Introduction

In today’s newsletter, Drawing Capital explores the following 5 topics:

Recent Percentage Drawdowns in Asset Classes

Changes in Investor Sentiment & Portfolio Positioning

Market Volatility & Methods of Managing Volatility

Historical Returns for Various Innovation Themes

Interest Rates & Inflation Impact Investments in the Innovation Economy

The key takeaway is that despite the market volatility in recent history, investing is about both finding opportunities in the future and managing risk according to one’s goals and preferences. Time marches forward, and positive investment returns are earned by allocating money in the near future in hopes of seeing higher prices in the distant future.

Additionally and while this may seem unconventional, it’s possible to have differing viewpoints across different time horizons. While price fluctuations will continue for publicly-traded innovative companies with potentially elevated volatility levels in the short-term, “innovation investing” in the long-term can have upside optionality and potentially positive performance, particularly for patient investors that are able to buy high-quality assets at discounted prices.

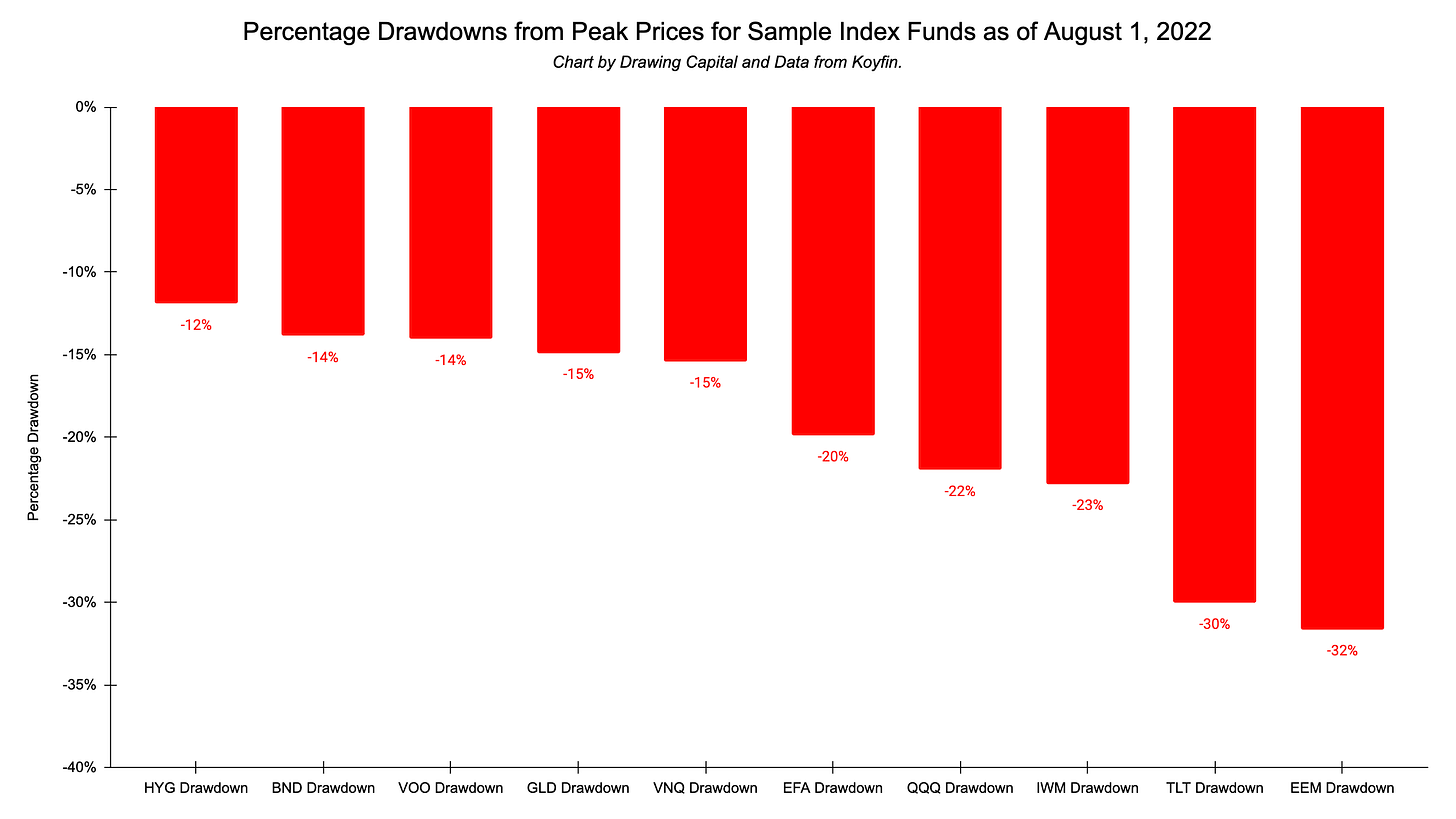

Drawdowns in Asset Classes

Hard to Hide: Across many asset classes, there have been significant drawdowns and losses in 2022 thus far, providing few tailwinds for optimistic investors in financial markets in the first half of 2022.

