Among investors, there are growing concerns about the risk of an economic slowdown and recession. One of the most commonly referenced indicators is the relationship between the 2-year US Treasury (UST) and the 10-year UST. Historically, when a yield curve inversion occurs, or the 2Y UST yield exceeds the 10Y, a recession has followed.

This can be observed in the chart below where the blue line represents the 2Y/10Y UST relationship, the black line represents the crossover point for yield curve inversion, and the red shaded areas indicate US recessionary periods.

Needless to say, the combination of US Treasury yields, commodity inflation, changing Federal Reserve monetary policy, bear market in growth stocks, Chinese tech regulation, and geopolitical concerns including the Ukraine-Russia conflict, are weighing on investor sentiment in financial markets and American stock markets.

Today, in an effort to help investors weigh their options for managing risk exposure, we will look more closely at common investment management techniques and their benefits and trade-offs. The discussed techniques include:

Exposure to high-quality bonds (most common)

Adding stop-loss orders

Selling short benchmark-based ETFs

Note: We are not endorsing any of the below strategies, but are simply outlining common methods for risk management and key considerations of each. Every investor should do their own diligence in detail, or work with a financial professional to implement an effective approach.

High-Quality Bonds

A very common method of managing risk among individuals and financial advisors is to allocate a variable segment of the portfolio to high-quality bonds. The general premise is that when equity markets experience downside volatility, capital flocks to safety (high-quality bonds and savings accounts), and thus, the portion of the portfolio acts as a counterbalance to perceived riskier stock positions.

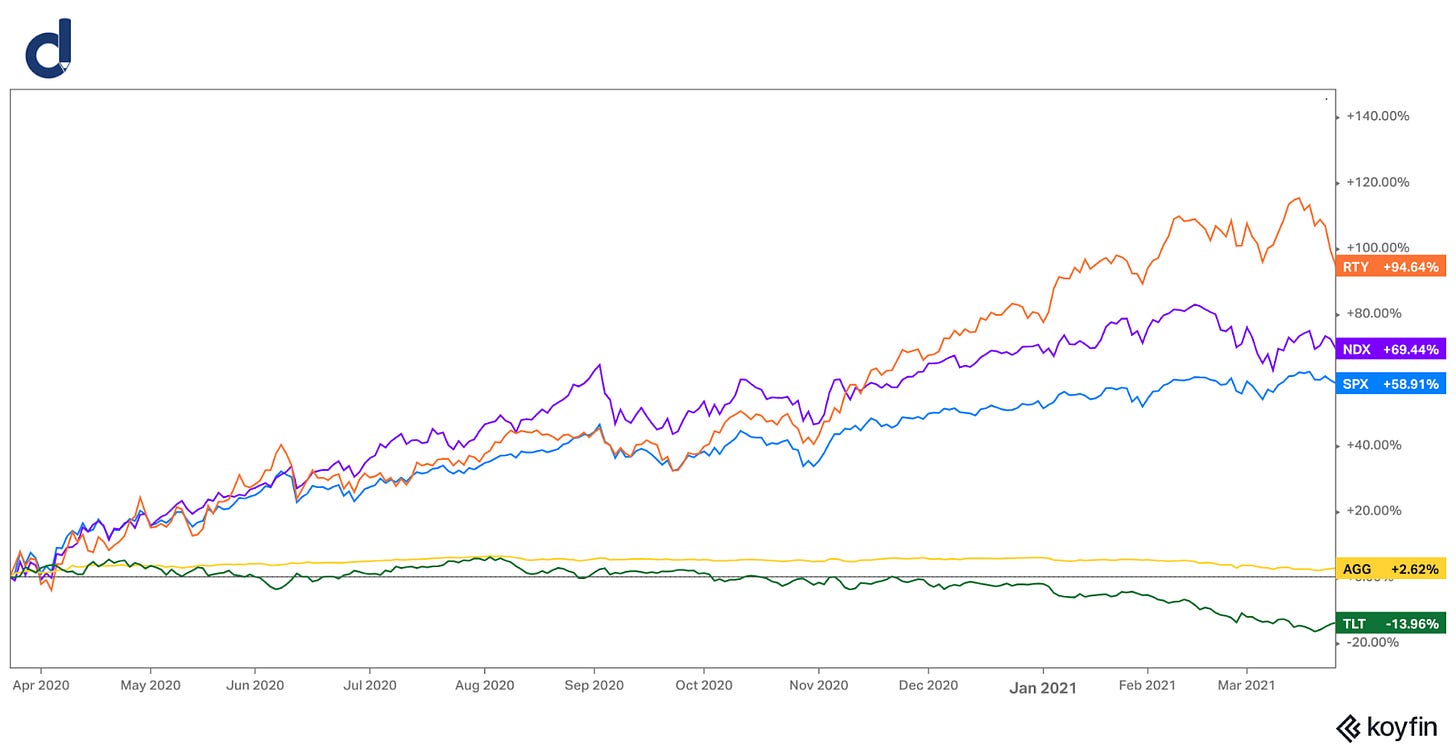

In general, this methodology has become common practice, especially given the prevalence and importance of target or strategic asset allocation models. Below, we can see the effects of such a portfolio through COVID-driven selloff from February 19, 2020, through March 23, 2020. The performance of stock-based indices and bond ETFs can be observed over that time period:

SPX (S&P 500 Index)

NDX (Nasdaq 100 Index)

RTY (Russell 2000 Index)

TLT (iShares 20+ Year Treasury Bond ETF)

AGG (iShares Aggregate Bond Index ETF)

During periods of market turmoil, long-dated US Treasuries have generally provided a strong counterbalance to higher volatility equities.

