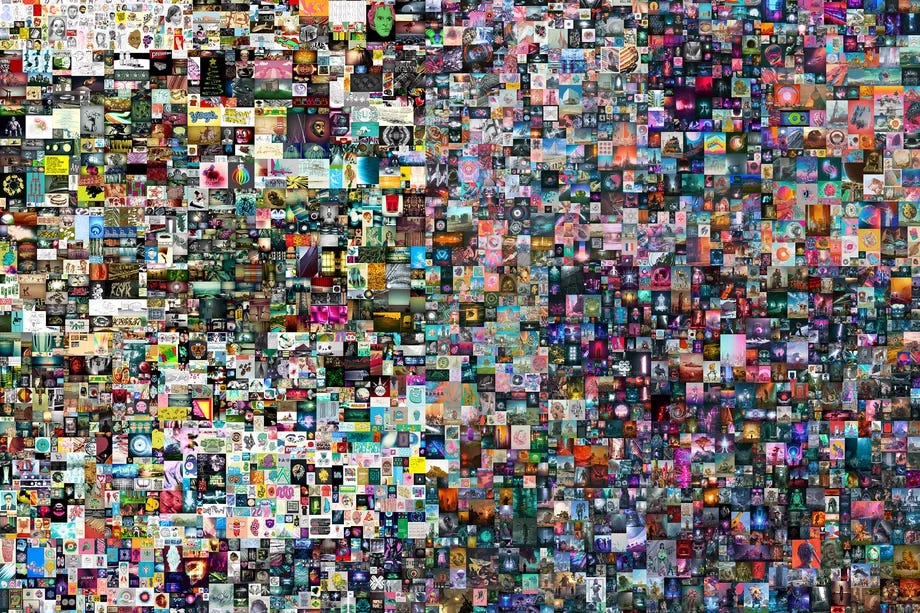

Over the past year, Non Fungible Tokens (NFTs) have become a big hit as the demand for digital assets has grown 1,700%+ in 2021 YTD. Below is a picture of the work of Beeple, a recently famous digital artist who sold his NFT mosaic of 5,000 individual artworks for $69 million on Christie’s Auctions. This work made Beeple the 3rd-most-valuable living artist.

Ethereum

To understand Non Fungible Tokens (NFTs), you first need to understand Ethereum.

Ethereum is a digital, decentralized, smart contract platform allowing developers to blend hard coded logic with the secure transfer of value or data. Sound confusing? It’s not.

Today, the transfer of money is coupled with additional instruments such as fees, interest payments, dividends, currency risk, and time value. However, these agreements of extra payments are backed by the law abiding contracts signed by participants of the agreement. If one party breaks the contract, our legal system can help further enforce the contract.

On ethereum, that agreement is enforced by code. If you’re a landlord charging a renter $X, then you could also encode an additional $Y fee if the renter does not pay by a certain deadline. This fee can be accrued by the month, day, or even millisecond if you wanted. Instead of running in the cloud, the code would run on nodes all over the world in a decentralized network. This network is called the Ethereum Virtual Machine (EVM), and it computes and validates all transactions on the Ethereum blockchain.

You can read the Ethereum Improvement Proposal for NFTs here https://eips.ethereum.org/EIPS/eip-721#rationale

Fungibility

A fascinating yet not widely discussed topic about money is fungibility. Fungibility is the ability to be mutually interchangeable. Two people can exchange a $1 bill and nothing would happen. Any $1 bill is just as good as any other because they are fungible.

Now let’s look at pennies created throughout the 1900’s. From the perspective of an average American, all pennies are the same; they are fungible because each one is worth exactly $0.01. However, to a penny collector, the year that the penny was made actually matters. Certain pennies made in 1914 or 1943 can be worth anywhere from $1,000 to $100,000 due to their historical significance. Therefore, all pennies are not fungible, but they are also not non-fungible. To an avid collector, pennies are merely less fungible than dollar bills.

Let’s jump back to $1 bills again. Is it really true that each one is the same as any other? If you look closely at the image below, each dollar bill has a green serial number that is universally unique (unless it is counterfeit). From this perspective, dollar bills are actually non-fungible after all.This is important because it provides security against a “double spend” attack and the ability to trace money to understand specific phenomena in the economy that may help with fraud investigations and economic analyses.

Now looking at digital currencies, fungibility is easily implemented. Data can be copied and moved around without any sense of originality. There is no serial number for every $1 in your bank account. If I send you $1 to someone via Venmo, and then receive $1 from someone else, then you cannot tell the difference between these digital dollars. The same phenomenon happens with Bitcoin. 1 BTC is no different from any other amount of 1 BTC.