The following chart displays the percentage drawdowns from peak prices of various popular index funds that seek to track the performance of various asset classes:

_____

Recent History & Changes in Investor Sentiment

Over the past several months, significant market volatility and price drawdowns have occurred for many stocks and other asset classes, causing a divergence in sentiment and investor reactions; for example:

Some investors have maintained their asset allocations, acknowledge that price drawdowns exist, and remain long-term investors.

Some investors, upon realization of possibly being over-extended on the risk curve, have rebalanced their investment allocations.

Some investors are fearful of large losses and have begun to panic-sell out of their investments.

Some investors are cautious, rebalancing towards their target long-run asset allocations, and reluctant to invest new capital unless large return opportunities are potentially present.

Some investors have significantly increased their discount rates and accounting of risk premiums when making investments. Said differently, these investors are demanding a higher projected rate of return in order to be convinced of committing capital to initiate & make investments. There are 3 implications of this:

If the “exit price” remains the same, a higher discount rate implies a necessity for a lower entry price. For example in a hypothetical scenario, if an investor believes that the exit price of an investment in one year is $105/share, an investor with a 5% discount rate is willing to pay up to $100/share to earn a 5% return, while an investor with a 10% discount rate is only willing to pay up to $95.46, which is about 4.5% lower price than the $100/share price.

Yields across asset classes matter. Less capital is available for low-return opportunities when yields on US Treasury bonds and high-quality corporate bonds have significantly risen. For example, when some bond yields were near 1%, some investors were willing to take risks to earn 2%; now that interest rates have risen, there appears to be a low appetite for attempting to earn 2% in stocks when the same investor can earn more than 2% yields in US Treasuries.

Speculative investment categories are not dramatically attracting significant capital, and as a result, the “liquidity sponge effect” in absorbing capital and enabling speculative asset bubbles has largely vacated many speculative investment categories. For example: many cryptocurrencies have experienced large drawdowns since the start of this year, the IPO window for many companies has temporarily shut, SPACs are in a bear market, and many unprofitable tech companies have experienced greater than -50% declines in stock prices.

Market Volatility

We believe that price fluctuations have and will continue to occur, especially with the ongoing geopolitical tensions, tightening monetary policy, consumer concerns with inflation and specific commodity prices (such as oil and gasoline prices), and other factors. We believe that these price fluctuations (which sometimes occur in a jarring manner) will contribute to both market volatility and investing opportunities.

Methods of Managing Volatility

We have the opinion in defining long-term portfolio risk as the probability of permanent capital loss over a long-term investment time horizon. This definition perhaps is counterintuitive to several investors that may use daily volatility and severity of short-term price fluctuations as portfolio risk measures.

From a volatility perspective, there are 3 common methods of managing volatility in investing: either reduce it, accept it, or use it as an opportunity.

Volatility Reduction: The use of hedging and making investments in less-volatile assets in a portfolio can reduce volatility, which can reduce the severity of drawdowns but may also potentially reduce the upside of long-term investment potential.

Volatility Acceptance: Higher volatility strategies have higher error bands, implying both larger upside and downside range-band possibilities. As investor time horizons decrease, price volatility often increases, particularly in long-term investments and innovation stocks. As volatility increases, the dispersion in the asset's returns increases, so portfolios with higher volatility have a wider range of outcomes, implying potentially higher high points but lower low points. Often, the price of admission for high-potential-return, high-growth investing is volatility; rarely are there scalable investment opportunities in which the potential returns are high with little volatility & small daily price fluctuations; as a result, there is often a tradeoff between risk and return, along with the condition that the future is not fully predictable because the future holds both unknown decisions and uncertainty around the impact & reactions to these unknown decisions.

Volatility as an Opportunity: Perhaps, a counterintuitive investment principle is using volatility as a buying opportunity for making and concentrating investments in high-quality assets because when there is max fear, uncertainty, and doubt, then market prices for quality assets are often trading at discounted or distressed prices. This kind of market environment enables smart investors to buy premium-quality assets at discounted prices. For hypothetical examples, here are 5 sample case studies for transforming stock drawdowns into potential investment opportunities for quality companies:

For a stock that has fallen 50% from its peak, if you believe that the stock can reach back to the peak in 5 years, then that's a 15% CAGR investment opportunity (2x in 5 years).