Though the drawbacks of such positions have led to dramatic underperformance upon market recoveries and expansionary periods, as we can see from the 12-months following the end of the COVID-driven selloff.

In summary, including high-quality bond positions, either statically or dynamically, can reduce overall volatility, but in return, weighs significantly on performance during periods of recovery and expansion.

Stop-loss Orders

Adding stop-loss orders entails entering a good-until-canceled order to sell a security – in full or partially – after a stock trades through a certain price. This is most commonly used for high-volatility positions.

Here’s what it looks like, in concept: “I want to sell my Apple shares after they fall below a certain point, in an effort to avoid further losses. In the historical example below, I sell out at just over $48/ share, further avoiding the -23% drawdown that ensues thereafter, and can reinvest at a time of my choosing”.

There are, however, some very key considerations surrounding this decision:

Where do I enter the stop-loss to avoid drawdown, but make sure I don’t endure a “false positive” (see below example)?

Do I have significant capital gains tied to this position, and will I have a large tax bill after exiting the position?

Do I sell all or part of the position?

When do I reinvest my capital again?

Here, we can see the other side of the same coin, where a stop-loss is entered at the most inopportune time. In this example, “I don’t want to lose more than 20% on my position. In May of 2019, Apple falls over 20%, I get stopped out of my position, and pay my capital gains tax. Then, over the next 8 months, Apple’s share price proceeds to double”.

When implementing stop-loss orders, a deeper understanding of security-level analysis (and expertise) is needed in order to set orders effectively. Additionally, investors should have a process for reinvestment of capital across multiple scenarios to avoid realizing all losses are and none of the subsequent recovery.

Selling a Benchmark-based ETF Short

Selling a security short requires much more sophistication than the previous two strategies. In selling short, or “shorting,” investors borrow a security at today’s price with the hopes of buying it back at a lower price at a later date.

Shorts are commonly run alongside long equity positions either to a) generate gains via the outperformance of individual securities relative to a benchmark or other securities, or b) offset the downside volatility of long positions. Today, we’ll focus on option “b”.

Implementation

The first step in the process is to identify the appropriate ETF to use as a short position. Ideally, your long stock positions will map as closely to the ETF’s holdings as possible. A helpful tool from ETF Database is their stock exposure tool, which can provide you with individual stock weights by ETF: https://etfdb.com/tool/etf-stock-exposure-tool/

Determine whether you’d like to offset a portion of the downside volatility to get as close to market-neutral as possible (e.g. short $1 for every $1 of long exposure).

Map out a trigger-based system (when are you shorting and when are you closing the short?) – moving averages are commonly implemented here.

As a simple example, we can use the Invesco QQQ Trust (ticker: QQQ), which represents the Nasdaq 100. In the chart, the red arrows denote the opening of a short position and the green arrows represent a closing of that position. In this model, two exponential moving averages (50-day and 10-day) make up the indicator of short-term uptrends versus downtrends.

The additional benefits of utilizing a short position to manage downside risk include:

Flexibility across securities

Can utilize in various amounts and exposures

Hedge long positions without realizing their associated capital gains

In summary, utilizing short positions requires a high degree of investor sophistication. While investors can alleviate large degrees of losses while remaining invested in high-conviction positions, the risk of poor planning can result in the need for covering short positions at significant losses.

Summary

In this newsletter, we’ve covered three methods of managing portfolio risk across the investor sophistication spectrum. To quickly recap the high-level points:

Utilizing high-quality bond positions can work well through periods of high market volatility and require the least amount of maintenance. However, long-term ownership can result in overall underperformance, especially in periods of recovery and expansion.

The implementation of stop-losses forces investors to consider their processes for entering and exiting positions and cap losses that may extend beyond a certain level. The drawbacks of this option are that the investor is constantly required to re-enter stop orders if their brokerage firm does not offer trailing stop orders, capital gains taxes on the position must be paid (if applicable) upon exit, and informed decisions must be made in order to re-deploy capital.

Selling short requires a high degree of sophistication, as the use of leverage via portfolio margin is involved. Multi-scenario planning must take place in order to avoid situations where the investor is required to cover the position at a large loss. However, shorting can provide several levels of flexibility and even generate alpha while broader markets continue to sell-off.

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.