Today’s newsletter by Drawing Capital displays a series of charts and illustrations related to visualizing the American healthcare industry. Among many insights, the overall key takeaway is that there are several opportunities for improvement in the healthcare sector across a variety of channels, such as improvement in patient outcomes, cost efficiency, pharma drug pricing, and more.

Key Insights: The market size of healthcare is large and growing. According to Centers for Medicare & Medicaid Services (CMS), American healthcare spending reached about $4.1 trillion in 2020, marking a 9.7% increase from 2019. Additionally, American healthcare spending in 2020 was about one-fifth of America’s GDP in 2020.

Key Insights: For every calendar year since the year 2000, American healthcare expenditures have increased. Data from CMS displays that American healthcare expenditures surged from $27 billion in 1960 to over $4.1 trillion in 2020.

Key Insights: Over the past 20 years and regardless of changes in political administrations or economic environments, American healthcare expenditures have consistently increased year-over-year. Additionally, American healthcare spending as a percentage of GDP has grown its weight and influence in the economy, rising from about 14% in 2001 to nearly 20% in 2020.

Key Insights:

Hospitals and professional services cumulatively make up over half of healthcare spending.

Across healthcare categories and based on the above chart, nursing care facilities experienced the highest growth rate, while durable medical equipment actually experienced a negative growth rate from 2019 to 2020.

For a contrarian perspective and despite the significant media scrutiny, spending on retail prescription drugs represents less than one-tenth of total healthcare spending, and the growth rate from 2019 to 2020 for retail prescription drugs was lower than the growth rates for several other healthcare categories.

Key Insights: Everyone eventually experiences healthcare expenses, and high healthcare cost inflation is expensive for society. When healthcare inflation rises faster than wage inflation, then the societal implication is that healthcare products and services unfortunately become less affordable or consume a greater portion of one’s budget over time. In 2020, America’s national health expenditure per capita was $12,530, implying an average monthly spend of over $1,000 per month on healthcare expenditures.

Key Insights: Low efficiency exists in improving average American lifespan longevity. It is true that the rise in healthcare spending has certainly benefited several patients in receiving better medical care and better outcomes for millions of individual patients. Interestingly, despite the significant increase in annual health expenditure per capita, the CDC estimates that the average American lifespan only increased about 2 years from 2000-2018.