For a stock that has fallen 75% from its peak, if you believe that the stock can reach back to the peak in 10 years, then that's a 15% CAGR investment opportunity (4x in 10 years).

If a software company grows its revenues at a 25% compounded annual growth rate over the next 5 years and maintains the same price revenue multiple & share count, then that's a potential 3x return on the stock in 5 years (aka 25% CAGR on investment).

Note: CAGR = Compounded Annual Growth Rate.

Investing in the Innovation Economy

For general technological trends, Drawing Capital primarily evaluates high-growth software, e-commerce, and healthcare technology companies, with an emphasis on innovative technologies, sustainable differentiation with growth, quality distributions channels, and enduring business models. Additionally, we actively utilize rigorous bottom-up fundamental analysis in the “innovation economy” with a technical overlay, combined with using insights from the startup ecosystem, market research, and intermarket analysis for public & private investments.

As innovation-focused investors, we are offered the potential for attractive long-term wealth creation in exchange for short-term price fluctuation. Since innovation investing and investing in emerging technologies have uncertainty around their validity and future impact, short-term price movements can be a rollercoaster ride. Changes in broader investor sentiment can increase or decrease the level of collective perceived uncertainty in financial markets. Nonetheless and despite the recent market volatility, we believe that the key takeaway is that several technological trends continue to present increasingly compelling opportunities for long-term patient investors, even as price multiples contract and several companies continue to exhibit strong growth results, product development, business performance, and financial fundamentals.

While historical data and narratives can be useful for historical precedent, we also recognize that 2022 so far has been a very challenging market environment for “growth stocks”, long-duration assets, popular stock indices, and the bond market. This challenging environment in popular market indices and in innovation investing is further amplified by four external factors:

Elevated levels of inflation

Tightening monetary policy from the Federal Reserve

Rising discount rates

Fears of an upcoming economic recession or “negative growth shock”

In some scenarios, there are some similarities between the drawdown in the bursting of the technology bubble in 2000-2002 and the current price drawdowns from their peak prices for unprofitable technology companies and various cryptocurrencies. According to data from Koyfin, the NASDAQ 100 Index fell nearly 83% from its peak from March 2000 to October 2002.

Performance Table for Innovation Themes

Connecting Interest Rates with Innovation Investing

From an interest rates perspective, low interest rates implicitly support "innovation investing" in 3 methods:

First, low interest rates encourage more investors to pursue high-growth opportunities and pay premium prices for premium assets in order to achieve their portfolio return targets. High-growth opportunities often are derived from disruptive technologies that create exponential growth, growth endurance, and positive network effects with upward inflection points.

Second, low interest rates enable a lower cost of capital, which allows highly capital-intensive businesses to get funded.

Third, high availability, accessibility, and affordability of credit are typically an optimistic signal for asset prices in general. In contrast, tightening monetary policy often reduces the magnitude macro tailwinds on specific asset classes. Along with reflexive positive feedback loops, changes in the availability, accessibility, and affordability of credit may contribute to “Boom-Bust” cycles in which bubbles form, followed by the painful process related to the bursting of bubbles.

Now that inflation and interest rates have both risen and with the monetary policy cycle increasingly moving towards a more tighter and aggressive policy stance, this situation has contributed to re-pricings of several stocks and has contributed to the lackluster year-to-date performance for broad stock market indices like the S&P 500 and the NASDAQ 100.

Rising Interest Rates and Rising Cost of Capital

As seen by the chart below, interest rates and the cost of capital have sharply risen over the past 7 months for the federal government, banks, corporate debt, and mortgage rates for new homebuyers.

Driven by the combination of elevated inflation rates, tightening monetary policy, rising probabilities of an economic recession in the near future, negative investor sentiment, and ongoing geopolitical tensions, the net result is that there is less availability, accessibility, and affordability for capital (especially speculative capital and capital inflows into “innovation stocks” & long duration assets).

Conclusion

As a bold idea, applying a venture-capital-style investment approach in the public stock market by specifically specializing our focus in the innovation economy can have potential rewards in the long-term with potentially significant price fluctuations in the short-term, particularly if specific investments experience large outlier returns with power laws and positive asymmetry.

Investing in good, innovative companies accelerates and amplifies their positive impact for multiple stakeholders.

Market volatility and price drawdowns have been tough to see for several individual stocks and asset classes over the past year. Market volatility is a double-edged sword: it’s tough to see losses & drawdowns, yet at the same time, market volatility may provide future opportunities when carefully evaluated. The ability to buy premium-quality companies at discounted prices is a compelling value proposition for some long-term, patient investors.

At Drawing Capital, we continue to obsess over technology, innovation, and the complexities in financial markets. Our objective is to innovate, learn, and disseminate that benefit to others.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.