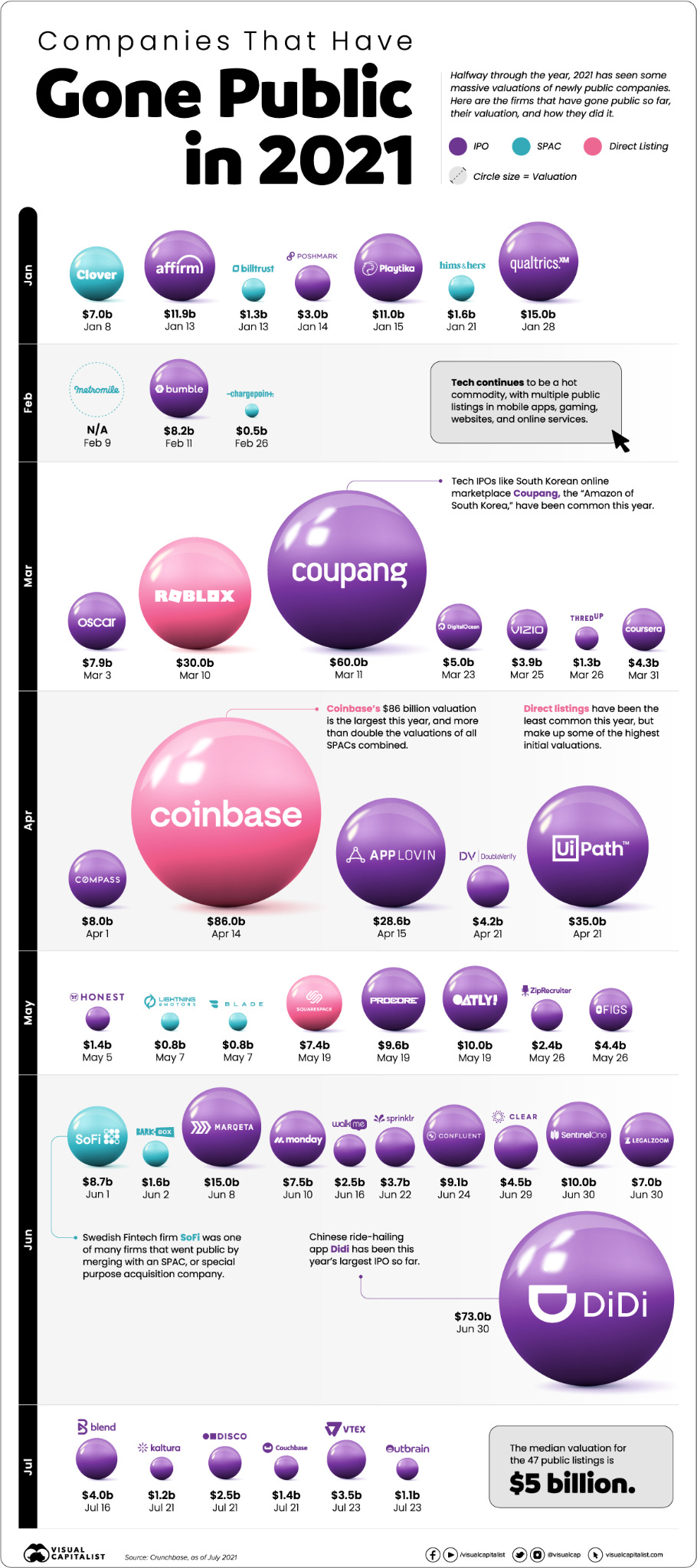

Previously, there were a limited set of exit opportunities for startups. Today, there are six very significant methods of creating an exit strategy for a startup:

Go public via an IPO

Go public via a direct listing

Go public via a merger with a SPAC

Get acquired by another company via a strategic acquisition

Get acquired by a private equity firm via a financial buyout

Continue to stay private for longer periods of time and allow liquidity to employees via secondary share selling in private markets.

The following charts and illustrations from PitchBook-NVCA Venture Monitor highlight several trends in the venture capital ecosystem:

2021 IPOs

Conclusion

The enormity of financial capital chasing positive, inflation-adjusted returns is immense, especially in a low interest rate environment with trillions of dollars in money creation. Retail investors, institutional investors from various backgrounds, and companies are increasingly exploring high-growth, high-signal strategies in both the mix of public and private markets in order to match their investment return targets.

While many people comment about the huge amount of capital in the private markets/VC ecosystem, the reality is that the size of the prize is higher than ever before in this new era of "exponential returns with platform-level network effects" in the world of software and exponential technologies.

A select group of companies are growing much faster and reaching historical milestones earlier than the previous decade’s set of companies. For example: Amazon took 22 years to reach $250B market cap, Google took 14 years to reach $250B market cap, and Pinduoduo took only 6 years to reach $250B market cap. Furthermore, a record number of multi-billion dollar IPOs have occurred over the past 18 months, such as Airbnb, Snowflake, Robinhood, Coinbase, Coupang, UiPath, and more.

Overall, the velocity of growth has accelerated for exceptional companies, and the magnitude of the victories from the winning companies are higher than ever. At Drawing Capital, we continue to remain focused on researching and investing in disruptive technologies and transformative innovation, particularly in software, biotech, e-commerce, and fintech. Keep advancing, keep innovating, and keep winning.

References:

“Unicorn Companies by CB Insights”. https://www.cbinsights.com/research-unicorn-companies. Accessed 9 Aug. 2021.

"Introducing Not Boring Capital - by Packy McCormick - Not Boring" 11 Jul. 2021. Accessed 9 Aug. 2021.

“Unicorn Companies by Market Cap”. CB Insights. https://www.cbinsights.com/research/unicorn-startup-market-map/. Accessed 9 Aug. 2021.

“PitchBook-NVCA Venture Monitor”. https://nvca.org/research/pitchbook-nvca-venture-monitor/. Accessed 9 Aug. 2021.

“Companies Going Public in 2021: Visualizing the IPOs”. Visual Capitalist. 4 Aug. 2021. https://www.visualcapitalist.com/companies-going-public-in-2021-visualizing-ipo-valuations/. Accessed 9 Aug. 2021.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.