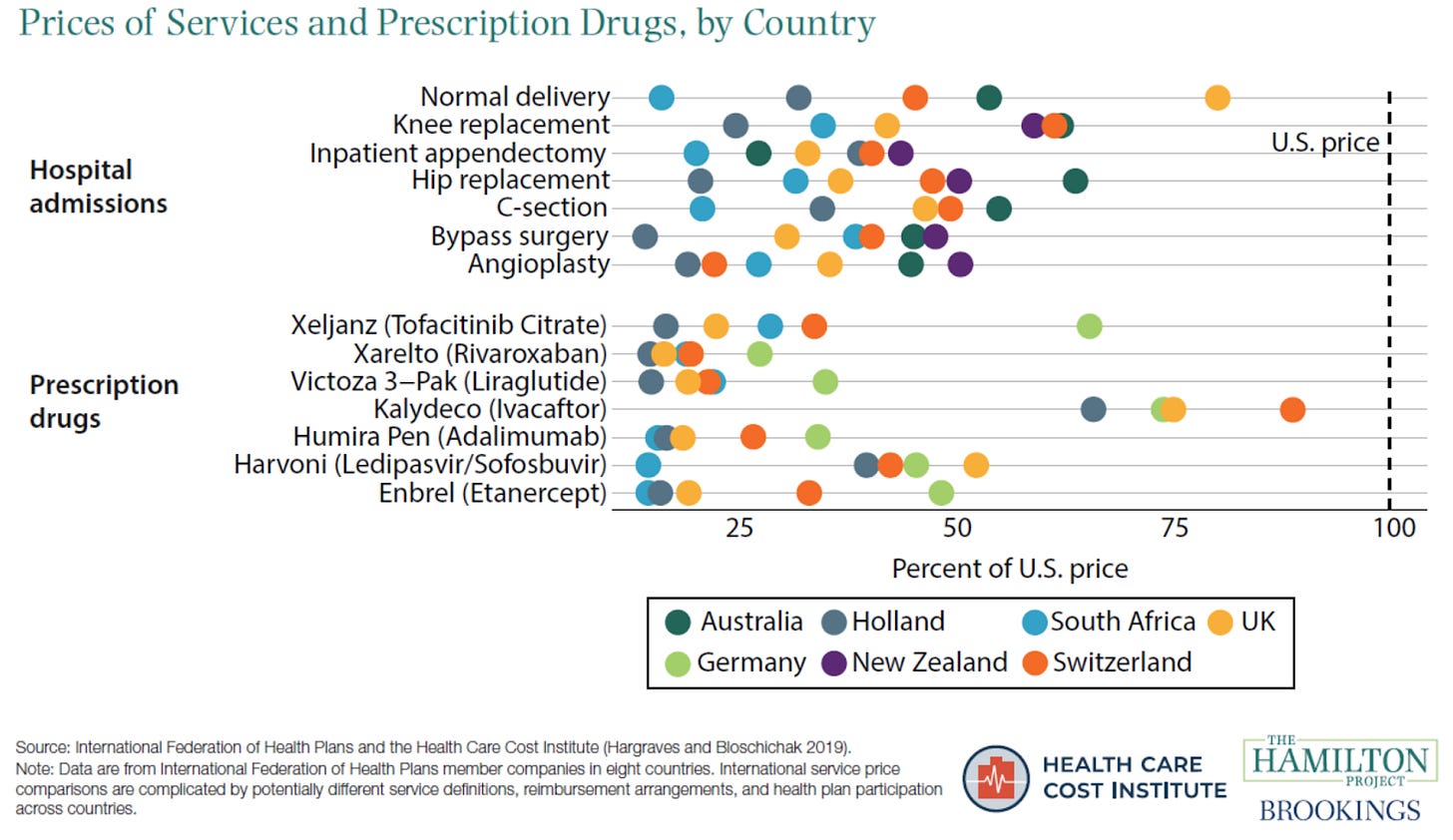

Key Insights: Based on the data and the illustration from the Health Care Cost Institute and Brookings Institute, healthcare in America is more expensive than healthcare in other countries across a range of services and prescription drugs.

Key Insights: As seen in the above chart America’s health expenditure as a percentage of GDP was double the OECD average. Combining the above chart with the previous chart, it is clear that American healthcare is more expensive and accounts for a greater percentage of economic GDP compared to several western European countries.

Key Insights: There is unequal distribution of health expenditures. According to the author’s calculations and the Brookings Institute and based on 2017 data, half of America’s population accounts for just 3% of healthcare spending, while 5% of America’s population accounts for about half of healthcare spending.

Key Insights: Based on 2017 data and authors’ calculations and the Brookings Institute, individuals with poor health are unfortunately and statistically more likely to experience higher and more variable healthcare costs. On the other hand, the data suggests that individuals with excellent health often experience greater certainty (less surprises) in healthcare spending and lower overall healthcare costs.

Key Insights: Based on data and the above chart from Deloitte’s Center for Health Solutions, there was a downward trend from 2013-2019 in returns on late-stage pipelines from pharmaceutical R&D (research & development). Additionally, 2020 & 2021 were “uptick years” that reversed the previous downward trend, and let’s see if this trend in “uptick years” continues.

Key Insights:

Sourced from the above data and chart from Deloitte’s Center for Health Solutions, it is evident that the drug discovery process from discovery to launch is an extensive journey in both costs, R&D investment dollars, and time. The extensiveness and uncertainty of this R&D journey can contribute to high prescription drug prices.

Deloitte estimated the average R&D cost to develop a compound from discovery to launch was about $2 billion in 2021. Additionally, Deloitte estimated that the average clinical cycle time in 2021 from FDA Phase 1 to FDA Phase III approval was about 7 years.

Regulations and patient safety are important.

To help augment, support, and add to pharmaceutical drug discovery pipelines, large pharmaceutical & biotech companies have utilized both partnerships and acquisitions.

Conclusion

In summary, today’s newsletter by Drawing Capital displays a series of charts and illustrations related to visualizing the American healthcare industry.

Among many insights, the overall key takeaway is that there are several opportunities for improvement in the healthcare sector across a variety of channels, such as improvement in patient outcomes, cost efficiency, pharma drug pricing, and more.

The market size for American healthcare is large and growing. Rising costs of healthcare makes healthcare more expensive. There are a number of issues and opportunities for improvement in both healthcare spending efficiency and in improving patient outcomes.

Given the significant issues and opportunities for improvement in healthcare efficiency, the patient journey, and patient outcomes, healthtech and computational biology can address healthcare issues and improve healthcare outcomes.

It will be increasingly valuable to patients and the overall healthcare ecosystem when innovations, discoveries, and scientific advancements can improve patient outcomes, decrease costs, enable faster time-to-market, and provide greater transparency.

References:

Centers for Medicare & Medicaid Services (CMS), https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical

Brookings Institute, https://www.brookings.edu/research/a-dozen-facts-about-the-economics-of-the-u-s-health-care-system/

Deloitte Center for Health Solutions; “Measuring the Return from Pharmaceutical Innovation 2021” Deloitte Report, Published in January 2022, https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/life-sciences-health-care/Measuring-the-return-of-pharmaceutical-innovation-2021-Deloitte.pdf

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Any stock, options or futures symbols, companies or investment products displayed are for illustrative purposes only and are not intended to portray recommendations. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.