This week we are going to learn about uranium as a functional commodity and why it recently has been trending upward. But first, let’s learn a little about how nuclear and uranium works and why it’s investable.

Overview

Uranium is a non-renewable source of energy. At current usage rates, there’s about 230 years of uranium left. Here’s a chart showing the price of uranium over the last 30 years. In 2007, we had a uranium bubble which crashed and caused prices to fall to distressed levels before recovering again after 2016.

Source: https://tradingeconomics.com/commodity/uranium

Intro to Nuclear

Nuclear energy is a form of energy that humans harness from the core of an atom (called a nucleus). A nucleus is held together by the strong nuclear force (one of the 4 fundamental forces of our universe). This bond between protons and neutrons contains vast amounts of energy that, if broken, will release that energy into something we can capture to generate electricity. The particular atoms we use are uranium, a heavy metal found in earth’s crust that comes in many forms called “isotopes”. One particular isotope, Uranium-235, is naturally occurring and radioactive, making it a great candidate for nuclear fission.

So what is nuclear fission? It’s when a heavy nucleus (like U-235) splits either spontaneously or on impact from another particle such as a neutron, thus releasing energy. Here’s a diagram from World-Nuclear.org.

By shooting a neutron into the U-235 isotope, it breaks up into various particles (atomic and sub-atomic). The strong nuclear bonds are broken which releases energy (the yellow kaboom) that nuclear power plants capture to produce energy in the form of heat.

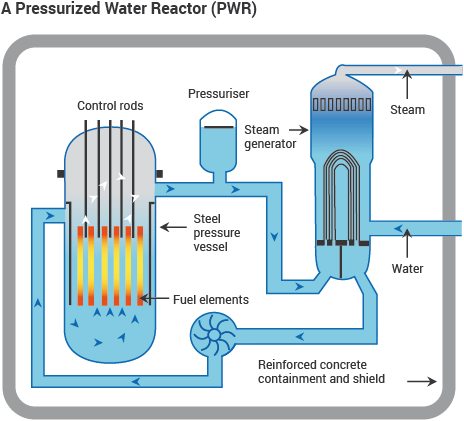

The heat is used to turn water into steam which then drives a turbine similar to how fossil fuels and geothermal energy are used. See the diagram below for how the process works.

Significance (Value)

10% of the world’s electricity and 20% of the United State’s electricity comes from nuclear power plants powered by uranium. Additionally, the push for global decarbonization is catalyzing the development of new nuclear power plants and increasing demand for uranium. The reason behind this demand is 4-fold.

Reliability - Nuclear is the most reliable energy source amongst renewables. The chart below shows it has a 92.5% capacity factor, which means that it is producing 92.5% of its theoretical maximum. Other renewables like Solar only have a capacity factor of 24.9% because it relies on the sun (which is only partially visible over 24 hours) as well as the efficiency of its solar cells.

Cleanliness - Avoids more than 470 million metric tons of carbon each year, which is the equivalent of removing 100 million cars off of the road.

Jobs - The nuclear industry supports nearly half a million jobs in the United States and contributes an estimated $60 billion to the U.S. gross domestic product each year.

National Security - The United States must maintain its global leadership in this arena to influence the peaceful use of nuclear technologies.

So we know uranium is valuable in itself because it is the best source of fuel for nuclear reactors which is the most reliable form of energy production we have today. Geothermal energy can have a higher capacity factor than nuclear, but geothermal has stubborn location requirements that nuclear doesn’t have. That’s another reason why nuclear power is the best energy source to work with.

Catalysts for Uranium Prices

The next question to answer now is “Why are uranium prices going up?”. The answer to that lies in many different places. Part of it is political, another is economic, and a final part of it is purely financial.

From the political perspective, there are only a few countries that are major exporters of uranium globally. The image below shows exactly which countries they are.

Kazakhstan, Canada, and the United States as of 2020 are the biggest exporters of uranium, where the U.S. plays a very small part relative to the former 2 countries. Therefore, any sanctions, trade agreements, import taxes, etc can greatly impact the supply of uranium while demand continues to grow as nuclear reactors come online.