Ethereum is interesting however, as it contains 2 protocols for developers to build on. The first is ERC20, the protocol for fungible tokens like Chainlink, Aave, and Uniswap. The other protocol, ERC721, enables developers to build Non Fungible Tokens which have unique identifiers and therefore ownership and history that differentiates it from any other token. These NFTs can be used to designate things like real estate titles, digital works of art, and personal identities.

NFT Adoption

A few notable projects have gained massive popularity over the years with NFTs as explained below.

Cryptokitties

In November 2017, a team created collectible digital cats on the ERC721 protocol. These cats are NFTs that can be traded via Ether on the EVM. Users can mate 2 cats to generate a new and potentially more valuable kitten based on random chance and hereditary traits. According to the Cryptokitties site, “There are 4-billion variations of phenotypes (what you see) and genotypes (what you don’t see)”. This creates a virtually never-ending game of creativity and community based entirely on NFTs.

Cryptopunks

Started in June 2017, Cryptopunks was the first NFT project built on Ethereum. It’s a collection of 10,000 unique 8-bit (pixel art) characters that were originally given out for free. Now, demand for them has grown so much that the marketplace is selling some for almost $1 million. More information can be found at https://www.larvalabs.com/cryptopunks.

NBA Top Shots

The National Basketball Association launched a collection of digital moments capturing popular trick shots and plays of players that can be owned by individuals. They built this on another blockchain technology called Flow chain, which seeks to become a faster and cheaper way to develop games and digital assets on blockchain compared to Ethereum. Learn more at https://nbatopshot.com/.

Opensea

Claiming themselves as the largest NFT marketplace, Opensea.io sells digital artworks that can be gifs, 3d models, or 2d images. This is probably one of the easiest ways for a graphic designer to get started with their digital art career and promote their work.

Finding Value

Many people have trouble understanding why NFTs are valuable. They keep bringing up the point that anyone can copy a JPEG file. Data is easily copied, so why is the original so special?

We believe that this is not so much a practical question as it is philosophical. Why is a penny from 1943 worth $100,000? What makes a work of art worth millions? Why do art museums pay millions for antiques and ancient works? It is because we as humans have decided that history is meaningful. The memories instilled in these objects hold sentimental value that can be traded for monetary value. For that reason, the original version of a digital work of art also holds sentimental value that a mere copy does not.

From a different perspective, a skilled artist can surely copy Picasso’s paintings, but these copies will not sell for as much as the originals because original works of art have the value of scarcity. In fact, in several examples, such as the Mona Lisa painting or Monet’s impressionist works, the more copies that exist worldwide, the greater the consumer appreciation for the artwork, which creates more value for the original artwork. In addition, a buyer may also need to pay for an expert art historian to validate the originality of a work before purchasing. In the world of NFTs, this validation is done on the blockchain. The original version of an asset holds a unique value on the blockchain that is never replicated. This value can exchange ownership, and the history of ownership is immutable. In some way, it is both cheaper and more believable that an NFT is an original work than a physical painting is. No matter how we spin it, if someone purchases a copy of a digital work, it simply does not feel as real as the original.

With the blockchain validating the authenticity of NFTs, another fun thought experiment is the role of remixes. In songs, audio remixes are quite popular, give credit to the original author, and are alterations of the original audio file with changes in tone or vocals. Since NFTs provide credit to the original artists, could we see a rise of NFT infused remixes that split royalties fairly?

Conclusion

For these reasons, in addition to a world becoming more digital over time, NFTs provide a brilliant platform to develop digital assets. Whether someone is buying artwork, in-game items in Virtual Reality, or needs to validate the identity of someone or something on the blockchain without a central authority, we believe there exists a bright future ahead for blockchain technology and technological advancement in the cryptoeconomy. We believe NFTs are going to open up an entire universe of possibilities that can impact logistics around identification and verification of assets across real estate, video games, automobiles, personal identification, and art. The industry is still young, and we will likely see more experiments like Cryptokitties and NBA Top Shots generating significant interest.

References:

"NFT Market Rages On: NFTs Market Cap Grow 1785% In ... - Forbes." 29 Mar. 2021, https://www.forbes.com/sites/youngjoseph/2021/03/29/nft-market-rages-on-nfts-market-cap-grow-1785-in-2021-as-demand-explodes/. Accessed 13 Apr. 2021.

"The Top 15 Most Valuable Pennies - The Spruce Crafts." 29 May. 2020, https://www.thesprucecrafts.com/the-most-valuable-pennies-4151629. Accessed 13 Apr. 2021.

"Technical Details - CryptoKitties." https://www.cryptokitties.co/technical-details. Accessed 13 Apr. 2021.

"CryptoPunks | Larva Labs." https://www.larvalabs.com/cryptopunks. Accessed 13 Apr. 2021.

"NBA Top Shot." https://nbatopshot.com/. Accessed 13 Apr. 2021.

"OpenSea." https://opensea.io/. Accessed 13 Apr. 2021.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”).

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.