Here’s a chart that illustrates such demand growing.

As the demand outweighs the supply, prices will increase as we’ve been seeing. The question is, “why has supply not kept up with demand?” Part of the answer there is because of the crash of the uranium bubble in 2008. When uranium prices are at distressed levels, the propensity for unprofitable mining and exploration operations reduces. This dormancy in uranium production causes a decrease in inventory that lasts for years. To give you a sense of just how slow mining can be, it can take 10-15 years for a mine to be constructed to then be fully operational. Similarly, it can take 10 or more years to build some nuclear reactors, though about 85% of the reactors today were finished in 10 or less years.

The key takeaway from this chart above is that nuclear power plants take a lot of investment of time and resources to build. And, the longer the delays that exist in supply chains, the larger the bullwhip effect that takes place which can, for example, cause large volatility in prices of uranium. You can learn more about the bullwhip effect and supply chain dynamics in a previous blog linked below:

In one such situation, if a country like China wants to build 10 new reactors, then they should be done in 7.5 years on average. However, if there’s already a low supply of uranium, then new mines will need to be built, which can take 10-15 years. That means that, on average, there will be 2.5-7.5 years of supply shock in uranium which will likely affect its price. And, when construction & lag times are measured in years, it can take time for prices to “normalize”, which contributes to both price volatility and a “boom-bust” cycle in commodities.

Lastly, when uranium prices increase, it drives more excitement among hedge funds and other businesses to get involved and buy more. This positive feedback loop results in prices continuing to trend upward. Eventually, this sort of behavior can also cause another bubble to arise like that of 2007.

Future

The future of nuclear power is seemingly bright. Additionally, the unfortunate events in the Russian invasion of Ukraine have ignited additional focus on renewable energy and nuclear power in western Europe, both as a mechanism for less environmental pollution and as a method to reduce dependency on Russian oil and natural gas. Also, we are seeing increasing interest in awakening dormant reactors while some countries such as China are looking to build many new reactors. The power generation provided by nuclear power on a global scale is shown below, with expectations that generation grows ~16% from 2020 to 2035.

Additionally, the next chart shows the demand for nuclear reactors growing primarily because of China and Russia. In contrast, the United States and Japan are reducing their operational nuclear reactor counts.

Potential Opportunities

If you’re interested in investing in uranium and nuclear, here are some sample ETFs that attempt to capture uranium and nuclear growth.

North Shore Global Uranium Mining ETF ($URNM)

Global X Uranium ETF ($URA)

VanEck Uranium & Nuclear Energy ETF ($NLR)

Below is a chart showing their performances compared to the S&P 500. It’s clear that $URNM performed the best and may provide the most exposure to uranium’s rising price. One possible reason for this performance is due to their holdings being highly correlated with uranium rather than nuclear power plants. See their holdings at this link: https://urnmetf.com/urnm. About 40% of their holdings consist purely of Camceo Corp ($CCJ), Nak Kazatomprom ($KAP), and Sprott Physical Uranium Trust ($SRUUF).

If you have any questions, please feel free to email us at invest@drawingcapital.com.

References

https://www.vaneck.com/us/en/investments/uranium-nuclear-energy-etf-nlr/holdings/

https://idph.iowa.gov/Portals/1/userfiles/124/MajorUsesofRadioisotopes_IDPH_Rad_Health.pdf

https://www.energy.gov/ne/articles/5-fast-facts-about-spent-nuclear-fuel

https://www.mining.com/uranium-supply-crunch-may-be-just-around-the-corner-experts/

https://sightlineu3o8.com/2019/08/warning-uranium-to-explode/

https://www.statista.com/

This letter is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Drawing Capital’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Drawing Capital has no obligation to update, modify or amend this letter or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This letter may not be reproduced in whole or in part without the express consent of Drawing Capital Group, LLC (“Drawing Capital”). The information in this letter was prepared by Drawing Capital and is believed by the Drawing Capital to be reliable and has been obtained from sources believed to be reliable. Drawing Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this letter constitute the current judgment of Drawing Capital and are subject to change without notice.